What is Cryptocurrency: Everything You Need To Know [Ultimate Guide]

What is cryptocurrency: unicorn 21st century-or the money of the future?

This introduction explains the most important thing about the Cryptococcus. After you read it, you will know more about it than most other human beings.

The current emergency crypto has become a global phenomenon that is known to most people. Although still geeky and not understood by most people, the banks, the Government and many companies are aware of the importance of.

In the year 2016, you will have trouble finding the big banks, the big accounting firm, the leading software companies or Governments that do not examine the kriptocurrencies, published a paper on it or start a project called blockchain.

"The virtual currency, perhaps especially Bitcoin, has captured the imagination of some people, creating fear among others, and it puzzled him from all of us." — Thomas Carper, u.s. Senator

However, outside noise and the press release the majority of people-even bankers, consultants, scientists, and developers — have a very limited knowledge about crypto. They often failed to understand the concept of essence.

So let's do the whole story. What is cryptocurrencies

-Where the origin of the species?

-Why should you learn about cryptocurrency?

-And what you need to know about the species?

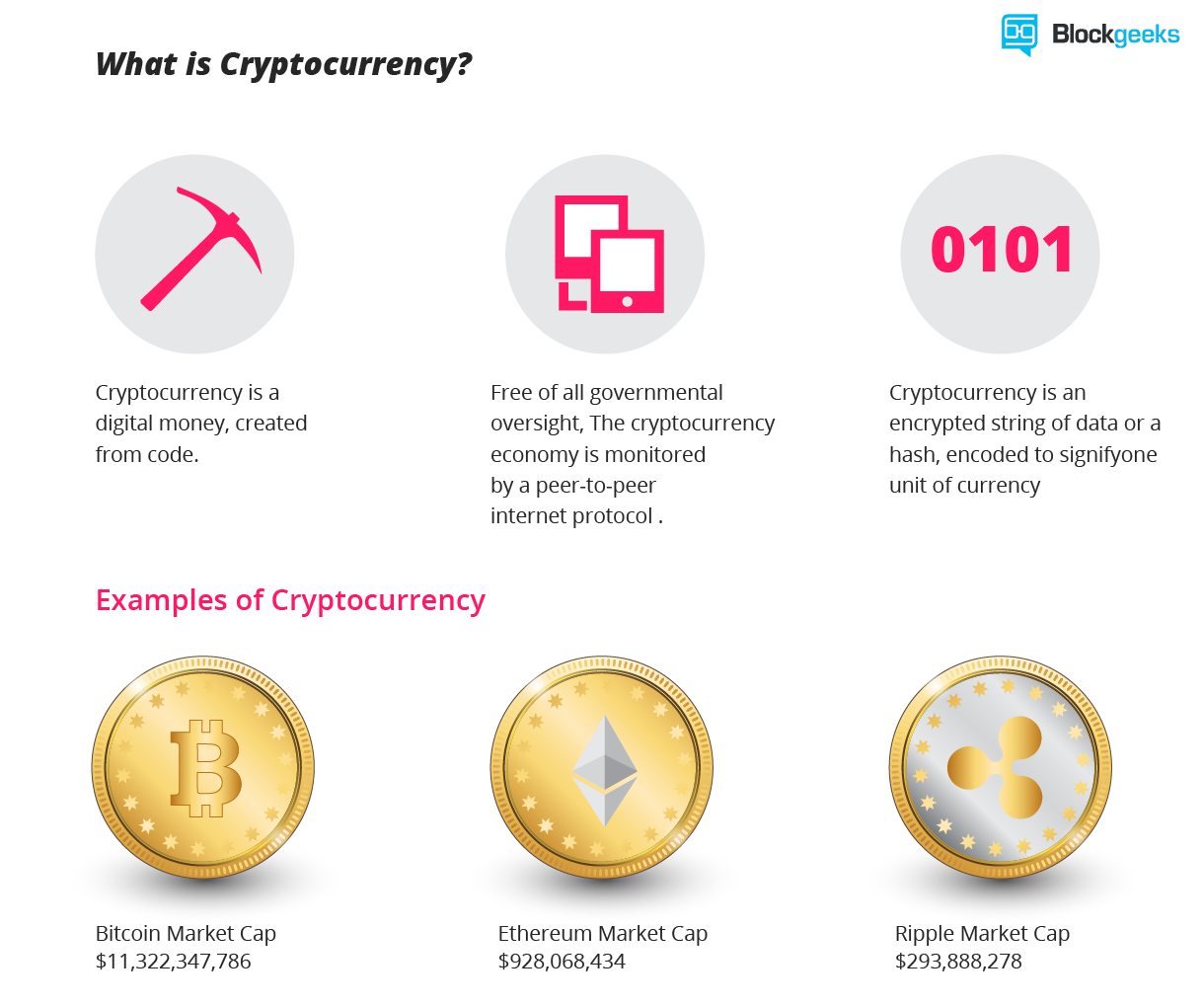

What is cryptocurrency and how cryptocurrencies emerged as a side product of digital cash

Only a few people know, but the species appears as a byproduct of other discoveries. Satoshi Nakamoto, inventor of the Bitcoin unknown, crypto the first and still most important, never intends to create currency.

In an announcement at the end of 2008, Bitcoin Satoshi said he developed "electronic money system for Peer-to-Peer."

The goal is to create something; many people fail to make money before digital.

Announcing the first release of the Bitcoin, a new electronic cash system that uses peer-to-peer networks to prevent spending doubled. This is really didesentralisasi without a server or central authority. -Satoshi Nakamoto, 09 January 2009, announced the Bitcoin on SourceForge.

The most important part of the invention Satoshi is finding ways to build the digital cash system is decentralized. In the nineties, there was a lot of effort to create digital money, but everything failed.

... After more than a decade of party-based system of Trustworthy Reliable (Digicash, etc), they see it as a lost cause. I hope they can make a difference, that this is my first time knowing that we tried a trust-based system. -Satoshi Nakamoto in E-Mail to Dustin Trammell

After seeing all the centralized effort failed, Satoshi tried to build a digital cash system without any central entity. Like Peer-to-Peer networks to share files.

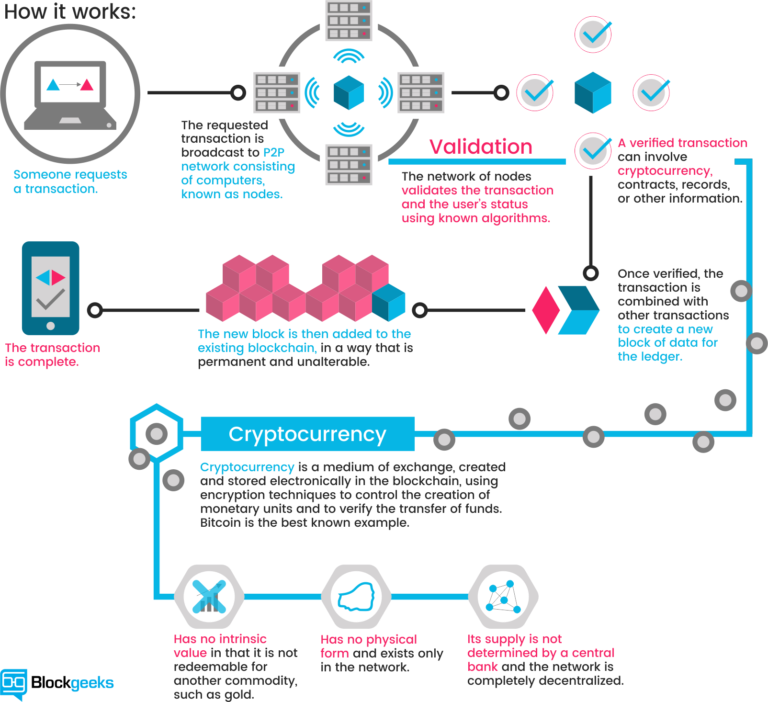

This decision became the birth of cryptocurrency. They are a discovered missing Satoshi to realize digital money. The reason why is rather technical and complex, but if you get it, you will know more about crypto than most people. So, let's try to make it as easy as possible:

To realize the digital money you need with payment network account, balances, and transaction. It is easy to understand. One of the main problems to be solved each payment network is to prevent the so-called double budget: to prevent a single entity spends the same amount twice. Typically, this is done by a central server which keeps a record of the balance.

In a decentralized network, you do not have this server. So you need any network entities to do this work. Each peer in the network needs to have a list with all transactions to check whether the applicable future transaction or an attempt to double the spending.

But how these entities can remain consistent with this entry?

If co-workers disagree networks have only one small balance, everything is broken. They need the absolute consensus. Usually, you take, once again, the central authorities to declare a State of balance. But how can you achieve consensus without central authority?

No one knows until Satoshi appeared out of nowhere. Actually, no one believes it is possible.

Satoshi prove it. Its main innovation is the central authority without reaching a consensus. Cryptocurrencies is part of this solution-part of what makes thrilling, mesmerising solutions and helped her slide to the rest of the world.

What are cryptocurrencies really?

If you remove all the noise around the crypto and reduced it into a simple definition, you will find that the entry is restricted in the database does not exist that could change without fulfilling certain requirements. This might seem okay, but, believe it or not: this is exactly how you can specify the currencies.

Take the money in your bank account: what is more than just an entry in a database which can only be changed under certain conditions? You can even take physical notes and coins: anything other than limited entry in the database of the public physical that can only be changed if You match your condition than you have the coins and notes are physically? Money is all about entry verified in some kind of database accounts, balances, and transaction.

- How the miners created a coin and confirm the transaction

Let's look at the mechanisms that regulate the database kriptocurrencies. Cryptocurrency like the Bitcoin network consists of peer. Each peer to have complete records of all transactions and thus the balance of each account.

The transaction is the file that reads, "Bob gives X Bitcoin to Alice" and is signed by the private key Bob. This public-key cryptography Basic, nothing special at all. Once signed, a deal broadcast on the network, sent from one peer to another peer. This is the basis of p2p-technology. Nothing special at all, again.

The transaction is immediately known by the rest of the network. But only after a number of specified time confirmed.

Confirmation is a critical concept in crypto. You could say that about crypto confirmation.

As long as the transaction has not yet been confirmed, it's been delayed and could be forged. When a transaction is confirmed, it's set in stone. This can no longer be imposed, it cannot be reversed, it is part of the historical transaction records have not changed: from what is called the blockchain.

Only the miners were able to confirm the transaction. This is their task in a network of crypto-currencial. They took the deal, cap them as legit and spread them in the network. After the transaction is confirmed by a miner, each node must add it to its database. This has been a part of blockchain.

For this work, the miners get rewarded with Cryptococcus, e.g. with Bitcoin. Because the activity of the miners was the most important part of crypto-cardiac system, we have to stay awhile and look deeper.

"In the next few years, we will see the national Government took a major step to implement a society without money in which people make transactions using centralized digital currencies. At the same time, the decentralized crypto-that some people even think of it as money is harder — would see an increase in the use of all sectors. "-Caleb Chen London Trust Media

What are miners doing?

In principle every person can become miners. Because of the decentralized network does not have the authority to delegate this task, a crypto-cardiac need some sort of mechanism to prevent one party in power abuse it. Imagine someone creating thousands of colleagues and spread the false transactions. The system will soon burst.

So, Satoshi set rules that miners have to invest some of their computers to qualify for this task. In fact, they have to find the hash-functions of cryptographic products-connecting new blocks with his predecessor. This is called a Proof-of-Work. In the Bitcoin, is based on the algorithm SHA 256 Hash.

You do not need to understand the details about SHA 256. It is important for You to know that it could be the basis of the kriptologis puzzles to be solved the miners. After finding the solution, a miner can build blocks and add them to the blockchain. As an incentive, he has the rights to add a transaction called koininan which gave him a number of Bitcoin. This is the only way to make a valid Bitcoin.

Bitcoin can only be made if the miners a cryptographic puzzle solving. Because of the difficulty of the puzzle increases the amount of computer power invested by all the miners, there were a number of signs of specific species that can be created in a certain amount of time. This is part of a consensus that does not exist on a network that peers could break up.

Revolutionary properties

If you really think about it, a Bitcoin network as a peer, decentralized storing consensus on account and balance, more than the number of currencies is that you see in your bank account. What are these numbers more than just entries in a database-the database that can be changed by people you do not see the rules and regulations you don't recognize?

"This is a narrative of human development in which we now have other fights to fight, and I would say in the realm of Bitcoin that is primarily a separation is money and the State." -Erik Voorhees, entrepreneur kriptocurrency

Basically, cryptocurrencies is an entry about a token in the database of decentralized consensus. They are called CRYPTOcurrencies because the process of consensus-keep secured by strong cryptography. Cryptocurrencies built on Cryptography. They are not guaranteed by the person or by the trust, but with math. It is more likely that an asteroid falls in your home than the address of the bitcoin disturbed.

Describes the properties of the crypto that we need to separate between the transactional property and monetary. While most kriptocurrencies share the same set of properties, they are not carved in stone.

Transactional properties:

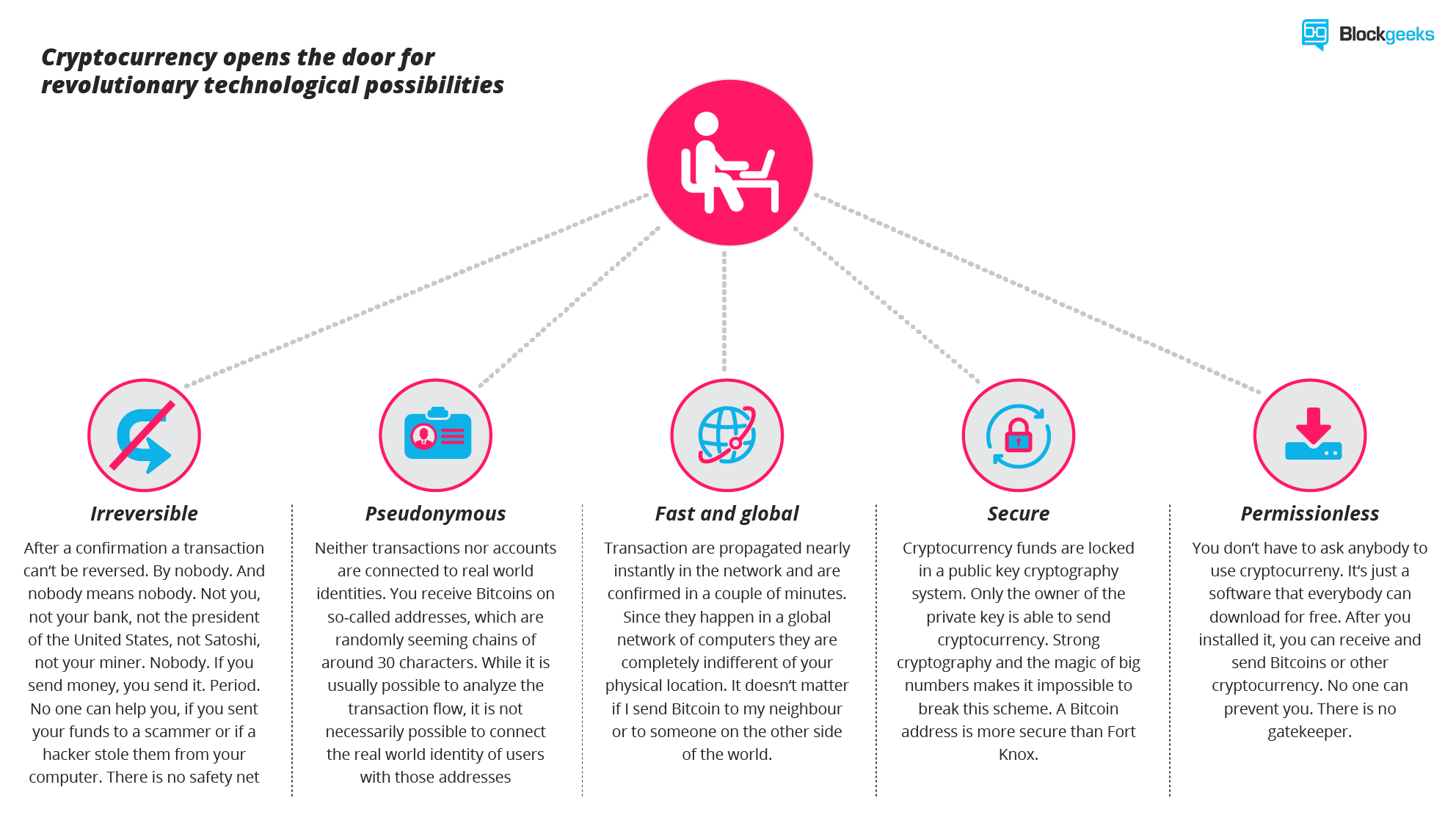

Can not be changed: after confirmation, the transaction cannot be cancelled. No and no means nobody. Not you, not your bank, not President of the United States, instead of Satoshi, not Your miners. No one. If you send money, you send it. Period. No one can help you, if you are sending funds to the scammer or if a hacker steals them from your computer. There is no safety net.

Pseudonym: transactions or account is not linked to the identity of the real world. You accept Bitcoin address called, which randomly appear to have a chain of about 30 characters. Although it is usually possible to analyze the flow of transactions, but not the possible real world identity connects the user with the address.

Fast and global): transactions almost instantly propagated across the network and confirmed within a few minutes. Because they occur in a global computer network, they are not at all concerned with Your physical location. It doesn't matter if I send to my neighbor Bitcoin or to someone on the other side of the world.

safe: kriptocurrency Funds locked in a public key cryptography system. Only the owner of the private key can send kriptocurrency. Strong cryptography and the miracle of large numbers makes it impossible solve this scheme. Bitcoin address even more secure than Fort Knox.

Permissionless: you don't have to ask people to use kriptocurrency. This is just a piece of software that can be downloaded for everyone for free. After you install it, you can receive and send Bitcoin crypto or otherwise. Nothing could mencegahmu. There are no gatekeepers.

Monetary properties:

Supplies controlled: most kriptocurrency limit the supply of the token. In the Bitcoin, reduced inventory in time and will reach the final number somewhere around the year 2140. All crypto token with supply control schedule written in code. This means the monetary supply crypto on any given moment in the future can be roughly calculated today. There are no surprises.

No debt but the carrier: Fiat money in your bank account is created by debt, and the numbers, you see in your great book is not another debt. This is an IOU system. Cryptocurrencies does not represent debt. They just represent themselves. Their money is as hard as gold coins.

To understand the impact of revolutionary crypto you need to consider both of these properties. Bitcoin as payment without permission, cannot be restored and the pseudonym is an attack on the control of the bank and the Government regarding the monetary transactions of its citizens. You can't impede someone for using Bitcoin, you cannot forbid a person to receive a payment, you cannot cancel the transaction.

As money supplies are limited and controlled which cannot be changed by the Government, bank or other central institutions, crypto-cardiac attack the coverage of monetary policy. They took the reins of the central bank are controlling inflation or deflation by manipulating the monetary supply.

"Although it is still fairly new and unstable compared to the gold standard, crypto drive definitely get the attraction and most definitely will have the use of a more normal in the next few years. Currently, in particular, is increasingly popular with post-Christmas market uncertainty of the election. The key will facilitate adoption of large-scale (such as Crypto) include developing protection and protection for buyers/investors. I hope that in two years, we will be in a place where people can get their money under a mattress through the virtual kriptourrency, and they will know to wherever they go, the money will be there. "-Sarah Granger, Author, And Speaker.

Cryptocurrencies: Dawn of a new economy

Mostly due to its revolutionary properties cryptocurrencies have become a success their inventor, Satoshi Nakamoto, didn‘t dare to dream of it. While every other attempt to create a digital cash system didn‘t attract a critical mass of users, Bitcoin had something that provoked enthusiasm and fascination. Sometimes it feels more like religion than technology.

Cryptocurrencies is a digital gold. Sound money safe from political influence. The promised money to preserve and increase its value over time. Cryptocurrencies is also a means of payment is quick and convenient with coverage worldwide, and is personal and anonymous means of payment to be made to the black market and illegal economic activities.

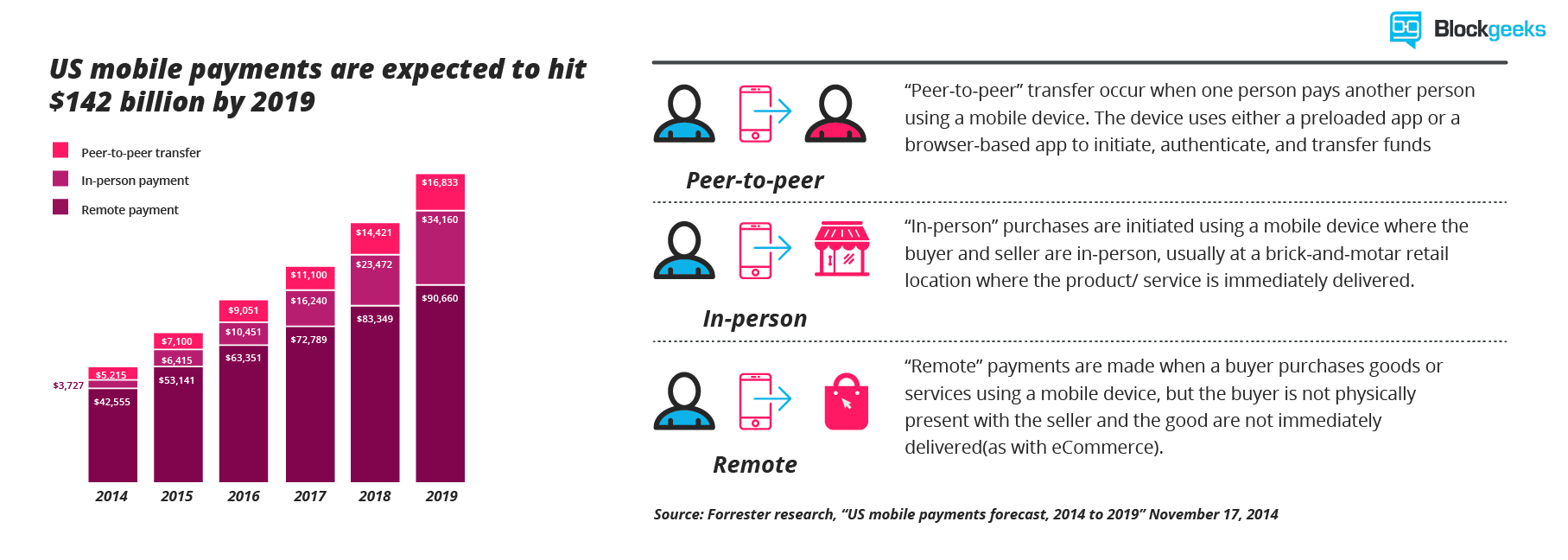

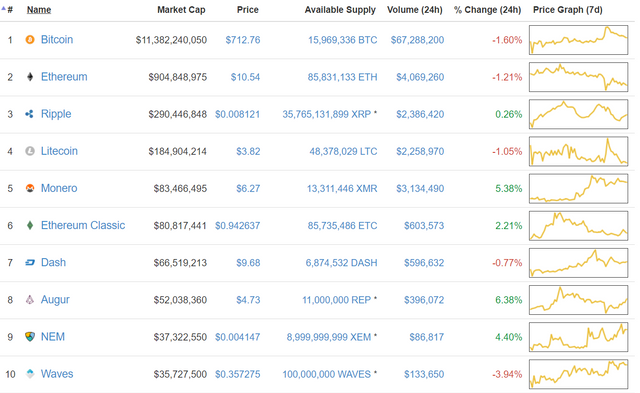

But while cryptocurrencies is used more for payments, its use as a means of speculation and the keeper of the value of the payment aspects of the dwarf. Cryptocurrencies gave birth to the market a very dynamic and fast growing for investors and speculators. Exchanges such as Okcoin, poloniex or shapeshift allows trade hundreds of kriptocurrencies. The daily trading volume exceeded the main European stock exchanges.

At the same time, praxis Initial Coin Distribution (ICO), most of which is facilitated by smart Ethereum contracts, provide a very successful crowdfunding project, where it is often an idea enough to collect millions of dollars. In the case of "DAO" already more than 150 million dollars.

In the ecosystem of the coin and token this rich, you experience extreme volatility. It's been okay if the coin up 10 percent per day-sometimes 100 per cent – the same as losing the next day. If you're lucky, your coin value grow to 1000 percent in one or two weeks.

While the Bitcoin crypto remains the most famous and most other crypto has an impact of non-speculative, investors and users should keep an eye on some of the hidden crypto. Here we present the most popular crypto today.

What is the future of Cryptocurrency?

Emergency quick crypto market and wild. Almost every day a new disaster crypto appear, die of old age, the early adopters get rich and investors lose money. Each kriptocurrency comes with a promise of a big story, most of it to change the world around. Some survive in the first few months, and most of the pumped and dumped by speculators and living as a zombie coins until the last bag holders lose hope to see a resumption of investment.

"In two years from now, I believe that Crypto will gain legitimacy as a protocol for business transactions, mikropansi, and overtake the European Union as a means of sending money which is frowned upon. Regarding business transactions – you will see two lines: there will be a financial business who use it because there is no cost, nearly instant ability to move some money around, and there will be people who exploit it for his blockchain technology. Technology Blockchain the greatest return with endless audits, single source of truth, the contract, and coins. "-Cody Littlewood, and I is the founder and CEO of Codelitt

The market is dirty. But this does not change the fact that Crypto emergency is here to stay-and this is to change the world. This is already happening people worldwide buy a Bitcoin to protect themselves against the devaluation of their national currencies. Most markets in Asia, living for the delivery of money have emerged, and the Bitcoin Bitcoin use darknets cybercrime is evolving. More and more companies are discovering the power of Smart Contracts or token on the Ethereal, first blockchain technology application in the real world appear.

The revolution has already happened. Institutional investors began to buy kriptocurrencies. Banks and Governments realize that this discovery has the potential to appeal to their control. Cryptocurrencies change the world. Step by step. You can stand on the side and observe-or you can be a part of history in the making.

"If the trend continues, the average person won't be able to buy one whole bitcoin in 2 years. As the global economy expands and the market is showing signs of a recession, the world will move on to Bitcoin as a hedge against fiat turmoil and runaway against capital controls. Bitcoin is a way out, and overall kriptourrency will never be lost, it will grow in the use and acceptance of maturity. " -Brad Mills: Serial Tech Entrepreneurs

Give your opinions and suggestions in the comments of this post in order to better

by BlockGeeks

Follow me @wahyue

The real winner of this fight is the IRS. They be waiting like

Nice post, very informative and will definitely help newbies, great job man!

thanks bro @avilsd...

please help me be your resteem this post

Awesome post! Took me a while to get through it, but I like how you've segmented the information -- encompassing most the elements of our growing community. Following you now!

Great post

great stuff **

Thanks for this! I am new to Steemit and new to cryptocurrency. Admittedly, I'm going to read this article more than once. 😊 Much needed. Thanks again.

your'llcome bro @melbookermusic , in my post i want to give everybody about cryptocurrency.

please resteem this bro :)

This post was resteemed by @resteembot!

Good Luck!

Learn more about the @resteembot project in the introduction post.

Pliz upvote

Great work, thank you for so much information, my full upvote!

great post..... keep it