Become A Successful Investor - My Guide To Investing In Crpyto (Part 1 of 2)

Become A Successful Investor - My Guide To Investing In Crpyto

Hello steemit community! I am beyond excited to get my first steemit post up on this site =) I'm a professional investor, been in crypto since 2012 and love teaching people about bitcoin/altcoin investing. I actually love talking all things investing; stocks, bonds, gold, financial planning - not just crypto. But for this post I'm going to focus only on crypto investing.

Disclaimer

Before we get into the meat of the conversation I want to point out that I will not be making any individual buy or sell recommendations in this post. The guide posted below is simply my own investing strategy and is not a fool proof way to making profitable returns on your investments. Invest at your own risk and PLEASE do your own research (DYOR) prior to making any investments, which includes fully understanding any/all risks involved... and with cryptos there are usually a lot ^^. That is all.

Step 1. Start with fundamentals.

Typically when it comes to investing you'll hear about "technicals" and "fundamentals". The technicals are the charts, graphs and algorithms used to make buying & selling decisions. I'll use technicals to decide if a coin is overbought/oversold - where to set my buy orders and where to set my sell orders. We'll get into the technical side of investing later but for now it starts with the fundamentals.

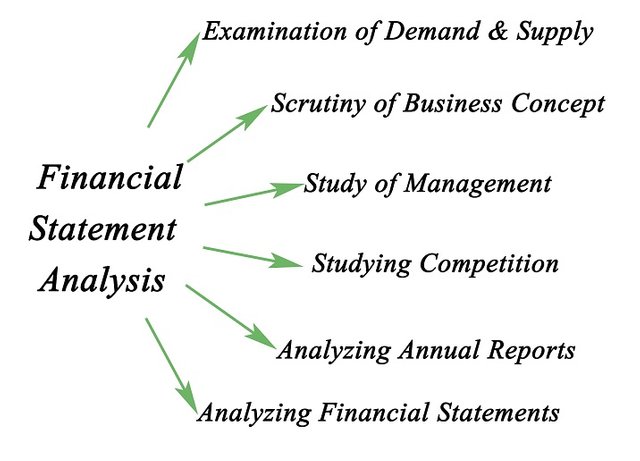

If I were to breakdown a tradition stock (a company) and look at their fundamentals - this would include items like:

- financial reports (income statements, balance sheets, cash flow...)

- earnings, cash/debt ratio, P/E ratio, PEG ratio...

- the management team

- the health of the industry/sector

- competitors & opportunities

Understanding the fundamentals are really the cornerstone to investing. Warren Buffett is the primary example of a fundamental investor. He looks for companies that are considered to be "undervalued" based on price to earnings and his overall view on the industry/sector. He only invests in companies that he believes are true winners. Now when it comes to cryptos we obviously don't have things like income statements, P/E ratio, balance sheets or cash flow reports. But what we do have are:

- management team (some of the time)

- white papers (some of the time)

- the health of the industry/sector

- competitors & opportunities

So when deciding on which coins to investing in - your best bet it to start with some research. A perfect example of this would be Siacoin. I started to do some research on this coin awhile back and before I got into any of the technicals I read up on the project's history, who the developers are/were, what was the coin trying to accomplish (what was their business plan if you will), I read up on the decentralized data storage space and then also look into their competitors with SJCX & MAID as their main 2 in the crypt-decenteralized data space. After doing my own research I came to the conclusion that I really liked the decentralized data space and within that space Siacoin was a winner. To be clear this is NOT a recommendation to buy Siacoin but rather an example of how I use fundamental investing to help choose which coins I'm going to invest in. That is all. An important rule to me is to make sure you both understand AND believe in the investment. Don't just invest in a coin because you think you can make a quick buck on it. Research, understand, learn and then make your decisions.

Speaking of rules.... before we get into the next side of investing (technical analysis) I want to point out a few general rules that apply to all forms of investing and certainly crypto as well.

Rule 1. Accept you will make bad trades.

My father was a stock broker for 40 years and when I first got into the business he gave me some sound advice; "you only need to be right 55% of the time". Come to accept the fact you'll be wrong, a lot. Don't feel like you need to be right every time - you just need to be right more than you are wrong ;)

Rule 2. Always, yes ALWAYS set your stop loss orders.

You have to be able to accept defeat and walk away. Typically what kills investors is when they not only make a bad trade (that will happen, see rule 1) but then they either don't take their loss and walk away or they double down because "it's being manipulated by whales" and it's go big or go home. Set a % from your original purchase that if that time ever comes you'll sell - period.

Rule 3. Don't trade on emotions.

It's a dangerous roller coaster and it often looks like this: anger => even more anger => wtf did I just do? => depression. If any of the following pictures resembles what you look like when trading - just walk away and take a break.

And when it comes to not trading on emotions you can also throw in there;

- don't panic buy

- don't be greedy

Rule 4. Do your own research.

Never and I mean NEVER trust what you hear from someone else. That includes the trollbox, bitcointalk.org, slack threads, articles posted on various websites, articles posted on this website. It's not to say that you can't hear about something and run with it but make sure you do your due diligence, ask questions and don't just take rumors for face value. Now don't confuse "never trust anyone" with "don't take the information". I actually get a lot of good info from the trollbox (if you're asking wtf is trollbox - that would be chatroom on poloniex.com) but I never trade on trollbox advice itself. If I get what sounds like possible good advice from the trollbox I'll then go Google and research, research, research to make sure it's sound advice.

Step 2. Identify potential winners.

Based on the research covered in step 1, I put together a watch list of as many good coins as I can follow. If you're relatively new to crypto and don't have a long list of projects that you follow, I suggest starting either with coinmarketcap.com and following the larger projects (typically have more info/research) OR going to your exchange of choice and following projects based on volume.

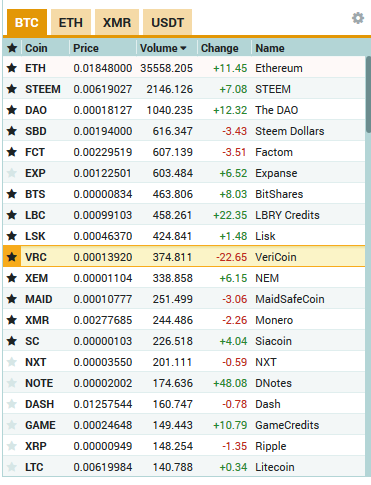

I myself do a majority of my trading on poloniex.com (this is NOT an endorsement - as I've said multiple times now - please do your own research and understand all risks involved) and when logged in you can see the projects I have highlighted as coins that I follow closely:

There are roughly 20-25 projects that I follow closely - each of which I find to have great potential for success. This includes a combination of some of the largest projects in the crypto world (Ethereum, MAID, BTS, STEEM, DAO) as well as some smaller projects that are less followed/talked about (Vericoin, SYScoin, QORA, Digibyte). Now that does not mean I'm invested in all 25 projects or even a majority of them. Actually it's pretty rare that I'm ever invested in more than 5 coins at a time. I use technical analysis to try and time when and how much of a project I'm invested in and again we'll get to that part soon but what's important first is putting together your list of winners that over the long haul - you'd feel confident being invested in.

Now a few things to note regarding the list of coins that I follow that help me make good decisions;

- I constantly am researching each of these projects, following any news or insight that would help me decide whether to buy or sell.

- My list constantly changes. The crypto world moves fast and just in the last 4 weeks there are probably 3-4 new projects that have really hit the markets hard (STEEM for example) that didn't have my attention previously.

- Just because a coin is on my list does not mean I will invest in it. Sometime timing isn't right and while I might follow what a project is doing and keep it on my radar does not mean the technicals or the funds are available to invest.

- Just because a coin is on my list does not mean I won't short the position. Again this will get into the technical aspect but just because I think long term a project has huge potential (MAID for example) doesn't mean I won't short the position if the technical analysis I use tells me the coin is overbought. While I typically don't go short often I'm not against doing so if the charts show it's a good time.

Having a good list and following what's going on in crypto is important. What's unfortunate is that there are too many projects and not enough time to following them all. There is no right/wrong way to choose what projects you follow but I suggest trying to follow as many as you can and staying atop of what's new in the crypto world.

Now that we've covered steps 1 & 2 we can move on to the conversation of technical analysis. I'm going to get pretty detailed in my explanation of what I do and the charts I watch. Since it's late and this post is already feeling like it's getting a little too long I've decided to follow-up with part 2 of 2, the technical analysis aspect tomorrow. If anyone has anything specific they want covered in that piece or something I did not mention yet that you have a question on - please feel free to ask and I'll gladly either comment below or add it into tomorrow's piece. Thanks for reading this and I hope you found it either helpful or slightly entertaining. I aimed for both =)

Ahh one of my favorite pictures... that would have been a great thing to add to the "don't invest on emotion" lol