Trading Steem with the Ichimoku Cloud

Hello everyone! I hope you will be good. Today I am here to participate in the contest of Steemit Crypto Academy about the Trading Steem with the Ichimoku Cloud. It is really an interesting and knowledgeable contest. There is a lot to explore. If you want to join then:

Question 1: Explain the Five Components of the Ichimoku Cloud

Describe the five main components of the Ichimoku Cloud: Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span. How does each component contribute to understanding market trends and making trading decisions for the Steem token?

There are a number of trading tools in the crypto market which help us to identify the trends in the market. Similarly Ichimoku Cloud is the technical analysis tool. This comprehensive tool is useful to identify the market trends and momentum. We can identify the support and resistance levels with the help of this tool. The five main components are given below:

Tenkan-sen (Conversion Line)

Tenkan-sen is also known as conversion line. It indicates the average of the highest high and lowest low over the last 9 periods. It tells about the short term market trend.

- Formula: (9-period high + 9-period low) / 2

It is used to as a short term trend indicator. When the price crosses above or below the Tenkan-sen then we can expect a change in the current trend. A steep Tenkan-sen represents strong momentum of the market. And on the other hand a flatter line represents the the lack of strong direction.

Kijun-sen (Base Line)

The Kijun-sen is also known as the base line. It is the average of the highest high and lowest low. It is calculated for the past 26 periods. It gives information about the medium term trend.

- Formula: (26-period high + 26-period low) / 2

It is used as a string resistance and support level than the Tenkan-sen. It provides information about the longer term market direction. When the price crosses the Kijun-sen it indicates a change in the trend and this change is significant. Many traders use this component to confirm the trend.

Senkou Span A (Leading Span A)

Senkou Span A is also known as leading span A. It is the midpoint between the Tenkean-sen and Kijun-sen. It is plotted 26 periods ahead of the current time. It is one of the two lines that are used to form the cloud or Kumo in the Ichimoku system.

- Formula: (Tenkan-sen + Kijun-sen) / 2, It is plotted 26 periods forward

Senkou Span A is one of the boundaries of the cloud. It helps to identify the potential future support and resistance levels. When the Senkou Span A is above the Senkou Span B the cloud becomes green. And when teh cloud becomes green it indicates a bullish market trend. On the other hand if it is below then the cloud becomes red. And the red cloud represents the bearish trend.

Senkou Span B (Leading Span B)

Senkou Span B is also known as Leading Span B. It is the average of the highest high and lowest low. But this average is calculated over the last 52 periods. It is also plotted 26 periods forward. It is the slow moving component of the Ichimoku Cloud.

- Formula: (52-period high + 52-period low) / 2 it is projected 26 periods forward

Senkou Span B forms the other boundary of the cloud.It tells about the long term market sentiments. And it serves as the strong support or resistance line. A flat Senkou Span indicates a strong support or resistance. And it gives consolidation signal.

Chikou Span (Lagging Span)

The Chikou Span is also known as Lagging Span. It is the current price. It is plotted 26 periods back in time.It provides historical data.

- Formula: Current price, plotted 26 periods back

This component is used to confirm the strength of a trend. If it is above the price from 26 periods ago then it suggests the bullish trend. On the other hand if the price is below than the 26 periods ago then it indicates bearish trend. Traders often use the Chikou Span as a confirmation tool for the buy and sell signals on the basis of the other components.

How Each Component Contributes to Market Analysis for Steem Token

Tenkan-sen and Kijun-sen: These component tells about the short and medium term trends. Crossovers between these components provides buy or sell signals. For eaxmple if the price of Steem crosses above both the Tenkan-sen and Kijun-sen then it provides signal for the beginning of the bullish trend.

Senkou Span A and B (Cloud/Kumo): The cloud shows where the support and resistance levels can be seen in future. When the price of Steem token is above the cloud it suggests strong bulish trend. And similarly on the other hand when the price is below it suggests a bearish trend. The thickness of the cloud also point out the volatility of the market. The thicker the cloud the stronger the resistance or support.

Chikou Span: This is used to confirm if the current price follows the historical trends or not. If the Chikou Span is above the price from 26 periods ago then it supports bullish signals. And it confirms that the upward movement has momentum.

So by analyzing these components the traders can do informed decisions about the trading of Steem token.

Question 2: Analyzing Trend Direction with the Ichimoku Cloud

Using a historical chart of Steem/USDT, analyze the trend direction based on the Ichimoku Cloud. Discuss whether the market is in an uptrend, downtrend, or consolidation phase. Provide specific examples of how the cloud signals potential buying or selling opportunities.

We can analyze the trend direction of the Steem token with the help of the Ichimoku cloud. And for this purpose we need to use all the five components of of Ichimoku Cloud. On the basis of the historical data and recent analysis Ichimoku Cloud can provide a comprehensive view of the market.

Trend Direction for Steem/USDT

There are different elements which contribute for the determination of the trend for the Steem/USDT.

Cloud Shape and Price Location

If the price of STEEM is above the cloud the it suggests an uptrend. And similarly if the price is below the cloud the it is the indication for the bearish trend.

If the cloud formation is flat or thin then it is the indication for the consolidation phase. It is actually the weak trend.

In all those periods where price of the STEEM/USDT stays continuously above cloud in the long term time frames such as 4 hour chart it is the indication for the strong bullish momentum. For example in this zone the breakouts occur above the resistance zones and they hint potential upward trend.

Crossover Signals

Bullish Crossovers: When the Tenkan-sen crosses above the Kijun-sen in the cloud it is a bullish signal. And it provides a strong buying opportunity at this pointy.

Bearish Crossovers: On the other hand if the Tenkan-sen crosses below the Kijun-sen it suggests a bearish reversal. And it provides selling opportunity to the traders.

Example of a Recent Analysis

By accommodating all the points and components of Ichimpoku I am going to analyse the current trend of STEEM/USDT. I will spot out the different phases of STEEM market using the historical data.

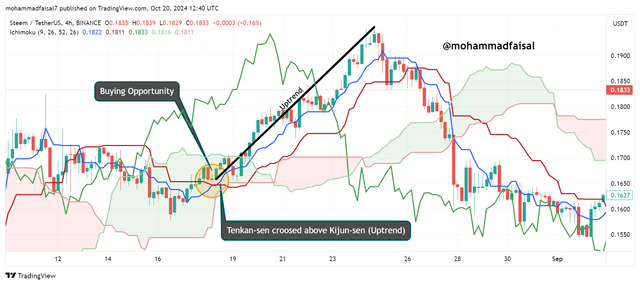

I have taken 4 hours time frame for the analysis. If we see back in July and August 2024 the Tenkan-sen line crossed the Kijun-sen line at the end of July. But it remained in the cloud and in the start of the August it further crossed below the cloud. It gave a strong bearish trend. It was the sell signal by the Ichimoku Cloud. Moreover the red colour of the Cloud also confirmed the downtrend. And because of this downtrend the price of the STEEM fell to around $0.1264 from $0.20. So the Ichimoku provided a strong bearish signal in the 4 hour time frame. And the Chikou Span remained below the historical prices. It suggested a strong and continuous selling pressure.

Then if we move forward to analyse the STEEM Chart in the month of August in 2024 in the 4 hour time frame we can observe a buying opportunity. On 18 August 2024 the component Tenkan-sen crossed above the Kijun-sen. It indicated a strong bullish signal. And the traders could take a long entry in this crossover and they could get benefit from this. The price moved from $0.1654 to in the upward direction and reached $0.1955. SO in this way Ichimoku help us to determine the bullish trend in the market.

We can observe the current market of STEEM. There was a downtrend in the earlier days after the bullish trend. But we can see that after the downtrend according to Ichimoku Cloud the first component crossed above the second component and it caused to recover the price from a downfall. But if we see keenly the price behaviour we can say that the price is moving sideways. The price of the STEEM market is fluctuating between the local support and resistance. The price is moving between $0.1663 to $0.1881 without any big movement out of this box. So the market is preparing itself for the next big movement and in the 4 hour time frame we can say that the market is in the consolidation phase.

And further if we see carefully the most last movement of Ichimoku Cloud we can say that the market is giving a buying opportunity for the short term because the first component of blue colour is crossing the second component in the upward direction.

Question 3: Identifying Support and Resistance Levels with Ichimoku

Explain how the Ichimoku Cloud can be used to identify support and resistance levels. Use a real example of Steem price action where the cloud acted as dynamic support or resistance, and how this helped in predicting a reversal or continuation of the trend.

The Ichimoku Cloud is an excellent tool for the identification of the dynamic support and resistance levels. The cloud formed by the Senkou Span A and Senkou Span B provides visual representation of these levels. These are continuously updated based on the price movements.

How the Cloud Acts as Support and Resistance

Support

In the uptrend when the price remains above the cloud then the cloud acts a support zone. If the price comes towards the cloud but the price does not fall. It confirms the strength of the support. Thicker cloud presents that the support is strong and the price cannot penetrate easily.

Resistance

In the downtrend when the price stays under the cloud then it acts as a resistance level. The price can try to break the cloud but it is rejected by the upper boundary that is the resistance. This boundary is formed by the Senkou Span A or B.

Trend Reversals

When the price breaks through the cloud such as below the resistance level or above the support level it provides the reversal of the trend signal. Moreover the thickness of the cloud help the traders to predict the difficulty of the trend reversal. For example when the Senkou Span A and Senkou Span B crosses each other it indicates the weakness of the trend. It gives the potential reversal opportunity.

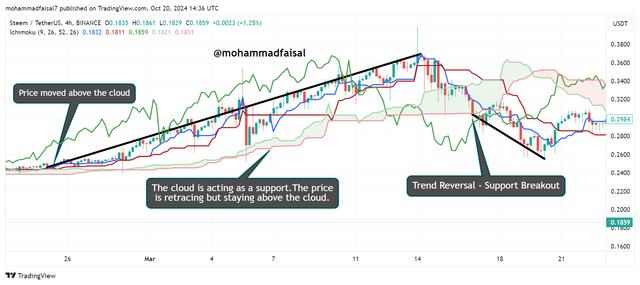

Example of Steem Price Action

If we see the historical data of the STEEM/USDT chart then we can observe a strong support level of the Ichimoku cloud. Here we can see that the price of STEEM/USDT moved above the Ichimoku cloud in the bullish trend. In this bullish trend the cloud formed by the Leading Span A and Leading Span B is acting as a strong support. The price is moving gradually in the upward direction. Indeed the price is retracing downward but it is always staying above the support level where the cloud formed by the Leading Span A and Leading Span B is working as a strong support. So this support acted as a key support and it drove the price always in the upward direction. We can see that the support of the cloud is moving in the upward direction along with the price movement so it is acting as a dynamic support.

In this above chart we can see that the price has broken out the support of the cloud. When the price moves below the support level it represents the trend reversal and we can see that the price was reversed and it went downward.

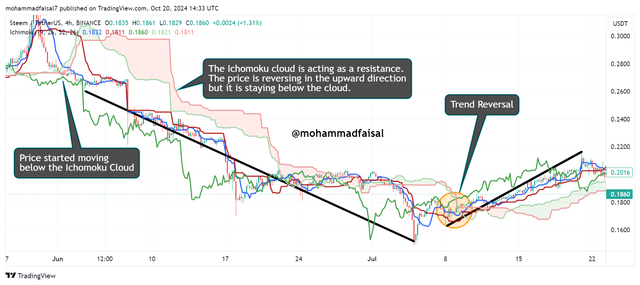

If we see the market behaviour in the start of June then we can see the formation of the resistance by the Ichimoku cloud. In this zone the price is moving below the cloud formed by the Leading Span A and Leading Span B. The price is fluctuating upward and downward but it is moving below the cloud which is acting as a resistance. And this resistance of the cloud is pushing the price in the downward direction and it is not allowing the price to move above this zone. It is acting as a dynamic resistance which is changing dynamically.

Here we can see that the price moved above the resistance and it indicated the reversal of the trend. We can see that the price was moving downward under the resistance of the cloud. But at the end we can see that the price broke out the resistance and the trend was reversed due to which the price moved against the previous trend.

Use of the cloud as dynamic support and resistance level in the STEEM/USDT traders can identify the strong areas for the entry ad exit. They can take better decisions based on the market conditions.

Question 4: Trading with the Ichimoku Cloud

Develop a trading strategy using the Ichimoku Cloud for the Steem token. Outline your entry and exit points based on key signals, such as the crossover of Tenkan-sen and Kijun-sen, the position of price relative to the cloud, and the behavior of the Chikou Span. Support your strategy with a real chart example.

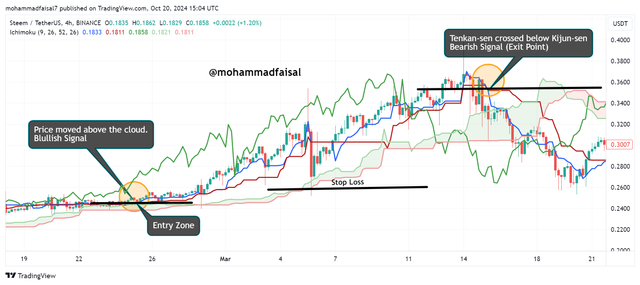

Here I have developed the trdaing startegy for the STEEM token with the help of the Ichimoku Cloud. I have taken the historical price chart of STEEM/USDT from 25 February 2024 with the 4 hour time frame. I have used different components of Ichokimu to develop the trading strategy. Here is the detail:

Entry

We can clearly see the price crossed above the cloud formed by the Chikou Span A and Chikou Span B. It suggests strong bullish signal. And it is the best zone for the log entry. According to this $0.2465 zone was the perfect entry zone.

Moreover the Tenkan-sen crossed above the Kijun-sen. It is also a bullish crossover.

The Chikou Span was above the price. And it confirms the upward momentum.

Exit

The price continuously moved in the upward direction. But in March 2024 the price was reversed. At this point the price crossed below the Kijun-sen at the around $0.3535. It gave the signal for the weak momentum of the current trend.

Whenever the Tenkan-sen crosses below the Kijun-sen it is a bearish signal and it is the best time to exit the long trades. As in the chart we can see that the Tenkan-sen crossed below the Kijun-sen so I have spot that zone as exit zone.

Further moving a little bit next the price also moved below the cloud and it was the confirmation of the trend reversal and the price moved downward after that zone.

A wise trader always exit long trades at this point to avail the profit without loosing the profit because of the trend reversal.

Risk Management

Stop Loss

- In this actually the stop loss is unpredictable but I have indicated a zone for the stop loss. It is the zone where the price can be reversed. We need to be very careful that if the price crosses below the cloud with significant move then we should cut the long entry without any significant loss.

Position Sizing

- Position size matters a lot to manage the risk of the trade. We should be very careful to allocate the size of the available assets for each trade. We should always follow the rule to not put all the eggs in one basket. So always use your assets wisely for the trading.

So Ichimoku Cloud provides a structured strategy for trading STEEM/USDT. We can develop entry and exit strategies. The cloud acts as a dynamic support as well as dynamic resistance zone. And the crossovers between the Tenkan-sen and Kijun-sen and the position of the Chikou Span gives information about the clear trading decisions. This strategy is very effective in the trending market. Moreover we can use some other additional filters such as volume or momentum indicators to confirm the trading setups.

Question 5: Forecasting Future Price Movements Using the Ichimoku Cloud

Apply the Ichimoku Cloud to forecast future price movements of Steem. Discuss the cloud’s forecast capabilities, particularly the Senkou Span A and Senkou Span B, and how they project potential support and resistance areas. What do these forecasts suggest about Steem’s next moves?

The Ichimoku cloud provides a unique forecasting capability through its Senkou Span A and Senkou Span B. These two form the cloud and provide information about the future support and resistance levels.

On the basis of the recent analysis the Ichimoku Cloud provides mix signals for the Steem. First of all I will take a look on the previous historical movement of the price of STEEM and then I will move to explain the future forecasts for the STEEM.

In order to cover a large data for the whole year I have used the 1 Day chart for the STEEM/USDT for the analysis.

Early 2024: If we see the above chart and the data about the STEEM/USDT and apply Ichimoku Cloud then we can conclude that in the early 2024 the Senkou Span A rose above the Senkou Span B. It gave the signal of bullish trend. And after some movements the price also rose above the cloud which further confirmed the bullish trend. The cloud provided dynamic support for the price. And it remained above the cloud for some time. And it suggested that the buyers were still in control.

August 2024: In the above chart we can see that when the Senkou Span A went below the Senkou Span B then the chart indicated a potential bearish signal. Moreover it was confirmed further when the first component of Ichimoku crossed below the second. After that the price started moving downward below the Cloud. The cloud acted as a dynamic resistance for the price. The Senkou Span B was above the Senkou Span A during this time period. It forecast resistance in future price movements. And it made it difficult for Steem to break into the bullish zone.

Next Potential Move

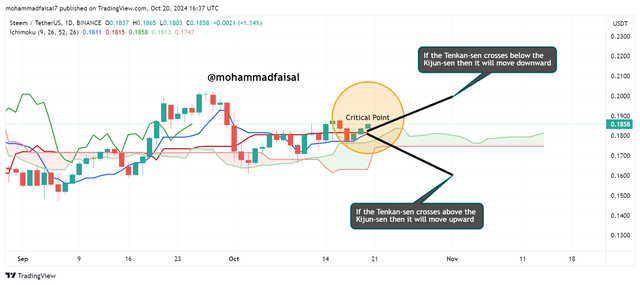

Crypto market is always unpredictable but we can try to guess the future trends based on the historical data and price behaviours. In the next movement of STEEM/USDT I have identified 2 different scenarios.

Case - I

Currently the price of STEEM/USDT is above the cloud means in the current situation the price is moving in the bullish trend. And it is looking that the Tenkan-sen will cross above the Kijun-sen to drive the price in the upward direction following the trend. The projection of the Leading Span A and Leading Span B is also below the price movement and it is looking really fascinating for the upward movement. So if the Steem price breaks the cloud significantly then the cloud will behave as a dynamic support. And it will be a great opportunity for the buyers to take entry.

Case - II

In the second case if the price falls below the cloud formed by the Senkou Span A and Senkou Span B as well as Senkou Span B stays above Senkou Span A then STEEM will probabaly follow a downtrend. The thickness of the cloud will represent the future resistance levels. It will be hard for the bulls to get control again.

So the Ichimoku Cloud Forecast for the STEEM indicates a careful optimism if the price can break above the cloud. On the other hand if it remains below the cloud bearish momentum takes the market in hands. Traders should watch the market carefully to detect the Senkou Span A and Senkou Span B crossovers. Because these crossovers help to detect the trend reversals. They can use the thickness of the cloud as a sign of the strong resistance or support zones.

Upvoted! Thank you for supporting witness @jswit.

X Promotion: https://x.com/stylishtiger3/status/1848049076438257998