How much Inflation is there Really? [100% SP]

We are constantly hearing central banks telling us that the inflation is very low ( ~1%) and we need more inflation, because inflation is good for the economy. They think inflation = economic growth, because inflation pumps up the stock market, and the stock market is supposed to be equal to the whole economy.

Nothing can be farther from the truth. The Keynesian economists surely have some crazy theories, but I am not going to debunk them here, it would take an entire book to do it. If you want to learn real economics you have to learn about Austrian Economics.

Real Inflation Numbers

So we are going to talk about the Real Inflation and the Fake Inflation. Keynesians sure have some crazy theories about inflation, but their theories might look good on paper, in practice it looks horrible. If they could create real economic growth, then how do they explain that in the US. the average prosperity hasn't gone up since the 70's, wages stagnating and the dollar almost worthless. If they only have 1% inflation yearly, then how is this possible?

Well let's start with a few real definitions:

- Price Inflation: The amount in % the prices go up over a period of time, usually 1 year measurements.

- Monetary Inflation: The amount in % the money supply is increases or

money printing.

Keynesians ignore monetary inflation, because they think that it's not important since only the price inflation affects the living standards of the people. This is true, but the price inflation will eventually be equal to the monetary inflation. Inflation is asymmetric, some things increase faster, and some things need more time to trickle down. Usually, liquid markets get affected faster, that is why they look at the stock market and such for guidance.

The full money supply in a country is described as M3, whereas economists partition different forms of the currency in different categories, from the most frictionless to the most tied-down form, the M3 is comprised of all the currency supply there is.

In fact Keynesians hate the money supply statistics so much that the FED doesn't even publish the M3:

So what is the money supply then?

Well it's hard to say, since the dollar itself doesn't have a clear protocol for creation and can be minted at will so, not even the M3 would be very accurate. Of course we have the 1.5 quadrillion derivatives out there, we might add that to a M4 layer, but so we can add anything other of value that is intangible, and because we can't define what is 1 dollar, we may never answer this question.

Back in the day 1 dollar = 1 ounce of gold, but now after the Nixon Shock, 1 dollar = 0 value, so you can essentially make up phony paper assets, and call that something of value, but in reality it's worthless. So even though the 1.5 quadrillion of derivatives sounds scary, it's actually worthless junk, because the basis of it is worthless as well.

Luckily with Bitcoin we don't have this dilemma, we know exactly how many Bitcoins exist, and how many will exist, so Bitcoin is a pure Austrian Economics currency, it's the Ideal Money that even Keynes has talked about. In Bitcoin M0=M1=M2=M3, or technically you could make a difference between coins tied up in exchanges and so, but that is optional and doesn't change the total supply. ( I explained in the previous post why BTC Fractional Reserve Lending is impossible )

So what is the Real Inflation?

Some people say that the discontinuance of the US M3 numbers is bad since we don't know the real supply, but I disagree, because it doesn't matter, since all those instruments there don't really technically matter if we don't have a clear rule set for money creation. Some say that the FED wants to hide the inflation, but even if it's true, it doesn't matter since the derivatives already dwarf the M3 by far, so the avalanche is already coming, and the real inflation will hit M1.

The real inflation metric is M1, this is the liquid money (cash + bank checking account), this is what really matters. Not even M2 matters since that money is tied up, if it's not spendable, it doesn't matter. The derivatives are also tied up, so until people don't cash it out, the inflation won't be visible.

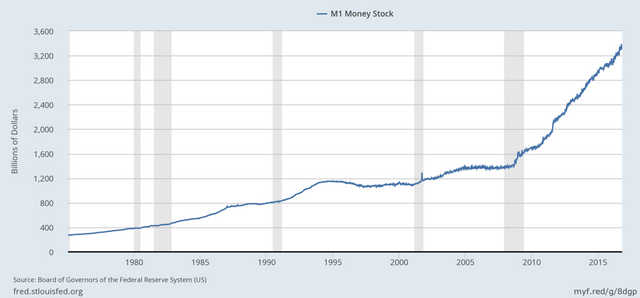

But it will all hit the M1 eventually, because when the consumers start buying things, they will either pay with cash or with bank account, they can't pay with CDS derivatives. So let's look at the M1 numbers:

| Date | FRED M1 | CPI | CPI Price Inflation | M1 Supply Inflation |

|---|---|---|---|---|

| Sept 2016 | 3306.9 bn. | 241.002 | +1.479% | +8.079% |

| Sept 2015 | 3059.7 bn. | 237.489 |

Hmm, so the "formal" yearly inflation is 1.479% while the true inflation is 8.079%!

Quite a difference folks, this is why it's important to count the inflation properly. The CPI is a very leaky statistic, it excludes many items, and it's data massaged heavily. If we presume that the M1 data is accurate then it's easy to see the difference. And again look at the stock market if you don't believe me, after all it's the most liquid internal market, inflation trickles down here the quickest.

S&P500 Yearly Yield (Sept -> Sept): +12.928%

Where do you think all that money came from? Surely not from a lousy 1.47% inflation. It came from the real inflation in the M1 supply, and you stupidly thought you made a return of 11.449%, when in reality you only made 4.849%, inflation adjusted.

So yea, if you have some lousy cash deposit or other low interest investment yielding you 2% yearly, and you thought you are protected against inflation, then think again, you need at least 9% to be safely protected against it.

I'd personally go with Bitcoin with a lousy yield of only +84.18%, that should be enough against silly fiat inflation, won't it?

It's very important to know exactly how much money you have and how much is the true inflation rate, otherwise you are losing money while you think you are making money.

Disclaimer: The information provided on this page might be incorrect. I am not responsible if you lose money using the information on this page! This is not an investment advice, just my opinion and analysis for educational purposes.

Sources: https://fred.stlouisfed.org

"...and the stock market is supposed to be equal to the whole economy. Nothing can be farther from the truth...."..!!

This is something I have been banging on about for years but most people think I am crazy. They have been brainwashed into thinking that The Stock Market is The Economy. IT ISN'T..!! Brilliant post. Shared on twitter. Stephen

https://twitter.com/StephenPKendal/status/795554724388962304

Thanks, yes the keynesian theory is pretty irrational. The funny thing is that the fake stock market pumping is not even good for the stock market, not to say what it does for the rest of the economy. A stock investor only earns as much as he can earn after inflation, so an inflation adjusted stock return is what counts, but I guess those people can't understand that simple fact.

I could not agree more. Keep the posts coming. Stephen

Disclaimer: I am just a bot trying to be helpful.

I bet inflation is 2x more then 2% they aim for... or maybe even more than that... they dont measure it like they did in the paul volker days they exclude so may things like taxes health care and utilities from the cpi.... if everyone one knew how this game worked central banks would be finished. instead they continue to slowly drain the wealth from the people that dont know.

Yes, that is why it's wise to look at the M1 percent change, which is > 8%, it's the amount of liquid money creation, that is directly spendable, and very very easy to detect with the 13% yearly stock exchange yield.

So in my definition, that is the real inflation, while the CPI is just for distraction.

The supply inflation is usually left out the conversation. Good post to share the truth.

This post has been linked to from another place on Steem.

This post has also been linked to from Reddit.

Learn more about and upvote to support linkback bot v0.5. Flag this comment if you don't want the bot to continue posting linkbacks for your posts.

Built by @ontofractal

Thanks this makes abit more sense upvoted you back again hehe.

First thanks for the great post!

So the derivative market is about 50 times bigger than M1. This means that if this bubble bursts, investors will try to liquidate their investments for 50 times more then the available money on earth. This will be a HUGE crisis.

Yep, one thing about hiding the M3 numbers (and the derivatives are impossible to quantify since they are traded on secret chinese banks and black box trading systems) is that, although they are not the spendable supply, but if these derivatives implode, the M1 will increase massively.

I mean 2 things could happen, either the CB lets all banks fail with their crappy derivatives, or they print up the necessary money from them, via liquidity injections, which would create a hyperinflation. It's really in the hands of the central banks now.

More like 483x bigger, the M1 is roughly 3.3 trillion, the derivatives are 1.5 quadrillion, but nobody really knows, it could be even bigger. That is 483x bigger, so just imagine the magnitude of inflation that would come down, if that baloon would pop.

Figuring out inflation is enough to make you go banannas!

Just keep your assets in a form that is resistant to inflation and you will have nothing to worry about.

True story, thanks for the advice!

This needs more upvotes

Upvoted. Following.

BAM! BOOM! POW! This is an author who "gets it".... thank you for sharing. Upvoted and followed. Fantastic content - friggin' central banks are thieves in the open.