FI/RE Series Part I: What is Financial Independence and why should I care?

Hey folks! @doggedfi here, short for doggedly pursuing financial independence!

What the heck is financial independence?

You may have heard this term floating around the Interwebs more and more recently. Basically, the idea is that focused and proper management of your finances can get you to a point where you have what some call..

"F-U money"

Once you are financially independent and have enough F-U money, you are no longer forced into working to live. You can finally escape the 9-5 corporate rat race and retire, if you so choose. If this is something that interests you, then I want to help you get set up for success!

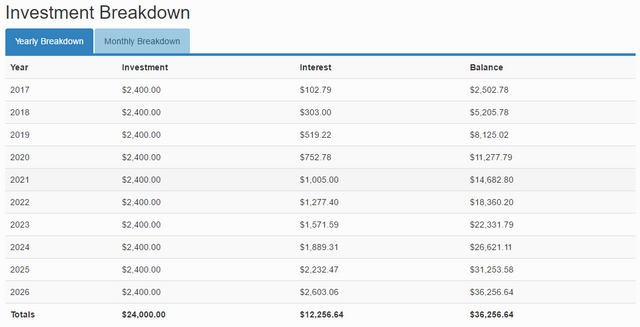

Financial independence is typically achieved by using the magic principle of "compound interest". You invest money, that money grows via interest the first year, that money + interest gains more interest in year 2, and so on. For example, investing just $200 a month can grow substantially over time. This effect is greatly magnified as number of years and size of investments increase.

Keep in mind that compound interest is a double-edged sword. It has the potential to be either your best friend or your worst enemy.

Staying in credit card debt month after month is a situation where compound interest is working against you. Your debt gains interest, debt + interest gains more interest, etc. Credit cards also have viciously high interest rates so use them responsibly (by responsibly, I mean pay off the entire balance every month).

Okay, tell me more..

First, you need a proper foundation upon which you can build up toward financial independence. The following steps should be performed in this order:

- Stack up your "emergency fund" of 3 to 6 month's worth of living expenses

- Contribute money to your employer-sponsored 401k/403b retirement plan up to the company match (ex. You have a $50,000 annual salary and your company matches %6. You invest $3000, your company also invests $3000. This is literally free money, take advantage of it.)

- Crush the enemy of wealth - debt - by paying off your highest interest rate debts first

- Open your own Roth IRA retirement account and contribute the maximum $5,500 a year ($6,500 if over 50 years old)

- Increase your 401k/403b contributions up to the annual maximum ($18,000 a year, not including any company match %)

- If you have left over money, invest more into regular taxable accounts

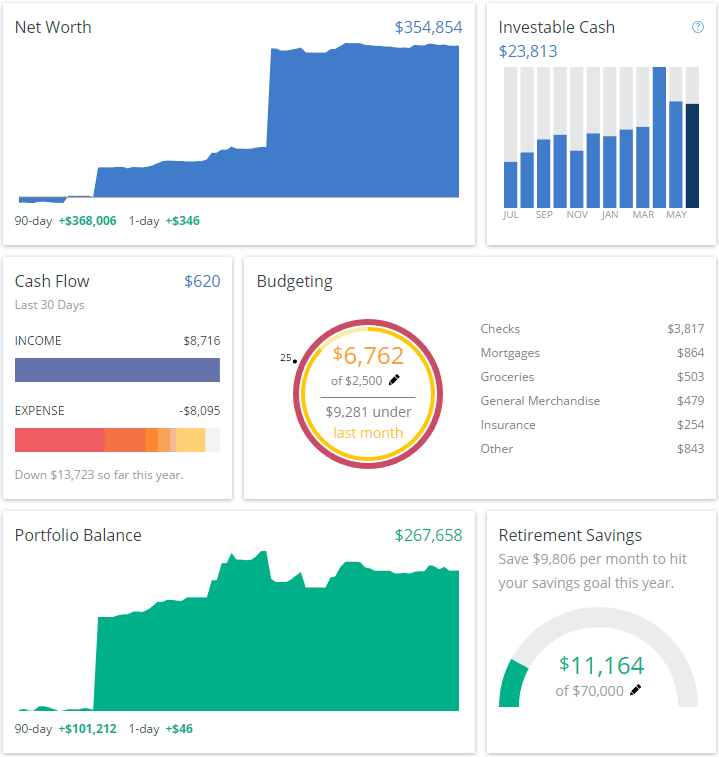

You also need to have a solid understanding of your income, expenses, assets, and liabilities. A good way to start assessing this is by opening a free Personal Capital account. You can enter all your financial accounts, assets and debts and they are aggregated into a great visual dashboard.

Budgeting will be your best friend by helping you control your expenses. I highly, HIGHLY recommend using the software called You Need A Budget (YNAB). I've used it for a couple of years now and it is excellent. I hated budgeting before YNAB and I never followed through with any other method. You can try it for 34 days for free and students can use it for a full year for free. YNAB will show you where every single dollar of your money goes each month. Use this info to cut out wasteful/unnecessary spending.

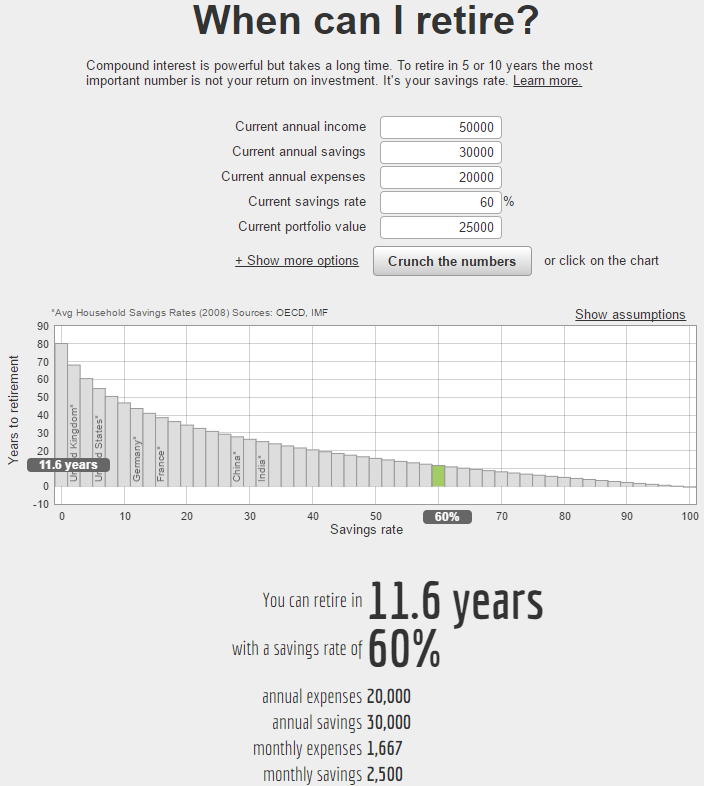

Once you have a solid handle on your income, expenses, and how much money you are able to save each year, you can use the Networthify calculator to determine when you are financially independent and able to retire!

We'll do a deeper dive in future posts on the key steps you should be taking to achieve financial independence if its something that you're interested in. Optimize your finances, slash your expenses, crush your debt (maybe mix in some kickass Steemit earnings) and you'll be financially independent and possibly retired before you know it.

I realize this is a ton of information.

Follow me @doggedfi for the next parts

of this financial independence series!

Recommended reading:

The Simple Path to Wealth

Mr. Money Mustache

The Mad Fientist

Personal Finance subreddit

Financial Independence / Retire Early subreddit

@doggedfi

brought to you by @aggroed, @ausbitbank, @canadian-coconut, @teamsteem.

That is a quality post packed with great info.

Great job dude.

Thanks man, appreciate it!!

Resteemed + upvoted. Class first post on some of the key aspects of Financial Independence.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by doggedfi from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, and someguy123. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you like what we're doing please upvote this comment so we can continue to build the community account that's supporting all members.

That's one hell of a hard worked post, great job mate!

Appreciate it man! Definitely took some time but its something I'm genuinely interested in so that helps a lot.

Great information. These days it seems like no one knows how to save any more.

It IS scary how many people aren't prepared!

Preaching my language. Passive income man! Been trying to build it, got a chunk need some more and be free of the man forever.

That's the dream! Gonna elaborate on future posts of diversifying income and other stuff. Thanks for reading!

Nice. I look forward to it. Gotta diversify. Rental properties, some small business investments, crypto, dividend paying stocks, etc. I need more passive income! :-)

I wish I would have cared about this stuff years ago when I was ruining my credit.

Adulting is so hard.

It is, man. Gotta play the ball wherever it lies though. Long as you're stopping bad habits and picking up good ones, you're on the right track!

Nice post. It's very informative. I've been doing my budget balancing on pen and paper for a while now and it has helped me wrangle some of my debts.

Upvoted and resteemed

Awesome. Appreciate your support! Yep, whatever budgeting method you'll stick with is the best for you! Cheers.

Great post with some really useful tools i will be checking out..minnow support all day e'ry day

Congratulations @doggedfi! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!