Crypto Academy / Season 3 / Week 1 - Homework Post for Professor @imagen : Staking

This is my homework post for Steemit Crypto Academy Season 3 Week 1 for Professor @imagen’s lesson Staking.

1.) Research and choose 2 platforms where you can do Staking, explain them, compare them and indicate which one is more profitable according to your opinion. (Binace is not allowed)

For this task I will write about P2P Validator and MyContainer.

1.1) P2P Validator

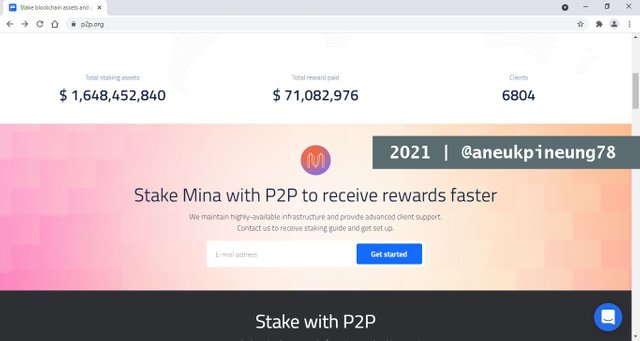

P2P Validator is a staking paltform that helps investor to generate rewards on their blockchain assets across more than 9 networks within a single interface. It is one of the popular non-custodial staking pool that allows users to combine their crypto and split the rewards.

P2P Validator was established in 2018. One of it’s primary focuses is to influence the development of PoS (Proof of Stake) technology in a possitive way, and also to improve existing networks. In September 2020, P2P Validator make a breakthrough step by announcing a grant work project that focuses on connecting the Polkadot and Filecoin ecosystems, the make it possible by creating an ETL solution. To date, more than six thousand active stakers are staking on this platform. These users have $1,648,452,840 in total staked assets. And these assets have paid out a total of $71,082,976 in rewards to date.

The 4 advantages offered P2P Validator by are :

- Simplicity. Everyone will generate reward for staking from day one. It does not requires users to have any technical knowledge, infrastructure and network control to stake at P@P Validator.

- Security & Infrastructure. P2P Validator guarantees that it was built with maximum security and performance at the forefront.

- Network Expertise. P2P Validator claims to have exhaustive financial analysis to provide support for top-tier staking networks. With an in-house team of analysts, P@P Validator conduct constant network monitoring so users can enjoy high profitability with peace of mind.

- Smart Governance. P2P Validator claims to believe in the value of decentralization and that it participates in active governance across all supported networks to ensure the interests of the community, as well as the stakers, is supported.

Staking in P2P Validators is easy. It only requires some simple steps to begin. A user canndidate need to provide email address and login details to get started with the platform.

P2P Validator offers a user-friendly interface. It offers a wide selection of stakable coins. Assets supported by P2P Validator so far are:

| No | Coin Name (Symbol) | APR | No | Coin Name (Symbol) | APR |

|---|---|---|---|---|---|

| 1 | Tezos (XTZ) | +6.0% | 2 | Cosmos (ATOM) | +10.6% |

| 3 | Polkadot (DOT) | ~15% | 4 | Solana (SOL) | ~8% |

| 5 | Kusama (KSM) | 17% | 6 | Kava (KAVA) | +15.2% |

| 7 | Ethereum (ETH) | ~7.6% | 8 | TheGraph (GRT) | ~11% |

| 9 | Cardano (ADA) | ~5% | 10 | Nucypher (NU) | ~50% |

| 11 | Irisnet (IRIS) | ~9.4% | 12 | FLOW (FLOW) | ~5% |

| 13 | DAOBet (BET) | ~10% | 14 | Oasis (ROSE) | ~20% |

| 15 | Terra (LUNA) | ~6% | 16 | Near (NEAR) | ~11% |

| 17 | Marlind (Pond) | ~30% | 18 | Mina (MINA) | ~24% |

| 19 | Regen (REGEN) | ~35% | 20 | Persistence (XPRT) | ~35 |

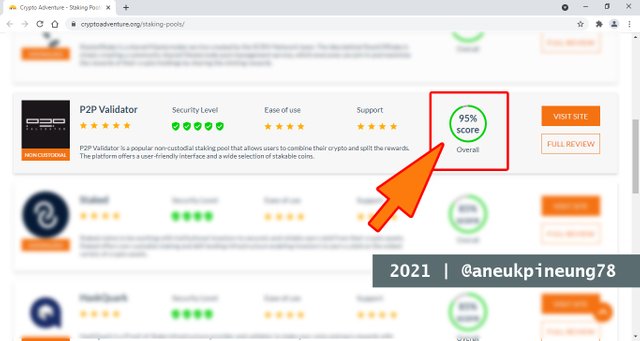

In https://cryptoadventure.org/, P2P Validator earn a score of 95%.

1.2) MyContainer

MyContainer is an online automatic staking and masternode platform which offers simple solution for staking. A user just need to pick a favourite cryptocurrency asset to stake, transfer it to the staking wallet on MyContainer, and earn profit. It generates profit in the form of stakes. Users are allowed to choose and stake their PoS coins and get reward from doing so from multiple assets at once. And in the long run.

MyContainer facilitates users to buy cryptocurrency with fiat currency. It is one possitive thing amongs another.

So far, MyCointainer supports 136 different assets as seen on https://www.mycointainer.com/assets, including:

| No | Coin Name (Symbol) | APR | No | Coin Name (Symbol) | APR |

|---|---|---|---|---|---|

| 1 | Dash (DASH) | 5.5% | 2 | PivX (PIVX) | 8.9% |

| 3 | Kusama (KSM) | 11.6% | 4 | Polkadot (DOT) | 3.9% |

| 5 | Cosmos (ATOM) | 8.1% | 6 | Cardano (ADA) | 4.8% |

| 7 | Tezos (XTZ) | 6.2% | 8 | IRISnet (IRIS) | 9.4% |

| 9 | Polygon (MATIC) | 11.9% | 10 | TRON (TRX) | 3.53% |

| 11 | EOS | 4.7% | 12 | Bitcoin (BTC) | NA |

| 13 | Ripple (XRP) | NA | 14 | Doge (DOGE) | NA |

| 15 | Ethereum (ETH) | NA | 16 | Litecoin (LTC) | NA |

| 17 | Kava (KAVA) | 9.1% | 18 | Near (NEAR) | 10.8% |

| 19 | NuCypher (NU) | NA | 20 | Chainlink (LINK) | NA |

MyContainer also support fiat currencies. For now, 6 fiat currencies are supperted: US Dollar (USD), Pound Sterling (GBP), Euro (EUR), Polish Zloty (PLN), Norwegian Krone (NOK), and Swiss Franc (CHF).

Earning reward on MyContainer is easy. A user, after signing up and logging in, need to deposit a crypto coin to the staking address provided by MyContainer. After the deposit succesfully made, the staking will begin automatically. The future rewards will be credited and added to user’s balance, since the investment is running automatically.

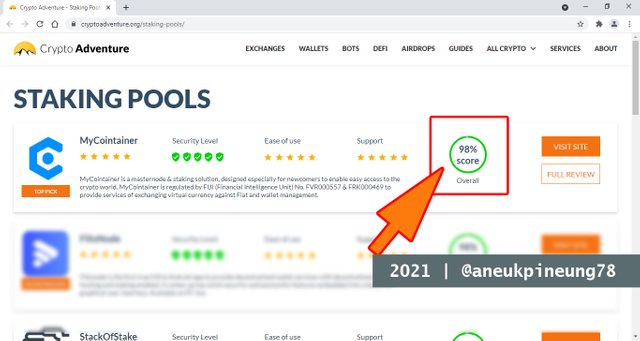

MyContainer earned a 98% overall score on https://cryptoadventure.org/.

Comparison Between P2P Validator and MyContainer

| No | Aspect | P2P Validator | MyContainer |

|---|---|---|---|

| 1 | User-friendly | Yes | Yes |

| 2 | Support Fiat | No | Yes |

| 3 | No of Currently Supported Assets | 20 | 136 |

| 4 | Wallet Management | Yes | Yes |

| 5 | Exchange | No | Yes |

According to the comparison table above, MyContainer is a better option of the two. But when the idea of “more provitable” is about the APR, then it will depend on the coin to stake and the fee it requires. I myself will choose MyContainer since it’s also act as an exchange and support more cryptocurrency assets.

2.) What is Impermanent Loss?

The term Impermanent Loss refers to a condition when the value of the coins we have has decreased in price compared to the price of the coin when we bought it. For example, I bought TRON at a price of IDR1000.- per TRON, then the TRON price dropped to IDR700 per TRON, meaning that I experienced a 30% impermanent loss.

As long as I hold and do not sell the coin, all the losses I experience are called impermanent, because in the future the price of the TRON coin might increase to IDR1200.- per TRON which means I will have the change to make a 20% profit at that time.

Impermanent Loss occurs not only because of the fall in coin prices, but can also be caused by other things, namely by paying transaction fees. For example, I bought BTT for IDR200,000.-, and I had to pay a transaction fee of 0.1%, so this is also an impermanent loss.

3.) What is Delegated Proof of Stake (DPoS)?

Delegated Proof of Stake or DpoS is a consensus algorithm derived from Proof of Stake (PoS) consensus development. DPoS utilizes a voting system. The inventor of this method is Dan Larimer, a blockchain developer and entrepreneur. He is the founder of BitShares, EOS and Steemit. Delegate Proof of Stake utilizes a democratic voting system.

DPoS was created as an alternative to traditional PoS with many new features. The DPoS protocol has all the features of traditional PoS which means:

- it is also energy efficient and cost effective,

- and is faster than previous algorithm (Proff of Work / PoW).

However, DPoS is an improved version in the way:

- it addresses a vulnerability that would allow anyone with enough money to take over the network.

- DPoS has a better reward system than PoS.

- DpoS is intended to bring higher scalability than previous algorithms.

The first cryptocurrency based on DPoS was BitShares. Some of the famous crypto coins that are based on DPoS are EOS and BitShares.

In the PoS algorithm, block validators are selected pseudo-randomly according to the coins held by the user. However, in DPoS, there is a proper voting system to select witnesses and then the top witnesses are rewarded to verify the block. The verification system used in DPoS is much faster and scalable because fewer people manage the blocks.

Another advantage of the DPoS protocol is that it can propose changes to the blockchain with user consent.

While DPoS has many more benefits than the PoS protocol, it also has vulnerabilities, like it increased centralization as a downside. Both protocols have their respective advantages and disadvantages and it really depends on the needs of the users which one is better for them.

4.) Conclusion

4.a) Staking

Staking is one way to enjoy the benefits of digital money that we have. There are many platforms that can be used to stake cryptos and enjoy rewards. But in deciding a staking platform to choose, a potential user needs first do some research on it. Some things to consider are:

- Number and types of supported assets. The more assets that are supported, the more choices the user will have. And of course the most important thing is to support the cryptocurrency of his choice.

- Interest rate offered (Annual Percentage Rate / APR).

- Fees.

- Security.

- Ease of use.

- Technical support.

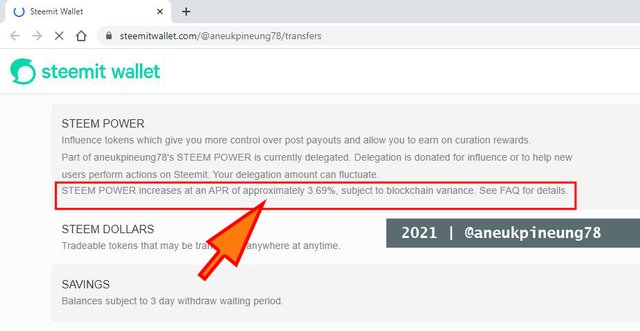

On the Steemit platform, users stake by converting their STEEM coins into Steem Power. Currently, the interest rate (APR) for Steem Power is 3.69% per annum.

4.b) Impermanent Loss

Impermanent Loss occurs due to the falling of coin prices and / or due to payment of fees when making transactions. It is “impermanent” as long as the owner of the coin still hold it and do not sell it as long as they still are experiencing this loss.

4.c) DPoS

Coming as the a development of PoS, DPoS has simplified some things that were previously a little bit more complicated in the PoS algorithm, so that reaching consensus becomes easier because of it’s nature of democratic which was gained from stakes delegation system. A fewer amount of people are are given the authority to represent many others to reach consensus, so this cuts a lot of time in the process of reaching it.

Thanks

Thanks Professor @imagen for the lesson titled Staking.

Pictures Sourcing

- The editorial picture was created by me.

- All another pictures were screenshoots and were edited with Photoshop CS 3.

Sources and Reading Suggestion

- https://blog.pluang.com/cerdascuan/crypto-staking-adalah/;

- https://trustwallet.com/staking/;

- https://www.binance.com/en/defi-staking;

- https://coinmarketcap.com/alexandria/article/crypto-staking-guide-2021;

- https://finance.detik.com/fintech/d-5570967/bukan-babi-ngepet-ini-tips-dapat-cuan-dari-rumah-aja;

- https://zipmex.com/id/learn/apa-itu-staking-dan-bagaimana-staking-bisa-menghasilkan-passive-income/;

- https://cryptoadventure.org/beginners-guide-to-staking-and-masternode-platforms/;

- https://cryptoadventure.org/staking-pools/

- https://defiprime.com/product/p2p-validator;

- https://www.stakingrewards.com/savings/p2p-validator;

- https://cryptoadventure.org/p2p-validator-a-popular-crypto-staking-pool-for-passive-income/;

- https://blog.liquid.com/impermanent-loss;

- https://academy.binance.com/en/articles/impermanent-loss-explained;

- https://coinmarketcap.com/alexandria/glossary/impermanent-loss;

- https://blog.bancor.network/beginners-guide-to-getting-rekt-by-impermanent-loss-7c9510cb2f22;

- https://indo.mt5.com/showthread.php?p=8294296&page=2;

- https://www.etoro.com/news-and-analysis/market-insights/dpos-vs-pos-winner-takes-all/;

- https://bitocto.com/octopedia/konsep-proof-of-stake-proof-of-work/;

- https://dailysocial.id/post/apakah-proof-of-stake-akan-menggantikan-proof-of-work;

Shared to Twitter : https://twitter.com/aneukpineung78a/status/1410922352985219072

Hi @aneukpineung78. Thank you for participating in Steemit Crypto Academy Season 3.

I congratulate you, you did a great job and you show a wide mastery of the topics requested in the assignment.

I look forward to continue correcting your next assignments.

Grade: 10.0

Thanks, Prof.

Your Welcome