The Liquidity Network: An Excellent Blockchain-Based Solution For BlockChain-Based Payments And Exchange

Blockchain Payments And Exchange: The Drive for Perfection

A Look Into the Problems Plaguing Blockchain Driven Payments and Exchange.

Barely a decade after the inception of the blockchain, it has been widely acclaimed to be the one of the foremost innovations of the 21st century which truly stand the chance of revolutionizing almost all facets human existence and most importantly, matters dealing man's day to day financial interactions. To this end, the blockchain has been utilized as a medium of transfer of value between individuals as well as exchange usually from one cryptocurrency to the other. However, several limitations still exist that continue to prevent the blockchain from unleashing its full potential capability. Some of these limitations would be discussed in the following paragraphs.

Foremost among these limitations is a lack of scalability. This means that blockchains lack the capability of processing large numbers of transactions as may be put to it without becoming overly congested. For example Bitcoin processes about 7 transaction on the average per second while Ethereum can only process about 15 transactions per second only. These figures apparently are grossly inadequate for these blockchains who are being fed millions of transactions per second. The result of this inefficiency. Closely related then to this lack of scalability is time wastage hence an individual who would most likely wish to carry out a swift and fast transaction for obvious reasons would be held back by slow transactions speeds arising from this lack of scalability.

Another problem that plagues blockchain driven payments and exchange is high transaction costs. High transaction costs are also closely related to the lack of scalability. These transaction costs are one of the most active hurdles which has acted in preventing the wide use or frequent utilization of the blockchain to make payments or carry out exchanges. These high transaction fees also makes it unfeasible for individuals to send or receive small amounts. One cannot therefore truly call blockchain driven exchange or payment ideal if it will not support the payment of micro amounts or compel users to pay outrageous fees.

Furthermore, failing alternatives in off-chain hubs is one more problem which has so plagued blockchain payment and exchange. An off-chain hub is designed such that transactions are carried out off the chain and not on the blockchain, the motive being the decrease in computations which the blockchain would have to carry out. Hence the lesser the load, the more fast the blockchain and lower the transaaction fees. However, contemporary off-chain solution providers as seen in Raiden and Lightning Network have not really been able to solve any problem as they also require complex routing procedures which increase costs and drain computational power.

The Liquidity Network, A Revolution in Blockchain Driven Payments and Exchange.

The Liquidity Network is an innovative solution that has been built on the Ethereum blockchain and tailored to expertly and brilliant provide an excellent way to make payments and exchange via the blockchain. It is a Non Custodian( Does not hold user's funds) financial intermediary, exchange and payment platform that is both fast, secure, instant and easy to use. It ultimately aims to bring on board millions of individuals who have been locked out of the blockchain in order to enable them leverage the advantages of the blockchain therefore fostering mass adoption while also reducing transaction costs to a negligible minimum. The Liquidity Network also provides innovative advantages as epitomized by its simple design and routing, non-custodial blockchain swaps as well as instant channel establishment. The Liquidity Network Ecosystem is made up primarily of two main innovative components which both act through their respective capabilities to revolutionize the blockchain exchange and payment space, these are the "Liquidity Hub NO-CUST" and "REVIVE".

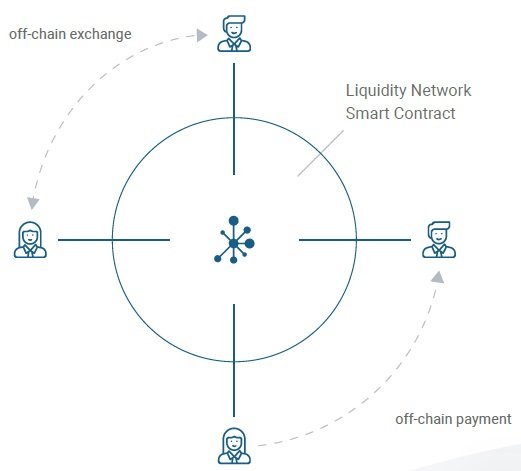

Affording Priceless Advantages Through Off Chain Settlement Made Possible By the Liquidity Network NO-CUST Hub

The Liquidity Network No-Cust Hub is one of the primary components of the Liquidity Ecosystem. NO-CUST allows users total freedom and control of funds through leveraging a decentralized ledger that is smart contract enabled as a means of dispute resolution. It enables the development Off Chain hubs which users can join at anytime in order to be able to transact with other members of such a hub without delays. Most importantly, these transactions are carried out off chain and so the various costs which arise with transactions carried out on-chain do not arise. As a result, with the Liquidity Hub No-Cust, users are presented a novel method of payment devoid of killer transaction fees. Off Chain hubs which are universal are also built such that funds are no longer locked just between two individuals, however, they are made available to all participants in a hub but is designed such that one participant cannot steal funds belonging to another.

The Liquidity Hub No-Cust therefore offers very many advantages prominent among which include the following:

- Lowering transaction fees to negligible amounts through off chain swaps.

- Enabling off-chain swaps.

- Ensuring that funds are not rigid locked.

- Simple design

- Free channel establishment.

It is also worthy of note to state that different Liquidity Network off-chain payment hubs can be interconnected to form a network of hubs. Thus individuals can still perform off-chain transactions across entirely different hubs.

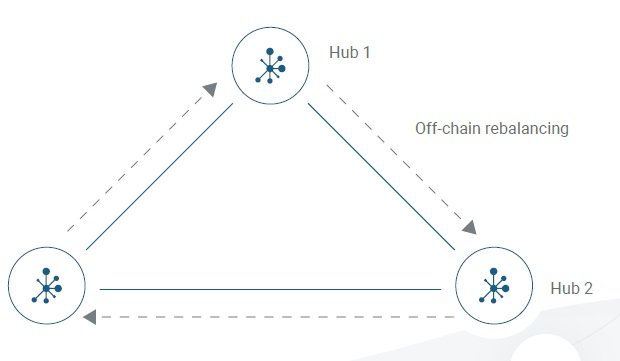

REVIVE: Supporting Off Chain Swaps By Enabling Off-Chain Re-Balancing of Payment Channels.

Below is to give a fair explanation to what payment channel rebalancing means;

Suppose you are node A and have channels with B and C with balances of 200 satoshis from each; you paid 200 sats to B but nothing yet to C. The current balances are(A,B) = (0,400)and(A,C) = (200,200). Say you buy things more frequently from B and would like to have credit in that channel and it happens that there is a channel between B and C. You will be able to use this channel as a bridge, sending 100 sats to C, as long as C sends 100 sats to B and B sends 100 sats to you. So the balance of the channels now is(A,B) = (100,300)and(A,C) = (100,100), which is satisfactory to you for now.

While decentralized ledgers requires the payment of mining fees to miners who advance the state of the global ledger, with the advent of off chain payment networks as made possible by the Liquidity NO-CUST, the need for the rebalancing of such payment channels off-chain has also arisen, a need which the REVIVE effectively satisfies.

A most important feature of the REVIVE is that it improves drastically, the scalability of blockchains as transactions are not made on-chain, but are made and balanced off-chain, thanks to REVIVE. Closely related to improved scalability is also reduced costs as on-chain transactions are quite expensive.

Understanding Off-Chain Settlement Types

There are basically two types of off-chain settlement models as also incorporated by the Liquidity Network. These are the 2 Party Payment Channels which typically involve only two users and the N-Party Payment Hub which have more than two users. These are explained in depth below:

(a) 2 Party Payment Channels

As already mentioned, the 2 Party Payment Channels is only made up of two users. It can be uni-directional where one party deposits collateral to guarantee the success of the off chain transaction. It could also be bi-directional where both parties have to deposit a collateral to guarantee the transaction, it is however flawed in that, the transaction can be invalidated by an illicit node on one of the channels which brings about risks of theft. The third type of 2 Party Payment Channel is Linked Payments used when the members of a hub are not directly connected, however, every member of such a hub must deposit collateral with the necessary factors being taken into cognizance. The last Channel type in this category is the 2 Party Payment Hub which transcends the idea of just two people interacting in a payment channel.

(b)N-Party Payment Hub

The N-Party Payment Hub is much more ideal than the 2 party payment channels as it is simpler and eradicates computational load that usually comes with their balancing. The N-Party Payment hub on the other hand makes transfers much more cheaper and encourages the transactions between many users hence it is not locked to only two users. Another very important aspect of the N-Party Payment hub is that computations are done on centralized servers which serve to drastically increase speeds while users hold their funds guaranteeing security.

The Benefits of Leveraging a Super Combo of Decentralized Private Key Solutions and Centralized Computing.

It is only natural that various solutions or products have their own strengths and weaknesses. A strength that a particular solution possesses might be a weakness to another solution. What happens then when two solutions are are made to complement each other such that the weaknesses that one solution possesses are covered up by the strengths of the other? Absolute Excellence!

The foregoing analogy perfectly explains the point under consideration. The Liquidity Network has employed the use of a super combo of the ability of users holding their own funds in a decentralized manner while computations are done centrally. In this way, the user's funds are kept very safe and secure with decentralized means and hence such decentralized means does not offer the luxury of fast computational ability, centralized systems are only used for computation in an ultra fast manner hence such centralized means cannot offer the trustless security of decentralized solutions. The result of this ingenious solution is low set up and maintenance costs for the various Liquidity Network hubs which are also made immune to blockchain congestion thanks to blazing fast centralized computing allowing for millions of transactions per second by millions of users per hub.

The Liquidity Exchange, An Illustration of The Liquidity Network's Prowess.

The Liquidity Exchange is one of the first products built atop the Liquidity Network and perfectly conveys the true sense of what could could be achieved with the Liquidity Network. The Liquidity Exchange is a non custodial (does not hold user funds) exchange. Through the instrumentality of the Liquidity Network, the Liquidity Exchange is able to perform atomic swaps off-chain. The result is an exchange that is immune to congestion which more often than not leads to scalability issues resulting in high fees.

The ability to carry out off-chain swaps therefore removes high transaction costs associated with on-chain transactions. The ability to scale this hurdle means a lot hence high transaction costs is one of the foremost problems that plague current exchanges and keep away otherwise willing adopters.

One more prowess of the Liquidity exchange made possible by the Liquidity Network which it is built on is the fact that off chain swaps are instantaneous and can reach the speeds of traditional centralized exchanges while being able to operate at considerable stable levels despite blockchain congestion.

The foregoing therefore shows clearly what can be achieved with the innovative Liquidity Network. With various use cases spanning many areas, a lot can be achieved by leveraging the advantages being made available by the Liquidity Network.

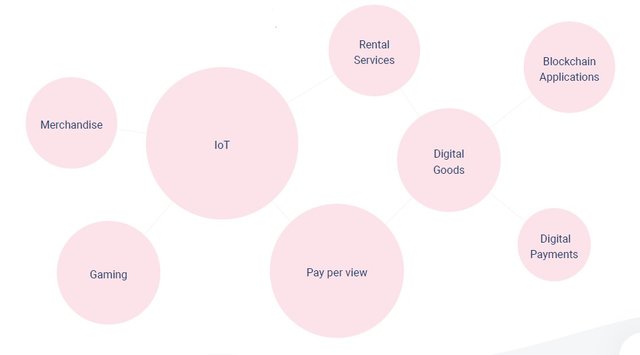

Applications and Use Cases

The Liquidity Network as a concept which seeks to improve blockchain payments and exchange has a wide variety of applications and use cases spanning very many fields including but not limited to Transfer of Value, The Internet of Things, Gaming, Blockchain Applications etc. However, i will highlight just a few of these use cases.

1. Application: Airdrops

Airdrops are very important for the building and development of various blockchain based projects. The Liquidity Network as opposed to contemporary inadequate solutions can carry out airdrops without making users submit their private keys or holding unto user's private keys. Better still, hence Liquidity Network's transactions are largely made to be coveniently off-chain, issues of blockchain congestion do not arise.

Use Case

Joromi & Co after months of developing CodeX, a blockchain game, decided to carry out an airdrop of their token in order to help potential users make use of their product. However, they could not find suitable means of carrying out their airdrop with the means they were exposed to as it all required using a custodian which will put user's private keys at risk and the fact that if they had to send the token to the millions of participants on-chain, it could take forever taking into account the congestion it could cause and the off the roof transaction fees they would have to pay. However, with the discovery of the Liquidity Network, Joromi & Co have been able to carry out their airdrop to their millions of users at virtually no transaction costs, without a custodian, instantly and fast, and without having to deal with the risks of potential private key leakages.

2. Application: Blockchain Gaming

Gaming is one of mankind's foremost recreational activity. However, gaming on the blockchain has had to deal with a lot of difficulties because of various problems foremost among which is a lack of scalability. In 2017, CryptoKitties literally paralyzed the Ethereum blockchain because of the influx of a lot users(which ordinarily should be a positive thing). Ethereum could not handle such and thus there was a hike in transaction fees. With the Liquidity Network however, hence most transactions would be processed off-chain, scalability which is necessary for games is achieved and thus a good gaming experience guaranteed.

Use Case

Joromi and Co developed their blockchain game BuzzX. However, with an estimated total users of more than a million, they were at a loss on which platform that could handle their game flawlessly as they had already learnt most contemporary solutions could not as evidenced by incidences such as Cryptokitties. However, with the discovery of the Liqudity Network, Joromi & Co have since launched BuzzX and it is doing pretty well in handling its millions of users flawlessly.

3. Application: Blockchain Payments

Blockchain payments are central to the functioning of the blockchain. This is because for one to leverage the advantages of the blockchain through one product or the other, there are usually some payments which have to be made. However, with high transaction fees, not many are incentivized to make use of the blockchain thereby preventing mass adoption. The story is sure to change with the Liquidity network as fees are minimized and micro payments made possible.

Use Case

<David operated a clothing store and decided to incorporate cryptocurrency payments through the blockchain. However, such payments required fees which even if settled by customers would leave him operating at a loss and moreover, some payments were what would be considered micro payments and so it did not make sense having to pay fees on them. With the Liquidity Network however, David has finally been able to incorporate blockchain payments in his store even with the ability to handle micro payments without having to operate at a loss as a result of fees.

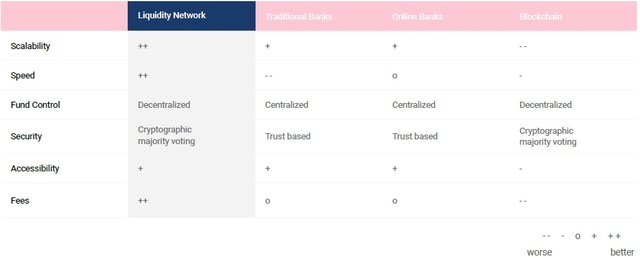

Visuals of the Liquidity Network Advantage And Superiority.

It is now very apparent that the Liquidity Network towers above current solutions as regards blockchain payments and exchange. The figures below shows just how much it does.

Figure 1: The Liquidity Network and Other Payment Solutions

The table above shows how the Liquidity network beats other platforms that offer payment solutions across various indices.

Figure 2: The Liquidity Network and Other Off-Chain Solutions

Aside the Liquidity Network, there are other platforms that offer Off-Chain Payment Solutions like Raiden, Lightning Network and COMIT, the Liquidity Network however beats them all as shown above and most importantly offers cost-effective simple routing.

Figure 3: The Liquidity Exchange and Other Exchanges

As shown above, from all the top exchanges, the Liquidity Exchange is the only one that is blockhain congestion resilient. It is this resilience that brings forth other advantages like scalability and minimal fees which are necessary for the proper functioning of an exchange.

The comparisons above between the Liqudity Network and other platforms in payment, off-chain and exchange solutions goes to show that the Liquidity network is actually the best out there, a solution that has attained excellence on its quest for perfection.

The LQD TOKEN

The LQD token is the Liquidity Network's token. However, unlike other solutions, the token would only be used for auxiliary services as an access token. The LQD would then not be needed in everyday usage of the Liquidity Network but would rather only be needed for premium features which a user may pay to access.

Conclusion

As evidenced by all the foregoing, the Liquidity Network has produced a standard that has caught up with excellence in the pursuit of perfection for blockchain payments and exchange. It only gets more interesting as the Liquidity network has been able to solve the problems plaguing contemporary solutions through its off-chain solution made possible by the NO-CUST and REVIVE solutions. This ability to effectively process transactions off-chain has brought about much needed scalability and removed killer transaction fees, the result which is excellence for blockchain payment and exchange.

MY VIDEO ON LIQUIDITY NETWORK

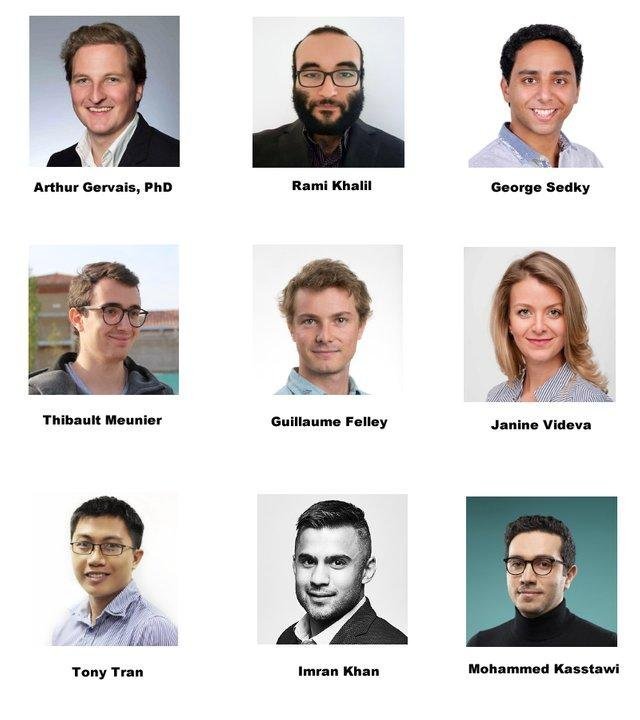

The Team

The Liquidity Network Team is made up of experienced professionals in blockchain solutions. Their Product truly speaks for them.

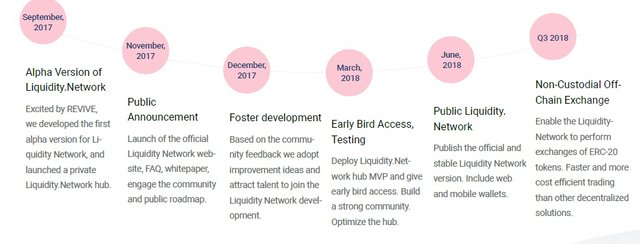

The Roadmap

More Information & Resources:

- Liquidity Network Website

- Liquidity Network Wallet

- Liquidity Network WhitePaper

- Liquidity Network NOCUST Paper

- Liquidity Network REVIVE Paper

- Liquidity Network Apple App Store (IOS)

- Liquidity Network Google Play Store (Android)

- Liquidity Network Telegram Group

- Liquidity Network Telegram Announcement

- Liquidity Network Twitter

- Liquidity Network Github

- Liquidity Network Blog

My tweet: https://twitter.com/Blezd_ben01/status/1083160923207057408

lqd2019

lqdtwitter2019

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Thank you so much for sharing this amazing post with us!

Have you heard about Partiko? It’s a really convenient mobile app for Steem! With Partiko, you can easily see what’s going on in the Steem community, make posts and comments (no beneficiary cut forever!), and always stayed connected with your followers via push notification!

Partiko also rewards you with Partiko Points (3000 Partiko Point bonus when you first use it!), and Partiko Points can be converted into Steem tokens. You can earn Partiko Points easily by making posts and comments using Partiko.

We also noticed that your Steem Power is low. We will be very happy to delegate 15 Steem Power to you once you have made a post using Partiko! With more Steem Power, you can make more posts and comments, and earn more rewards!

If that all sounds interesting, you can:

Thank you so much for reading this message!

Congratulations @blessedben! You received a personal award!

Click here to view your Board