CryptoTalk - How Firmo may spark the growth of crypto-based derivatives

Hello Steemians! I get to know about this company called Firmo through @originalworks's most recent contest (post here). I think Firmo is working on something really interesting and it will potentially spark the growth of cryto-based derivatives.

What is a derivative?

First of all, what is a derivative? From the definition on Investopedia:

A derivative is a financial security with a value that is reliant upon or derived from an underlying asset or group of assets. The derivative itself is a contract between two or more parties based upon the asset or assets. Its price is determined by fluctuations in the underlying asset. The most common underlying assets include stocks, bonds, commodities, currencies, interest rates and market indexes.

Still lost? Derivative is essentially a contract between 2 or more parties to "speculate" on the price of an underlying asset. For example, a derivative contract based on STEEM's price will be something like this:

- Alice has 10 STEEM that she bought when it was $3 each. The price of STEEM is $3.5 now but she thinks that the market is very volatile and wants to protect her investments.

- Bob is willing to invest in STEEM when it is $3. So he offers a contract, valid for a month, to allow his counterparty the right to sell STEEM to him at $3 regardless what is the current price. But to enter into this contract with Bob, the counterparty must pay $0.10 for each STEEM in the contract.

- Alice sees Bob's offer and decided to enter into the contract with Bob. So she pays Bob $1 ($0.10 for each STEEM which she has) and get the rights to sell her STEEM to Bob at $3 regardless the price.

- In a bullish event, which STEEM price remains above $3, within the month, Alice will not exercise her rights to sell Bob her STEEM. So Bob got paid $1 and Alice got her much needed assurance.

- In a bearish event, which STEEM price falls below $3, let's say $2.50, Alice will exercise her rights to sell Bob her 10 STEEM at $3 each. By doing so, Alice had limited her losses. Bob on the other hand made a paper loss as he bought STEEM at $3 instead of the market price of $2.50.

I have just described a simple derivative contract. In real life, it is a little more complex than this but for the purpose of this article, it should suffice.

Use of smart contracts for crypto-based derivatives

In the above example, Bob could potentially code a smart contract and add it to the Ethereum blockchain. He then sends $30 worth of money into the smart contract and lock it in escrow. Alice can enter into the contract by sending the contract premium ($0.10 per STEEM) to the smart contract. Since the smart contract is immutable, both Alice and Bob can be assured that they can both get what they want depending on the outcome.

Sounds simple? But in reality, it is not so simple to write such smart contracts and commit them to the blockchain. You will need to be familiar with smart contracts development to write the contract. Even if you are the counterparty, you will also need some basic smart contract knowledge to be able to understand the contract and be sure that it does what it claims to do.

Firmo's value proposition

So what is Firmo is trying to achieve? Let's take a look at their introductory video:

Firmo is offering a set of tools and infrastructure that will allow for easy creation of such smart contracts for derivatives and they have a very apt name for them, smart derivatives. Firmo developed their own language called FirmoLang which is very focused on creation of smart derivatives. Based on Firmo's technical paper:

FirmoLang is built on the insight that all financial instruments are reducible to the same triad of events: A series of transfers of value between counterparts, at selected time intervals, governed by a set of conditions like the price on the

market or a counterparty calling an option.

This is important because if a language is built with just a set of predefined focus and rules, then it will be much more secure than a general purpose programming language like Solidity.

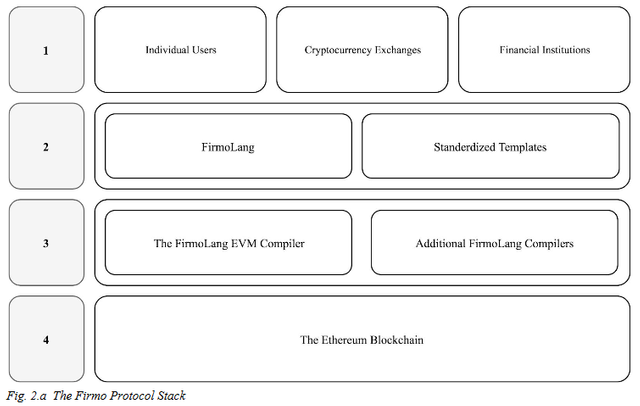

Besides that, Firmo is also offering standard templates for smart derivatives deployment. This will enable much faster deployment speed and enhanced contract security. The full Firmo Protocol Stack can be seen below:

In addition, Firmo protocol is blockchain agnostic and will work on most smart contract blockchains like Ethereum, NEO, QTUM and even EOS. This allows for greater flexibility for crypto exchanges and financial institutions who will like to create their own crypto-based derivatives.

How it might benefit the overall cryptocurrencies market

By enabling faster and more secure deployment of crypto-based derivatives smart contracts, I expect to see a growth and increased focus on this new marketplace. When such derivatives become more accessible, investors will be able to deploy more sophisticated trading strategies to allow their trades to be hedged from sudden price movement. I think this will encourage more financial institutions to invest in the cryptocurrencies market.

On the flip side, derivatives are by nature very risky financial instruments and extra care should be given when investing is such instruments. That being said, derivatives in traditional financial assets like equities or bonds are already very common. It is a natural progression for crypto-based assets to also start having their own derivatives. Firmo, in this case, is in pole position to drive this change and I am certainly looking forward to what they can produce.

What are your thoughts on this project and crypto-based derivatives? Let me hear your thoughts?

firmo2018

Great find of a ICO @culgin.

When an organisation (ie. in the oil industry) requires risk management, derivatives are the go-to instrument for hedging the downside. Investors, too, can take advantage by using derivatives as an alternative. And for traders like myself, derivatives are pure speculating instruments.

But like everything else, crypto-based derivatives will only be valuable if their underlying (crypto-currencies) are widely accepted and used on a daily basis. And even here, the term "widely accepted" can be debated.

Also traditional derivatives are highly regulated financial instruments. And we know that governments around the world are still unable to come to a consensus with regards to crypto regulation.

Not sure about the obstacles Firmo will face, but with all things considered, definitely an interesting project, seeing that they may have first mover advantage. And they have a huge team relative to other companies at the ICO stage, likely shows they firmly have their sights on the end-goal.

Hi bro, you are absolutely right. What I think Firmo is doing differently is that they are offering the tools, framework and infrastructure for 3rd party exchanges to offer crypto-based derivatives. This is unlike projects that build their own crypto-based derivative exchanges and only allow themselves to use the tools they developed.

Lit article brother. (:

Sounds very interesting; I am curious how this will work out.

And very good explanation/example regarding derivatives although it is really simplified haha.

Haha.. thanks bro! I try to simplify the example as I will like to allow more people to understand the value of derivatives. Because only after understanding derivatives, can you understand what Firmo is trying achieve.

Culgin, I wish you all the best for this contest. I had difficulty learning the financial jargon of the whitepaper but I will overcome it nonetheless. Upvoted!

Thanks! I am looking forward to your entry too!

The financial analysis looks very professional👍

Thanks! Hope I stand a chance to win something. Haha..

Hmm, this is a very good one, very enlightening. Love your post, i guess you're a professional at this. Thanks

Thanks for your kind words!

Coins mentioned in post:

This post has been submitted for the OriginalWorks Sponsored contest!

You can also follow @contestbot to be notified of future contests!