Dividend Income Extravaganza – October & November 2017

Hello and welcome to my dividend income extravaganza for October & November 2017!

Since I headed over to Lisbon, Portugal for Steemfest2, (which was absolutely amazing!) I missed posting my dividend income for October, this post combines both October and November. Result!

October Dividends

October Motif Investing - $27.64

Nevsun Resources (NSU) - $0.51

This is a Zinc/Copper miner with operations in Eritrea. Nevsun has had a bit of a hard time lately as the life of its mine was reduced from over a decade to just 4 years. Thankfully, they are creating a new Copper/Gold mine in Serbia that should be complete in 4 years. They are also constructing the mine without using debt (the company is 100% debt-free). This did require a dividend cut, which hurt the stock price.

Euronav (EURN) - $5.46

Euronav is a shipping company focused on crude oil tankers, with the largest publicly-traded fleet on a cargo capacity basis. I’ve been accumulating oil tanking companies as oil shipping names have traded poorly over the past two years. Despite a rock-solid balance sheet and a significant financing war chest. Value or Value-Trap? Time will tell if I made the right call.

Medical Properties Trust (MPW) – $29.28

MPW owns and leases acute care hospitals and inpatient rehabilitation services. It has over 269 properties in 5 countries, which are leased to over 30 operators. FFO has been growing at a 9.4% rate since 2011 and has a dividend yield of 7% that is easily covered. If you are looking for a solid REIT, check this company out.

CubeSmart (CUBE) – $2.70

This is a self-storage REIT. Over the past month is has shot up in price to the point that I will probably sell it. The yield is currently just 3.7% as it is near its 52-week high. That’s pretty low as far as REITS go. (Update: I sold my position)

STAG Industrial (STAG) - $1.88

This is an industrial REIT that pays monthly. The stock price is pretty high and dividend growth is minimal (Last raise was about a penny increase per share for the entire year!). So while I like the company I would not buy more right now. But with a 4.9% yield that pays out monthly I am happy to hold on to the few shares that I own.

W.P. Carey (WPC) - $6.03

I have owned this REIT stock for a while now, but only in the last 6 months has the stock price taken off. Lately they have taken to increasing their dividend by half a cent each quarter. Maybe this regularity has helped bring it to the attention of the market? Either way, they still own quality real estate around the world and have a 5.6% dividend.

General Electric (GE) - $0.24

Oh boy, has GE been in the news lately – and not for any news a shareholder wants to see. My single share has only ever been to keep the company on my radar, but I still have double digits losses even after adding the dividend back in. Latest news is that the dividend has been cut in half and they will be selling off about $20 billion worth of the company to better focus on 3 product areas. It has been hit so hard that it is coming ever closer to a buy point for me. At $14 or so I would do an in-depth look at owning a position.

Air Lease Corp (AL) - $2.85

This dividend growth stock is flying below the radar of the DGI community. Mmmm, puns.

Their industry has large demand which means they are able to lease all aircraft before they even take possession of it. The recent dividend increase was 33.3%, and the year before that they raised the dividend 50%. Going from .05 to .10 for a yield of 1% and a payout ratio of under 12%. The one problem is that 73% of each aircraft purchase, on average, is debt. But while their debt load looks high, it is used to immediately increase their revenues (and profits). Worth a look if you are interested in grabbing a dividend growth company in the early stages.

OCTOBER GRAND TOTAL = $76.59

November Dividends

November Motif Investing - $15.97

STAG - $1.88 –

What can I say, it’s nice to get paid every month!

Omega Healthcare Investors (OHI) - $55.90 + $67.60

I own shares in two different accounts. I started accumulating shares in my brokerage account, but early this year bought a position in my Roth IRA. The plan was to sell the brokerage shares and use those funds to buy something else. Alas, the hefty dividend yield kept me hooked and now the company is having problems collecting rent.

OHI is down around 20% from two months ago, hitting a new 52-week low. In my brokerage, I’m down nearly 12%, but if I add back in the dividends I am just slightly below break-even. Maybe I will sell out of my brokerage position on a day where OHI is trading up.

Teekay Tankers (TNK) - $24.00

This oil tanker company has struggled in a weak oil shipping market. A combination of lower oil production and more ships means that the daily rate they receive for a contract has gone way down.

Luckily, they have found a company to merge with that appears to be a good deal for investors. The merger makes the 8% dividend yield that much safer as the new company has good income and little debt due for some years into the future. Hopefully, long enough for the oil shipping market to recover as it has always been cyclical.

NOVEMBER GRAND TOTAL = $149.38

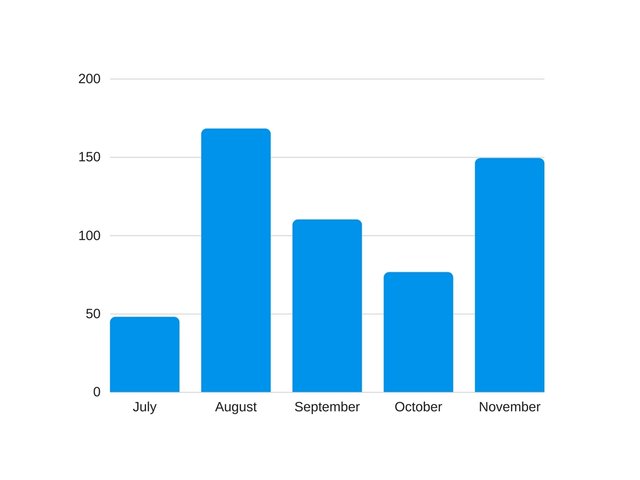

I first started tracking my dividends back in July, and this graph shows my total income for each month since then. Altogether it is $552.33 in dividend income! That is 552 dollars that I didn't have to actively work for. Now it has all been reinvested and will work for me for the rest of my life.

Speaking of reinvesting, I FRIPPED 9 shares of MPW which increases my annual dividend by $8.64. Yes, I am still using Scottrade which has been bought by TD Ameritrade. The main benefit is the Flexible Re-Investment Program where all your dividends go into a pot and are used to purchase shares of any dividend payer in a ratio you select and on any date you want. There have been rumors of the FRIP program being removed, but I think it is a wonderful thing that many customers have come to love. Doing away with that without providing something similar would be folly.

I also wrote an article for Seeking Alpha in which I researched a pure-play blockchain technology company, BTL Group. I have been invested with them since early in the year and it has performed wonderfully. Shortly after that article was published the stock ended up doubling, giving me a triple.

Siiiiiick. Great post, thanks for sharing.

I was just talking to a co worker a couple months back about setting up a DRIPS program to fund his kids college. (he recently came into some money).

I don't own any dividends at the moment, love some of your picks though. Such as the oiltanker picks (over the short term 3yrs), Nevsun, and I'd heard of Motif but never actually knew what they did.

Have you considered any peer to peer lending?

Such as

I've been researching them, and even know someone who's invested and he's been making 6% - 12% !!!

Not as safe as GE or Boeing, but still worth investigating.

Keep up the good work.

I've been on lending club for a few years but am slowly taking my money out. I just cant trust their lend vetting much anymore. So I wouldnt say for anyone to start an account there. Actually have had the thought to write a post about why I'm getting out.

I did make an account on fundrise but havent funded it yet. So that might be where I put my lending club money.

Interesting. Yeah the thought has occurred to me that lending club and prosper may be more dangerous late in an economic expansion when I assume lending policies are looser. Especially for unsecured loan.

But perhaps even RE backed vehicles like peerstreet and FUNDRISE.

I'm definitely interested in hearing your results if you decide to go that route.

The guy that created google analytics co founded Peer Street and one of it's biggest investors is Dr Michael Burry. That name might sound familiar if you read or watched the movie the Big Short. He was played by Christian Bale and made a ton of money in the housing crisis.

Quite the vote of confidence!

Having said that, I'm still really interested in YieldStreet that is uncorrelated to the stock market or real estate and isn't an unsecured loan like prosper of lending club.

I've gotta run, but it's worth a look if you haven't heard of it!

apologies for any grammatical errors I was in a hurry!

I would pickup some o stock for dividend increases every 3 months!

Show me your O face!

check out CVS and LOW they are on sale at moment

I agree, some solid companies there. People hating on the CVS-Aetna deal, but it is transformative and could really set off the growth once the transition is worked out.

What is dividends? Sorry noob question , I will re read again and try to understand.. it's really nice to have extra income monthly !

Some companies pay their shareholders dividends. Usually once every three months. So for each share you own, you will get that payment. Often it is a few cents, but when you have dozens or hundreds of shares it adds up!

Since you only have to own shares to get money, it is basically money for no work. Some people invest heavily in dividend companies and then stop working when they get enough dividend money to live life.

thank you for the explanation.. so you find the company that pay dividends... so on top of the price increase on the shares , you also earn extra from dividends? this is awesome!

Heck yeah it is! Remember though, since they are paying you a chunk of their cash they cant use it to grow. So growth is usually lower in dividend payers. Still, you can find yourself with great gains if you add up both sides.

Is it true? That for stocks I have to buy a bunch( like a certain amount). not like crypto ?

You can have one share (or even a partial share) and still get the dividend. Just that it won't be a lot of money until you also have a lot of money invested in that company.

For instance, Verizon pays a yearly dividend of $2.36 - that is $0.59 once per three months.

If you have one share you get $0.59 every three months. However, if you have 100 shares then you would be getting $59 - or $236 a year.

Once share of Verizon is currently $53.19. So to get that $236 you need to currently invest $5,319.

The trick is to buy them at a low and hold them for years as they increase the dividend every year. So in 10 years you might have paid $5,000 for your 100 shares, but now the shares are worth $8,500 and the dividend is $480 (this is an example).

So buying right and/or holding for a long time.

Cool..

Thanks for the info

Good idea.thanks for this post :)

https://steemit.com/@vordexus

thanks for news