HERBALIFE: the biggest ongoing fraud?

THE COMPANY

Herbalife is a nutrition company, present in over 90 countries, which aims to help “people pursue healthy, active lives”. The company was founded in 1980 by Mark Hughes, who began by selling weight management products from the trunk of his car. His vision was to change the nutritional habits of the world, for the better. In 1986, Herbalife had its first IPO on the NASDAQ exchange market. Only ten years later, the company reached 1 billion USD in annual sales. In 2002, J.H. Whitney & Company and Golden Gate Capital acquired Herbalife for 685 million USD and the following year Michael O. Johnson became its new CEO. When he stepped in, the company was in trouble for allegations on the part of the Canadian government and its financial performance was declining.

Johnson, previously employed at Walt Disney Company for 17 years, represented the perfect embodiment of Herbalife’s vision: athletic, bold, and arrogant. As a CEO, he had a huge impact on the company, by shifting its focus from weight-loss to encompassing nutrition and fitness too. Johnson also brought product manufacturing in-house, set up quality controls, and expanded the product offerings. Thanks to him, the “Herbalife fever” begun. Johnson recruited famous athletes, like Cristiano Ronaldo, as spokespersons, sponsored events such as the Special Olympics World Games and introduced the annual President Summit, the Herbalife Honor event and the Herbalife Extravaganza, a massive celebration which, in 2015, took place across 17 countries and was attended by 158,000 members. Johnson stepped down as CEO in June 2017, replaced by his longtime lieutenant Richard P. Goudis, but he is still part of the company as an executive chairman.

Herbalife manufactures and sells products ranging from protein shakes, protein snacks, nutrition and fitness supplements, to personal care products. In a report by the German Society for Nutrition (GSN), it can be read that “Herbalife cannot be the only measure to reduce weight in the long term because users do not learn to have a balanced diet by using these products. There is a lack of a permanent change in dietary habits towards a full-fledged diet. In addition, sufficient movement is also essential for weight reduction.” Moreover, the GSN saw the marketing offer of Herbalife, in which the customer has to invest around 146€ for a 4-weeks program, as “critical”. They concluded by saying, “The diet products are marketed on a per-commission basis by consultants who often lack the training of a qualified nutritionist.”. Furthermore, Herbalife’s products used to contain ephedrine, which acts as a nasal decongestant and can increase the heart rate. The ephedrine was banned by the FDA in 2004; however, Herbalife had already eliminated the substance in 2002.

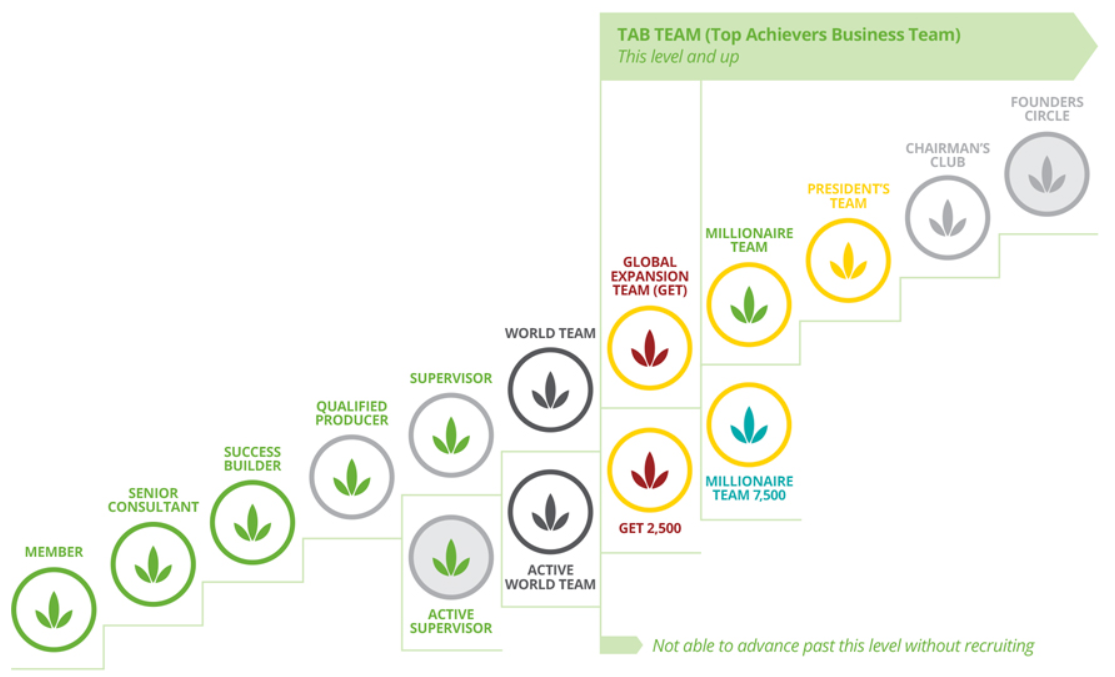

Hughes structured Herbalife according to a multi-level marketing (MLM) model. This means that Herbalife’s products are available exclusively through independent distributors, who are paid based on the volume of their sales but they also earn additional commissions from sales performed by their “downline”, constituted of other distributors that they recruited, the recruits of their recruits, and so on. Therefore, in an MLM model, vendors are incentivized not only in finding retail customers but also in signing up additional distributors. The more layers a member has below him/herself the upper he is in the ranking and the greater the earnings, as exemplified in the figure below.

However, it has been calculated that, while only about the 0.12% of members make above 148,000 USD a year, the 86% of distributors earn nothing from the company. In other words, the top 1% of Herbalife distributors receive nearly 90% of the total rewards. Herbalife recognizes these statistics as correct but justifies them by stating that many “distributors join simply to receive a discount on Herbalife products”, and are therefore not interested in selling them for personal profit. Furthermore, it should be noticed that at the bottom of the pyramid there is a continuous turnover of members who leave the company after seeing that its business opportunity is completely unprofitable and are immediately replaced by new investors: 90% of Herbalife distributors drop out in the first year.

THE BILLION BET

Herbalife has been accused multiple times of being a fraudulent company. However, the major scandal broke out in 2012, when Bill Ackman, the manager of the Pershing Square Capital fund, disclosed a 1 billion USD short position against the company, betting its share price would eventually fall to zero. Ackman’s move was based on the fact that he believed Herbalife to be an illegal pyramid scheme and that its stocks were, as a consequence, destined to plummet.

In response, Johnson claimed that Ackman’s allegations were “a malicious attack on Herbalife’s business model based largely on outdated, distorted and inaccurate information.” Herbalife’s CEO added that “Herbalife operates with the highest ethical and quality standards, and our management and our board are constantly reviewing our business practices and products. Herbalife also hires independent, outside experts to ensure our operations are in full compliance with laws and regulations.”. In conclusion, “Herbalife is not an illegal pyramid scheme.”.

Carl Icahn, hedge fund manager, founder, and primary shareholder of the Icahn Enterprises, with a net worth of 16.6 billion USD, took Herbalife’s side too. Several weeks after Ackman revealed his short position, Icahn bought a 13% stake in Herbalife, causing a price rally. It’s not clear if Icahn move was motivated by a real faith in the company or by the desire to see Ackman squeezed. In fact, the animosity between the two, caused by an old dispute ended in court in favour of Ackman, was well known in the Wall Street environment. In this respect, Icahn insisted, “This is not an ad hominem thing. It is really not a personal thing. The fact that I don’t like Ackman you could say is the strawberry on top of the ice cream.”.

In the following years, Ackman became increasingly obsessed with Herbalife. He called out the government to investigate the company and lobbied with Washington. Ackman also called numerous press conferences and he showed presentations of hundreds of slides. However, the stock price never appeared to plummet. He obtained his first victory only a year later, in 2014, when Herbalife received a civil investigative demand from the FDC, which caused the stock price to fall by the 8%. Just the previous day, Icahn had purchased another 26.3 million USD shares of the company.

The results of the investigation came out in July 2016, when Herbalife was accused by the FTC of deceiving the buyers and sellers of its products into the belief they could make good money out of their investment, while for the large majority of them the returns were zero or even negative. Herbalife was sentenced to pay back 200 million USD to consumers, hire an outside monitor, and substantially restructuring its business practice, especially concerning the bottom level of the pyramid.

However, the FTC didn’t make any move towards shutting down the company for fraud and didn’t confirm Ackman allegations of Herbalife being a pyramid scheme. As a consequence, the settlement was seen by Wall Street as positive and Herbalife’s share price actually increased. CEO Michael O. Johnson Tweeted on the agreement: “The FTC settlement is an acknowledgement that our business model is sound and underscores our confidence in our ability to move forward successfully, otherwise we would not have agreed to these terms.”. In the aftermath of the disclosures by the FTC, Ackman publicly stated that Icahn was trying to sell his shares. In response, the Herbalife investor shelled out a further 19.1 million USD reaching a 24.6% stake.

On, October the 7th 2017, Herbalife bought back 600 million outstanding shares for a total of 458 million USD. The action caused an increase in share price of the 11.2%. Icahn gained roughly 218 million USD and his stake went up to 2% as a consequence of the fewer share outstanding. On the other hand, the buyback meant for Ackman a recorded single-day paper loss of 145 million USD and increased interest rates for the future. It can be said that, so far, Ackman has been proven wrong by Wall Street. However, on October the 4th, Ackman made a statement in which he confirmed he is still confident he’ll win this war. “Short-selling is risky,” he said, “And Carl Icahn taking the opposite bet on the stock was not part of my list of potential negative events.”.

A PYRAMID SCHEME

The difference between a multi-level marketing strategy and a pyramid scheme is that the former focuses on rewarding sales of products to customers, while latter mainly rewards the recruitment of new distributors. The US law requires that compensation schemes shall not be based on recruitment that is divorced from sales. The FTC indicates pyramid schemes as illegal because “they must eventually collapse” and they “make money for those at the top of the pyramid, but must disappoint those at the bottom who can find no recruits”.

But is Herbalife a pyramid scheme? The company has two separate missions: their goal is to change people lives by providing “the best nutrition and weight-management products in the world” and also “the best business opportunity in direct selling”. But to demonstrate that Herbalife is acting fraudulently it must be proved that (1) its distributors obtain monetary benefits primarily from recruitment rather than sales of goods and (2) that Herbalife purposefully conceals the fact that its recruiting rewards are much higher than its retail profit.

First of all, the company showed a remarkable growth since its foundation, with products that sell much better than those of competitors. However, these extra sales cannot be attributed to price (Herbalife’s products are on average more expensive) neither to a lack of potential substitutes. Also, Herbalife does not dedicate more resources in advertisement and it tends to promote brand awareness with the purpose of recruiting vendors more than particular products. In conclusion, it appears that the reason behind Herbalife’s extraordinary volume of sales is that the company bundles its products with a business opportunity. The fact that Herbalife refuses to track the number of products sold to external customers also leads in this direction.

Furthermore, the retail profit varies depending on the ultimate sale price that the distributor achieves for the product, while the royalty overrides paid by Herbalife are fixed. On average, Herbalife products are sold at a discount between 34% and 40% from the suggested retail price adjusted for fees. Herbalife claims that many of its members make zero profit because they are only interested in buying the products for personal use at a discount. However, the question arises of why should people pay a 55 USD subscription to get a 25% discount on Herbalife products, while the same products are widely available with a greater discount and no fee? In conclusion, it is likely that those individuals indicated by Herbalife as “internal buyers” are nothing more than failed distributors.

These two arguments together substantiate the allegations made by Ackman against Herbalife. In fact, it appears that the selling of the product is unprofitable for the distributors, who actually invest more money that the amount they can collect from external buyers. As a consequence, the way distributors do make money is by recruiting other distributors. Even though recruiting is not paid in itself, premiums are paid for any amount of Herbalife’s products purchased by a distributor’s downline. Since to become a new distributor an individual has to acquire a certain amount of inventory, a part of this money goes to the recruiter. Given the facts illustrated above and Herbalife’s opaqueness when it comes to disclose the amount of external sales, it is likely that they are indeed concealing the fact that their products just do not sell.

Resteemed your article. This article was resteemed because you are part of the New Steemians project. You can learn more about it here: https://steemit.com/introduceyourself/@gaman/new-steemians-project-launch

Congratulations @perpetualroot! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!