My 10 GOLDEN RULES for Brokering Crypto | What 1500+ Hours of Experience Trading Since Q3 2015 taught me --> TA & Research/trial & error + Experience >>> FOLLOW THESE RULES; DO NOT PIVOT & YOU WILL NEVER LOSE AN INVESTMENT AGAIN! <<<

I will re-iterate in big font because I cannot stress the importance of this rule. FOMO/FUD are both single-highhandedly responsible for 100% of losses made by investors.

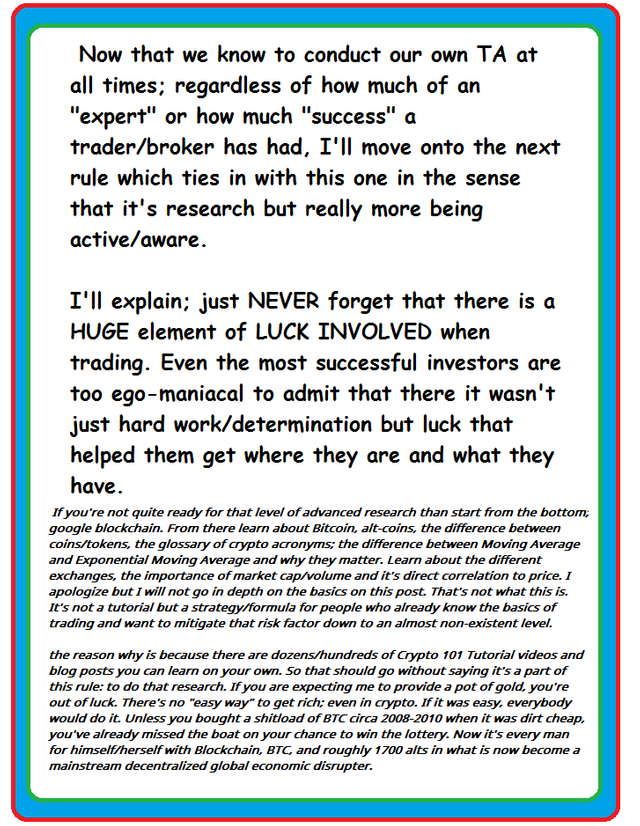

Even if you're just a novice trader who's looking to take it to the next level; so as long as you have a strong work ethic and are willing to work/commit for it; this is the post for you. Adhere to my 10 rules and you'll always be a successful investor.

I quickly learned that Twitter is perhaps the best way to obtain headlines/breaking news in finance. Get on Twitter and follow anyone & everyone with enough clout to swing the market in a completely opposite direction using under 250 characters.

So much for short & concise... oh well.

This one will be short & concise; I mean it. Whenever you do your research and you feel as if a coin is about to breakout; you're not clouded by emotions & your head is telling you strong buy recommendation than go for it. It's not panic buying/selling if you pre-determine in an objective manner what and how much you intend to purchase and set the limits for not only the percentage in which you can afford to lose but also to not let your greed get the best of you (we're all guilty of it) and SELL once you've surpassed your sell point. Even if the coin keeps mooning; you SELL.

NEVER INVEST A PENNY MORE THAN YOU CAN AFFORD TO LOSE!

OKAY FOLKS! Whew that was lengthy! Took me almost 4 hours to write! But I do believe it was most definitely:

Last rules:

it's bizarly hard to earn more in trading than most jobs...

Don't invest only in crypto.

Agreed.

Your concern is addressed in Rules #6 & #7 for this very reason.

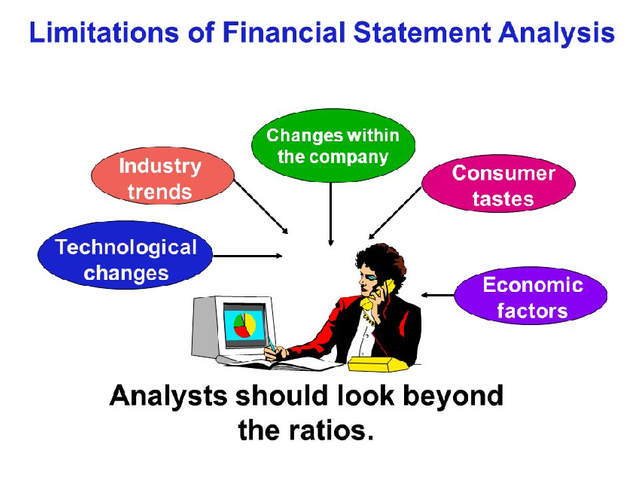

By setting contingencies; studying roadmaps & whitepapers, and getting daily updates on the coins/tokens in your portfolio you can mitigate losses so much so that they are almost non-existant; also if you're investing in a platform you believe in than like anything in life it's a risk worth taking.

Even if that doesn't work out... that's why 70% of your assets are stored in a long-term HODL portfolio (Rule #7 / Warren-Buffet model) so that either way if some freak of nature, mass panic & FUD occurs resulting in 3 market crashes in the span of 2 weeks: (i.e an anomaly occurs like we saw in Q1 of 2018 (January) the entire market could death spiral, millions will lose billions yet you'll walk away with only 30% of a loss: keeping 70% of your assets.

??????????? ?????????

?????????

I know 30% is a pretty big loss; we're talking about extremely rare freak incidents like a death spiral; only than will this safeguard be used... and compared to the more aggressive swing/day traders, losing 30% of your portfolio (when they've lost 100%) is like ripping off a bandaid. You'll live. They on the other hand... might end up eating a bullet. Why do you think the phone number for the national suicide hotline was all over Reddit/Coindesk & other crypto news sites when $BTC dropped from it's ATH over $20K to a staggering low number (makes me cringe to even say it so I won't)

Because people were committing suicide; literally... and could you blame them? Imagine spending years earning a small fortune (say 1 million USD) and overnight it's gone. That can fuck with your head; especially if there are other circumstances in life that are exacerbating the predicament/circumstance.

>Again Rule #1 for this very reason.

>Again Rule #1 for this very reason.

Nobody likes them; but they are the only thing standing between you losing 25-30% of your net worth versus you going broke overnight.

Agreed on the notion that trading alone isnt' enough (not now atleast; maybe in 2016/2017 when $BTC was not mainstream) and we could get away with the most insane returns. I never thought I'd say this... I miss those years: the good 'ol days; back when we'd see 10,000%++ ROI on all sorts of coins/tokens.

The best years of trading & we won't have a time in crypto more lucrative than those years IMO.

Also; having an an additional source of no-risk all-reward income in my case its mining, angel-investing/margin-trading is always necessary because brokering crypto is NOT enough to quit your job and make a living strictly due to the volatility/infancy & rapidly changing uncertainty of the market's future

https://steemit.com/bch/@a1mtarabichi/cryptolife-is-hard-if-you-have-the-passion-love-and-time-then-nike-otherwise-don-t-bother-you-will-lose-usdbch-s-and-xlm-buy-rec

This post is worth gold man, very informative!

Congratulations @a1mtarabichi! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP