Celebrating the Ethereum Merge with a stETH story as this asset made headlines this year !!

Staking on Ethereum Beacon Chain using staking Pools

I always wondered how one can stake on Ethereum’s Beacon Chain earlier with people saying they joined staking pools where they deposited and locked their ETH to earn staking rewards. However, this locked ETH can only be unlocked when withdrawal of deposited ETH is activated in Ethereum’s Beacon Chain.

stETH, the liquid ETH asset represents ETH locked in Lido Finance’s staking Pool

This year news on stETH kept flashing with stETH losing its peg to ETH and CEFI lending platform, Celsius facing liquidity crunch issues because of that.

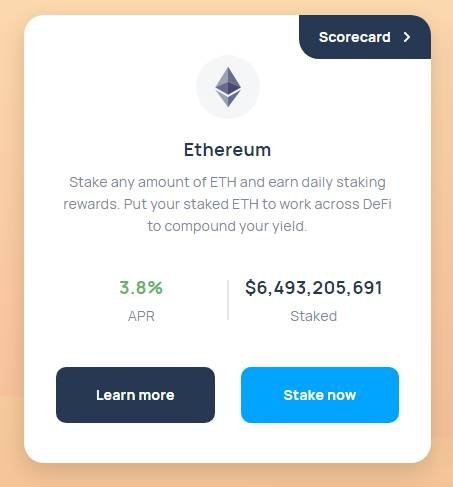

Soon, I learnt that stETH is liquid ETH received by users who locked their ETH in Lido Finance’s Staking pool. This stETH was an easy way for users to earn staking rewards without having to set up validator nodes that require locking up of 32 ETH (obviously costly) and needing to maintain the node hardware and software performance to avoid penalties of slashing.

*Slashing is punishing validators by taking away a portion of their stake if they act maliciously or don’t keep up with required uptime performances.

Users only need to lock up any amount of ETH they want to in Lido Finance's platform which will use users' funds to set up their own Beacon chain validator nodes.

Lido Finance then rewards their ETH depositors with a portion of validator rewards, taking a cut in form of fees for their overhead costs on running and maintenance of node infrastructure.

ETH staking module in Lido Finance's Platform

stETH depeg this year led to the start of liquidity troubles for Celsius

Meanwhile, even though ETH depositors have locked their ETH in Beacon Chain through Lido Finance’s staking pool, they get equal amount of stETH in proportion to their locked ETH, which they can freely use in DEFI, lending their stETH and borrowing against their stETH collateral besides being able to sell and trade their stETH.

However, a few months ago stETH lost its peg to ETH which caused issues for now bankrupt CEFI platform Celsius.

What seemed to have happened was that since Celsius had locked the majority of its customers’ ETH deposits on Lido Finance, the platform could not cater to large ETH withdrawal requests from its customers.

Most of Celsius customers’ stETH were locked as collateral in DEFI protocols like Aave and with the value of stETH down and lower than ETH, issues arose with Celsius unable to retrieve equal value of ETH for it’s customers’ stETH deposits.

I also suspect some liquidations may have happened for Celsius on its stETH collateral it deposited in DEFI platforms, where the platform borrowed assets against its stETH collateral.

Tradingview chart

stETH is 0.957 to WETH, meaning it's still lower than the value of WETH, which is nothing but wrapped Ethereum. From the period of June 6th to June 17th stETH experienced a major depeg from ETH and WETH

stETH depeg dramas making news this year got me acquainted with Lido Finance

Well… all these interesting stETH dramas got me acquainted with Lido Finance. I found it interesting that even though stETH was liquid ETH that represents ETH locked in Lido, it lost its peg to ETH.

Coingecko

stETH is 0.958 ETH, its price peg is not fully restored to ETH, but this is no cause for worry because every stETH out there is come only after locking up ETH in Lido Finance Platform

This was mainly because a lot of stETH was swapped for ETH in Curve Finance, with that eventually resulting in a huge imbalance in the ETH/stEtH pool there, with the pool comprising 20% of ETH and 80% of stETH.

This had Curve adjust the price of stETH lower than that of ETH to lure traders to buy stETH at a lower price, a mechanism to bring parity of stablecoins assets in Curve.

Curve Finance is one of the most important Defi protocols out there, having deep liquidity for stablecoins and assets like stETH. Trading activities there can be instrumental in determining the price of stablecoins and other assets.

stETH continues to be the most popular liquid ETH asset used in DEFI

Well, now this is an old story indeed as Ethereum Beacon Chain is poised to get activated soon yet I am still sharing a Ethereum based crypto story celebrating the countdown to Ethreum’s transition to POS chain, happening anytime between 10th and 15th September!!

You can read all about it in this article -:

I can imagine that a lot of stEtH holders feared a permanent depeg of stETH to ETH as that was a time when UST’s death spiral collapse was fresh in the minds of crypto investors. But stETH’s value in the end equals that of ETH because every stETH in circulation represents an equal amount of ETH locked in the Lido Finance platform.

So, the stETH saga continues…

I am planning to write some more Ethereum based articles this season of Ethreum’s Merge, thankyou for reading!!

@tipu curate

Upvoted 👌 (Mana: 5/6) Get profit votes with @tipU :)