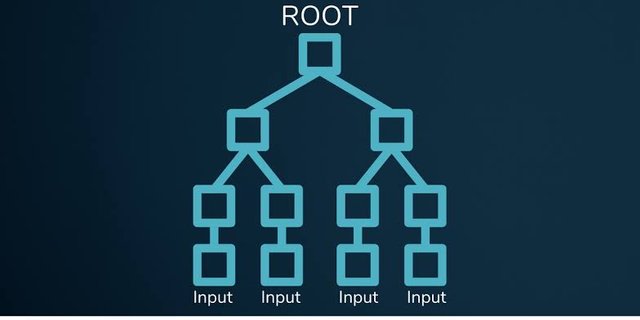

Merkel tree a gateway for exchange transparency proof of Reserve PoR

Ralph Merkle in 1987 proposed a digital signature based on cryptographic encryption to verify large transactions on-chain without a user going through the whole process of downloading all transactions

files from grass root his idea was proposed to save lots of time and space of occupying large amounts of memory space on a computer hard drive.

Let's say a user wants to check a particular transaction data from two years, with the Merkel tree he only needs to verify that particular transaction by checking/verifying the Markel root hash

without downloading junk of large file folders of two years' transactions.

Bitcoin and other cryptocurrencies, Merkle trees serve to encode blockchain data more efficiently and securely.

source

Citing the FTX crash a lot of centralized crypto exchanges have loose users' trust as less confidence is been placed on the credibility of most exchange assets reserve,

seems the best means of securing one assets in this chaotic market is holding asset on cold storage, in other for exchange to proof they can account for their customers, loss a new standard known as Proof of Reserve (PoR) was initiated for investors to verify an exchange reserve holding.

Binance exchange did a proof show of their PoR holding with its assets holding of 582,485 BTC in its reserves, more PoR on other crypto assets will be added in the future according to the exchange.

Binance Market tree

To show that Binance has all user assets 1:1, we have built and implemented the Merkle tree to allow people to verify their assets within the platform.

source

Users can log in to their binance account to prove to check their assets are secure on the exchange, you can use this link to learn more about binance Merkel tree and Proof of Reserve.

Will this increase transparency for centralized exchanges?

Well, this could be a good step towards increasing users' trust although this saying still stands "not your keys not your assets" with binance showing off their PoR investors could have a glimpse of faith in the exchange for going public with it's reserve holding which also means they are financially capable of handling a large number of liquidity cash out pool from investors when the need arises.

We can't say for sure of this is 100% satisfying for most investors, but it's a good short worth appreciating.

.jpeg)

@tipu curate

Upvoted 👌 (Mana: 2/6) Get profit votes with @tipU :)

Hi, definitely a good post, greetings and thanks for sharing.

Thanks much for the feedback.

Hi @mccoy02

I'm failing to see how "proof of reserves" can actually help anyone. It only shows how much funds exchange has in serves. It doesn't say anything about debt and other liabilities.

We shall all demand not only proof of reserves, but also proof of liabilities. Otherwise PoR means as much as nothing.

Am I making sense?

Sure you are making sense, centralized exchanges need to actually more than just showing their PoR, although its first of its kind which is a step towards improving transparency in crypto space, more need to be done for users to fully trust these exchange showing their debts and liabilities will be another option to look into thanks for your feedback.

nice