Become A Successful Investor - My Guide To Investing In Crpyto (Part 2 of 2)

Become A Successful Investor - My Guide To Investing In Crpyto (Part 2 of 2)

Hello steemit community! This is my follow-up post to my part 1 post of this two part series on how to become a successful investor. Now unfortunately I doubt reading my two posts alone is going to be enough to make you a superstar investor. However, I greatly enjoy teaching and have spent the last 4 years trading crypto currencies and would like to continue to share some of my investment philosophies.

Disclaimer

The following article is the expressed opinions of only myself and should not be taken as investment advice. At the time of writing this article the author (myself) holds a long position in mentioned Vericoin and holds no other interest in any of the other coins shown or mentioned. Please invest at your own risk and PLEASE do your research prior to making any investment decisions. Thank you.

Quick recap from yesterday's post.

I would highly suggest if you have an extra 5-10 minutes to go back and read my first post as it sets up steps 1 and 2 in how I make sound investing decisions. The TLDR; of that post explains first you want to use good fundamental analysis to survey the market and second you want to use that fundamental analysis to pick your pool of potential 'winners'.

I also covered what I would call 4 basic rules when it comes to investing which include:

- Accept you will make bad trades.

- Always set your stop loss orders.

- Don't trade on emotions.

- Do your own research.

So if you care to read the breakdown of that post please feel free to. However assuming you're ready to move forward we'll get into the next aspect of trading which is technical analysis.

Step 3. Putting technical analysis to use.

So at this point it would be assumed that you've done your fundamental analysis on the markets and have hand chosen a handful of coins that you feel have good potential for success. And it's important to note the fundamental research aspect never ends. Markets change daily and it's important to stay atop of the news if you want to be successful. But turning to the technical analysis (TA) here we'll start with our list of coins.

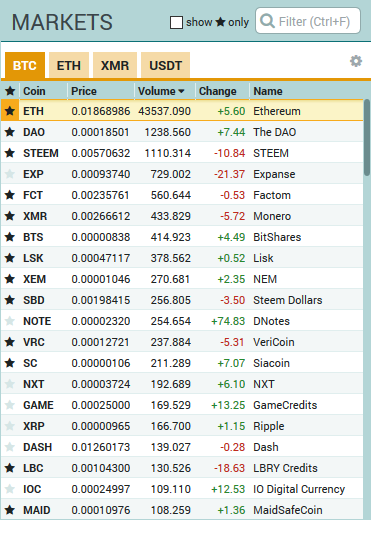

Now the picture below is the real current list of coins that I follow on a daily basis.

And it's not to say coins that aren't starred are bad projects. NXT for example has done really well and has a solid dev team. I simply don't follow it mainly due to time constraints. However below I have 15 or so coins that I keep my eye on most days. Now when it comes to technical analysis I often start with keeping my eye on volume and volatility.

Volatility and Volume

Volatility is important because that is how money is made and lost. What makes crypto such a wild ride are the +/-20% swings that you can see in a day. So you typically don't have to look far to get that aspect of trading. Volume is equally important (if not more) because that is what provides liquidity. Without volume you can't really move a lot of money in or out of a coin. There are dozens of coins that trade on various websites with less that 1BTC of daily volume. That basically makes it impossible to enter or exit the market unless you're looking to trade literally dollars, like $5. The main thing with volume is that you want to make sure anytime you invest in a coin you can easily get in and more importantly easily get out.

Lets assume as an investor you're sitting on 15BTC (roughly $10,000) and of course want to have liquidity. A good rule of thumb is to make sure your investment is no more than 10% of the average daily volume (24h) IF you don't want to disrupt the market. What I mean by 'disrupt the market' is that you won't cause a large swing in buying or selling your position. Why does this matter? Well you don't want to invest in a coin that is going to cost you a 25% premium to buy in due to the fact the order books are thin or even worse cost you 25% on the sell side because there is no buy support.

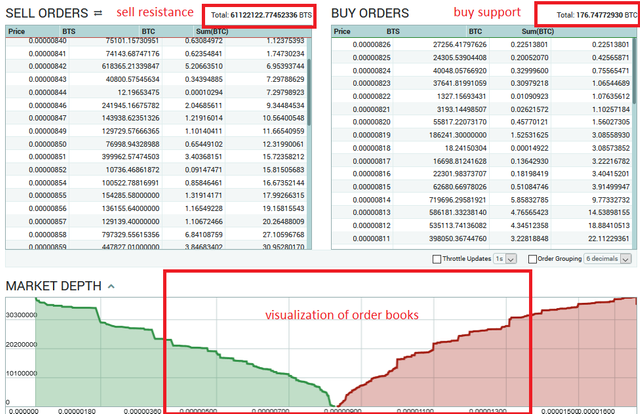

So lets for a sake of example take a look at Bitshares (BTS) and at this point we are looking at 2 things on the screen:

- The daily volume.

- The order books.

For the first picture (looking at daily volume) I have the daily volume of all the coins highlighted in red on the right hand side with a different red line pointing to the gray bars that show daily volume. What's also important to note and highlighted in blue is that for his picture I'm using a 1 month chart with 1 day candle sticks. The reason I've chosen these settings for this image is because I'm trying to get a grasp of whether the volume we see here today is average, above average or below average. The reason this is important is because going back to the point I was making above, I don't want to invest my 15BTC into a coin who's AVERAGE daily volume is below say 150BTC/day (10% rule). There are times when a coin with typically low trading volume sees a sudden spike in volume and as a result rookie investors over commit and get stuck holding more coin than they can sell back after the volume dries up. We call those folks bag holders. ^^

Now if we jump into the next picture that shows the order books what we want to understand is how the order distribution is currently setup and whether there is a good spread of orders or a few tightly placed orders holding everything up/down. In theory I like to look for coins that have a nice straight light up and down, which would show a more even distribution. If a coin has what looks like more of a stair case/steps then it's the result of tightly placed orders, which if removed, could cause a large stir in the market. Now that's also sometimes what we are looking for, which is why I say "in theory" we're looking for smooth order books.

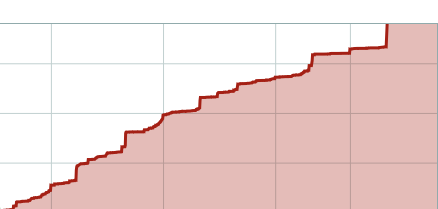

The above is a picture is a different coin than what we were just looking at (Bitshares) to showcase more of a stair-step pattern on the order books. To me as a buyer, that's actually kind of a good sign because the resistance to go up is really placed in 5 or 6 large orders. That might be an indication of another investor trying to simulate downward pressure to possible try and increase their position and can quickly remove and release resistance upon any good news.

So to jump back here looking at the example of Bitshares we are using, lets ask ourselves does this coin make the cut?

- Does it have good fundamentals? Yes.

- Does this have a good future for success? I'd argue yes.

- Is there liquidity in the market? For 15BTC yes.

- Do we have volatility? You can pretty much check yes for most coins on that one.

Ok so this seems like a good coin, what do we do next?

Using TA for order placement.

So when it comes to placing orders I have changed my charts slightly from the last image to this new one. What's changed? Well mainly that I switch from 1day candle sticks to 4hour candle sticks. Still looking at a 1 month timeline. In addition we have 3 colored lines on the chart:

- Purple line is a 200EMA

- Yellow line is a 50EMA

- Blue line are bollinger bands set at what I believe are 20/2

Now there is plenty of good content already available on the internet as to what all those terms mean. I'm going to skip ahead for the sake of time and simply point out for my own investing these are the settings that I use. When it comes to technical analysis one of the more important variables is what metrics you use and what you set your indicators to. Now I'm sure plenty of other traders would disagree with the fact I use a 1m/4h chart with 50/200 MAs to make investing decisions in crypto. But these are the charts that I've been using for years and they have done me well. I'd call it my secret sauce but nevertheless I'm still happy to share these settings with anyone who's interested in using them.

Now when it comes to placing orders this might be an over simplification but my general rule of thumb is when a coin breaks the bottom bollinger band (blue line) that is my time to buy. So for a coin like Bitshare that we're looking at - we're currently way off that spot and in fact over the last 1 month have not even have a entry point into the coin. It almost crossed that point on July 7th-8th but volume was very low and there wasn't enough downward pressure to push the coin into what would have been an order around .00000620. On the contrary side, again this might be a bit of an over simplification but on the sell side I simply look to have the price break out of the top bollinger band and more times then not - you'll be in good shape to sell.

Now any other good trader will tell you - never trade on bollinger bands alone. Really you should never trade on just 1 indicator itself. However this process has done me very well over the years and while I certainly do take into consideration other trading metrics - I try to not over complicate things and follow this simple rule. 1 month/4 hour charts and follow the blue bands.

Now above is a 1 month/4 hour chart of Vericoin, which for the sake of the example I will argue it checked off yes's for all the typically questions I'd ask before investing in a coin (fundamentals, good future, volume, volatility). Whether you would agree with that assessment or not is completely up to you but again for the sake of this post I'm going to say that - yup we're good to go on those 4 questions. Well based on my general rule of buy below the blue and sell above the blue I would have recommended selling out back on the 15th and buying back in well pretty much today. Now I unfortunately don't always follow my own rules because well I too got greedy (rule #3. don't get emotional) so I did not sell my position when it crossed the top bollinger band because I was thinking "we're for sure going higher". However once I realized not selling was a mistake I still got out in the .00016-17 range and am now buying back in since it's dropped below .00013. Again this is NOT a recommendation for you to purchase Vericoin yourself. What I highly recommend is that you conduct your own research and make your own decisions based off the information you collect.

So with all that said, what I would like to do at this point is pause and ask if there are any questions based on what I wrote? I'd be happy to pick up on this tomorrow assuming there are people out there who find this information valuable/interesting ;) Thanks for those who took the time to read through this all and I hope it helped.

Great post! though there isn't much scientific evidence that technical analysis actually works better than simply buy and hold

Actually funny enough I would argue that buy and hold > TA analysis. Typically those who try to time the market under perform what would otherwise be a buy & hold strategy. Which is why at the end of the day I definitely make sure there are good fundamentals in any coin I invest in and never invest on technicals alone. Appreciate the contribution!

Great post. Just got throught it, lots of work was put into this.

Everyone upvote @dogguy ヅ

thank you for taking the team to read it :) appreciate the feedback

Hi, good info here, thanks! A steem TA would be also nice

I'd love to break down STEEM but I typically stick to polo charts for my investing and since it just got there can't use my 1m/4h charts =p

I'd be happy to zoom in a little and do a TA analysis of the 4 day charts/15min candles. I'll take a look at that for tomorrow =)

Five stars post to complement the previous one! You mention all the basic stuff a newcomer must know before even buy 1 satoshi of any altcoin!