Crypto Academy Week 10- Homework Post for Professor @fendit - Make your cryptocurrencies work for you.

Dear Steemians,

I am pleased to be part of this week's lesson. I thank professor @fendit for giving us this excellent lecture on making our cryptocurrencies work for us.

In his lecture, Professor @fendit talked a lot about making our cryptocurrencies work for us, which he explained in depth.

After going through the notes and researching this week's topic, I have decided to review what I have learned in my homework task.

Which is your risk aversion, which of these products you find the most appealing, and why?

Cryptocurrency investment should not be something one should entirely depend on, but one can use it as a source of passive income. Because cryptocurrency is decentralized, this has made it very risky to invest in due to its vitality. Knowing the risk involved made me invest in the amount I can afford to lose. I usually invest with risk capital since it does not affect my finance if there are any losses; the profit can be huge if the asset's price increases.

Investing in the small assets at the start of their development is one thing I always consider. Since they are still young and developing, these projects have great potential to make a significant profit in the future when invested early. Likewise, one can make a huge profit when the project succeeds, it is the same way these projects can also fail, and a significant loss will beared.

Per the assessment I gave, I can indeed say that my risk aversion is aggressive risk tolerance. I am this type because I always make sure I use my capital risk for the investment and always accept the outcome of the market.

One can use many saving platforms, but per those, I tried Binance savings is the one I like most and always use it. It has a nice interface one can easily navigate through, even without any assistance.

On the savings page, there are bo flexible and fixed savings to choose to deal with. My choice depends on the one which offers the percentage of returns. I usually go in for the high percentage savings, which can either be fixed or flexible.

Explain in your own words fixed and flexible savings, high-risk products, and launch pools.

Fixed savings is a type of savings that gives the investor a predetermined interest within a specific period of time. During this period, the investor cannot withdraw the funds or even have access to the funds. In a fixed deposit, the interest with the principal is paid at the end of the savings period.

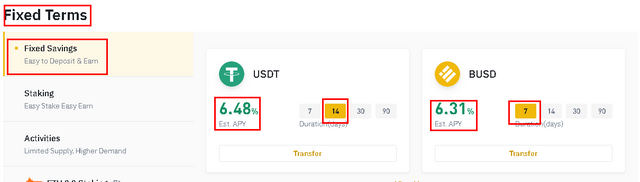

Most investors usually use this type of savings for long-term investment; this savings duration can be for 7days,14days, etc., and so on. The interest one gets at the end of the saving period depends on the duration chosen; the higher the duration, the more interest earned.

The picture below is taking from Binance fixed savings page, which is set at 2weeks for USDT, which the estimated APY is 6.48%, and BUSD is set for 1week, and the estimated APY is 6.31%

Advantages of fixed savings

Fixed savings are not influenced by the market; this makes it safe to invest which you are assured of your money at the end of the saving period.

Fixed savings have a moderate Interest rate.

Fixed savings are not affected by the liquidity of the crypto market. The fall or rise of an asset does not affect the investor's interest at the end of the saving period.

Disadvantages of fixed savings

Fixed deposits lock in the funds for a fixed time without you having access to the funds.

The rate of interest on fixed savings does not change during the period of the savings. Investors do not get the benefits on their interest even if the inflation rate increases.

Fixed savings are less risky than most saving options; this has made the interest rate on fixed savings very low.

created on Snappa

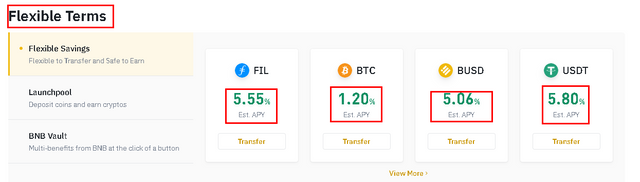

Flexible saving is a term that means to deposit your money to gain interest. With this type of savings, the investor can withdraw his or her funds at any time. Unlike fixed savings, where the funds are locked for some period before you can get access to the funds, Flexible saving allows you to have access to your funds at any time that you want.

Flexible savings offer a lower interest rate as compared to fixed savings.

Investors who subscribe to flexible savings will have the funds deducted from their wallet., The funds will be locked up for 24 hours; these funds will start accruing interest 24hrs after subscription.

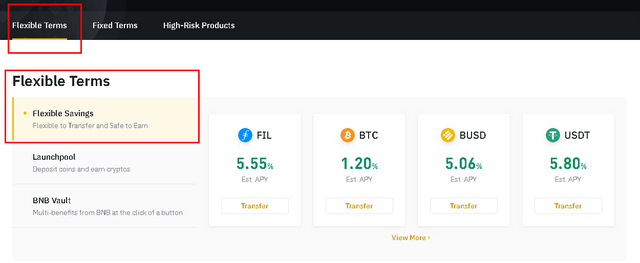

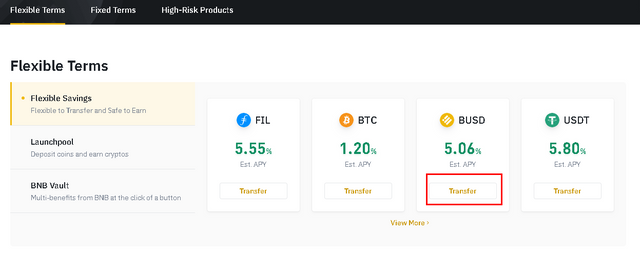

The picture below shows the various assets with their interest rates under flexible savings.

Advantages of flexible savings

There is a low tax rate since the amount to be deposited for saving is deducted before any taxes.

Investors have access to their funds any time they want.

Disadvantages of flexible savings

Since the interest rate is not fixed flexible savings, the investor can get less than what he or she was expecting.

With flexible savings, an investor can not change the saving amount.

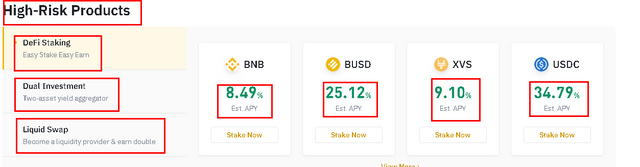

This is the type of crypto asset with high volatility features in the crypto market. These assets can quickly increase or decrease in value. These products are best for those good at crypto price forecasting; they can predict a high chance of the market price in the near future. Dual investment, Defi staking, and Liquid Swap are some of the high-risk products on Binance.

Advantages of High-risk products

The chance of earning huge profits is more significant than normal investments.

Investors can easily sell or buy securities without any hindrance or restrictions.

Disadvantages of High-risk products

There is a high Volatile on the assets; this makes it easy for investors to lose a great deal of money.

Investors do not have control of the company assets; this can make the asset's manipulation of the asset easy.

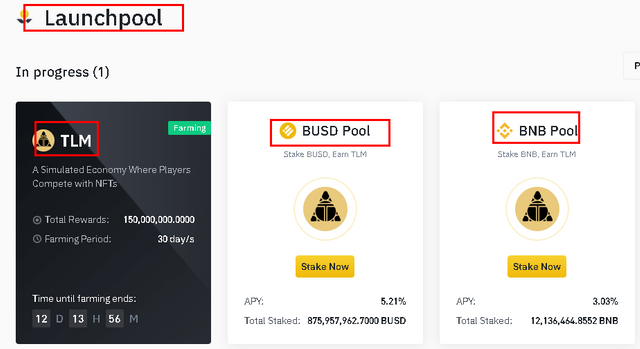

Launch pool is platform exchanges use to provide notice of a new digital coin that is just about to be listed on the exchange. After creating the notice, those who want to farm the asset to stake on them. The launch pool is one of the ways for an investor to earn passive income. These coins are launched through Initial Exchange Offering (IEO).

Users can stake the coin using BNB or BUSD; mostly, these coins have been vetted before making them available on the exchange pool. Most coins on Binance end up been listed, so this another for those who want to make passive income to consider.

Show and give detail on how to set the investment you chose in Binance.

There are many saving opportunities on Binance which one can make passive income. Investors can either choose Stable coins such as USDT, BUSD, USDC, which higher l interest rate than volatile coins like BTC, BNB, etc.

Before doing any trading on Binance, you need a verified account.

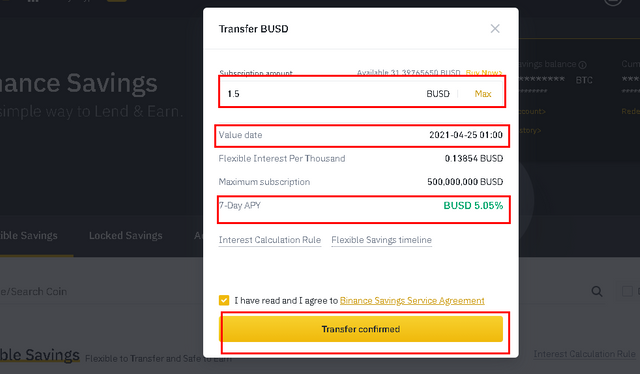

For the sake of this illustration, I will be using BUSDT, and I am using the official website, not the App.

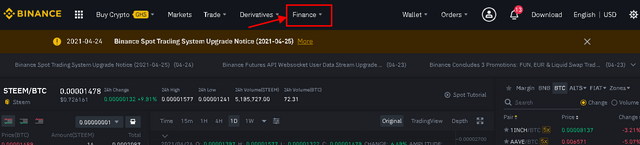

- Click on " Finance" on the home page

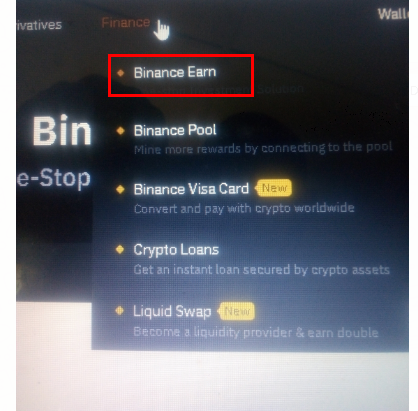

Select "Binance Earn" on the drop-down menu

Click on "Flexible terms" and select "Flexible Savings."

- Select "BUSDT" and click on "Transfer" to continue

- Enter the amount you want to invest; this section also contains some information for your reading, and click on confirm.

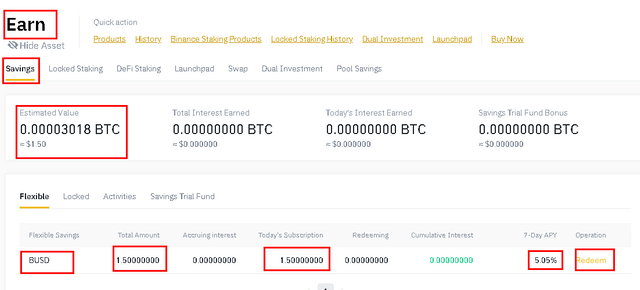

- To track your savings, click on the wallet and select Earn, and you see the details of your savings.

- I subscribed for 7days, I can also redeem my funds before the set date, but there will not be any interest in it.

Conclusion

There are many cryptocurrency opportunities offered by Binance, from which you can earn some income. However, there is risk involved; if you want to enter into any of the trades, make sure you have the needed information. If not, consult an expert for guidance.

- All the pictures I used for the illustration were taken from my Binance account.

Thank you for being part of my lecture and completing the task!

My comments:

Nice work, all three tasks were very good!

General comment:

Explanations were clear, post was correct when it comes to markdowns... nice job! :)

Overall score:

6/10

thank you @fendit for checking my work

please I have completed my achievement 3 to 5 task 1

but they have not been verified

Achievement 3

achievement 4

Achievement 5 Task 1