Crude Price

Crude and energy sources in all forms form a basis for geopolitics. Energy is not the only thing to guide geopolitics but I am focussing on it as I often track crude prices for divergent reasons- my own trading for example. As you would have guessed it, geopolitics and crude price are closely related.

Crude Price movement:

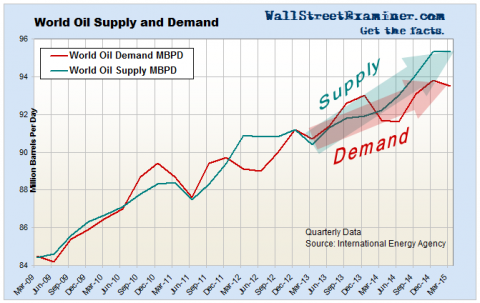

Why crude prices are falling at the moment? Crude prices have been falling for more than a year. Is it happening due to lower demand? Higher supply? Or both? The following graph makes it clear.

Crude: Demand vs Supply

Chart source: Wall Street Examiner by Lee Adler

Obviously, demand has fallen where as supply has kept up its pace and increased a bit despite several supply disruption coming from Nigerian terrorists, Canada forest fire and so on. The reason behind uninterrupted supply is crude extraction by fracking in USA. Fracking started when crude price was above USD 100 per barrel. So, to kill Fracking is getting cheaper and efficient by every day. Increased supply from fracking led to downfall in crude prices. Before fracking days, OPEC would lower production to maintain the price. But this time, OPEC, under leadership of Saudi Arabia, played smart. SA increased its production to keep market share intact or increase. Second motivation was to kill fracking business which was not viable below $70 per barrel, at some time in past.

However, fracking technology has kept evolving and has become ever more efficient. Fracking has become viable now around a price of $50 per barrel. As for double whammy to S. Arabia, sanctions on Iran was lifted in the meantime and Iran is also trying to get its production level to pre-sanction times.

Now, lets consider Syria problem. USA and its allies want to oust Assad. But Russia doesnt want interventionist method to change a regime, at least in its neighbourhood. Iran and China has joined Russia. Turkey's behaviour doesn't seem to be predictable, but likely to be assuaged by USA sooner or later. Iranian economy has been under distress and it also wants to help Assad of Syria. So, Iran is bound to keep its production increasing. Don't get fooled by OPEC bluffs and Russia proposal to OPEC to lower crude production.

Syria Again:

USA strategy to oust Assad has got stuck after Russia, Iran , China has joined hands to support Assad. At the moment, it seems USA has failed badly in handling Middle East affairs. So badly that its nearing a loss of dominance in ME. S.Arabia feels cheated with US Nuclear deal with Iran. Iran is yet to show an act of reciprocation towards USA. Now, USA has no other option but to evolve a new strategy to keep its dominance in Middle East alive. If USA can not find an effective strategy to outwit Russian coalition, crude oil may get priced in Euro or SDR (issued by IMF) as opposed to current pricing in USD. When that happens, there will certainly be lot of volatility in crude prices. Crude pricing in a different currency is not a matter of only currency, but also a show of power.

Beyond Syria: Electric cars

In the face of upcoming innovative electric cars, which are not going to be main stream driving option pretty soon, importance of crude continues to be there albeit with decreasing influence on energy markets and with a new rebalance in geopolitical power equations.

These equations are two tiered. Set of equations in one tier involve variables like technology, infrastructure and inputs of productions. Second tier involves variables like cultures, associations, military, history and politics- basically the old school geopolitics.

Saudi Arabia and other middle east countries have realised that arrival of electric car is for real . These countries have started investing in diversification of their economies in a big way. They never acted like this before. They never thought about selling stake in Saudi Aramaco. Now proceeds from Saudi Aramaco will be channelled to different sector of economy or reinvested , is remains to be seen. Smartness of the move is to raise the money for an asset that is still valued by investors, before it all collapses.

War and conflicts are other factors to consider while trying to predict crude price movement. All is not well with major powers to be. So far, as on date, Czech and German government has put its citizen on alert to stock essential goods and foods for about ten days. This has something to do with ISIS perhaps. We do not know for sure.

To , sum it up, crude price movement will be guided by technological developments- fracking , electric cars; conflicts and geopolitics. As for now , its price is expected to be range bound near current price levels. In my opinion, if everything remains as it is today, the upper price range is capped by minimum viable price for fracking. This minimum viable price keeps changing. Keep an eye on it!

PS: I am not Lee Adler and I have not taken prior permission from him to post link to his web site or a link to one chart image. But I will certainly inform him of this blog and I am sure he would not mind it. His twitter handle is @Lee_Adler

The Chinese economy is slowing and that is hurting demand a lot. And of course Europe's problems means that demand there is suppressed too.

There is a supply surge too. US fracking has contributed significantly to the surge. If it was only a demand problem, OPEC would have reduce production level. Instead OPEC leader Saudi A. has increased crude production. Why? That is discussed in the blog.

how low can it go

It depends on lot of factors. Low 20s is a low level support price. Below that no body is going to extract crude for long term

Congratulations @ingwald! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

For more information about this award, click here

Congratulations @ingwald! You have received a personal award!

Click on the badge to view your Board of Honor.

Congratulations @ingwald! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!