Technical Analysis & Normal Distribution

Are you using Technical Analysis to trade? Do you use tools like Bollinger Bands? Then you must read this article, because I am revealing to you why they won't work. Yes, they don't work!

I already explained why TA doesn't work, it's too much superstition combined with subjectivity:

https://steemit.com/trading/@profitgenerator/top-reasons-why-you-are-not-making-money-from-trading

But this one tool called Bollinger Bands, which is very popular, gives the impression like it's scientific, because it throws words like moving average, standard deviation, to make it sound scientific, but it's as scientific as tarot cards. There are of course variants of it like Keltner channel and many others, but it's not like that one is working.

Let me tell you a secret. None of the technical tools in your trading application works. Yes, I am a quantitative analyst for 10+ years and I can guarantee you, they are all bogus. They make themselves sound scientific by throwing scientific terms in there, but just by claiming they are scientific, doesn't make them so. There are even academic papers debunking them all, and proving that they have effectively no analytical power whatsoever.

So they make you look like a fool who is reading tarot cards if you use them, but hey it's a good business selling books about sorcery, atleast the publishers and authors earn money, because you don't!

Why they don't work?

Well, here I am going to demonstrate scientifically why they don't work. Yes we are going to use real science and mathematics to demonstrate why they don't work. Don't worry about the technicalities, I will explain it simply, so even a 5 year old can understand it!

Now first of all the Bollinger Band uses a moving average to smooth the price that can be configured, and has 2 bands on the 2 sides projected from that average that can be customized, but usually is set to 2 standard deviations.

First Problem:

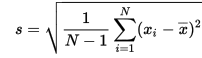

Common implementations of the BB (at any popular trading software like MT4 or MT5 or Online Platforms) use this formula to calculate the standard deviation:

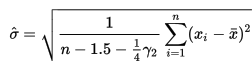

This is wrong, this formula works only for the Normal Distribution, it implies that the market is Normally Distributed like a bell curve, which is not. At bare minimum it should use this formula:

This is the standard deviation formula for all distributions, unbiased by factoring in the excess kurtosis. But even this is not entirely correct, which brings us to the second problem.

Second Problem:

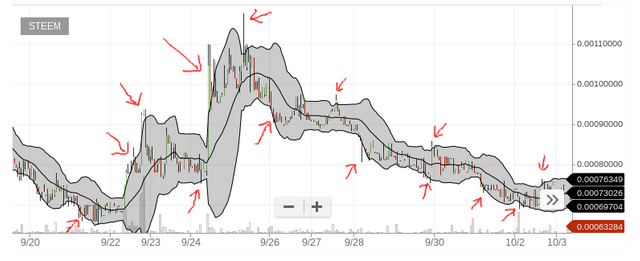

Markets are not stationary, which means they don't have a constant mean, variance and covariance. It's essentially a joint probability distribution made up of many subsets, so you can't measure the standard deviation, you can only estimate it. You can measure it for the sample you have but it won't be constant after you obtain new data, therefore these indicators will all show you bogus results:

I went to Bittrex and used their Steem chart, plotted a Bollinger Band with 20 period and 2 deviations, and it's leaking price as a bad faucet. C'mon how can anyone take this seriously? The 2 standard deviation on a Normal Distribution should contain 95.4499% of the price, yet it leaks the price like a bad faucet, the price constantly popping out of the boundaries, and always swinging near the edges.

So yes this indicator is a joke, a bad joke, and every Wallstreet quant are laughing their asses off at newbies who use them instead of proper analytical tools.

So how to deal with the distribution of the price?

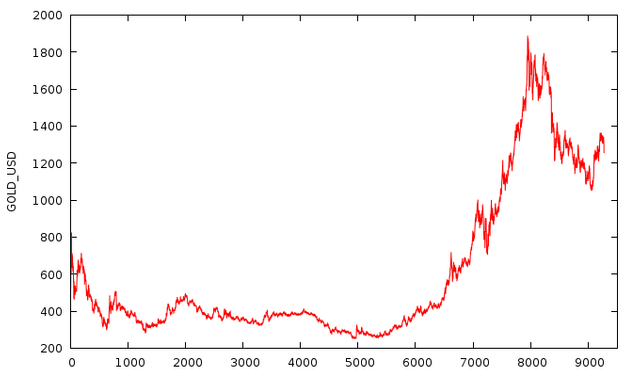

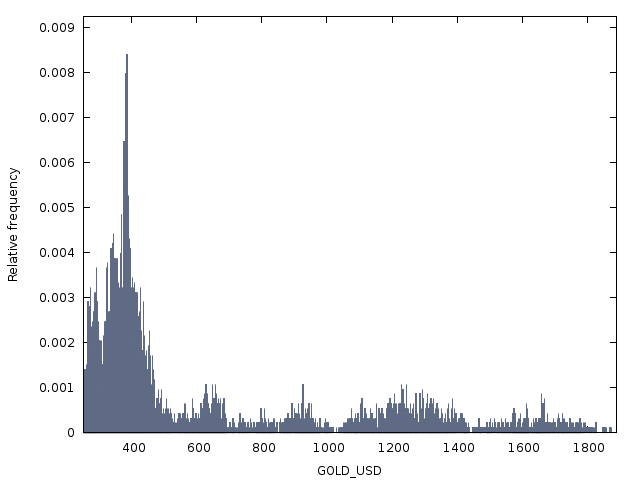

Well, there are ways to estimate the distribution of the price, but ongoing, and isolating separate environments of the price by finding optimal coefficients for each instance. But before this, let's see first how the price looks like. I have grabbed the GOLD_USD chart as an example from my previous article:

Just by looking at the chart, you can already see that this is not normally distributed, by far. For example a Normal Distribution doesn't have a trend, it has to be a stationary process. But let's see a formal analysis:

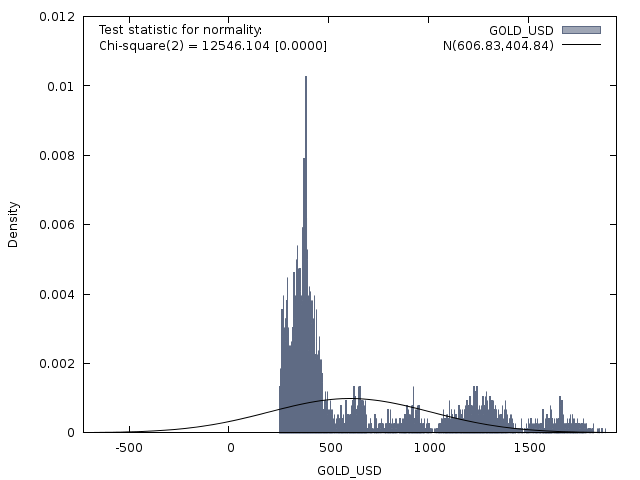

That is a bell curve overlapped at our distribution, the spikes should be below the curve, and should be aligned on the line in order to quality a Normal Distribution.

Now you can say oh but I have only 40 years of data here, what if you put the entire gold market history from the past 5000 years would that make it a Normal Distribution with more data? and the answer would be NO! If you look closely, for it to be a Normal Distribution it should be symmetric, so the price would have to be -500$ at some point. Hahaha that would be nonsense, markets can't go below 0, so yes it's definitely not a Normal Distribution.

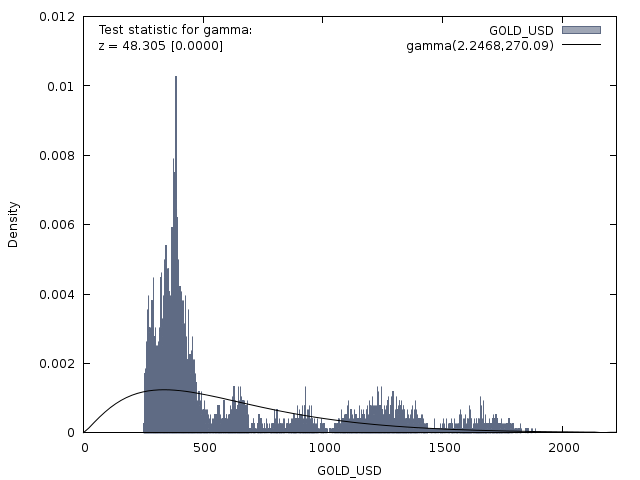

It's actually closer to being a Gamma Distribution, but even for that it doesn't qualify.

| Attributes | GOLD_USD market | Normal Distribution | Gamma Distribution |

|---|---|---|---|

| Skew | 1.3943 | 0 | not gamma |

| Excess Kurtosis | 0.62211 | 0 | not gamma |

We have to understand what makes a Normal Distribution a normal one, and that is the Skew and the Kurtosis being 0, and for the GOLD_USD market it's certainly not, in fact I doubt it is for any market. It is a fact that no financial market is normally distributed, it's impossible.

But if you don't believe me even after all this evidence, we can do a Normality Test just to make sure.

| Normality Test (GOLD_USD) | result | P-value |

|---|---|---|

| Doornik-Hansen test | 12546.1 | 0 |

| Shapiro-Wilk test | 0.744907 | 3.83205e-80 |

| Lilliefors test | 0.284306 | 0 |

| Jarque-Bera test | 3156.3 | 0 |

So yes all tests failed, the p-value is under our threshold, typically 2% so we can safely say that the Gold market is not normally distributed, guaranteed, and this is true for all markets! So you can take all your garbage indicators and throw them in the trash can, because they won't work, and you were making a fool of yourself by using them and taking them seriously.

So what tools can I use then?

GARCH, and it's variants or other ARCH models. I will write about this in my next article, how to use it, especially setting the stoplosses correctly with it, so stay tuned!

Disclaimer: The information provided on this page might be incorrect. I am not responsible if you lose money using the information on this page! This is not an investment advice, just my opinion and analysis for educational purposes.

Image Credits:

[1] Wikipedia formulas

[2] Bittrex Chart

Also I forgot to say that the price sample is always a discrete probability distribution, while these garbage technical analysis indicators always imply a continuous distribution. The price hardly takes on all values between 2 points and it's usually trimmed to 4 digits. So the price is technically a

discrete heteroskedastic joint probability distribution.If you have any questions or problems understanding the article feel free to ask and i will be happy to explain!

Interesting. Looking forward to reading what works. I am learning to trade Forex and cryptocurrencies so, this article help me to see the light. Following you. Welcome to follow me.

Thanks, I have just wrote the continuation of this article, you can read it here:

https://steemit.com/mathematics/@profitgenerator/trading-moving-average-crossovers-useful-part-1-2