$1000 Ethereum Price Forecast

It may sound too good to be true but Investing Haven’s research team calculates a long term ethereum price forecast of $1000, say for 2018 and beyond.

The challenge forecasting Ethereum’s price

There is one important challenge in trying to forecast the price of Ethereum: there is no useful data available to apply a direct forecasting method. Stated differently, based on the limited set of relevant data we have to rely on an indirect forecasting method.

It may sound counterintuitive that there are hardly relevant data points available.

There is of course plenty of data in Ethereum space. Take, for instance, Ethstats, a real data hub for Ethereum statistics visualizing ongoing activity on the network, while Etherchain looks at transactions per second, top miners, and so on.

All that is interesting information, but not relevant in understanding the real intrinsic value of Ethereum which, essentially, is the basis to forecast a future price.

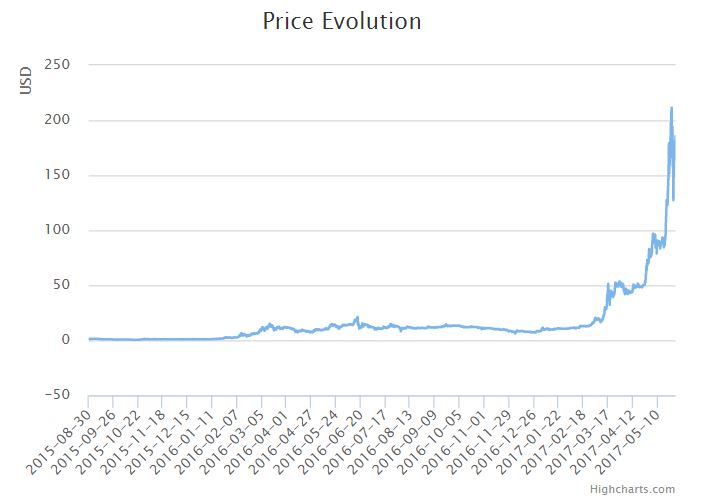

Moreover, in classic markets we are used to take a price chart and look for patterns as a reliable way to derive a price target. Chart analysis is also not very useful in deriving an Ethereum price forecast. The long term chart of Ethereum does not reveal any form of pattern apart from a parabolic rise. This pattern, however, has no visible indications which may suggest how long or how high the rally will go on.

Ethereum price forecast: our method

Given the challenge outlined above, InvestingHaven’s research team developed a method based on classic supply/demand fundamentals. Similar to any other market Ethereum is subjective to its supply and demand. Our method looks to collect data points which paint a picture of demand, and, in doing so, gives an indication on the intrinsic value of Ethereum.

- Supply statistics

At this moment in time there are 92M coins of Ether available. Supply of Ether will become flat data over time. For now, the supply of Ether keeps on growing, but we will soon reach a point, probably in one or two years, where new coins will be equally created against the number of coins that go out of circulation. That is the intent of the Ether community, so we take that as our working assumption. So for long term forecasting the supply of Ether is not a very important indicator; supply is certainly relevant in the short term but our forecasting timeframe has a long term horizon.

- Ether application demand statistics

A very important indicator is the usage of Ether in decentralized applications. To us, this is the real intrinsic value of Ethereum.

Many applications are being launched and developed at this point, and we clearly see a trend in the number of Ethereum based blockchain applications. Here again, we lack specific data, because most of those applications are private in nature, and associated usage stats are not released.

Case in point: The Ethereum Alliance, for instance, was set up to create a “spot trade” on the foreign exchange market for global currencies using an adaptation of Ethereum as the settlement layer. The Alliance was created by giant companies like Microsoft, JP Morga, and the likes.

Ethereum is playing a major role in applications like predictive analysis, decentralized market places, cross border payment services, digital signature in transactions, digital rights management, crowdfunding, and many more.

One of the problems Ether solves is offering Smart Contracts, as explained on Ethereum‘s wiki page.

Ether is well on its way to become the standard in decentralized applications among cryptocurrencies, used by many giant corporations.

It is hard to calculate the demand and future usage. The finance sector is where Ethereum offers major value. That sector has a huge potential. From that perspective, it is really fair to say that Ethereum’s usage in decentralized blockchain applications will go up 20 to 30 fold over the next 5 to 7 years. That is not an overstatement, but rather an understatement.

- Ether investment demand

The other demand aspect is investment driven demand.

Right now, Ethereum is closed to the public. One can buy Ether as an investment only with access through a wallet. That really is not mainstream at this point.

In April 2017, Grayscale launched The Ethereum Investment Trust (ETC) which is a private fund in Ethereum. It is a real success, and the chart below illustrates how investors are rushing to invest in Ethereum, with the value of ETC almost quadrupling within a month. However, it is a private fund, so not very accessible to a wider audience.

Note that this is one of very few hard data points that is really relevant in forecasting the Ethereum price.

It will really become explosive once the huge group of traditional investors and, more so, institutional investors start buying Ether for investment purposes. That group has no positions whatsoever in Ether currently, apart from the private fund mentioned above. Imagine what happens with investment demand once just 0.1% of that group starts buying Ether.

Furthermore, there is no Ethereum ETF yet. Such an ETF would open up access to the large group of traditional investors as an ETF needs to hold a minimum of Ether once it launches.

The first Bitcoin IRA is a fact, but there is no Ethereum IRA to drive the price of Ethereum higher. Imagine what happens if just 0.01% of retail public starts buying Ether for their IRA.

Long term Ethereum price forecast of $1000

All in all, we get a clear picture of the enormous long term potential of Ethereum as we examine the supply and demand components. That brings us to the following Ethereum price forecast: supply will be neutral over time, usage demand will go up at least 20-fold, and investment demand will provide incredible leverage.

Because of that, it really fair to conclude that an Ethereum price forecast of $1000 will be achieved before 2020, which is a fivefold increase against today’s price level.

I'm not sure about ETH. It's highly speculative at this point.

Right, and so are all the other crypto assets including bitcoin, however I do highly believe that ETH technology has a very bright future and holds a great chance of some major price gains.

Personally I've bet all my savings on Dash and Etherum. Dash is very underrated and ETH certainly have 100 times better future than BTC. I'm honestly being serious here. Dash will be the Death of Bitcoin and Etherum will be its own kind of new frontier.

https://www.dash.org/evolution/

I'm also very hopeful and optimistic about Siacoin and Maidsafe. Factom is criminally overlooked and steem would have a solid future.

I as well put most of my savings in almost all the coins that you've mentioned. Great minds think alike :) Lets hope for a good outcome. Fingers crossed.

What about EOS? I am betting on Etherum and Litecoin, but recently I acquire some EOS.

I'm positive on EOS but ETH has the first mover advantage which counts a lot. It's the only reason for BTC to be even a thing in the current market.

LTC is certainly a better pick than BTC but seriously try Dash maybe Monero or just get more of the EOS.

http://www.youtube.com/channel/UCAzD2v9Yx4a4iS2_-unODkA

Thanks for the reply!

Congratulations @cryptovoice! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPReally awesome article. Have upvoted and resteemed.

Interesting. What do you think the impact of EOS will be on the price and popularity of Etherium?

I'm no expert nor a financial advisor but I've personally contributed in the EOS initial coin offering because I believe in the team behind the project and see that the implemented technology will be quite disruptive in the future. EOS and TEZOS are 2 of my ETH alternative top picks but I still think ETH will continue to dominate in the smart contract field.

ETH has the first mover advantage which is a very powerful thing. That's why I consider ETH to be one of the safest high return investments of our time. Bitcoin should already be dumped and preserved in a museum and replaced by Dash. Yet it has the #1 market cap and popularity simply because of its first mover advantage.

It's always better to have more competitors like EOS or Waves. But I do belive ETH team is very capable and above all there is the first mover advantage.

Thanks for sharing the article @cryptovoice and for the constructive discussion @vimukthi, I also believe Ehtereum has the momentum of the first mover, but the proposal of EOS seems to me quite innovative. I am investing on both.

This truly encourages me to invest in ETH, Thanks for sharing this important news :D

invest in assets and not just currencies. ETH counts as an asset

The Ethereum has been a great success for this reason, but also because it is based on an innovative and open source programming language that can be used for other applications related to the financial field. It is to this language that the major banking groups turn for their solutions of tomorrow.