Crypto Academy Week 6 Homework Post for [@stream4u]

After reading @stream4u post in week 6 of crypto academy, I learned an interesting lesson and become a great guide for beginners like me. Now I have started to understand about investing in the cryptocurrency world and I'm getting interested in investing. As a learning process, in this post I also want to complete some homework that has been given by @stream4u in this 6th week learning material. In order to complete this task, I had to answer the following 4 questions:

- Differences in Large Capital - Mid Capital - Small Capital and how they will affect to the Investment?

- Your view, Which type of Asset capital can be more profitable? Why? Advantages and Disadvantages (Explain only 1).

- Thoughts on Risk Capital and Penny Cryptocurrency.

- What is the Role of Watchlist? Best way to set Watchlist. Additionally, For Example, show your watchlist if you have configured it and give a short description of it.

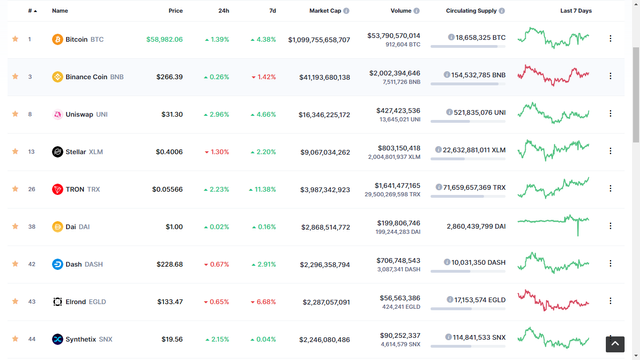

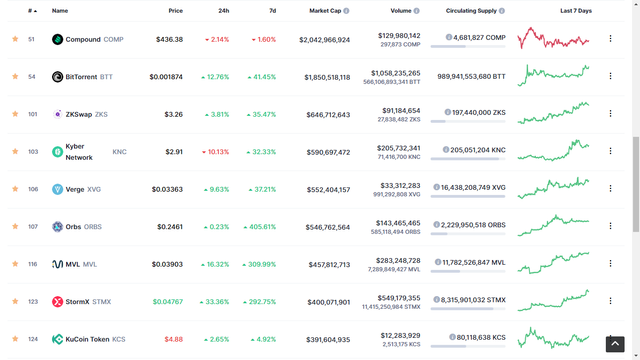

After I read @stream4u post, I can conclude that there are 3 types of capital, namely large capital, mid capital and small capital. Large capital has a market capitalization of more than 10 billion dollars, mid capital of 1 billion dollars to 10 billion dollars, while small capital is less than 1 billion dollars. In terms of asset categories, large capital assets are in the top 10, mid capital is between 10-50, while small capital is outside the top 50. In terms of volatility and risk, large capital is classified as low, mid capital is high, while small capital is very high. In terms of investment returns, large capital has the lowest possibility, while small capital provides greater opportunities.

After understanding these differences, I then tried to conclude. In my opinion, if I invest in small capital assets, then I have a greater chance of getting more profit. Because I think these assets will pump high. I just need to choose the right asset, be patient and have a little luck.

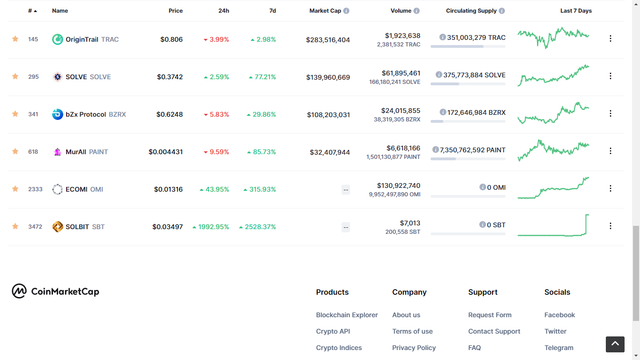

I am very interested in investing some penny cryptocurrency. Because I can manage it in large quantities with a capital that is not too expensive. And imagine if the price goes high, then I will get a big profit. Because the capital that I spend is not too large and does not interfere with my economy, I do not really think about this capital and I think of it as invisible money.

As an investment, I am currently looking at several cryptocurrencies that have great potential. In the meantime, I have noticed that the OMI, SOLVE and SBT tokens have a pretty good chart of improvement. To keep track of each asset, it's a good idea to create a good watchlist. A good watclist must consists of 2 or 3 assets in each category (large capital, mid capital, small capital and penny). Here's my watchlist:

Thank you for reading and see you on next post!

Hi @wonderfulcountry

Thank you for joining Steemit Crypto Academy and participated in the Homework Task 6.

Your Homework task 6 verification has been done by @Stream4u.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy