Illusory U.S. Economic Boom as World Economies Fall

Economies built around using fiat currencies are in melt down around the world. Except the for the U.S. which has seen the reverse with an economic upsurge. The U.S. isn't immune to the popping worldwide debt bubbles. It's to blame.

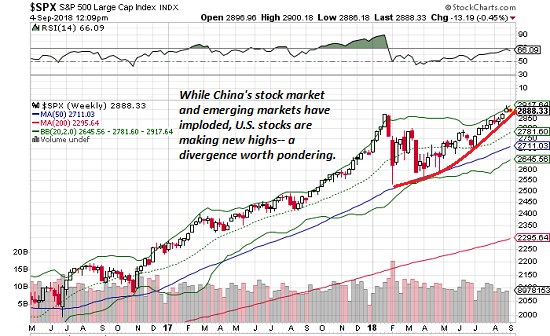

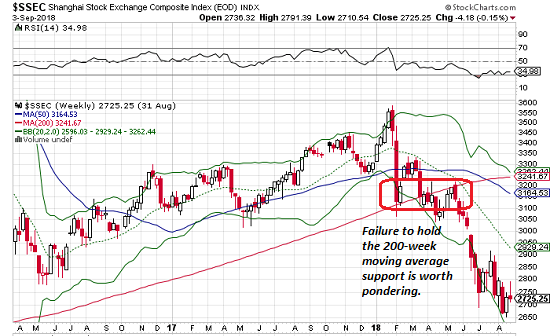

As the U.S. S&P 500 stock market index is soaring high, higher than ever before, the Chinese Shanghai Stock Market is crashing after being unable to hold it's 200-week moving average support.

Source

Source

China is an engine of global growth, while the U.S. is the world's consumer paradise that eat up what China puts out. Since China sells, it should be doing well. But the buying U.S. is instead. What's going on?

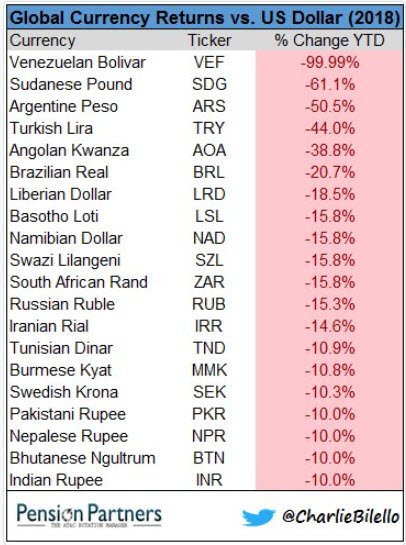

These two top economies of the world have been in a bull run for nearly the past 3 decades, yet now they are diametrically opposed in economic performance. Looking at other world currencies, they are also in a meltdown. This doesn't bode well for the world economy, even if the U.S. appears to be on top and dominating.

Source

Any nation can create an illusion of solvency by over-borrowing, over-spending and over-printing their currency. But eventually this money-magic game implodes as investors and traders lose faith in the currency. All currency value is based on belief, faith, trust and loyalty in it's value. If the game is rigged and manipulated, it's not really worth what people believe it's worth. When people catch on to the deception and the coming devaluation and loss of purchasing power, they bail.

With so many currencies falling apart, it's not a coincidence. They all share a common disease that is causing the outcome. The global debt bubble built up from the past decade after the 2008-2009 economic crisis is popping. The indebted, over-leveraged and mismanaged nations are showing symptoms of the disease first through stock market crashes or currency meltdowns.

When the past economic crisis hit, the bubble never really deflated the whole way. In an effort to prevent a reset back to the grounded reality and live in the real world again, more money-magic manipulation was used to pump things back up into the clouds of fantasy. This was through the expansion of debt and asset valuation.

The global economic system was out of whack back in 2008-2009 with a $500 billion subprime mortgage bubble popping. But the unreal global financial system of $200 trillion was rescued with more financial trickery. The "fix" of creating more debt to inject more money into economies and keep them afloat only made things worse and made the whole system even more vulnerable than it was in 2008. The bubble was just inflated even larger than before. And when it pops, things will be even worse than before.

With so many currencies around the world under pressure and leaking, it's a sign of another coming financial crisis. The current high valuations of assets and currencies will sink to lower levels in order to correct a system that is out of touch with reality, floating in the clouds as inflated bubbles of bullshit.

The U.S. looks great. Many people think there is nothing to worry about if you're in the U.S. market. But the U.S. started the subprime mortgage crisis, then went on with inflating the bubble through more debt and printing of fiat currency. The U.S. market is not immune to what's happening and what's coming. When the asset bubble pops, defaults on financial obligations will pile up, spending will decline, and the economy will crash.

Countries that printed money and went into debt, such as those in emerging market economies, took on loans in U.S. dollars. With currencies falling in value, it will take even more of their local currency to pay back the U.S. currency of debt they owe. Their loans are going to go bad, and the U.S. and EU banks are going to end up with piles of bad loans and bad debt.

Recall in the past crisis that many countries have bailed-out failing institutions that were deemed "too big to fail", as their failure would have sent the economic dominoes falling everywhere. The public had to bail-out companies that failed to be fiscally responsible. We had to pay for their failures. We footed the bill. And we will suffer because of their actions indefinitely it seems.

Governments don't want to let the bubbles pop, and will keep using the public to pay for corrupt industries to survive and keep playing money-magic manipulation games that fail and make everyone suffer. Now many nations have instituted bail-ins, where people who have money in institutions will have to foot the whole bill. Instead of the public at large through taxes paying for failures, it's going to be people with bank accounts and investors.

Prepare to lose most of your money when the banks start failing in the upcoming economic crisis that we are now seeing the start of.

Thank you for your time and attention. Peace.

References:

- The Global Financial System Is Unraveling, And No, the U.S. Is Not immune

- Major Currencies All Over The World Are In "Complete Meltdown" As The $63 Trillion EM Debt Bubble Implodes

If you appreciate and value the content, please consider: Upvoting, Sharing or Reblogging below.

me for more content to come!

me for more content to come!

My goal is to share knowledge, truth and moral understanding in order to help change the world for the better. If you appreciate and value what I do, please consider supporting me as a Steem Witness by voting for me at the bottom of the Witness page.

The US is in trouble in its own way. We have "the economy" which is supposedly doing GREAT, and then we have individual people's economies, which on the balance suck rocks.

Problem is, we keep "selling AIR" to people, and people keep buying it, even if no real value is added.

Take the pile of wood, metal, wiring, paint and other stuff needed to build a house. The cost is certainly "up somewhat" when you compare the 1978 pile to the 2018 pile. But it's up much less than the corresponding house in 1978 vs. 2018.

The price of materials in 1978 vs. 2018 increased on the order of 280%.

The house itself between 1978 vs. 2018 increased 530%.

That difference; that money "isn't anywhere." But it makes the economy better. As do corporate profits that end up purely in the "investment layer" of the economy, while the people working for those corporations are not materially better off.

Closer to home... we just renewed our homeowner's insurance. It costs just under $1300 this year, compared to $1250 last year... which falls within the realms of inflation. But here's the kicker. We normally pay in monthly payments, deducted from our bank account. NEW this year is a $3.50/month "convenience fee" for the auto withdrawal... AND a 10% surcharge for "financing" that was not there before.

So in REALITY our insurance went up $222 this year, but that will not be reflected in the "economics" sense, because "on paper" our premium is still $1300... the convenience fees aren't part of the actual premium, as economists measure it. And yet we — at end users — just got massively screwed at a rate increase that by FAR exceeds cost of living increases or inflation. And that's ultimately the house of cards that is going to collapse.

a house is greater than the sum of its parts, tried to hire a contractor lately? Plus the land, they are not making much new real estate. you should fire your insurance company.

Yup, the personal and national economies are hitting the rocks and many are trying to stay afloat. Those stats on the housing cost vs value is important to note for how the housing market overvalues real estate.

The banks and companies are trying to fleece people anyway they can for using their systems. they know you're hooked, so they can get way with it and you have no choice. We're being "skinned alive" metaphorically ;)

Interesting read, can’t believe some of those currency drops... it’s a bad situation in Venezuela, I hope something can be done.

Do you really think the banks could hold or take our money/savings away? I know it happened in many places, Greece for instance a while back where they couldn’t access their money. Could that happen in the uk or USA I wonder? I know people go crazy everywhere but imagine the riots in the uk. However, most of the riots in uk end up with vandals just stealing and damaging everything, most of whom don’t have financial assestsnto worry about loosing. Still... if the bank took my money I wouldn’t know what we could do?!

I would love to put more fiat into crypto, but crypto is way more volatile, unless I had it all in tether... but then when a rise comes it will be worth nothing. Crypto is great but not for all of our assets surely..? Due to the crazy fluctuations we see. A few months back everyone thought a boom was coming, unless that’s waiting for December/January again...

Take some dollars and put them into crypto while they are on sale. Forget about the volatility. In fact, forget about the cryptos and then look at them again in 5 years. I'd bet a big some of money that if you choose from the top 20 cryptos by market size you will see 100X your money in 5 years. The world is changing and blockchain is going to be driving this next global tech revolution. I'm deep in the weeds on blockchain and cryptos. I'm buying my favorite positions with all of my monthly cash flow. I've seen the future. In January, one of my positions was up 750x! Buy small positions and forget about them. This way you won't worry about volatility.

People may riot a bit, but police will smack them down. You can't take money even if you break in, as it's all digital with only a little reserve to pay out in liquid cash. If people tried to take it out at once, the whole bank would fail from being insolvent.

Crypto may not be a dead-ringer solution indeed... It might flop and go down with the hype over :/ But in maybe 5 or 10 years it will be a whole different story relative to the existing financial system...

It’s going to be interesting to see what happens to the people who spent money in the fashion that they want them to. People buying these huge houses for exorbitant prices. It’s 2008 coupled with lots of other bubbles that will burst. When is the only question now.

When indeed... is 2018 the year for the new world currency?

I have a feeling that they are setting crypto up to be the next bubble they will use to stretch out the coming collapse just a bit further down the road. So many have little in the bank now the option of stealing it out of accounts would barely make a dent in their debt structure.

Yeah, crypto might be in a downfall, it's all a belief in value like any other currency :/

Prepare to lose most of your money when the banks start failing in the upcoming economic crisis that we are now seeing the start of if you sell at the bottom of the market correction instead of HODLing. Market corrections happen about every 10 years, we are due for one. If you are smart you sell now while things are high and then buy after the correction. To be frank though I don't see the conditions in the US housing market for a collapse very soon. We have a ways to go.

Hold onto something as the price falls, isn't much of a smart move. Maybe some ppl will sell now before it pops...

The best thing would be to take profit now and then wait for the correction and the buy low but timing the bottom is pretty hard. When the price totally shits the bed then hodling is the way to go, you don't lose a dime until you sell or the company goes totally bankrupt and you don't really stand to gain much by selling at that point so you may as well hodl.

Thanks for laying the situation out on the table for us to see. We go about our business forgetting we are living in a debt fantasyland.

Yeah, fantasy dreamworld of thinking everything is fine when it's not... clueless, blind being led by the blind at best, and willfully led by crook most likely :/

What do you suggest we do with our fiat money? Crypto, US equities, metals, real estate?

All? Crypto seems promising, metals are time tested, and real estate is something real.

Would you mind sharing your favorite long term stock picks? Or maybe make a new post, would be interesting!

Curated for #informationwar (by @commonlaw)

Our purpose is to encourage posts discussing Information War, Propaganda, Disinformation and other false narratives. We currently have over 8,000 Steem Power and 20+ people following the curation trail to support our mission.

Join our discord and chat with 200+ fellow Informationwar Activists.

Join our brand new reddit! and start sharing your Steemit posts directly to The_IW!

Connect with fellow Informationwar writers in our Roll Call! InformationWar - Contributing Writers/Supporters: Roll Call Pt 11

Ways you can help the @informationwar

It's always an illusion look here not here. Market report Greg Mannarino talks about this often. A whole world has financial problems America included and we've never had our recovery. Thanks for sharing a great article @krnel

Yup, the ground hasn't been hit for nearly a century.. we're free floating...

this is a big lie since failure is embedded in the premise... always has been unfortunately

It's planned, signed, sealed and deliver that way indeed.

sure, as to wonder how the house of cards still holds... I want to follow you but then realized that I am already a follower of yours. LOL