Crypto Academy / Season 3 / Week 4 - Homework Post for [@stream4u]

I feel privileged to be a part of the Crypto Academy under the tutelage of @stream4u. I am not taking this for granted.

What Is the Importance Of the DeFi System?:

Away from the traditional banking system, the DeFi (Decentralized Finance) system gives you 100% control over your funds. The traditional system of banking has been flawed due to its centralized nature. With the DeFi system, there is a complete ownership and control of your funds. You earn good returns from your investments too unlike the traditional method of banking that invests your money and pays the owner of the money stipends. The most important and impressive aspect of it is that, you don't need middle men to have access to your funds.

Buyers, sellers, lenders and borrowers can interact with each other and earn good returns too for the worth of their investment. With the banks, there is a need for proof of address and ID cards and none of these are necessary with the DeFi system.

Smart contracts has been designed to automate agreement terms between all levels of partakers and that includes the buyers, sellers, lenders and also the borrowers and it makes financial products possible.

The major components of DeFi are stablecoins and use cases which enables the development of applications and makes transactions relatively easier too.

Flaws in Centralized Finance:

There are flaws in the centralized finance as you don't have 100% control of your money - there is limitation in the access to your own funds and as earlier mentioned, your money is being used while you get meagre amount back as interests.

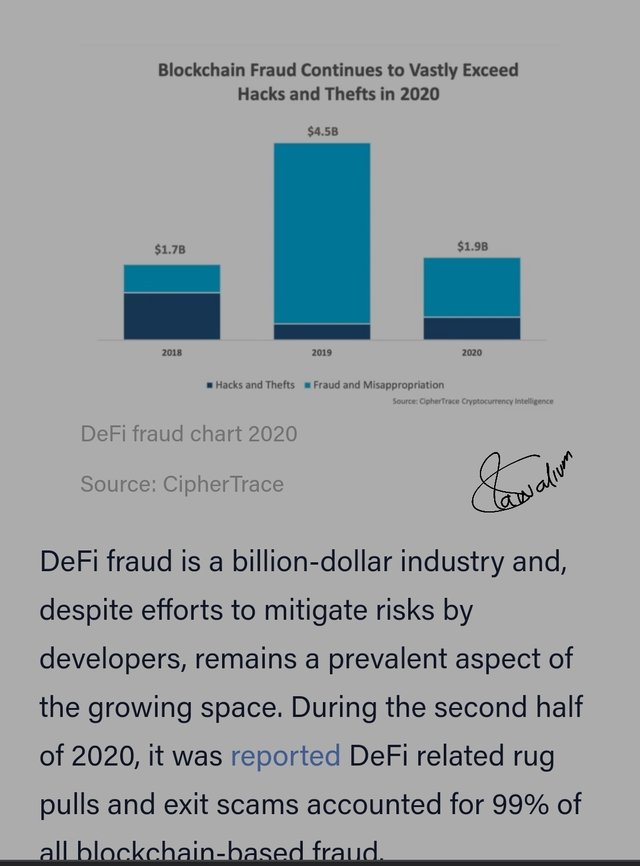

Apart from not having the control over your funds, looking at the traditional banking system anyone would see there is delay in transactions as well. The process is always longer and tedious. There is questionable lending processes, forgery and of course, fraud.

DeFi Products. (Explain any 2 Products in detail):

A. Lending:

DeFi allows individuals to supply loan to another person without the use of a third party. When anyone takes the loan, the lender gets interests on the loan supplied. With the help of the smart contacts, interests rates are programmed directly. The interests being earned is relative based on the assets used and the platform being used.

Here are some of the lending DeFi platforms:

Aave, bZx, BlockFi, Compound, Nexo, Coinlist, Curve, dYdX, yEarn, Maker, mStable, Nuo Network, to mention just a few.

B. Decentralized Exchanges (DEX)

It's a peer to peer transaction without any need for a third party. This allows users to swap their assets with ease and without any form of insecurities with so many trading pairs involved. The use of it has increased in recent times with some offering liquidity incentives as well just to supply funds to the platform.

Here are some of the projects involved in the Decentralized Exchanges:

0xProtocol, 1inch, Bancor, dYdX, Kyber Network, Oasis, OpenSea, Matcha, Uniswap amongst others...

((Signature included as proof of work. The image isn't originally mine. Link included.))

Risk involved in DeFi:

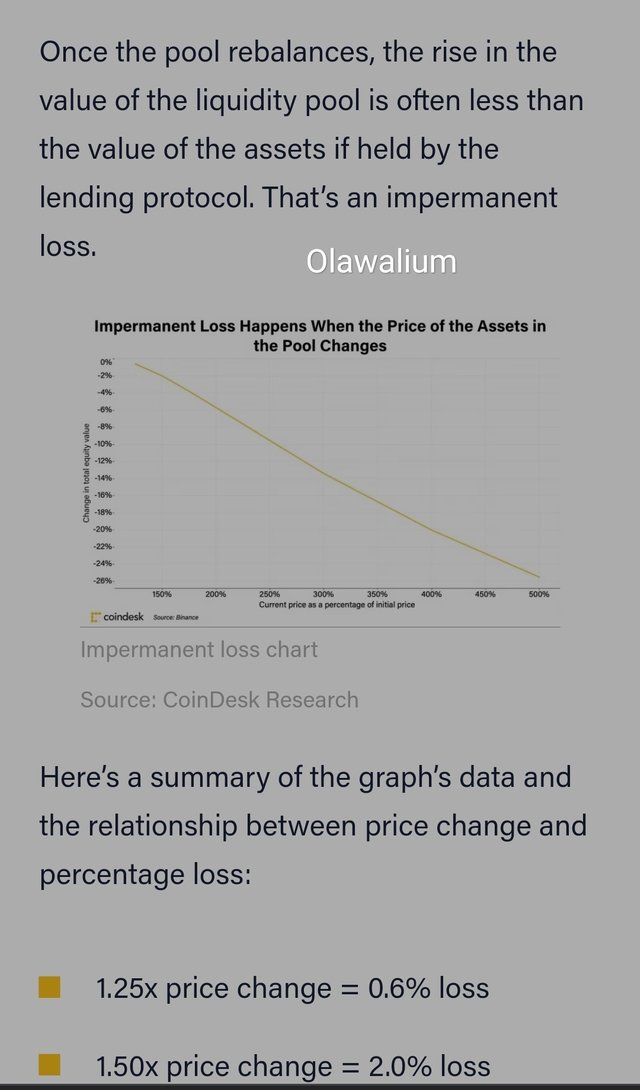

There is nothing without its risks and more so, DeFi. There is what we call "Impermanent Loss" where DeFi is concerned and this means when the price of the assets you locked up in a liquidity pool changes even after you have deposited that assets, it can create for you an unrealized loss in terms of dollar ratio compared to if you had decided to keep your assets in your wallet without it.

Another risk involved with DeFi is access to Unsecured Loans. Because it is a decentralized platform, there is no collateral to securing these funds, a user can borrow as much as he desires and it has zero risks. A user is supposed to pay back at a scheduled time and when the user fails to pay back at the stipulated time, he can roll back the time. In a traditional banking system, there would be a credit score rating that would be attached to such a user but in the case of DeFi, there is nothing like credit score to know the history of such a user to gain access to further loans.

What is Yield Farming?

This is a project that allows users to lock their assets and in return, they receive rewards for it. It is a process that allows cryptocurrency holders to earn reward on their holdings.

How does Yield Farming Work?

This works in a similar way to bank loans. The bank borrows you money and you pay back with interest but in this case, as a crypto holder, you are the bank.

Yield farming works with a liquidity provider (investor who deposit his funds into the Smart Contracts) and a liquidity pool (this is a smart contract filled with the money that came from the investors) which empowers the DeFi market. Yield farming functions with Automated Market Maker model which contains every buy and sell orders on the exchange. It provides liquidity pool as well using the Smart Contracts.

What Are the best Yield Farming Platforms and why they are best. (Explain any 2 in detail)

Pancake Swap:

This is another Decentralized Exchange (DEX). It is on the Binance Smart Chain (BSC) network and not Ethereum.

Of all the Binance Smart Chain DeFi projects, Pancake Swap holds the highest total value locked and it stands at $7 billion. It offers Binance Smart Chain token swaps, you also earn interest in your staking pool, there is game gambling also where users can predict the future prices of BNB and NFT art.

Uniswap:

This is the second largest DEX behind Curve Finance that runs on Ethereum. It offers swaps of Ethereum and many other ERC-20 tokens. Liquidity providers also earn percentage of their trading fees for any swap they initiate and when they are able to deposit enough, they earn interests as well.

The Calculation method in Yield Farming Returns:

We have the Annual Percentage Rate called the APR and also the Annual Percentage Yield called the APY.

APR:

This is the percentage of early rate of return given to the borrower but it is paid to the depositors. It doesn't give you a compounding interest but you earn based on your locked away assets and for a duration of time.

APY:

This is the annual rate of return that is being charged to the borrowers before it is paid to the lenders. This one gives you a compounding interest as your daily interests earned is automatically reinvested so you can earn even more interest.

Advantages & Disadvantages Of Yield Farming:

Advantages:

A. One of the advantages of Yield Farming is that it is the best alternative to the traditional way of saving money in the bank; savings account. You earn better interest compared to the bank's. You can also lock up your funds to earn even more income.

B. It has given both the borrowers and the lenders huge benefits. Easy assess to funds for the borrowers and additional income for the lenders.

C. Easy access to the loans. Borrowers have easy access to funds. The normal banking process takes time and the process is longer but with Yield Farming, it is quick, fast and easy.

Disadvantages:

A. Some of them are still in their experimental stages.

B. The slightest error in the coding can lead to manipulation and of course, hacking which will put your funds in a potential danger.

Conclusion on DeFi & Yield Farming.

They are the future. You can be rest assured that your money is not being short-changed. In a world where everyone work for money, with DeFi and Yield Farming, you can allow your money to work for you while you engage yourself on other meaningful projects. This is the best avenue for increased source of income and independence too.

Hi @olawalium

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

I promise to do better. Thank you, Prof.

Great write-up. Wish you all the best with this assignment.

Thanks a lot, my brother.