Crypto Academy Season 3, homework task for professor [ @stream4u]| Decentralized finace and Yield farming

Hello all this is my homework post submitted to the author @stream4u. Thank you for the lesson and I have learnt many things about decentralized finance and centralised finance field farming. Let's go to the homework 😁.

What Is the Importance Of the DeFi System?

DeFi stands for Decentralized Finance allows it's users to do all the transactions without the need of any third party.

For example centralised finance system for example bank account functions on the central authority hence we are here in the need of authority of third party. We can able to reduce the the authority and make powerful freedom on decentralised finance system this is the great advantage of decentralised finance system.

As this decentralized finance work on blockchain it remains transparent and one hundred percent legit. Where we can't find those in centralized finance system like banks.

Flaws in Centralized Finance.

Lack of speed and efficiency - when we try to access the fund from our bank it will take too much of time when compared to decentralized finance system. And if we need to move huge fund we need to keep waiting for the banking hours and get it done which is lacking it's efficiency.

Age limits - In India we need must be adult to access the full efficiency of banking system. Fir example I get into steemit by 2016 at that time I was 16 I can't able to withdraw the money which I needed it's a gread flaw in centralized finance system.

Usage limits - we have to do certain number of transactions as per centralized Authorization when we cross the limit we have to pay heafty fee for every transactions.

- Opening account - We have to create the bank account in our proof locality else it would be a long process to create an account. I am personally facing this issue. I opened my bank account which is 500 kilometres away.

DeFi Products

Decentralized finance have many products and it's services here I am going to explain about the two which is mentioned below.

- Lending and borrow.

- Decentralized exchange.

Lending and borrow

Lending is the good investment method when compared to simply sitting your money on your bank account or fixed deposits. In banking system the lender will get low interest and borrower need to get pay high interest the difference between these two is converted as profit of the bank. But here in decentralized finance system we are free from this profit of agent who connect lenders and borrowers.

Decentralized exchange

DEX is the short form of decentralized exchange. These exchanges also gives their profit 100% to its users. Where centralized exchanges will make good money from the users in the form of fee.

This process will cost small fee that fee is also benifit for the defi users as this fee is given for the liquidity providers.

For example, we can take Uniswap Dtube tokens are tradable in Uniswap which makes the tade instant and accurate. But currently Uniswap is running on ethereum blockchain hence we need to pay high fee this is the only disadvantage right now in this service.

Risk involved in DeFi

Most of the decentralized finance projects are in ethereum blockchain where currently we are facing the high gas fee. Previous month we faced heavy gas fee compared to current situation. I need to pay 100$ fee for 20$ asset which is funny to hear.

ERC 20 tokens can be easily created. This gives scammers to clone the existing successful DeFi token and make a trap for the new DeFi users.

DeFi has a danger of human errors like sometimes we will forget our keys or foolishly share our keys with anonymous scammers on their traps.

As we are making everything on use of token when we stake our tokens due to this high volatile market we may have high risk to loss our fund.

Scalability is one of the major issues as well. Blockchains which have low scalability result in expensive transactions and long time for transactions to take place.

What is Yield Farming?

Yield farming is process by which users can stake their tokens for a certain period of time this will result in giving back your token with certain additional tokens (intrest) after staking period gets over.

It was like our traditional finance banking we can stake the token for centrain period of time like fixed deposits and we will get it after mentioned time with intrest amount.

How does Yield Farming Work

The Yield farming works on the basis of Automated Market Maker (AMM) which creates a Liquidity Pool with the help of smart contracts. These pools implement the trades determined on pre decided algorithms.

For example, user can provide their tokens to the liquidity pool. This tokens will used for the decentralized exchange and the fee paid by the users will paid as the intrest for the liquidity providers.

What Are the best Yield Farming Platforms and why they are best.

Pancakeswap

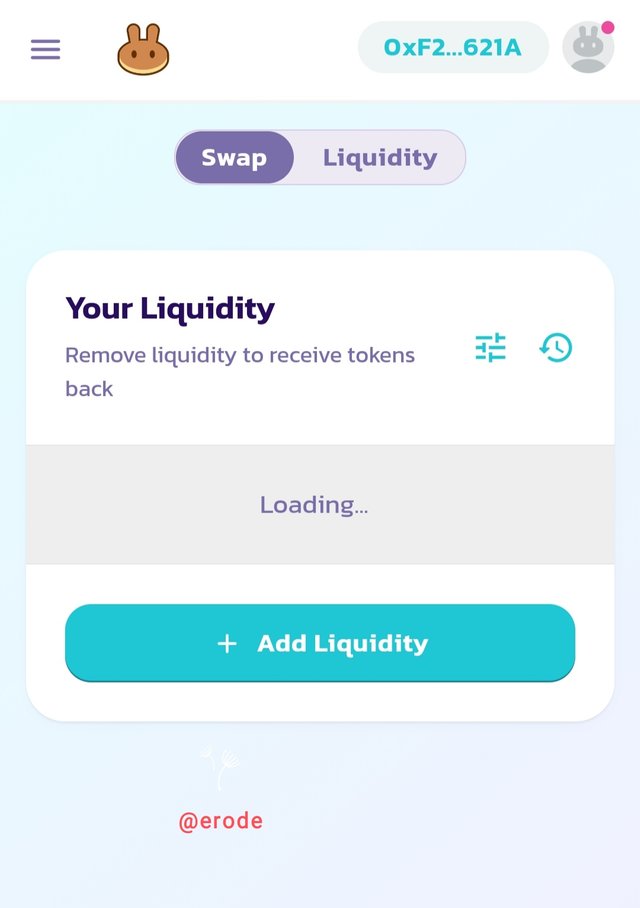

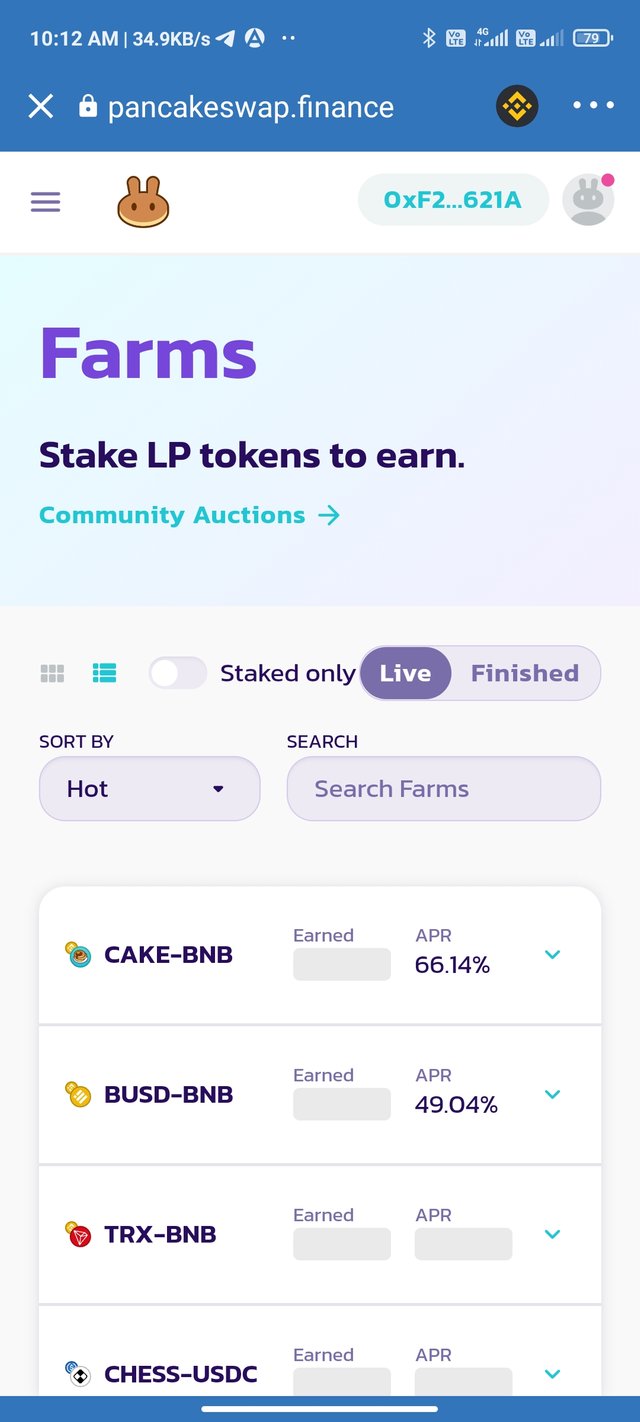

Pancakeswap is working on AMM automated market maker mechanism running on Binance smart chain. Which allows the user to access the yield Farm easily and very efficiently.

Here is the major key points why Pancakeswap attracted me.

Allows to access through our mobile phone. You can see the above screenshot is took from mobile device where I can't find comfort like this.

Binance smart chain has large number of user volume where the number of users increases the business runs smoother.

Less fees when compared to other yield farms like running on ethereum blockchain

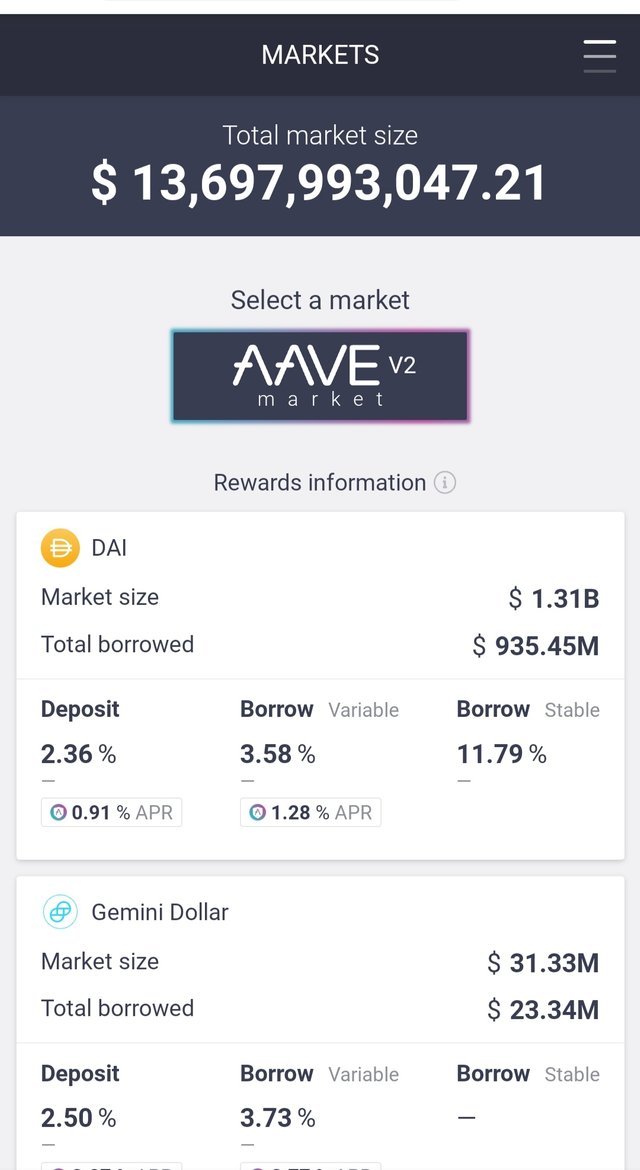

AAVE

AAVE users earn interest from their assets which they deposit as collateral and can borrow. By means user can lend their AAVE token and earn rewards.

As I mentioned above the number users increases the smoother business. As the number of user increase the price of AAVE token. So in this mean time your yield AAVE will make profit 😁.

The Calculation method in Yield Farming Returns.

APR Annual percentage rate

APR allows users to get their interest in the prescribed percentage manner. Which we can simply understand it by simple intrest. For example, for 100 AAVE token you described as 10% APR mean you will get 110 AAVE token at the end of 365 days.

APY Annual percentage yields

APY allows users to get their interest in the from of compound interest calculation. This will give higher benifit compared to APR. You can calculate by formula (1+r/n)^n-1.

Fir example, 100 AAVE token you described as 10% APY mean you will get 110.515 AAVE token at the end of 365 days.

Advantages & Disadvantages Of Yield Farming.

Pros

We can gain the opportunity to earn high interest rate when compared to fixed deposits in the banks.

we doesn't need bulk amount to do this process. All we need is certain little amount to start yield.

High return of investment will attract more users to invest results in increased buy pressure of token which we brought hence we get double profit from it.

Cons

As you seen many times that cryptocurrency market are high volatile market hence it may reduce the portfolio value of the token which you yield results in loss.

Slight chance of loop hole in software code of yield farms will result in data leaking and funds will be stolen.

Conclusion

DeFi is better than centralized finance such as bank in some aspects which allows the users to use 100% freedom to use their money. Where centralized finance involves third party.

Farm yielding is a good way of savings for our retirement life 😄. Which provides good return of investment through APY compund intrest.

I need to thank professor @stream4u for the wonderful lesson. I leaned a lot a lot from this homework post.

Hi @erode

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

You have been upvoted by @sapwood, a Country Representative from INDIA. We are voting with the Steemit Community Curator @steemcurator07 account to support the newcomers coming into Steemit.

Engagement is essential to foster a sense of community. Therefore we would request our members to visit each other's post and make insightful comments.

Thank you