KINESIS- addressing the volatility and hoarding of cryptocurrency.

Ever since the evolution of the blockchain industry and cryptocurrencies, people who have dared to venture into it, have benefitted maximally, owning to the unique characteristics of the blockchain industry and cryptocurrency which has granted participants, more power over the control of their finances and traditional assets due to the introduction of digital assets.

However, irrespective of this wonderful innovation this concept brings, its limitations cannot be ignored. One of such is the volatility in the price of cryptocurrencies: the fluctuation in the prices of cryptocurrencies has discouraged investors or traders in adopting them as reserve currencies or means of exchange.

This limitation has caused these investors to lean back to the banks and other financial institutions that are known as store houses for traditional assets.

These banks and financial institutions hold legal titles to these traditional assets belonging to their clients, and in turn amass wealth for themselves from the proceeds of trading or investing with these assets, giving back little or no return to the owners.

Use Case

Dave is a multi-million dollar businessman, who has investments in businesses whose tentacles cut across different sectors of the economy, but Dave is constantly a subject of theft and fraud and has clost substantial amounts to these vices.

Dave seeks a platform that guarantees safety of his investments and money and one that would ensure yields better than that which banks and financial houses promises.

He somehow gets to know about cryptocurrencies and the blockchain, but is also aware of the issue of volatility of the cryptocurrency and is unwilling to take the risk.

However he comes across the Kinesis

Monetary system that addresses the issues plaguing cryptocurrency and the blockchain.

Now he has invested and is reaping the massive benefits that is associated with being a participant in the Kinesis ecosystem.

KINESIS

Kinesis is designed to enable the creation of an international monetary system that is able to be substituted for something of equal value. This monetary system would go a long way to address one of the plaguing problems of the cryptocurrency network: HOARDING OF CRYPTOCURRNCIES.

Sir Thomas Gresham stated an economic principle after observing human behavior and money:

Bad Money Drives Out Good.

This implies that because of the volatility of cryptocurrencies, most often than not cryptoinvestors would hold back from spending their cryptoassets (spending other currencies they consider less valuable) in hope that the fluctuation in prices would result in favorable profits for them, when it hits a high point.

The ripple effect of that hoard is that, it would rid the crypto-market the chance of using that token as a means of exchange.

Kinesis Monetary System

Kinesis runs as a system for executing commercial and economic activities.

It introduces its own currency, and encourages it use by promising rewards.

The Kinesis system is fashioned to encourage and influence the circulation of money which is a very attractive characteristic to encourage injection of money and capital into the system and ensure zero-existence of hoarding.

Every money that comes into the Kinesis system is through the purchase of tokens.

The fiat currency received, is allocated 1:1 asset backing of either gold or silver(based on its unit) and tagged with a system that accrues yield to specific owners (based on trading rather than debt-based interest offered by financial institutions)

The system further enhances its economy by encouraging exchanges and fair distribution of wealth amongst its members.

In Summary, the basic elements that characterize Kinesis Monetary System are:

-Gold (KAU) and Silver (KAG) kinesis tokens

-Investment Yield

-Blockchain

Kinesis is created to address the constraints encountered in these major areas:

Cryptocurrency Market.

Fiat Currency Market.

Investment Asset Market.

Gold and Silver Market.

The Constraints of the Cryptocurrency Market.

As stated earlier, the volatility of cryptocurrencies has discouraged investors or traders in adopting them as reserve currencies or means of exchange.

This has further hampered the mass adoption of cryptocurrencies. Although cryptocurrencies boasts of a prospect of decentralization, nevertheless its volatily has hindered the possibility of it even being adopted as a means of exchange.

The Constraints of the Fiat Currency Market.

The major problem with fiat currency is durability. Fiat money lack the ability to stand the test of time.

Fiat currency also runs in a banking system that is centralized and totally controlled by the government, thus leaving them with the power to dictate the regulations and laws governing fiat currency circulation and in turn printing more currency to fund themselves and creating deficiency in the amount and quality of money in circulation.

The Constraint of the Investment Assets Market.

The system of trading bullion has not really evolved in recent times. Wholesale bullion-Markets still trade Over-the-Counter(OTC) and in a physical environment, which is very outdated and considering the evolution of technology, an innovative digital system would serve better.

Furthermore, the Bullion-market is run mainly by bullion banks or international trading houses. Exchanges and trading are fragmented between them, leaving no point of entry for local market participants to trade with local clients.

The Constraints of the Gold and Silver Market.

Precious metals such as gold and silver which serve as asset-backed currency are subject to deterioration and do not yield any interest, rather they cost the owners more money in preserving them in safe houses and vaults that can be stolen.

Also the inability of investors to clearly define pure gold from fake has subjected many investors to fraud and loss of money during exchanges.

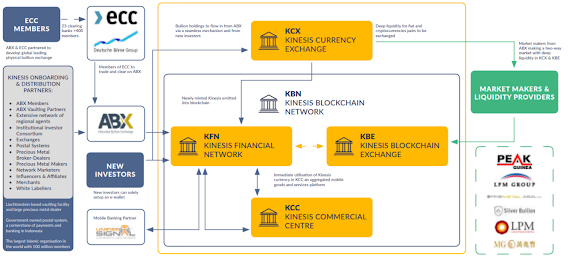

Featured Components of Kinesis Monetary System

Kinesis is made up of different components functioning as a single unit. Each components are unique and can function independently based on their varying characteristics, nevertheless Kinesis monetary system incorporates all these different components towards the goal o achieving a successful and effective monetary system.

Kinesis Currency Exchange (KCX)

KCX functions as the printing press of the kinesis ecosystem. It is a wholesale market that created and mints currency.

Kinesis Blockchain Network (KBN)

KBN functions as the pillar of the ecosystem for trading. Through the blockchain, currency can be sent, spent and saved.

Kinesis Blockchain Exchange (KBE)

KBE ensures the liquidity of Kinesis currencies and serves as a platform for trading Kinesis and other digital currencies.

Kinesis Financial Network (KFN)

KFN is the mobile banking system of the blockchain. it issues a MasterCard/Visa Debit Card and enables the use of Kinesis currencies as means of payment.

Kinesis Commercial Centre (KCC)

KCC is an online platform that enables kinesis currency suite to be employed by users as a means of payment to merchants.

Velocity Based Yield System

The Kinesis yield system functions in four ways:

1. Minters Yield

This yield system is designed to rid the blockchain of cryptocurrency hoarding, by encouraging the input and free-flowing of currency within the system, prompting participants to sell, spend and use their currency.

This system rewards participants who create and transact more currencies in the system. The yield accrued to each participant is based on their involvement in increasing the velocity of currency in the system.

2. Holders Yield

This yield simply applies to users who do not use their currency. It works like keeping cash in a bank and receiving meagre profits.

3. Affiliate Yield

This yield is designed to encourage the adoption of more people to the platform, it rewards participants who refer others to join the Kinesis system.

4. Depositors Yield

This yield rewards investors who deposit large sums to the ecosystem. It grants rewards on initial deposit and also on further use of the currency. Whatever profit is realized from transacting with the depositors investment is credited as a yield.

** KINESIS TRULY IS THE FUTURE OF CURRENCY**

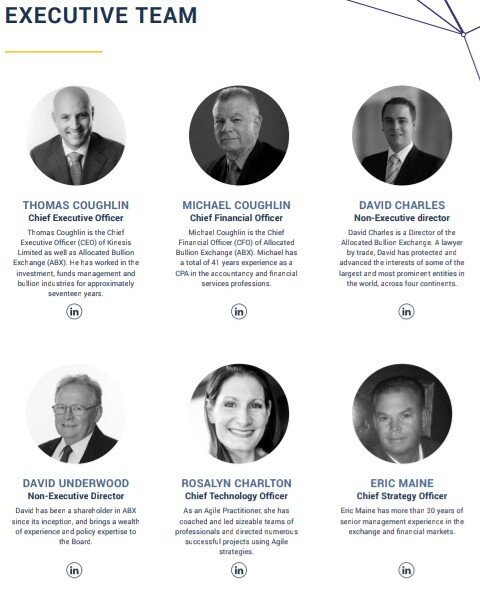

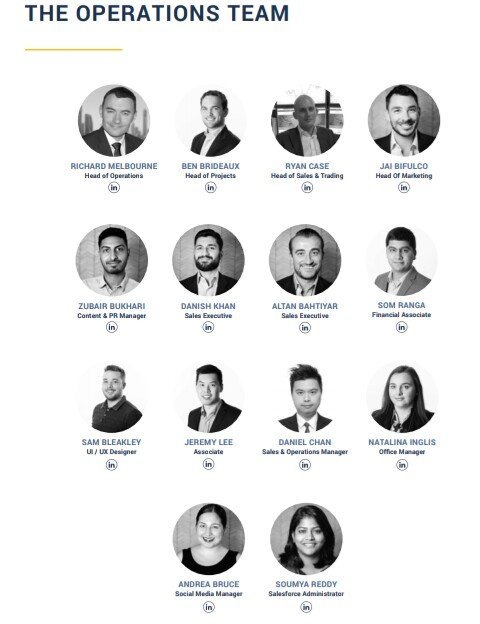

KINESIS TEAM

Watch this video that I made, for more explanations:

Twitter Link: https://twitter.com/GodwinFyoung/status/1036260895947739137?s=20

For More Information check out:

Kinesis Website

Kinesis Whitepaper

Kinesis OnePager

Kinesis YouTube

Kinesis Telegram

Kinesis LinkedIn

Kinesis Github

Kinesis Steemit

Kinesis Bitcointalk

Kinesis Medium

Kinesis Twitter

Check out the contest here:

https://steemit.com/crypto/@originalworks/980-steem-sponsored-writing-contest-kinesis

kinesis2018

.jpeg)

.jpeg)

.png)

.jpeg)

.jpg)

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Friend @contestbot. This is to inform that I didn't receive upvote from you on this weekly contest.

My link :

https://steemit.com/partiko/@saun/kinesis-a-new-era-of-safer-investment-entry-for-contest-955eccb5c4e45

This post should be on the @originalworks contest post.

Yes, Gentleman I entered this link there.

But contest bot did n't upvoted it. So, I thought to inform it.

Thanks.