Quantitative Crypto Investing(1) - Invest Only in Rising Markets

Hello, I am Kangcfa. I am the co-author of “Gazua! Magic Formula for Crypto investing.”

(Gazua – An outcry of investors/traders wishing their stock or crypto going up - originated from South Korea and popularized during the coin bubble of 2017)

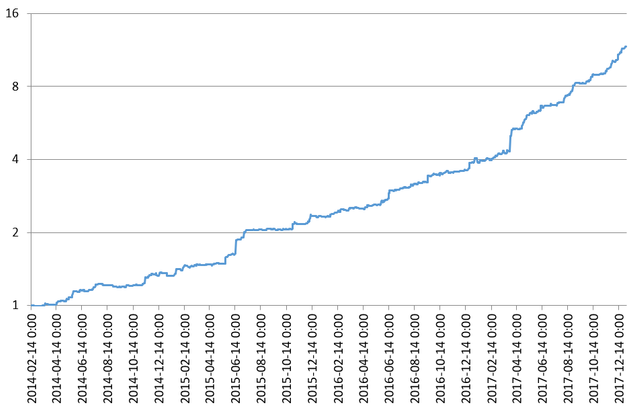

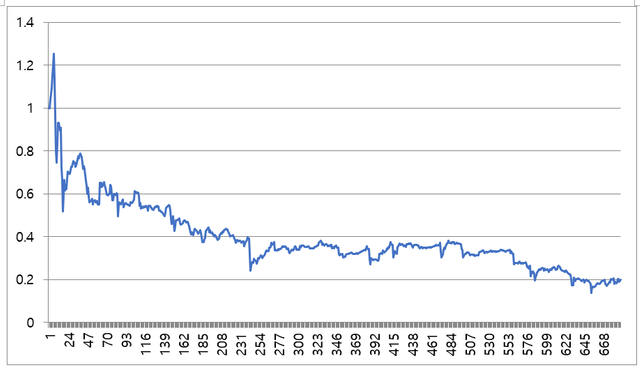

The book is probably the first book in the world which uses elements of quantitative investing and system trading in the world of cryptocurrencies. To give the conclusion first, the book gives detailed instruction to create strategies which look like this:

This picture shows the backtested result of a certain trading strategy which I will describe in due course.

The strategy invests in 4 cryptos(Bitcoin, Ripple, Lightcoin, Dash) between February 2014 and January 2018. I have chosen 4 coins which were existent during the bear market of 2014(Ethereum came into being in 2015).

This strategy has a CAGR of 85.95% while having a MDD(Maximum Drawdown) of only 4.15%! Maximum drawdown measures the maximum loss from a peak to a trough of a portfolio before a new peak is attained. It describes the worst possible loss an investor has to endure. Moreover, there were only 10 occasions in these 4 years where the strategy lost more than 1% of its equity in a singe day.

You will probably think this is totally impossible as cryptos can lose up to 50% in a single day. You might also think this strategy is either 1. Overoptimized or 2. Fake.

I will gradually describe the logic and every detail of this strategy, and after reading that, you might make your own mind.

The best part: This strategy looks pretty nice, and it is the one that the author currently uses with his own assets, but there are even better ones.

Let’s get started.

1. Invest only in rising markets

I really want you to make money. Of course, I am grateful because you invested time to read thisk. However, it is much more important that you make money and praise my cleverness and genius so that more people watch this, I can sell more books, get more steem dollars and become more famous. Anyway, I will begin by telling you a big investment secret.

“You should invest only in rising markets.”

Exactly! That’s how you are supposed to invest. If the market goes up, even the stock or coin recommendations of my dog or my 3 year old neighbor boy probably makes money.

If you win in the markets, it’s not because of your wisdom, but because the market is moving up.

On the other hand, in falling markets, nothing really works. Even great investors like Warren Buffett lost money during the 2007-08 bear market. Obviously, he is a far greater investor than me, so he might lose less than I do. But he cannot avoid losses altogether. You won’t be an exception. This secret is so important, let’s say it one more time:

In falling markets, you should just not invest – If you have some cryptos, sell them.

“Yeah, great guys, everyone knows that! But how am I supposed to know if I am in a rising or falling market!” You might counter me. You have a point, but it is not that difficult to differentiate between rising and falling markets.

There is not an absolute rule to divide rising and falling markets. You just choose one subjective benchmark, and if the price exceeds it, you are in a rising market, and it the price below, you are supposed to be in a falling market.

It is important to note it is not that important what this benchmark actually is. Your benchmark of choice tells you if you are in a rising or falling market. You act accordingly and invest only if you are in a rising market, and sell out and do nothing if you are in a falling market.

2. The power of the moving average

Now we will become more concrete. We use the “Moving Average” to determine whether we are in a rising of falling market.

If the price is above the moving average, we define it as a “rising market”, while the price below the moving average indicates that we are in a “falling market.”

What is the moving average?

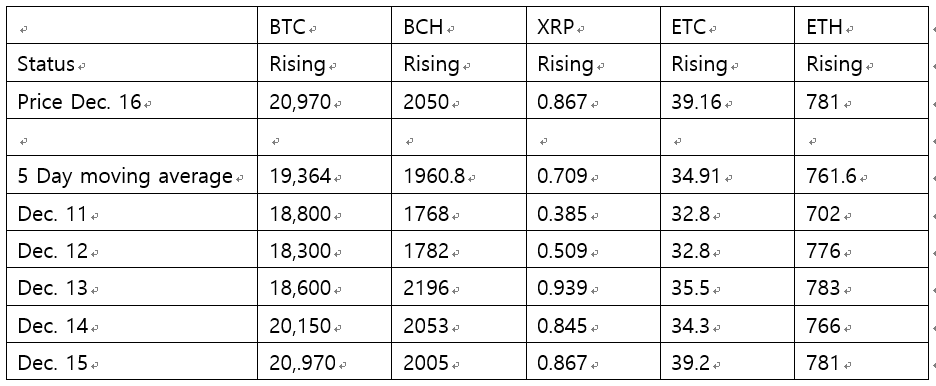

Suppose today is December 16 and Bitcoin costs 20,970.

If you use a 5 day moving average, you just add the close of the last 5 days.

Example: The average of the five closes(Dec. 11-15) is approximately 19,360. As the price is above that benchmark, we are in a “rising market.”

<Example for the calculation of the 5 day moving average>

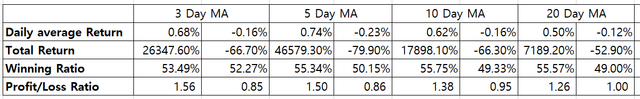

What would have happened if you had invested only in ‘rising’ markets? We have created backtests for the 3,5,10 and 20 days moving average.

<Bitcoin, 2013.11-2017.12, Performance in rising/falling markets, transaction costs excluded>

This chart shows you how important it is to invest in rising markets only.

If you had invested only in a rising market, meaning when the price was above the 5 days moving average, you could have made 0.74% in a day, or a staggeringly high 46,579.3% in just 4 years! However, if you had invested in a falling market only, you would have lost 79.9%.

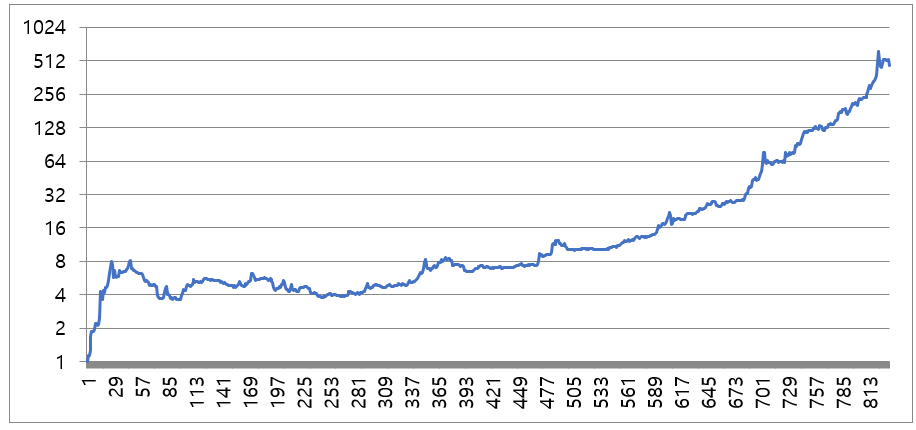

We will also show you the results on two charts.

<2013.11-2017.12, Bitcoin, Investing in a Rising market using the 5 days moving average, transaction costs excluded>

<2013.11-2017.12, Bitcoin, Investing in a Falling market using the 5 days moving average, transaction costs excluded>

You can see again that investing in a rising market would have made a lot of money, while investing in a falling market was…not a great idea.

If you use the 3,10 or the 20 days moving average, the results are quite similar.

Obviously, the exact return, MDD, win ratio and profit-loss ratios are differing, but the message is very clear: Investing in a rising market is wise, investing in a falling market is pretty stupid.

Unfortunately, you could not have earned 46,579% in real life, as transaction costs were excluded from the calculations.

However, we believe the numbers and the charts were enough to deliver our message. Actually, the win ratio of the ‘rising market’ is not that much higher than the win ratio of the ‘falling market.” However, the profit-loss ratio was much, much higher!

This means in a rising market, you win big if you win, and you lose small if you lose. The opposite happens in a falling market.

(Continues)

TAKE MY 100% VOTE! I started reading your gazua cryptocurrency strategy book today.

Yeah!!! G A Z U A!!!

Awesome! I am also interested in quantitatively approaching the cryptocurrency market.

Which trading platform do you use and why?

I use Korbit. There are currently three major Korean exchanges which provide open API: Korbit, Coinone and Bithumb. Korbit is the most stable among these three, I believe.

Would you recommend me any trading platform I can use in US?

I am not quite sure which exchanges are usable in the United States, but as a rule of thumb, it pays to use the most liquid exchanges(high volume). You can find these data on www.coinmarketcap.com.

Welcome to steemit!

I'm a big fan of you! Actually, I am reading your book.

My two articles will help you.

스팀잇에 올리면 안되는 글 https://steemit.com/kr/@nand/do-not-write-these-things-on-steemit

마크다운 총정리 https://steemit.com/kr/@nand/markdown

Thank you for providing me with these helpful articles. Copyright won't be an issue, as 1. I am one of the author 2. I told my co-author about it 3. My publisher liked my facebook post about this. Some global promotion won't hurt sales numbers, I guess.

이 글 저작권에 대해서 뭐라고 한건 아니었고요. 앞으로의 활동에 도움이 될까 싶어서 남겼습니다. 감사합니다.

페북 글이랑 책이랑 잘 읽고 있습니다. 많은 도움이 됩니다.

Coins mentioned in post:

짝짝짝! 세계로 나가는 환국님 화이팅입니다~

오오오 공동저자님 오셨네요 영광입니다 ㅎ

우와 가즈아~~ 스팀잇에서도 좋은글 많이 올려주세요. 열심히 읽겠습니다.

누구신지 대충 알거 같아요 ㅋㅋㅋㅋㅋ