Homework post for @kouba01 || Rate Of Change Indicator || @utsavsaxena11

Hello steemians how are you? I hope you all are doing well and you all are safe and healthy during this pandemic time. Hope we all soon get the vaccine.

Today I go through one of the best and simplest language explanation homework posts by @kouba01 on Rate Of Change Indicator. It's interesting to read the lecture post. Now I am Submitting my homework post to the professor.

HOMEWORK

QUESTION 1:

In your own words, give an explanation of the ROC indicator with an example of how to calculate its value? Comment on the result you obtain.

Answer 1:

ROC also known as rate of change Indicator is a momentum indicator that measure movement of price in percentage in current time frame with respect to the previous selected period. Rate of change depends on current price and price of previous nth candle. It not only allow us to make perfect entry and exit point from the market but allow tell us about strength, movement and trend in the market.

It consists of a normal fluctuating line move on a line refered as zero line. We can also say that this line is located in the middle of the indicator. It plays major role for making exit and entry in market and also allow us to study strong and weak Trend in the market.

This Indicator have a very unique method to identify Over-brought and over-sold condition. In the indicator it is considered as if percentage value of indicator is +ve then market is in uptrend from last few periods and if percentage value of indicator is -ve then Market is in downtrend from last few periods. From last few periods I mean that nth period we selected for Calculation.

Calculation of ROC Value:

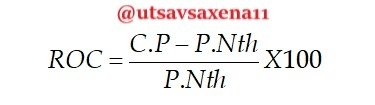

It's calculation is very simple, just we have to decide the period from which we want to track the market movement. The formula which we are using for Calculation is Given as:

C.P. = CURRENT PRICE

P.Nth = PRICE OF Nth PERIODS BACK

ROC = RATE OF CHANGE PERCENTAGE

According to this formula we have to calculate the value of ROC in percentage which requires current price of an asset for which we are also have to consider nth period back maybe 12, 10, 14 according to your trading strategy.

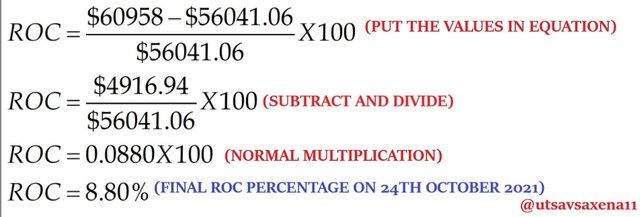

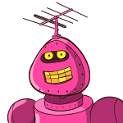

Now let us take an example to calculate ROC Value:

I am performing this task on 24th October 2021 and the current price of BTCUSD is at $60958.

Let us consider, Nth period candle is to be 12 that means we have to see price of same BTCUSD candle on 12th October 2021 that is coming out to be $56041.06.

Now simply put the values in the formula given above and calculate ROC percentage. In the next image you can see the steps of calculation.

Now the value we calculated of ROC percentage is coming out to be 8.80%, to check whether the calculated value is correct or not we have to analyse the BTCUSD chart on 24th October 2021.

Both calculated and observed values are equal (only 0.1 difference) and hence we can say that our working style and method is correct.

Observation:

Here we observe that our ROC Value is coming out to be +8.9% a positive large value which clearly indicates that market is in uptrend and it's strength is very high and it indicates that it will move more up. So we Also observe that it is the purest form to analyse only price movement in trend direction in comparison with previous periods.

This is the breif description about rate of change indicator and its mathematical analysis.

QUESTION 2:

Demonstrate how to add the indicator to the chart on a platform other than tradingview, highlighting how to modify the settings of the period (best settings).

Answer 2:

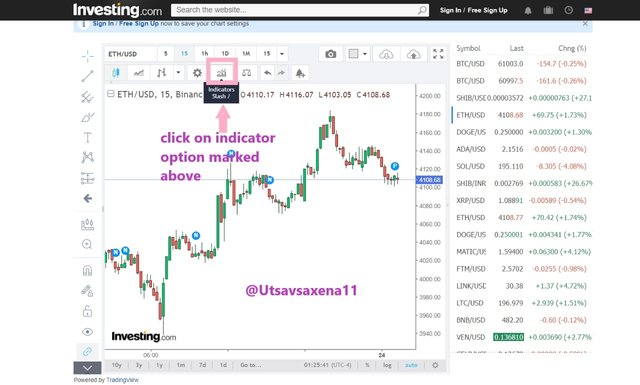

We can add this indicator on many other platforms like Tradelize, investing.com and many more. But today let us try investing.com. To Add ROC indicator on investing.com we have to follow few steps that are shown below :

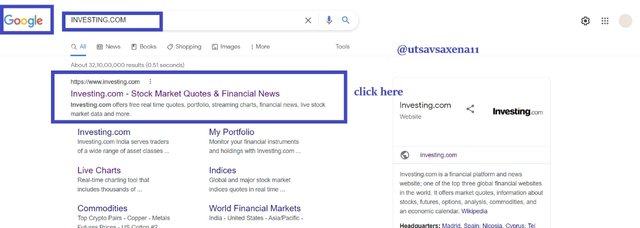

Click on the link Given here or simply search investing.com on Google search engine and click on the first link given.

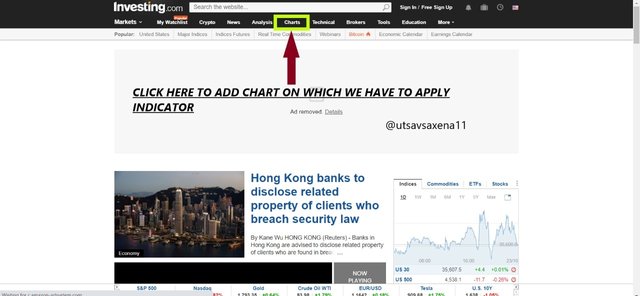

Now you are on the main interface of the investing.com. click on the chart option to add the chart on which you have to apply the indicator.

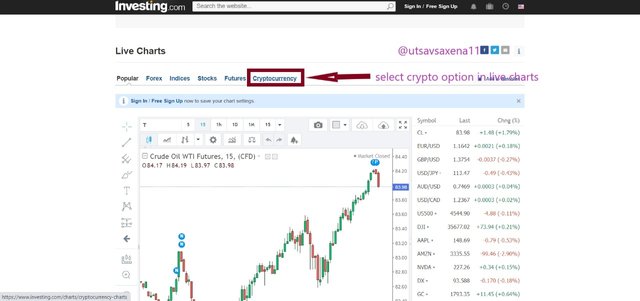

As you click on the charts option you can see different pair of charts available, simply click on Live charts where you can get live status of each price trends.

Scroll down a little bit you can see a chat already applied on the interface. Above the chart there are five options and the fifth option is the cryptocurrency option, click on it.

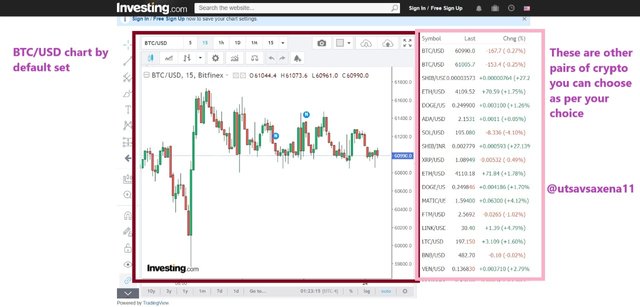

Finally you can see btcusd pair applied on chart by default. You can choose time frame and different charts from taskbar and right side corner of the chart.

Click on the indicator Slash option given on the task bar above the timeframe of the chart. Here you can find the rate of change indicator.

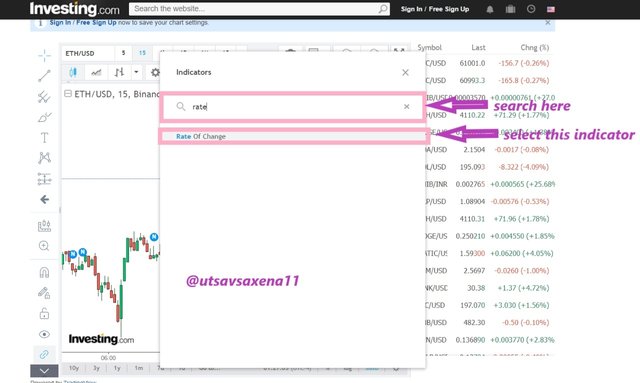

Search rate of change indicator. The first indicator that appear is your indicator click on it.

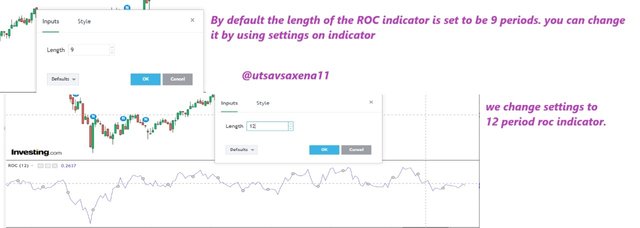

Finally at the bottom of the chart our rate of change indicator is applied. The applied rate of change indicator is set at 9 period. By default it always set at 9 period.

This is how we have to apply indicator on the chart on the platform investing.com other than tradingview.

Best period settings:

By default the period setting of rate of change indicator is 9 which is considered to be the best in both short term and long term trading as it provide the least errors and false signals. But we can choose other periods also depending upon situation and also method of working of a Trader. But few things while choosing period we have to keep in mind:

Do not choose large period off indicator at short time frame of 5 minutes or 10 minutes. In this combination indicator provide maximum false signals which may trap you in wrong trade.

In the above screen shot you can see that indicator provide sideways trend but according to the price movement it shows strength in market at many different positions. So it is different to enter in the market and if we enter with this combination we may get trapped in a trade.Do not choose small period off indicator at large time frame of 1day to 1week. In this combination indicator provide maximum false signals which may trap you in wrong trade.

In the above image we can see that market is not showing high fluctuations or movement but at the same time indicator is moving or fluctuating very fast. In such an unpredictable Trend we have to be very secured and try not to enter and also so not use such combination off indicator period and time frame. If we enter with this combination we may get trapped in a trade.

Now if we talk about the best time frame and the best period of rate of change indicator, it is depend on trading style of every investor and trader. If I talk about my strategy, I am an intraday trader and we'll always use default setting of nine period because it give us perfect movement of price with perfect overbought and oversold condition. It also allow me to enter at correct entry and move out from the market at correct exit point by making good profit. I will recommend and I will use this indicator at default setting on 1 minute 5 minutes and up to 10 minutes time frame. If we are working on time frame like one hour or one day we have to prefer period 12 to period 15 as per my recommendation, according to experts you can use period till 25 on one hour time frame but according to me it's a very large period and may provide false signal.

QUESTION 3:

What is the ROC trend confirmation strategy? And what are the signals that detect the trend reversal.

Answer 3:

According to my research and understanding there are four different type of trends created in between the price movement and the rate of change indicator. These four trends directly confirm the strength and weakness of the market price. We all know there are two type of trends uptrend and downtrend. But we can find accelerating uptrend, weak uptrend, accelerating downtrend and weak downtrend with rate of change indicator. Let Us Try to analyse these four Types of trends:

Strong uptrend :

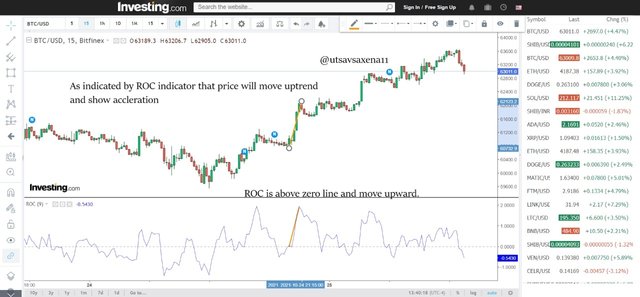

When the rate of change indicator line sharply cut zero line and move upward then we can say that it there is an uptrend in the market and that up trend is an accelerating uptrend showing strength of buying in the market and increasing indicator positive value.

In the above BTCUSD 15mins timeframe we can see that ROC line is moving above zero line and at that time the price is moving uptrend with good strength in the market. Starting from $60745.2 and move to $62061.6. This shows good acceleration in uptrend.

Weak Uptrend:

When the rate of change indicator line is above zero line and start falling towards zero line then we can say that it there is an uptrend in the market but that up trend is getting weak hence the indicator positive value also decrease. This indicates that may be uptrend is coming to an end and soon we can see a downtrend.

In the above BTCUSD 15mins timeframe we can see that ROC line is moving above zero line but start falling and at that time the price is moving uptrend but with weak uptrend in the market. Starting from $62073.9 and move to $62197.0. This shows very small change in Price and indicate weak uptrend.

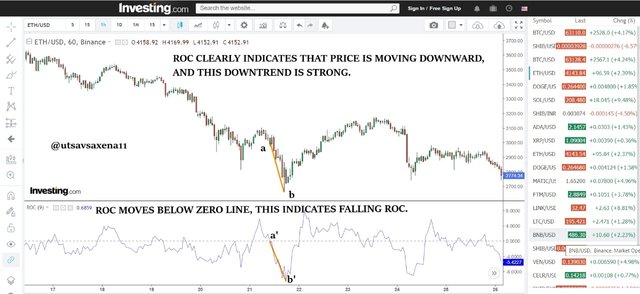

Strong downtrend :

When the rate of change indicator line sharply cut zero line and move downward then we can say that it there is a downtrend in the market and that downtrend is an accelerating downtrend showing strength of selling in the market and increasing indicator negative value.

In the above ETHUSD chart of 15 mins timeframe we can see that from zero line roc start moving downward in negative direction which indicates downtrend in price movement and this is a strong downtrend. Approximately starting from $3065 to move down towards $2696, it's a clear indication of strong downtrend.

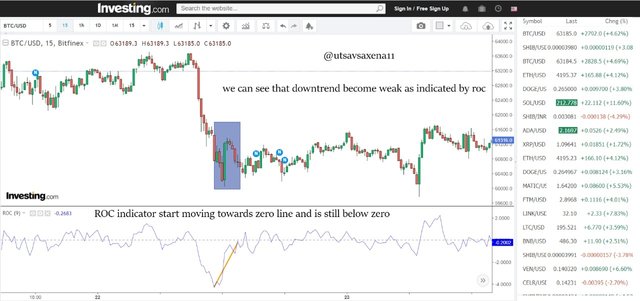

Weak downtrend:

When the rate of change indicator line is below zero line and start moving towards zero line then we can say that it there is an downtrend in the market but that downtrend is getting weak hence the indicator negative value also decrease. This indicates that may be downtrend is coming to an end and soon we can see an uptrend.

In the above BTCUSD chart of 15 mins timeframe we can see that ROC indicator is moving below zero line and is now moving towards zero line. It means that market is move loosing downtrend or downtrend getting weak that we can see in the above chart.

Trend Reversal

When price Trend change its trending pattern then we called the market is showing a trend reversal. Different indicators have different methodology to identify trend reversal. Rate of change indicator have 2 different methods to identify trend reversal in the market. Overbought & oversold condition and divergence in the market. These two can help us to identify trend reversal in the market easily using rate of change indicator. Let us take an example of each method.

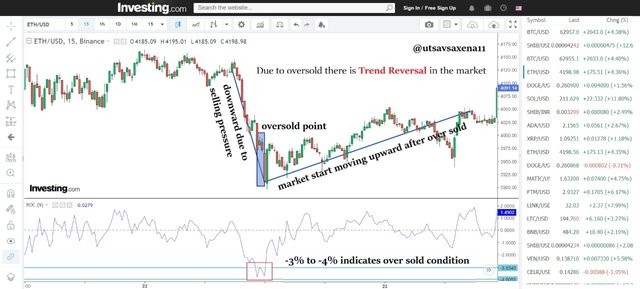

Oversold condition and trend reversal:

We will discuss about over-sold condition later, but here let us talk about trend reversal. If we saw and oversold condition in the market then definitely there will be a trend reversal and market will start moving in upward direction. If you want to trade you can take ok buy at oversold levels and sell them at upcoming trend reversal which make market to move in upward direction.

As you can see in the above ETHUSD chart that market is showing over-sold condition after huge downtrend in market. But soon after the oversold condition market start moving upward and show trend reversal in the market. This is how we can identify trend reversal in both overbought and oversold condition. In this situation we can take a buy trade at oversold level and sell them in between uptrend at good profit.

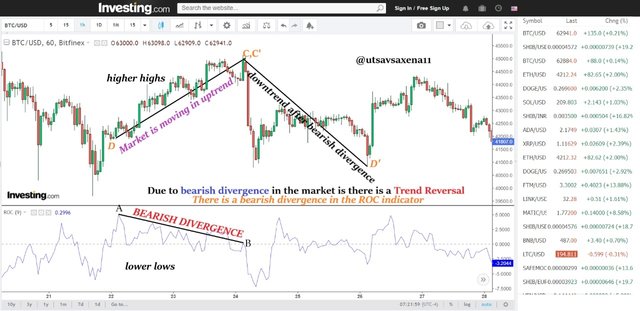

Divergence and Trend reversal:

When price chart and Indicator both move in opposite direction then we can say there is a divergence in the market. This divergence is the main reason of trend reversal in the market. When market is in bearish divergence then price move up and indicator move down. This will show that soon market will Start moving downward.

In the above BTCUSD chart we can see that there is a bearish divergence in the market that is indicator is showing bearish trend while the market is in bullish Trend this indicates that there will be a trend reversal in the market and market will soon start moving down Trend. This we can see in the above image that market start moving down current just after the bearish divergence ends.

This is how we can easily find the trend reversal in the market using rate of change indicator at small and large time frame according to the selected rate of change period. In many charts I have takes 15 minutes time frame that is a small time frame and for small time frame I choose 9 period by default ROC.

QUESTION 4:

What is the indicators role in determining buy and sell decisions and identifying signals of overbought and oversold.

Answer 4:

Rate of change indicator use very easy technique to identify entry and exit from the market that is the buy and sell signal. The only thing we have to check is the zero line and percentage line moving on it. Now let us see how to identify the buy and sell signal:

If ROC line is at zero line and start moving upward then we can say that Market will soon come to uptrend and above or near zero line buying trade will be more valuable. Always remember that price maybe sometime retest itself so we have to be careful while taking entry. when zero line break above then just after take buy trade at next candle form.

If ROC line is at zero line and start moving downward then we can say that Market will soon come to downtrend and below or near zero line selling trade will be more valuable. Always remember that price maybe sometime retest itself so we have to be careful while taking exit. when zero line break below then just after take sell trade at next candle form.

For example:

In above BTCUSD chart of 15 mins time frame we can see that when ROC line crossing zero line straight upward then at below level at next candle we Buy our trade. Buy @$65109. Just after when the same ROC line start moving downward and cross the zero line and move downward straight then at next candle sell the trade. Sell @$65928. As we can see that we gain good profit in BTCUSD price.

This is how we have to take buy entry and sell exit from the market.

Now let us talk about over-sold and Over-brought conditions.

In rate of change indicator overbought and oversold condition are not fixed. These conditions depend upon user definition. According to many trader and investor use rate of change indicator if rate of change line cross (+,-) 3 to 4% Then in positive it is over brought condition and in a negative it is oversold condition.

Over-brought level:

If rate of change indicator line lie in between or cross (+3%)-(+4%) mark, then we can say that market is in Over-brought condition. This indicates that over buying increase the price and soon market will take a down trend. This is how we can identify overbought condition using rate of change indicator.

As you can see that in BTCUSD chart rate of change line is in rang +3% to +4% it means that market is in Over-brought condition and hence price will take a Trend reversal soon that we can see in the above chart.

Oversold level:

If rate of change indicator line lie in between or cross (-3%)-(-4%) mark, then we can say that market is in Over-sold condition. This indicates that over selling decrease the price and soon market will take an up trend. This is how we can identify oversold condition using rate of change indicator.

As you can see that in ETHUSD chart rate of change line is in rang -3% to -4% it means that market is in Over-sold condition and hence price will take a Trend reversal soon that we can see in the above chart.

QUESTION 5:

How to trade with divergence between the ROC and the price line? Does this trading strategy produce False signals.

Answer 5:

When indicator and market price both move in opposite direction then we can say that there is divergence in the market. There are two type of divergence in the market, bullish divergence and bearish divergence. Let us talk about this to divergence with respect to the rate of change indicator.

Bullish Divergence:

When rate of change indicator makes higher highs that means rate of change indicator moves above zero line and at the same time price on main chart make lower lows then we can say that there is a bullish divergence in the market. This divergence is the clear indication of trend reversal in the market. From downtrend to uptrend price will take a trend reversal hence we can buy trade at the peak of divergence and sell it in between the trend reversal.

As you can see in the above BTCUSD chart that Indicator is making higher highs while the price chart is moving in opposite direction making lower lows, this indicates that market is in bullish divergence and soon we can see a Trend reversal.

Bearish Divergence:

When rate of change indicator makes lower lows that means rate of change indicator moves below zero line and at the same time price on main chart make higher highs then we can say that there is a bearish divergence in the market. This divergence is the clear indication of trend reversal in the market. From uptrend to downtrend price will take a trend reversal hence we can sell trade at the peak of divergence and re-buy it in between the trend reversal.

As you can see in the above BTCUSD chart that Indicator is making lower lows while the price chart is moving in opposite direction making higher highs, this indicates that market is in bearish divergence and soon we can see a Trend reversal.

False signals By ROC indicator:

Every indicator provide false signal as no indicator is 100% accurate. Maximum time signals generate at the time of divergence. If we are using single indicator when it is difficult to analyse the for signal but is we use two indicators together then we can easily identify false signals in the market. ROC indicator provide false signal during divergence only. Let us try to analyse false signal and true signal using relative strength index and MACD indicator with rate of change indicator on price chart.

False signal and MACD:

As you can see in the above ADA/USD pair of 5 mins timeframe we select a trade in which we can see a bearish divergence according to rate of change indicator. But when we apply moving average convergence and divergence indicator we find that this year is divergence is a false divergence as after an uptrend,downtrend did not occur, and same is confirmed by MACD, so we can say that in this situation rate of change indicator providing false signal.

True signal and RSI:

As you can see in the above btcusd chart of 15 minute time frame there is a formation of bearish divergence and that varies divergence is confirmed by relative strength index indicator that both rate of change and relative strength indicator are in bearish movement and price is moving up print it is a clear indication of upcoming trend reversal that is down trend that we can see in the above image.

This is how we can easily detect false signal and to signal using two Indicators or any other indicator with rate of change indicator.

QUESTION 6:

How to identify and confirm Breakout using the rate of change indicator.

Answer 6:

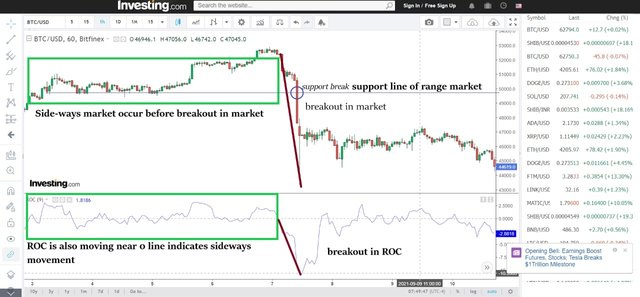

When market move in sideways movement for a long time and after that because of huge volume trade in market, price move straightly up or straightly down depending upon the volume trade direction then we can say that there is a Breakout in the market and the sideways market break in uptrend or downtrend depending upon the direction of volume trade.

Rate of change indicator easily help us to identify Breakout in the market. When rate of change line move near or on zero line that means slightly up and slightly down hover near zero line then we can say that there is no trend in the market and market is moving in sideways direction.

We can mark both resistance and support levels on indicator as well as on price at same level then if price break resistance straight and move up then we can say this is bullish breakout and if price breaks support straight and move down then we can say this is a bearish breakout. At this time rate of change indicator will also behave the same.

For example:

As you can see in the above BTCUSD chart in 1hr timeframe we can see that for a long time market move in sideways direction, we created resistance and support level on both indicator and price chart. After few hours we can clearly see that bearish Breakout occurs and market break the support level in both indicator and price chart. This Breakout is a clear bearish Breakout that is volume move out from the market.

QUESTION 7:

Review a chart and define various signals given by rate of change indicator.

Answer 7:

There are many different signals produced by ROC indicator as we discussed above. Let us use a chart pair and try to identify it's both uptrend and both downtrend signals with perfect entry and exit points.

Pair used: MATIC/USD

Trends:

As we discussed earlier there are 4 type of trends that we can easily find using rate of change indicator two of them are strong trends that is strong up Trend and strong term Trend. Two of them are weak trend that is weak uptrend and weak downtrend. Strong currents when rate of change indicator line cross zero line straight above or below. And weak Trend created when roc above zero or below zero start moving towards zero line. These four situations are created in the above graphic of MATIC/USD.

Entry and Exit :

When rate of change indicator cross zero line and slightly move above than we can buy a trade and if slightly move down then we can sell the trade. As you can see above in case one we buy MATIC/USD at $1.77 and sell around $1.20. Similarly we can re-buy trade at lower level and then get good profit in market. We can see this situation in case 2 where we buy trade at $1.22 and sell at $1.24. Finally we re-buy trade at $1.20.

Sideways and breakout:

MATIC/USD rate of change indicator move near zero line that is slightly above in slightly below. This is a clear indication of sideways market that we can see in the above graphic. If we create a resistance line and support line on this sideways market we can clearly see that after few minutes resistance line breakout and create a bullish Breakout which make market to move up current that we can see in rate of change indicator also.

These are the major trends that we can easily find out using rate of change indicator which is I think one of the best indicator for entry and exit point in the market as it shows correct price momentum with less false signals.

Conclusion

It is time to conclude our homework post in which we discuss about rate of change indicator which is an price momentum indicator. It give us correct information about change in price in both up and down directions and also provide correct information about strength and weakness in the market. This indicator is also famous for its unique technique to find overbought and oversold condition. To calculate rate of change indicator percentage we have to use a formula which use current price and the previous price of any candle. By any candle I mean you have to choose a perfect period.

There are in total four type of trends created in market using rate of change indicator out of which two are strong or show strength in the market and rest two show weakness in the market. This indicator also consists of a Central line cal zero LINE which decide buying and selling point. If line that is the rate of change line move above zero line then we can buy our trade and if move below zero line then we can sell our trade.

Finally we can also find divergence breakout using rate of change indicator. It not only provide strength of price in the market but also give information about various entry exit and re-buying positions.

This is all about my homework post thank you so much professor for such an interactive and great lecture on rate of change indicator.

Invest/Delegate your Steem Power and be assure of your daily income. Click here for more details.

Join our Discord Server & Community for more details

Hi @utsavsaxena11

Thanks for participating in the Steemit Crypto Academy

Feedback

Total| 8/10

This is good work. Thanks for demonstrating such a clear and well detailed understanding of trading using Rate of Change indicator.

Congratulations! Your post has been selected as a daily Steemit truffle! It is listed on rank 18 of all contributions awarded today. You can find the TOP DAILY TRUFFLE PICKS HERE.

I upvoted your contribution because to my mind your post is at least 10 SBD worth and should receive 31 votes. It's now up to the lovely Steemit community to make this come true.

I am

TrufflePig, an Artificial Intelligence Bot that helps minnows and content curators using Machine Learning. If you are curious how I select content, you can find an explanation here!Have a nice day and sincerely yours,

TrufflePig#club5050 😀