Cross-Asset Correlation Analysis .

| Hello SteemitCryptoAcademy a warm welcome to you all here. |

|---|

This is me @kathy-cute from Philippines and you are here Reading my Blog. I hope you all are enjoying the 12th season here. I am participating in the fourth week of this season. This is my participation in a contest Cross-Asset Correlation Analysis .

Explain the concept of cross-asset correlation and its significance in portfolio management. How does understanding correlations between different cryptocurrency assets contribute to effective diversification strategies? |

|---|

This term Cross-asset correlation is the combination of two terms, Cross asset and correlation. Let me explain these two first then I will I will tell what is it's importance.

Cross Assets.

It means looking two different commodities together. For example Crypto, foresx, real estate, gold silver, stock and other major commodities like that. This is actually use to see a good option in the market. Now I have money whether I should invest it in crypto or Forex, or real estate. It's something you see which market is performing well by comparing it with other and then you pick one.

Correlation

Correlation is very simple term which means the relation between two things. It could be any two things, if they are same or having some sort of similarities we say that these are corelate. In crypto we mostly correlate other coins with BTC. In correlation if the price of one pair goes up, the other go up too, if down, the other goes down too.

| cross-asset correlation and its significance in portfolio |

|---|

Now Cross-asset correlation mean means looking two correlate commodities together. This correlation can either be a positive one, or a negative one. A positive correlation between assets means, if one assets goes up, the other will also goes up. If one goes down the other will also goes down. While we have another type of correlation and that is negative correlation. The more the negative the correlation is, the more opposite will be the two commodities.

Now this is the trading strategy more trader use it to avoid too much lost. This is less risky strategy. For example you take in notice two negative correlate assets, now if one goes down, it's obvious the other will goes up and vice versa. In In negative you know if one goes up, the other most go down, so your portfolio get safe from too much lost.

We can say that Correlations do help us in managing the market strategies. If assets in a portfolio are highly correlated, It shows our portfolio is at risk, because it is highly expected that both the assets will go the same direction. In case if it gives you profit will be too much profit and if lost also too much lost. On the other hand, if assets have low correlations, the portfolio is better diversified and less susceptible to market-wide fluctuations. As we know crypto market is a highly volatile one, so low or negative correlation can safe us.

| How does understanding correlations between different cryptocurrency assets contribute to effective diversification strategies |

|---|

The effective use of diversification through understanding cross-asset correlations can potentially enhance returns. It can make your small capital into large one with minimum risk. Their is a very simple strategy for it. combine cryptocurrencies with low correlations, You can capture gains from assets that perform well while minimizing losses from assets that underperform.

Explore how cross-asset correlations change during bullish and bearish market conditions. How can traders leverage this knowledge to adapt their portfolio strategies based on the overall market sentiment? |

|---|

Lower Correlation in bullish market.

In a bullish market, investors are generally in optimistic mode. They are seeing more profit here and expecting the market to move smooth in upward direction. It leads to lower correlations among different assets. The Investors here diversify their portfolios, resulting in less uniform movements across asset classes. For example I see crypto market behaving very good, I withdraw my capital from stock exchange and invest in here. A Gap will create between the two assets which were parallel before.

Bullish markets often coincide with a "risk-on" sentiment from the investors, where investors are more willing to take on riskier assets such as crypto, stocks and forex. They see more profit here, because in such market, their is more profit and more lost,( highly volatile). So if they are sure that these market are bullish will obviously invest in here to take more profit. As a result, correlations between crypto, forex and stocks may increase, while correlations with safe-haven assets like bonds and gold may decrease.

Correlation in Bearish market.

In bearish markets, tge correlations among asset classes tend to increase as investors flock to safe-haven assets and they move away from riskier assets. It very obvious that trading a highly volatile market in bearish phase can give you more harm. You can come up with great lost. During market downturns, assets may move in tandem as investors seek refuge in less volatile market. They get their capitals from the volatile place and invest it in safe one. These volatile market then come in a close correlation ( all moves down) because of the low liquidity in it.

In Bearish market a very much famous phenomena work and that is "flight to safety" where investors prioritize capital preservation over maximizing returns. Here the investment of the people shift to a more safer asset class. This often leads to increased correlations among traditionally safer assets such as government bonds, real estate, silver and gold.

Explain how understanding cross-asset correlations can be utilized for effective risk management and portfolio diversification. Provide examples of how allocating assets with low or negative correlations can help mitigate overall portfolio risk. |

|---|

Cross-asset correlations always refer to the degree to which the prices of different asset classes move in relation to each other. Assets with low or negative correlations can provide diversification benefits, in simple words it means, the assets tend to move independently or in opposite directions.

Diversification helps you reduce the risk of any subsequent lost, means if you invest only in one asset, it means you are sure about it that it will must give you profit and will goes up. Incase if it goes in opposite direction, all your portfolio will get stuck. You will have a great lost. On the other hand if you follow opposite correlation principle and invest in different assets class, you can reduce the risk of any subsequent lost.

For example you have invested money in Gold and real estate, and they are at opposite or negative correlation, now if gold goes down, it's most obvious that real estate will goes up. If you come up with some lost at Gold, you can cover it in real estate. This is the phenomena of opposite correlation.

Now let me show you some practical examples from the real world market.

Stocks and Bonds: Historically, stocks and bonds have exhibited low correlations. And this is mostly see that in such big markets history does matter alot. If bonds perform well in the market, stock must will goes down. Now the investors will find safer investment. Investors will must put their capital here in bonds. The vise versa is the case for stock too. Now it will be good if you target these two markets because they are in negative or opposite correlation.

Gold and Equities: Gold has typically seen in a negative correlation with equities, especially during the periods of market stress or inflationary pressures. Now holding gold alongside equities in this phase can act as a hedge against stock market downturns and currency devaluation.

Real Estate and Stocks: Real estate investments is often seen in low correlations with stocks. Including real estate investment trusts (REITs) in your portfolio alongside stocks can provide a valid diversification benefits. It's confirm that real estate values may not move in tandem with stock prices.

Explore the historical correlation patterns between STEEM and other major cryptocurrencies, such as Bitcoin and Ethereum. How have these correlations evolved over time, and what insights can traders draw from STEEM's behavior in relation to the broader market? |

|---|

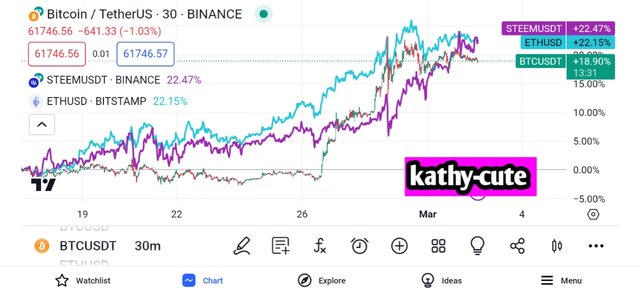

Let me show here combination graph of STEEM COIN with Bitcoin (BTC) and Ethereum (ETH). This is a one year graph these coins that show us a valid comparison between these crypto currencies. Let me explain here each chart.

BTC Vs STEEM

Their isn't a very solid relation between BTC and STEEM if look the whole year graph. Yeah in some past month we see BTC and STEEM look in a correlate relation. From October month a raise in the price of BTC is shown. Similarly the price of STEEM COIN is rasing too. Now these both coins are in uptrend move.

ETH Vs STEEM

ETH and STEEM comparison is something same to that of BTC will Steem. In past few months we can say ETH and STEEM are in positive correlation. They both are in uptrend direction these days.

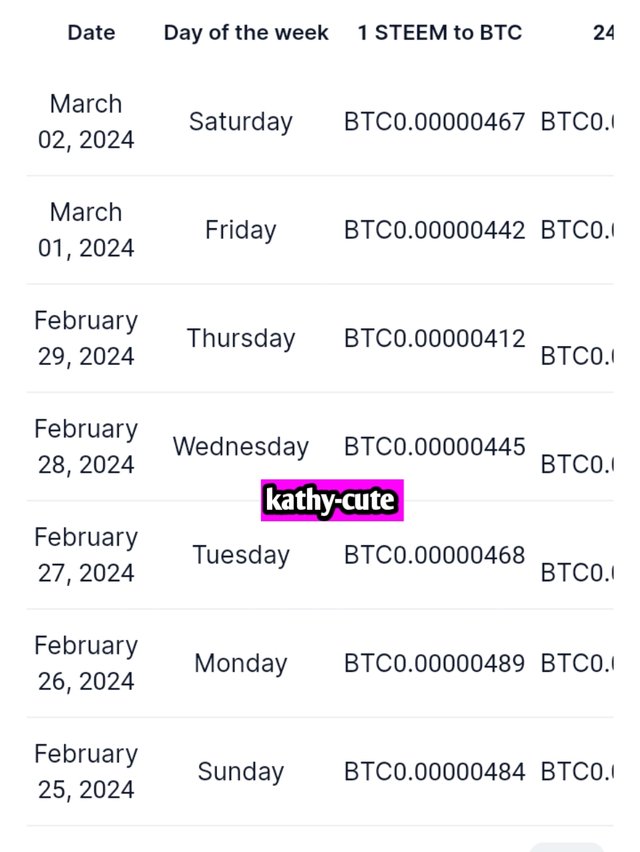

This is another price comparison of steem and BTC for the past one week.

Screenshot from coin marketcap

| My deep heart invitation to my dear friends : @cive40, @jasa107, @nathalidelgado, @emsonic, @elrazi, @safridafatih, @hotspotitaly, @hardphotographer, @beemengine, @tommyl33, @nushrat, @reetuahlawat, @carlaisl. |

|---|

Have a nice Day ahead.I know You must be someone beautiful with a beautiful heart. I know you must be someone cute/handsome. I wish you too many blessings in life. |

|---|

Regard kathy-cute

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Great explanation sister You've provided a clear and comprehensive breakdown of cross-asset correlation touching on both its components cross assets and correlation. Your examples like comparing assets to eggs and bacon or various ice cream flavors make the concept easily relatable.Best wishes in the contest..

Thank you dear friend. Such precious comments always boost up my energy.

You have given derailed explanation I admired your work best of luck

My pleasure friend, best luck to you too.

💜💜💜 😊

AsslamuAlikum sis In your informative article you explain the importance of cross-asset correlation and portfolio management. It also details measures that can be taken to understand the relationships between different cryptocurrency assets. Your article is very educational. good wishes.

You have explained Cross asset correlation term very well by breaking it into two simple words that cross asset means two different asset and correlation means relationship between each other so understanding and studying relationship of two different commodities at one time could be regarding as cross asset correlation that can be negative for one asset and can be positive for another asset.

Good luck

Thank you very much friend for such a beautiful comment.

My pleasure ☺️

Keep posting with originality...

Stay shining 🌟

Stay blessed 😇

Dear friend you have really done really awesome and the article is really attractive to the eyes of botany maths and top professionals, I must say please keep it up research quality articles that could impact high quality knowledge and intellectuals into anyone who goes through you article

Once again thank you for sharing such quality article please you are at your free time drop a comment on my article using the link below

https://steemit.com/hive-108451/@starrchris/eng-esp-steemit-crypto-academy-contest-s16w1-cross-asset-correlation-analysis

Thank you so much, thanks dear for the beautiful comment.

There's no better way to explain than this i think 🤔. You've indeed satisfy me with your explanation.

Cross-Asset Correlation Analysis is undoubtedly one among the triggering and very paramount analysis strategy to investors.

You've help provide me with competence knowledge on the meaning of the strategy, what it does, how it's operate and how to definitely follow ot up to avoid losses and otherwise.

I'm indeed grateful for this knowledge anytime.

Thanks 🙏 and good luck 🤞 sir

Thank you so much dear for the beautiful comment, have a nice day dear.