The USD is like a fence that keeps debt-slaves inside a labor camp: It "must" not collapse

Ever since the dollar became unconnected to Gold and Silver, a complex debt-slavery scheme, that involves both countries and citizens alike, was put into motion.

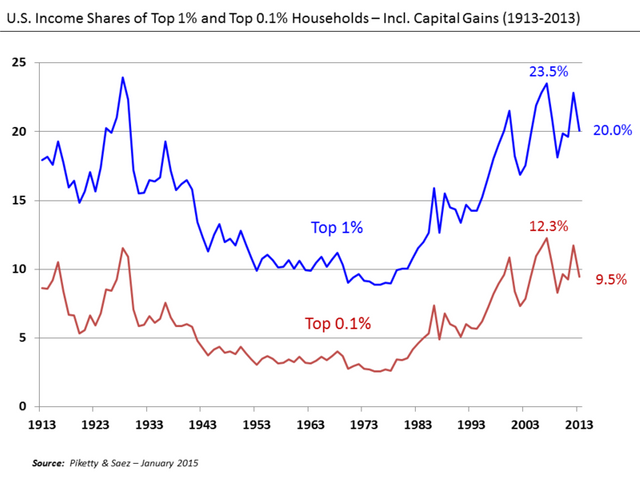

It is no co-incidence that in the post-Bretton Woods era, we've seen a huge wealth redistribution in favor of the top 0.1 and 1%, while the middle-class is being downsized and the lower class is increasingly dependent on welfare.

In the same time most people have not only seen a reduction in their wealth, but also accumulated a lot of debt - which is practically unserviceable.

The same is true for a lot of countries as well. It has to be understood that these debts are the quintessence of control.

No debt, no control.

No global debt, no global control.

And what is global debt denominated on? USD.

If the USD is allowed to collapse, all the planning and strategies of how to enslave the world, go down the drain.

If, say, the USD goes down 20 times and the Gold/USD ratio goes up 20x, and suddenly 1 ounce of gold cost 30.000$, then you only need a couple of gold coins or a small gold chain to repay a student loan, a car loan or even a mortgage.

Actually, by that point, your car or house will have a real life valuation that is 20 times the price of the loan. It will be the reverse of 2008, with plenty of fiat needing to get dumped (to protect investors from devaluation), pumping asset prices.

On top of that, if, say, the USD goes down 90% compared to other currencies, that's an external debt reduction (effective debt haircut) of third countries by 90% that owe to IMF or other countries.

Obviously, the Elite can't allow this to happen: The dollar is like a labor camp wall. The wall cannot be allowed to collapse, lest the prisoners escape.

If what we owe gets to be valued next to nothing -due to a dollar collapse- then we get an effective haircut of immense proportions and thus can easily repay what we owe - provided we have a few assets (most people and countries do). This automatically makes this scenario quite improbable to manifest because it cuts the strings of debt-control.

That doesn't mean however that the dollar will become any stronger. It's just that its devaluation will be in a manageable glide-path, coordinated with similar devaluation of other major currencies, all the while trying to suppress the rise of alternative-money like gold, silver and cryptocurrencies (with varying degrees of success).

Things might change dramatically if we have some kind of black-swan event (real or manufactured) that will be used as a catalyst for the adoption of some new global currency - but at that point the discussion about any national currency (including the dollar) will be much less relevant.

Dumping fiat money as a political act

Regardless of whether the USD will collapse or not, the dumping of fiat money will always be a simple, yet practical political act. Personally, I disagree entirely with the existence of debt-based fiat money that creates enslavement and as such my personal preference is to dump it at first sight.

At the same time I understand that most people in cryptocurrency (or Gold/Silver) are in it for their own non-political reasons: They just want to make more fiat money and they use the above "investments" as a "tool" to multiply their fiat. I don't have a problem with that, but one has to understand that this does not offer any practical solution to the debt-enslavement problem: It only fuels more of the same problem.

Synchronized fiat-dumping would devalue fiat (USD or otherwise) allowing for a practical way to reduce the levels of debt-slavery. We've seen how a simple campaign like what Max Keiser did a few years ago ("buy silver, crash JP Morgan") led to an explosion in the price of something tangible, like silver.

If "cracks" appear to form in the "image" of the USD as a stable currency, and instead the perception shifts to "USD is losing value fast", this would probably trigger some serious dumping that could reach self-accelerating proportions...

Confidence in the US Dollar can be artificially propped up, and since the media is controlled, it's easy to sell it. Any major event for the U.S. Dollar will probably only lower it's value by 5 cents or 10 cents at the very maximum.

What logically could and should happen, won't happen, because we're not in a logical world anymore. This is by design.

Is it just me, or do others agree? :)

No, it's not just you :D

Very good article - agree! Upvoted.

In my Blog I am trying to explain why we are where we are. May be a good read for you, if interested at all:

https://steemit.com/philosophy/@conspi-theorist/why-global-crisis-is-inevitable-part-2-the-biggest-problem-of-capitalism

1913 was a bad year and Nixon put the final nail in the coffin of sound money. Considering what a collapsing dollar would do to the world economy is indeed scary. Silver and gold is all I can say.

This is timely. Let's wait 40 minutes (FOMC).

https://dtube.video/#!/v/auraculus/i2xomvvc long ago foretold

Indeed it is :)

I often think (daydream?) about this. Not that I want chaos to reign or anything, but things will never "naturally" change in this kind of system, save some event like you described. I'd love to get rid of student debt by flipping them a gold coin and telling them to make a golf course with that.

Also, not to nitpick, but irregardless isn't a word. Someone else will point it out, thought I may as well do it.

Thanks for the article. I'm in a particular mood today and this is in line with what has me in a funk.

That's what they want to avoid really: People trying to escape the labor camp. But there is also the global dimension where entire countries can un-chain themselves by doing something similar (provided the USD is crushed).

Right. So how do you crush the USD when it's already been devalued to damn near nothing? I think the answer may lie in decoupling it from oil. Once that happens, bye bye world reserve status and hello reality.

Trust me, it's not that bad. You'll realize it's bad when you see asset prices multiply (think Venezuela)... As for what will take to take it to the next level, increased use of alternative national currencies in global commodity markets (including but not limited to oil) might do the trick.

Asset prices don't have to multiply for me to realize it's bad now. This is Rome, and it is burning.

Nero was fiddling and Obama is a golfing.

Is there any way to stop it from crashing? It seems like that's the plan and after that, just give everyone digital money tied to their banking system and outlaw all other currencies. Then, if they don't like you, they just turn off your bank account. It's like you won't be able to buy or sell without their "mark". What a Beast! Down with the Beast!

The mark of the beast will be introduced soon, if not already. The RFID chip. The beast will even wipe away all your debts n give you credit just to accept it. Cheers.

That's why we need electronic currency from the people, for the people (cryptocurrencies) which will allow people to circumvent the beast with exo-banking / uncontrolled transacting.

Yes, the infamous inflate away the debt. The U.S. has essentially tried this but, uhm..not working. Wages have barley moved and CPI is bumping along. The only thing that Fed policies have done is inflate the equity markets and aid the increase in home prices.

Inflating out of debt has been a failed policy by so many countries. Brazil was the only one to really pull it of in the late 80s-early 90s. by causing hyperinflation with the mass creation of currency. It was an ugly time for them, but it sort of worked. Sadly they are right back in the same place financially.

There is no other viable policy really in the context of the existing system.

From the moment the money is issued as debt it requires X (the money) + interest. So you need more than X. But there is no money supply in the market larger than X, so the debt is unserviceable. Thus you need new debt.

Even if you tax everyone, even if you have zero government spending, you cannot repay the debt by austerity because debt equals money and the money in circulation, deposits, etc, is less than the total amount of debt.

The only trick that would actually work is the reintroduction of gold/silver as a monetary medium. Then have gold/silver rise in value (due to their monetary demand) and this gold/silver bubble will then be able to repay the debts. I can't see any other way out of this, that does not involve a "reset". It's either a reset or a gold remonetization.

Inflating the debt is viable in the short-mid-term, but non-viable in the very long term. Austerity is not viable because it's just drying up liquidity and it can never repay the debt (total money < total debt), plus it shrinks GDP fast (escalating gdp-to-debt ratios, despite debt repayments).

There's another variable to consider here. Governments aren't always the same thing as "elites," however, they are at a minimum highly interconnected.

Governments are the world's largest debtors - the ones who benefit most from a devalued currency. I believe inflation is the most politically expedient path forward. I wrote a related blog post last week that seems to contradict some of what you are saying. I'd like to get your thoughts on it.

World governments (perhaps with the exception of the USA and a few others) have two types of debts. Internal (in national currency) and external (in foreign currency). As far as their internal debt is concerned, they prefer their internal currency to have high value because the alternative (too low a value) will create social friction if the printing gets out of hand. But it is also useful to have a highly valued internal currency because then the rate of external debt to local GDP is smaller. If the national currency collapses, then the external debt, denominated in foreign currency, strangles the local economy.

For the US things are somewhat different because it doesn't need to make these tradeoffs, in a sense...

As for the blog post, I notice this point in particular:

The short answer is that hyperinflation is not the outcome of the above scenario. It's just plain-old "inflation". You'd need to print a massive amount of money on a continuous basis to get that kind of result. I've elaborated on the possibility of hyperinflation in an older post of mine, which is actually a pretty long read, over here: https://steemit.com/hyperinflation/@alexgr/hyperinflation-dollar-collapse-and-precious-metals

Thanks for your reply. In that quote, I was using the term "hyperinflation" in a relatively loose way. Whether it was in that post or the comments, somewhere, I talked about how as inflation gets higher and higher, it becomes less politically expedient because public outcry will grow rapidly. I'll read that post when I have more time later and get back to you.

But we also have big guns and military might backing our currency. Plus, the dollar is a petrocurrency, and it has a high level of intrinsic value that wont diminish overnight. This is good if you're in America, but sucks if you do the same work Americans do but live in Zimbabwe.

I wouldn't go as far as saying petrocurrency status gives the dollar intrinsic value, but it does make it desirable to have for international trades.

Just shared this on Twitter. This is a fantastic post and deserves an up-vote. Following and looking forward to reading more of your posts. I joined STEEMIT a few weeks ago and I have seen a remarkable increase in the quality of posts like this. I recently posted a couple of articles about GOLD and SILVER. You may find them interesting to read. You can also catch us Twitter✔. Cheers. Stephen

Thank you Stephen! I'll take a look right now :)