Crypto Academy Week 7 Homework Post for [@stream4u]

Hello Sir @stream4u Today I am writing your lecture Homework task for week7.

Discussed Money Management.

Money management is about how you manage every aspect of your paycheck, from calculating each paycheck to setting long-term goals and choosing the investments that will help you reach those goals. Money management should not only say "no" to buyers but also create a plan that helps you say "yes" to the things that matter most. If you don't have the skills to manage your money well, this can be a little cumbersome.

Future plan on how to manage your money.

The personal financial plan should first set some goals, including all savings and investments. In contrast, you need to consider both short-term and long-term financial goals and various standards related to financial risk management. The activities of personal financial management include generating income, expenses, savings, investment and protection.

Income refers to the flow of cash / money that an individual earns and uses to meet his and his family's needs. Individuals can use it to spend, save, or invest, making it the first step in your personal financial roadmap. Expenses are all types of payments that individuals make to purchase goods and services, or any expenditures that are not in the form of an investment. Expenses can be classified in two main ways: cash and credit (i.e. payment by borrowing money). Disciplined consumption habits are essential to proper personal financial management. Any income that exceeds expenses is called savings. However, excessive saving is sometimes considered unfavorable because it has almost no return compared to an investment.

Investing refers to the expectation of a reasonable rate of return when purchasing an asset and getting more funds out of the initial investment. However, investing brings risks, and some assets may eventually lose money, so the risk and return must be considered at the same time before making a decision. Protection includes funds intended to prevent accidents. Before making any decision, a detailed analysis is required to assess an individual's insurance needs.

As the saying goes: "Failure of a plan is a failure of a plan." It is imperative that you start financial planning as soon as possible to provide yourself and your family with a secure future. Therefore, it is essential to manage personal financial requirements at an early stage. Because you have more time to invest in long-term insurance policies. Compared to later stages, adopting the same strategy in the early stage may yield higher returns. Start small, but start early, slowly increase your savings and build a cohort that you may like in your post-retirement life.

Budgeting is an important part of personal finance. The budget helps in assessing the financial position which in turn helps in assessing the financial position. It is recommended to keep the 50-25-25 method, i.e. to allocate 50% of income (after taxes) to necessities, 25% of income to cover lifestyle expenses, and the last 25% of income for the future, and that is, save both in case you need it. An easy, worry-free retirement life and the need to deal with emergencies. Planning for emergency financing is just as important. Funds should be kept at more than 25% of normal savings to recommended wages.

It is always recommended not to overuse of credit. Using plastic cash as a preferred alternative to paying for expenses can have dire consequences. Credit must be managed effectively; The balance must be paid before the due date and ideally, the austerity (if any) should be kept within 25% of the credit limit. Poor credit scores are a tool that can undermine credibility and are constantly changing when the necessary financing needs arise. Therefore, it is imperative to formulate performance-based risk-free strategies to maximize retirement savings and redistribute savings.

In line with the above, people should maintain an appropriate balance between savings and investment, while at the same time allocating the most appropriate amount of funds to protect individuals and families. In order to create a diversified investment portfolio, people need to allocate their money to different types of assets. Various combinations including growth and defensive assets will ensure good returns while significantly reducing risk.

Discussed Portfolio Management, if you have an investment and if it is okay with you then show portfolio and explore it briefly.

Project portfolio management depends on the organization’s strategic goals and delivery capabilities to select, prioritize and control the organization’s plans and projects.

The goal is to strike a balance between realizing the transformation plan and resuming daily business while increasing the return on investment.

Future plan on your Portfolio Management.

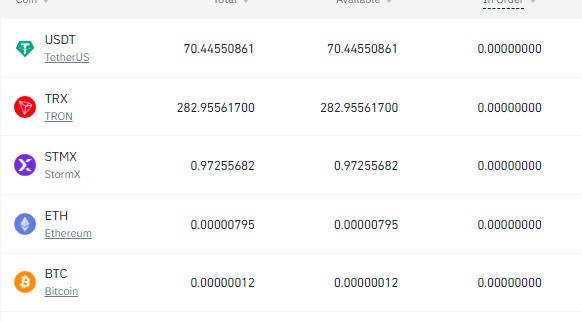

I plan to invest in USDT because it is already mature in the market. But considering the volatility of prices, I will diversify my portfolio by making small investments in 4 to 5 cryptocurrencies. The other coins I want to target are on my watch list.

When was the last investment failed and Why? (those who have experienced this can provide views.)

As far as I remember that I have been making exchanges in cryptocurrency since 2017, but if any of my transactions have not yet failed, I have no idea, nor do I have any experience.

Conclusion

Investing in cryptocurrencies is a very risky investment. You must have sufficient knowledge of fund management and portfolio management to improve your risk prevention ability. When buying or selling cryptocurrencies, it is necessary to pay attention to technical analysis. If we decide based on technical analysis, our profits will increase and our losses even more.

Hi @amjadsharif

Thank you for joining Steemit Crypto Academy and participated in the Homework Task 7.

Your Homework task 7 verification has been done by @Stream4u, hope you have enjoyed and learned something new in the 7th course.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

Thank you for your feedback.