Meet Onam : An exchange with a difference in terms of compliance, regulation and security of your digital assets

Preamble

Cryptocurrency exchanges has being around for as long as blockchain technology became the new wave of financial revolution after the debacle of the economic crisis that threw many economies and individuals into an oversight mode interms of the way they manage and store their resources especially finance. Since then, this technology along with its signature currency : cryptocurrency and exchanges : which serve as the channel for trading cryptocurrency; have all witnessed immense growth in their own different ways. However, as we know already, digital currency trespass all international jurisdiction and this fact alone constitutes a challenge to its continuous growth and wide adoption because it could serve as a means for terrorist organizations, cartels and other criminals to move "dirty money". Therefore, one of the important steps in reducing(if not eliminate) bad actors is to ensure that users of such financial institutions including exchanges are screened properly to ascertain the legitimacy of any potential customers.

Going forward: This represents one of the few reasons why having strong compliance schedule is important among cryptocurrency exchanges because they serve as the gateway to both worlds.

However, in the rather short history of exchanges just like cryptocurrency; centralised exchanges as opposed to decentralised seems to represent the best outlet for different classes of users to enter the cryptocurrency landscape. This is due to the obvious advantages it offers traders interms of speed of matching orders. However, their lack in major areas such as security can be augmented by implementing a strict compliance schedule to filtrate and rid the system of bad actors. Something many exchanges are negligent of.

Onam is borne out of the need to arrest most of this issues and many more as we shall get to see very soon.

What is Onam

Onam is simply a compliant cryptocurrency exchange. Onam employs fireproof technologies to ensure the security of their users while maintaining a high liquidity and consequently scalable platform for mass adoption. This is not to talk less of their irreverent approach to ensure compliance and transparency while offering customers support. In light of this, Onam does not only sees itself as a cryptocurrency exchange, it is trying to position itself as a regulatory firm for the cryptocurrency market which we all know will be vital to the wide adoption of this technology.

But first....let's identify the key issues behind the present exchanges options

The success story of the blockchain technology will not yet complete without atleast being able to match the speed of present transactional systems such as paypal, visa and the likes and that is why inspite of the obvious security and privacy benefits, decentralised exchanges are yet to be able to fully replace centralised exchanges; making centralised exchanges the desired option for serious and real-time cryptocurrency traders. However, present centralised exchanges are lacking in some of this key are as highlighted below

Security Deficits

It is no news that many prominent exchanges has suffered attack in recent times. This has resulted in the loss of customers fund or even in the closure of the exchange. The fact states that only in 2017 and so far 2018, exchanges have lost almost a billion dollars which are split between the year in question as follows : $266 million and $731 million respectively. The trajectory for keeping exchanges alive is on the downward and if nothing is done, exchanges may cease to exist in the near future (sounds like an overstated belief).

Scalability limits

Having blockchain ready for mass adoption means that there must be adequate facility for value to be transfered easily and conveniently without the slightest delay and this is why exchanges are at the center of the value chain for digital currency value transfer. But it seems many of the present exchanges affect this flow by adopting long maintenance routine which leads to inevitable system downtime.

This has resurrected further fears that the present exchanges might not be able to handle the influx of new traders and investors into the cryptocurrency sphere. 2017 and 2018 witnessed an unexpected influx of new traders and investors, which has consequently led to the emergence of new exchanges which were mostly structured to meet their present market demands. However, this rigid structure presents a challenge to the wide adoption of cryptocurrency by businesses and institutional investors in the near future.

Market Manipulations

Due to the less regulation of the general cryptocurrency market, exchanges have find a means to checkmate customer's activity by ensuring they submit their KYC (Know Your Customer) data which they can use as a detterent to monitor trader's activity and ensure they are complying. However, this process can be manual and slow.

Having a system that can learn trade patterns and make intelligent decisions on traders activity can solve many of the manipulations that goes on in the background. Machine learning is a technology can dissolve situations like this that seems rather out of control for most exchanges.

Inactive Customer Support

In a recent survey conducted by encrybit, where 1000+ member audience were interviewed simply by asking them the question : "What are the biggest problem that you see in currently available exchanges". There responses is summarised in this little chart below

Evidently from the graph above, 33% of the audience agree that the customer service unit of most exchanges are unresponsive even in grievious instances like loss of funds, account lockout and so more. This numbers tells us most exchanges are not doing something right in this aspects and many others as have likely being mentioned in the course of this article.

Poor Market Liquidity

Out of the 300+ cryptocurrency exchanges available, only the top 20 exchanges controls more than 90% of the market capitalization which means that in reality most of the other exchanges fake a rich order books, resort to unfair and illicit tactics by front-running,wash trading or spoofing all in a bid to portray good liquidity to its traders.

Lack of Regulatory Compliance

While cryptocurrency has gained huge growth in a very short while, the system is still fabled to be uninviting to institutional investors who are looking to enter the market. Some of the good reasons are the sheer amount of scam ICOs that troll the space, the neck-breaking collapse in value of an asset within a very short time.

In order to leave behind the era of false promise invented by scam ICOs, there is need to adopt a strong regulatory framework to guide the activities of every player within the cryptocurrency sphere. Exchanges as a matter of fact this should not be left out of the equation.

And that is why Onam is bringing an holistic solution to all the issues that confront cryptocurrency exchanges along with building a compliant schedule for every users of the platform.

Onam's Potential solutions to the problems confronting cryptocurrency exchanges

These section introduces Onam's response to all the issues outlined above in a bid to improve or correct some of the anomalies which has in one way or the other derailed the overall performance of the present cryptocurrency exchanges options.

Advanced Threat Prevention, Intrusion Detection and Trade Surveillance

This technology is powered by machine learning algorithm and its a proprietary software developed by the team at Onam to help the exchange detect any irregular activities and flag inappropriate activities in real-time, preventing breaches before it is too late.

The beauty of this is that Onam is implementing this technology along side industry standard security measures such as DDos Mitigation, anti-phishing and 2FA solutions. Inorder to fully secure the platform from attacks and ensure customers funds are 100% safe, Onam will implement an encrypted database that holds fund in a highly secure wallet.

10 Million TPS

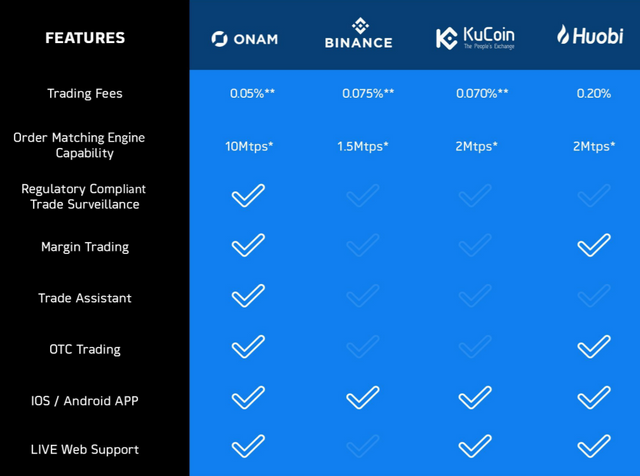

Onam is built to meet the needs of the present and future market demands. Hence, implementing an exchange that can outperform its peers in terms of transaction speed is the first step to building a highly scalable platform. Unlike most conventional exchanges which can process just 1-2 milllion transactions per second; Onam's exchange has a built-in structure to accomodate its own versatile matching engine capable of processing 10 million transactions per second with latencies as low as 40 nanoseconds.

This structure is made possible by implementing the GoLang programming language designed by google specifically for computationally intense server applications Source : Whitepaper page 8

Real-Time Market Surveillance, Supervision and Compliance system

This system uses the concept of machine learning to look for irregular and suspicious trading patterns. By analysing pre-trade and post-trade data, the system is able to learn itself and identify activities such as highlighted below

- unusually large trades

- Pass-through trades

- Wash trades

- Spoofing

- Layering

- Stuffing

- Hammering

- Front-running

- Momentum ignition

Source : Whitepaper page 8

This ensures they keep the platform fully compliant against any irregular activities while also being committed to a mandatory quarterly 3rd party security audits.

24/7 Customer Support

Onam promise to offer 24/7/365 live chats in multiple languages and commit to addressing the most common issues within the first 15 minutes of a support ticket being submitted. There will also be a phone support within the first 6 months of full launch to make sure no issue goes unresolved.

Incentivize Participants

In a bid to eradicate the issue of low liquidity associated with many exchanges, Onam plans to attract large market-makers, volume traders and miners by providing them with incentives for participating and using the platform.

Along with this, Onam will utilize order books from multiple exchanges . This will help to solve high slippage and market manipulations brought on by poor liquidity other exchanges are facing and offer a truly rich and transparent order books.

Adopting a fully-compliant exchange platform

This represents one of the core feature of this exchange as they aim to drive a fully compliant platform to encourage businesses and institutional investors in using the platform to their many benefits. This fully compliant approach will drive a regulated economy where all participants feel safe that their funds are in good hands.

Highlighting the Full Features and Benefits of Onam Exchange Platform

Services available only to Onam token holders

More Information on Onam's Regulatory and compliant Structure

Onam is establishing itself as the frontburner when it comes to adopting strong regulatory framework that meets international standard and bodies. Therefore they have joined forces with a reputable legal to acquire all the necessary documents to obtain licences and registration required by SEC to operate an exchange which are outlined as follows

Register as money transmitter in all 50 U.S statesObtain a Broker/Dealer LicenseRegister as an Alternative Trading System (ATS)Become a member of Self Regulatory Organisation (SRO)Enforcing KYC/AML laws

Summary

Before blockchain and its sisters proponents including exchanges can be ready for mass adoption, all hands must be on deck to rid the system of any excesses due to unregulation of the entire ecosystem. Therefore exchanges are at the cynosure of this system and therefore must take the initiative to position itself as the powerhouse of stability, security and compliance with regulatory rules.

Onam fits the bill of an exchange that is tolling this path of driving a rich digital asset economy for institutional investors and businesses who are lured by the potential of the blockchain technology.

Note : Onam will initially support the trading of this cryptocurrency once its platform launches

Use Cases

Use case 1 : A high leverage platform

Mike has being using XXX exchange for buying and selling his cryptocurrency assets on a daily basis but at the end of his trade activities, he finds it hard to reconcile his investment portfolio with his profit margins easily because of complex and often unclear fee structure and which is adopted on this exchange. This has turned Mike into a mini-harlot of a trader who keeps trying different options just to suit suit his requirements of being able to project his earnings on any given transactions, but so far all efforts proved abortive.

So a friend introduced him to Onam exchange where every transactions attracts reduced fee. He was lucky enough to participate in their ongoing pre-sale and buy into the Onam token when it is still very cheap and be able to unlock many cool benefits of using the platform such as market scanning tools, save upto 50% on trading fees and many more once trading launches.

ICO and token distribution

Other useful information about their ICO program can be found in their whitepaper

Synopsis

- Onam Vs Other exchanges

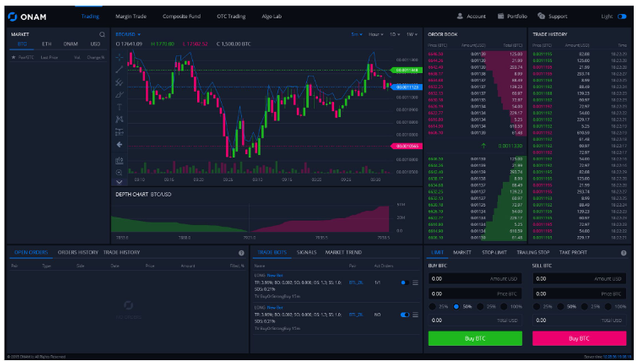

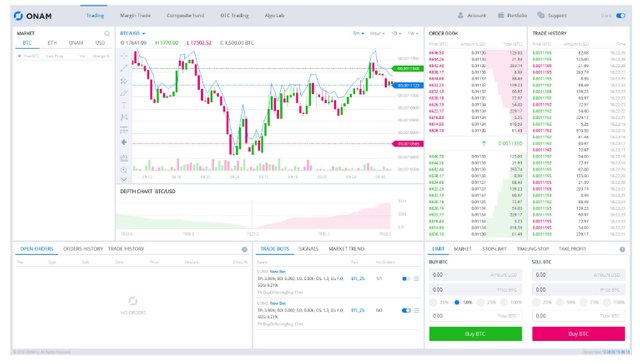

- Modular Interface

Night mode | Day mode |

|---|---|

|  |

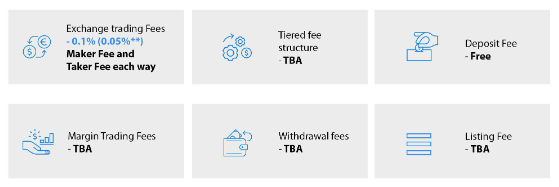

- Fee Structure

Roadmap and Partnerships

Partnering with BitGo - Offering custodian services to institutional investors for cryptocurrency investment.

Meet the Team

Check this Links for more Info

Onam2018

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!