Crypto Academy / Season 3 / Week 4 - Homework Post for @stream4u | Cefi-Defi-Yield

Introduction

It's a wonderful time to be back at the academy for the week 4 of the season 3, the season that has been running smoothly. This time, I've attended the lecture presented by professor @stream4u as he took us on a ride about Cefi-Defi-Yield, it was indeed an eye-opening lecture to the development seen in the crypto ecosystem and I will be attending to the task given by the professor.

1. Importance of Decentralized Finance (DeFi) system

Before talking about the importance of DeFi, let's open a background to it with a short explanation. Decentralized finance system is an evolution of financial system seen in the blockchain technology whereby users can perform transactions of choice without waiting from an approval from a central authority. In short, DeFi system is run by smart contracts whereby users process any transaction of choice through a pre-written code to get it executed without the involvement of intermediaries. Let's take a look at some of the importance of DeFi system in the list below.

.jpeg)

Image source

Above are a few importance of the DeFi system and how it has effectively shaped the financial sector, especially, as we have seen in the crypto ecosystem.

2. Flaws in Centralized Finance

There are a few flaws associated with the centralized finance system and some of them would be given in the list below.

3. Two DeFi Products.

I will be talking about 2 DeFi products in this section of the task which are Decentralized exchanges and Lending. Let's take a look at each of the products mentioned earlier.

i. Decentralized Exchanges

Decentralized exchanges is one of the products of decentralized finance that offer users to buy/sell, swap/exchange, provide liquidity, borrow/lend... any coin of choice at any time of the day without the involvement of third parties in transactions. On the decentralized exchange, a user can perform a transaction of choice with full control over it which completely eliminates other users involvement.

The technology used to quote prices on the decentralized exchange is AMM (Automated Market Maker) which utilizes the fund supplied into the liquidity pool to complete transactions. Examples of decentralized exchanges are; PancakeSwap, JustSwap, Uniswap and many more. Let's talk briefly about JustSwap.

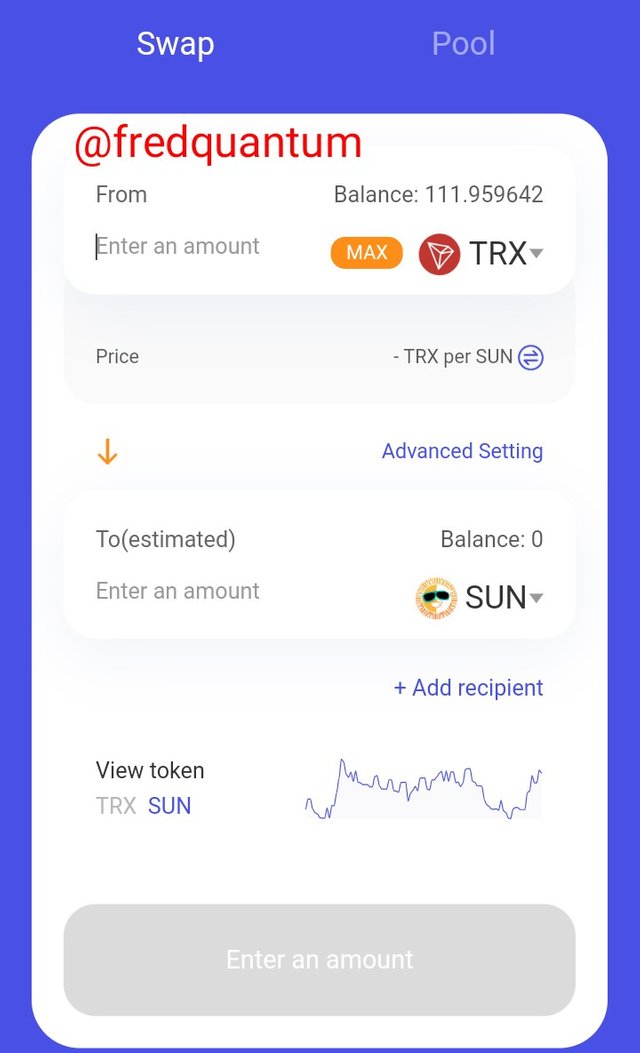

JustSwap: JustSwap is a market protocol built on the Tron blockchain which allow users to swap any TRC-20 token of choice. JustSwap allow users to buy/sell or swap/exchange any TRC-20 token of choice for another one without the involvement of third parties. In addition, users can provide liquidity on JustSwap to earn more. Transactions on JustSwap are quite cost-effective which is great feature of the Tron blockchain but a user might end up burning a lot TRX if they don't have enough Energy to trigger the smart contracts.

JustSwap DEX swapping interface- Screenshot from JustSwap

ii. Lending

Lending is another product of decentralized finance whereby users can supply their assets to the lending pool to earn certain interest rate in APY or APR and users can as well borrow assets from the one's supplied into the lending pool and pay back with certain interest.

This product of DeFi has enabled users to earn passive income from their assets supplied and has allowed borrowers too to access funds for their needs. An example of a DeFi platform that offers Lending/Borrowing is JustLend, let's talk briefly about JustLend below.

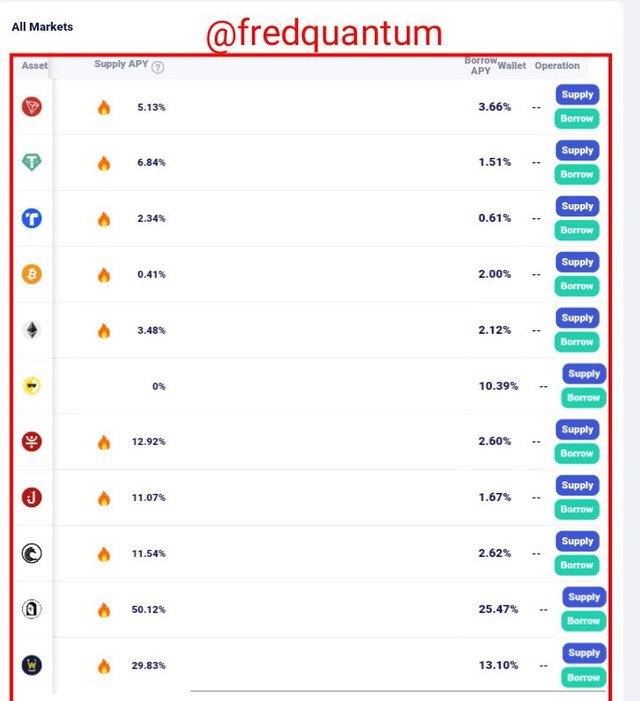

JustLend: JustLend is a lending platform that is built on the Tron blockchain which allow users to supply their assets into the lending pool to earn certain percentage interest over a period and at the same time allow users to borrow from the assets in the lending pool to be repaid with certain interest..

Assets supplied into the lending pool on JustLend enable users to acquire jtokens for the period to which they have supplied their assets into the pool and this jtokens can also be collateralized to borrow on the platform. For example, if you supply TRX into the lending pool then you acquire jTRX and so on. An advantage of JustLend is that transactions fee are quite less which can be said to be a

feature of the Tron blockchain, nevertheless, much Tron might be burned to accommodate the required energy to trigger the smart contracts and interest rate on borrowed asset can be much which is a demerit to the borrowers.

Supply and Borrow market on Justlend with the APY- Screenshot from JustLend

4. Risks involved in DeFi

In this section of the task, I will give a few risks associated with the DeFi system. Let's take a look at them below.

Impermanent Loss Risk: This is the type of loss that is seen in the DeFi world whereby the value of the assets supplied into a liquidity pool differs from what it could have been if left in the user's crypto wallet. Impermanent loss could be as a result of the DeFi system that tries to increase the price of an asset in higher supply of a liquidity pair and lower the price of the assets in lower supply in the pool in the quest to create a balance.

Liquidity Risk: As seen in decentralized exchanges, liquidity is always lower as compared to centralized exchange and as such can lead to excessive transaction fees in the DeFi system.

Smart Contracts Risk: There is risk associated with smart contracts in DeFi, knowing that operations on DeFi is done through smart contracts which are codes that are pre-written. These codes are susceptible to hack or errors which can result to loss of assets the users have in their accounts and this could be so disastrous if all what the user have as capital is in the DeFi product that was attacked.

Financial Risk: Talking about financial risk in DeFi, it can be related to the price volatility behaviour of the assets that has been locked up earlier which has now depreciated greatly at the time the user is trying to unlock it. This contributes to financial risk as the price volatility of the asset over time has affected the investment of the user locked up earlier.

Aforementioned risks are some associated with DeFi and users should be aware of them before venturing into the DeFi world.

5. What is Yield Farming?

Yield farming is another method of earning passive income in the DeFi world whereby users can lock up their assets over a period and earn from it. Users that locked up their assets in this case are called liquidity providers having their assets locked in the liquidity pool to earn from exchanges fee based on the percentage return (APY/APR).

The assets locked up in yield farming are also used for lending purpose to other users and the providers earn rewards based on the APY/APR of the pool the asset was supplied. Through Yield farming, users earn more from their assets which is more preferable than letting the asset sit idle in the crypto wallet.

6. How does Yield Farming Work?

The way Yield farming works is that the users (liquidity providers) locked their assets in the pool of choice to earn tokens. The assets are also referred to as liquidity which is used to enhance liquidity on the DEX, the tokens locked by the users is used to complete transactions on the DEX and notably, used by the technology used for quoting prices in decentralized exchange, AMM (Automated Market Maker).

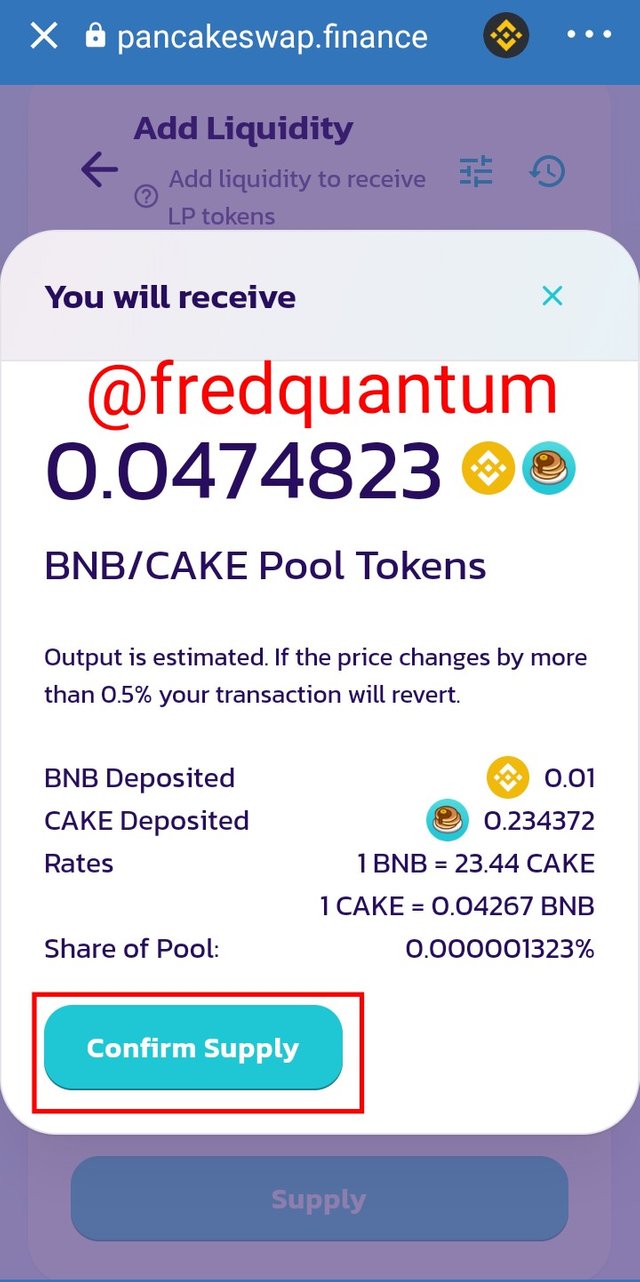

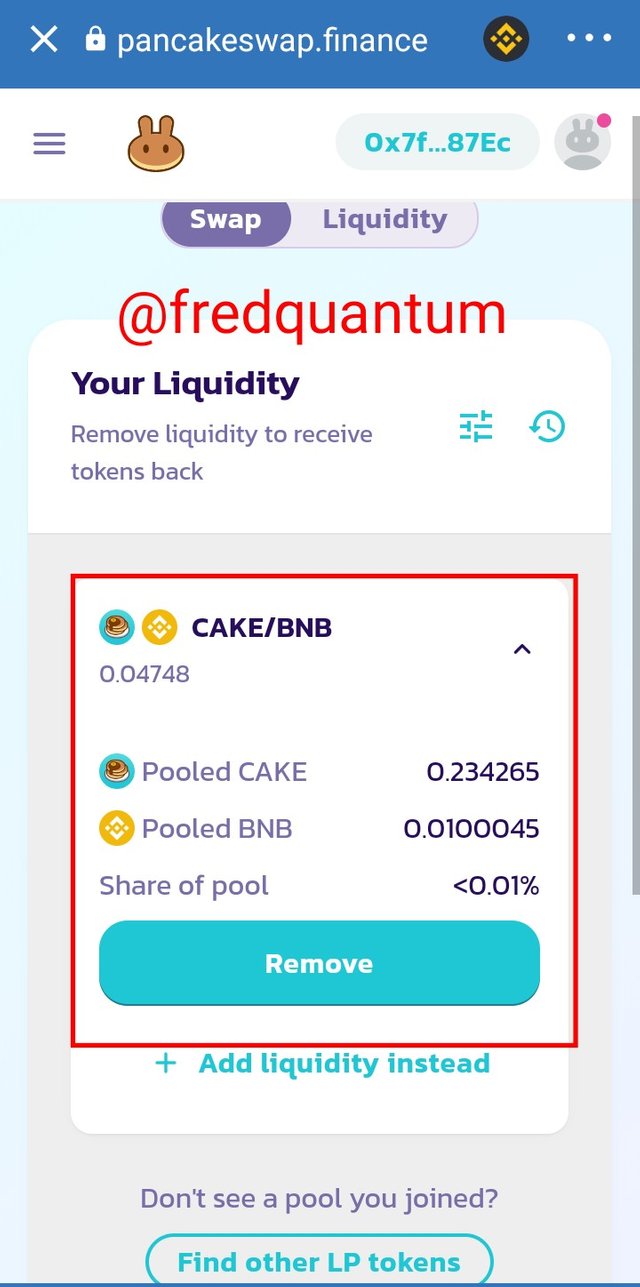

Let's take for example, if I am providing liquidity on an Ethereum-based decentralized exchange, I will be supplying a ERC-20 token and in that case, I will earn ERC-20 tokens as a reward based on the APY/APR. Similarly, if I am providing liquidity on a decentralized exchange built on the Binance Smart Chain then I will need to supply a token deployed on the Smart Chain and I would get BSC token as reward for providing liquidity.It would be interesting to go through the practical of providing liquidity on a DEX to see how yield farming works.

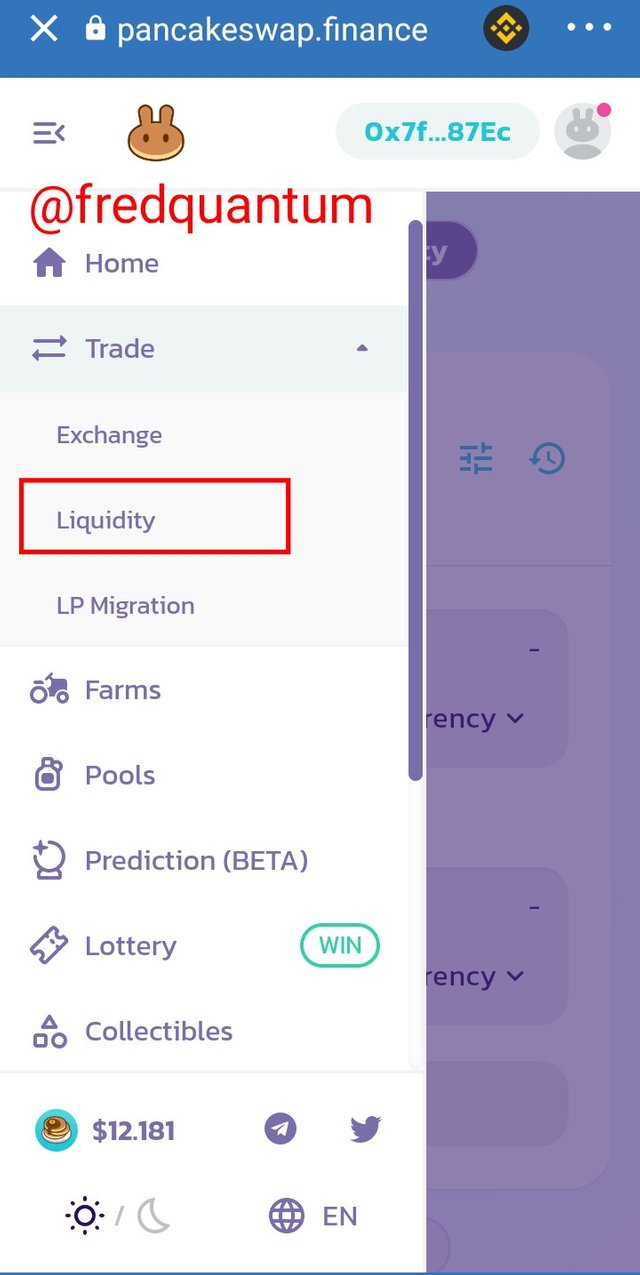

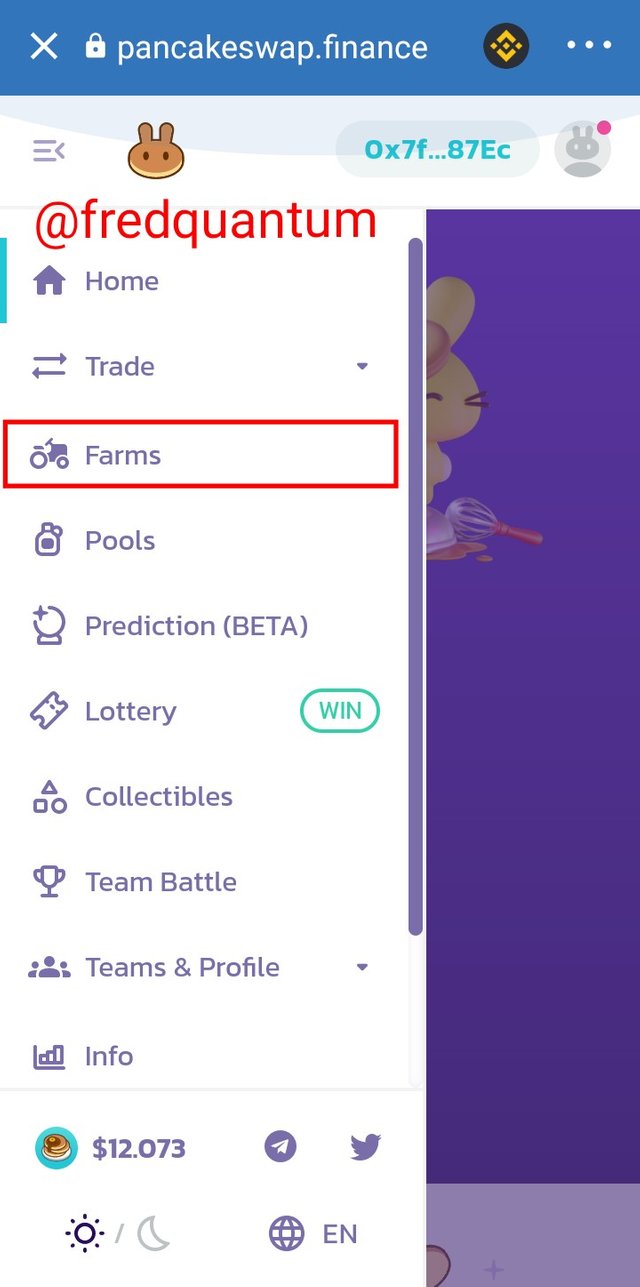

How to add liquidity on PancakeSwap

All the screenshots used in this section of the task were taken from PancakeSwap Finance.

7. What Are the best Yield Farming Platforms and why they are best.

At this section of the task, I will be discussing about two decentralized exchanges on different blockchains that offers yield farming and they are; PancakeSwap (Binance Smart Chain) and SushiSwap (Ethereum Blockchain). Let's discuss each of the aforementioned yield farming platform below.

PancakeSwap

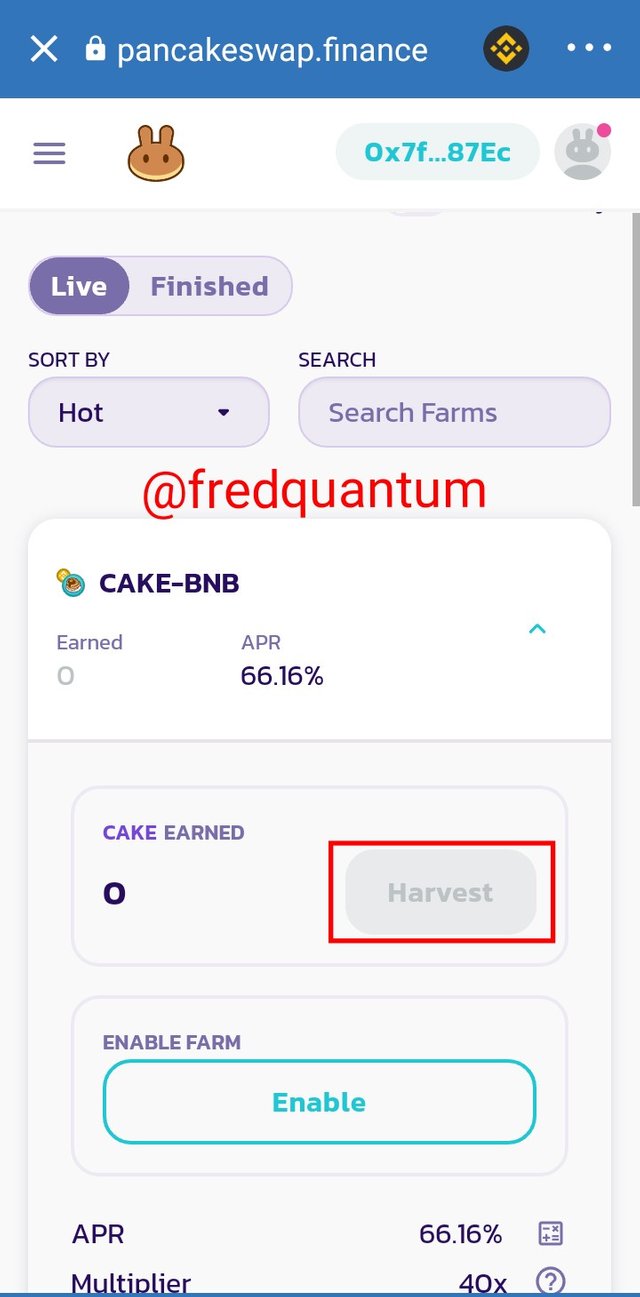

PancakeSwap as a decentralized exchange is one of the numerous DEX that offers yield farming and it is deployed on the Binance Smart Chain. PancakeSwap came into existence in the year 2020 and has since been relevant in the list of numerous decentralized exchanges available in the crypto ecosystem.

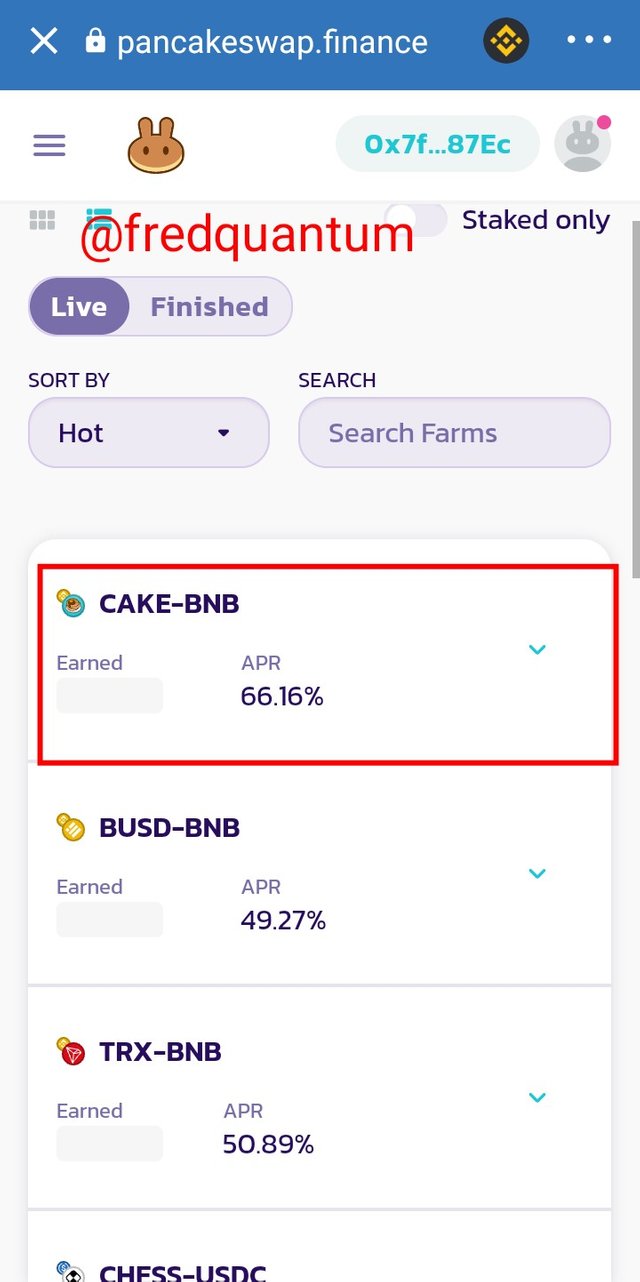

PancakeSwap offers the buy/sell, swap/exchange... of BEP-20 (BSC tokens) which makes it easy to exchange BEP-20 tokens for another BEP-20 token. In addition, PancakeSwap offers liquidity providing through different pools to earn passive income, prediction, yield farming, lottery, collectibles (NFTs) many more others. PancakeSwap has been one of the leading decentralized exchanges available in the market as at the time of writing this article. Some of the liquidity pool available on PancakeSwap are; Auto CAKE, Manual CAKE, Earn TRX Stake CAKE, CAKE-BNB and many others each with differing APY/APR.

The native token of PancakeSwap is CAKE which is on the number 33 by market capitalization ranking has a value of 12.28 USD as at the time of writing this article. PancakeSwap (built on BSC) has been widely accepted for its fast and cost-effective benefits which is better as compared to other decentralized exchanges built on the Ethereum blockchain. PancakeSwap uses the AMM (Automated Market Maker) technology to quote prices on the DEX by utilizing the funds in the liquidity pool.

Why PancakeSwap is among the best

As compared to other DEX that offers yield farming, PancakeSwap has a lot of yield farming products which range from; Add liquidity, Liquidity pools, Farms, and so . Acquired LP tokens from providing liquidity can be used to stake in the farms to earn more (as demonstrated in the section above) and the transactions on PancakeSwap (built on BSC) is cost-effective as compared to other DEX built on the Ethereum blockchain that offers yield farming. One of the shortcomings of PancakeSwap is the risk of Impermanent loss.

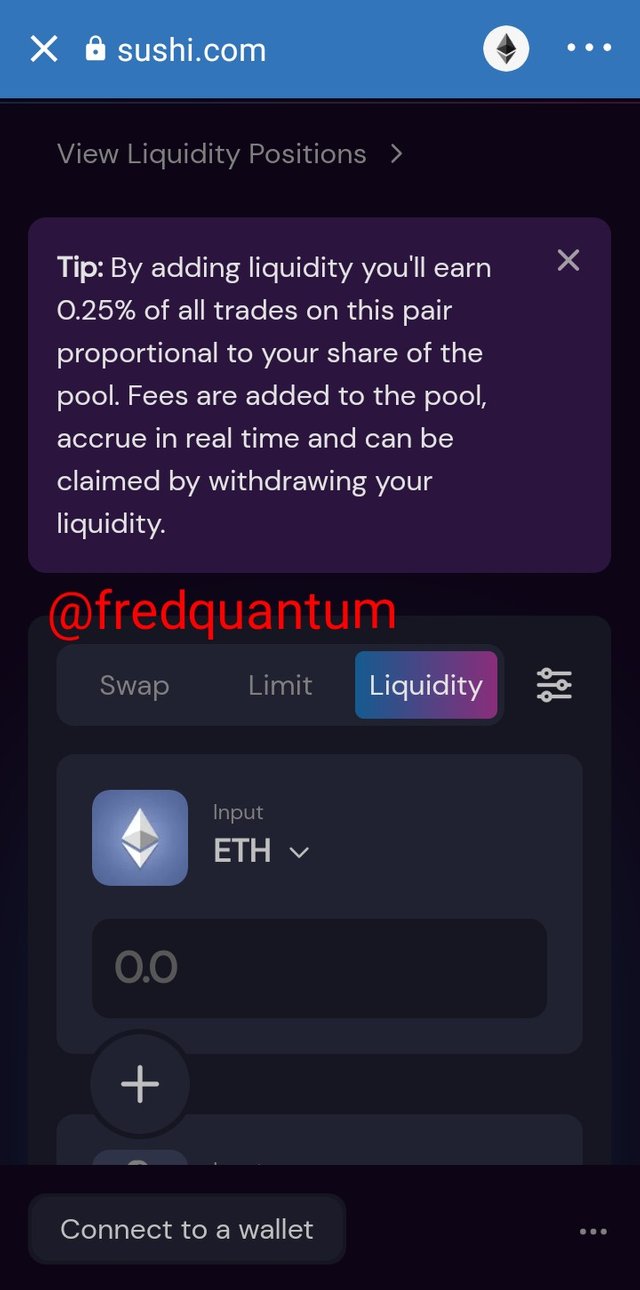

SushiSwap

SushiSwap is yet another decentralized exchange that is built on the Ethereum blockchain for the buy/sell or swap/exchange of ERC-20 tokens. SushiSwap DEX came into existence in the year 2020 and it's the hard fork of the Uniswap (a DEX earlier built on the Ethereum Blockchain). The technology used to quote prices in Sushiswap is AMM (Automated Market Maker) which enhances liquidity on the DEX.

In addition to the buy/sell and swap/exchange features of the SushiSwap DEX, it also offers yield farming whereby users can supply liquidity into the pool of choice and earn passive exchanges fee from the transactions on the DEX. This option of liquidity providing enhances liquidity on SushiSwap and at the same time allow liquidity providers to earn passive income.

The native token of the SushiSwap is known as SUSHI which is currently on the number 74 by market capitalization ranking and currently has a value of 6.58 USD. In conclusion, the SushiSwap DEX does not only allow users to swap their ERC-20 tokens but also allows them to earn passive income through yield farming.

Liquidity Interface of SushiSwap- Screenshot from SushiSwap

The above is the liquidity providing interface of the SushiSwap where liquidity providers stand the chance to 0.25% of the exchanges fee which is solely dependent on the stake (portion of his/her locked asset) of the user in the pool.

Why SushiSwap is among the best

SushiSwap is among the best DEX that offers yield farming with its numerous Liquidity pools and we know that most DEX faces liquidity problem, SushiSwap is said to have a substantial liquidity that can even be compared to some centralized exchanges. In addition, the upgrade on SushiSwap consider users as part of the governance as holders of SUSHI can vote to effect an upgrade. One of the shortcomings of SushiSwap is the excessive gas fee because it's built on the Ethereum blockchain.

8. The Calculation method in Yield Farming Returns

Yield farming returns are calculated in two ways, namely; APR (Annual Percentage Rate) and APY (Annual Percentage Yield). Let's discuss the duo of APR and APY below, and also see their calculations.

Annual Percentage Rate (APR)

Annual Percentage Rate (APR) is termed as the annual return on investment without compounding interest. Well, this is often seen in loan acquisition return terms yet it is used in crypto yield farming. Let's see the calculation below.

APR Calculation

For instance, I staked CAKE assets worth $500 (500 USD) in the Manual CAKE pool with a 100% APR. In this case, since the APR is 100% then we have;

100% of $500 in APR is equivalent to ---> 1 X $500 = $500

Therefore, My initial investment + APY --> $500 + $500 = $1000

So, after one year my total investment equals $1000.

Annual Percentage Yield (APY)

Annual Percentage Yield (APY) is the total annual return on one's investment taking into consideration the compounding interest, this is the part (compounding interest) that differentiates between APR and APY. APY is also used for returns calculation in yield farming. Let's take a look at the calculation below.

APY Calculation

I will considering using an equation to calculate the APY in this condition. For instance, I staked my CAKE assets worth $500 into the Auto CAKE pool which offers 100% APY.

Using the formula, (1 + r/n)n -1

Where we have; r = interest rate , and r = 100% ~ 1

n = the compounding period, and n = 365 days

Now, let's put the resources together,

(1 + r/n)n - 1 <---> (1 + 1/356)365 - 1,

(1 + 0.002740)365 - 1,

(1.002740)365 - 1,

(2.717) - 1 = 1.717,

Now the APY = 1.717 X 500 = $858.5

Now my total investment after one year = Initial investment + APY = 500 + 858.5 = $1358.5.

Therefore, my total returns after one year = $1,358.5.

9. Advantages & Disadvantages Of Yield Farming.

Advantages of Yield Farming

Passive Income Generator: Yield farming offer users the chance of earning passive income on their crypto assets instead of leaving it sitting idle in the crypto wallet. In this case, a user can combine holding an asset for a long term investment and also earn passive income from it by locking the assets into the mining liquidity pool.

High Profitability: It's highly profitable to involve oneself in the yield farming as the returns from it at the end of the farming period is tremendously greater as compared to other conventional system's returns on investment.

No Hindrance of Participation: Users from every part of the world can participate in yield farming without been hindered by identify verification such that users don't have to bother about getting past KYC verification. Once you have the asset, you are free to participate in the yield farming and earn passive income.

Involvement in Governance of a Protocol: Yield farming can earn users the opportunity in the governance of a protocol. An example of this is seen in the case of SushiSwap whereby the governance as regards upgrade is determined by the holders of SUSHI, in the same way, if a user farms tokens of SUSHI-ETH, they get the chance to be involved in the SushiSwap governance provided they have farmed the required token for the purpose.

Disadvantages of Yield farming

Price Volatility: Price volatility characteristics of cryptocurrency can affect the value of the asset supplied into the yield farming pool and this is what is known as Impermanent loss.

Smart Contracts Alteration: Know that the yield farming as a component of the DeFi system runs on smart contracts which can be disastrous if the code guiding the contract is altered/attacked as it can lead to massive loss on the side of investors.

Stake weight deficiency: Users with huge amount of assets locked in the yield farming position themselves for huge returns while users with less investments eat on the fragments.

Returns rate: Return on investment gets decreased over time especially when there are new pool options.

High Transaction Fee: This is a case of excessive transaction fee (gas fee) which can be see on DEX that are built on the Ethereum blockchain and it can result in excessive gas fee while trying to supply to a mining pool of choice which is not quite cost-effective.

Conclusion

Decentralized finance (DeFi) has shaped our crypto ecosystem into a more comfortable place for making transactions with complete elimination of third parties and of course, it improves the speed of transactions with no delay that could have been experienced when waiting for an approval as seen in the centralized finance. In addition, it has enabled users from different parts of the world to transact without the hindrance of identity verification, although, this can be seen to usher in some frivolous acts (illegal money movement) but the good is that, it offer ease of independent transactions.

Speaking of the Yield farming, this is a remarkable achievement of DeFi that enable users to earn passive income from their crypto assets and it's extended to the experts and to the ones that have no much knowledge of cryptocurrency as all that is required is to add your assets into the pool of choice and start earning. Thanks to professor @stream4u for this great lecture.

Cc: @stream4u

Written by;

@fredquantum

Hi @fredquantum

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Thanks for the review professor @stream4u. I'm glad to have been in participation of this awesome delivery by you. Thank you once again.