Deep Academic Study of ICO Returns By Boston College

ICO theme has reached the radars of academic science. In late May, two researchers from Carroll School of Management, of Boston College, Hugo Benedetti and Leonard Kostovetsky, have published a study titled "Digital Tulips? Returns to Investors in Initial Coin Offerings".

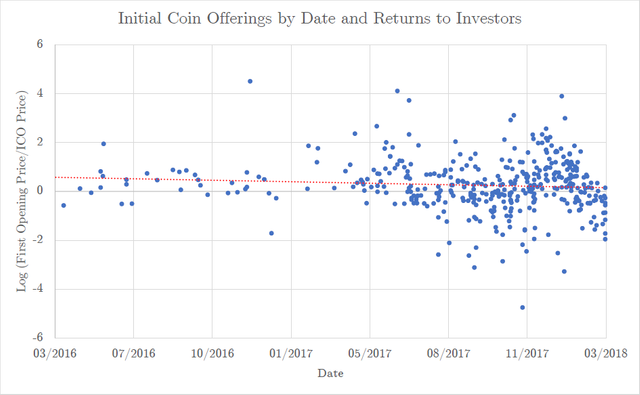

The paper is good for many reasons, one of them is its comprehensiveness — they have studied a dataset of 4,003 token placements with total funds collected of $12bn. Key conclusions show that the ICO segment was extremely profitable for investors, namely (i) generated an average returns of 179% from the ICO price to the first day’s opening market price, over a holding period that averaged just 16 days; (ii) given an adjustment and imputing returns of -100% to ICOs that don’t list their tokens within 60 days, the representative ICO investor still earns 82%; and (iii) after trading begins, tokens continue to appreciate in price, generating average buy-and hold abnormal returns of 48% in the first 30 trading days.

The paper is a strongly recommended read. Besides the basic analysis of returns, it contains a good study of media and smm activity in connection with the end-result, which is definitely something to look into for every ICO campaign manager and project founder.

You can contact me via