ICOs inflated the bubble, and they will burst it

Do you want to know the date and time when the bubble bursts? Or find out how much the capitalization of the cryptocurrency market will increase before this happens? You can find answers to all these questions in the publications of other authors. I, unlike them, suffered a fiasco when I last tried to buy a «time machine.»

However, I know for sure that, in the market right now, an economic bubble is blown, which can burst in five years, or perhaps even in five minutes. I know the reasons for why this happens, and I know how I will get out of this whole situation as a winner.

The economic bubble is a phenomenon whereby the rush demand for a specific product, as a consequence, entails a rapid price increase, which, in turn, provokes a further growth in demand. This cycle literally «inflates» the price, hence the name bubble.

Enough of the introductions... let’s move on to the market.

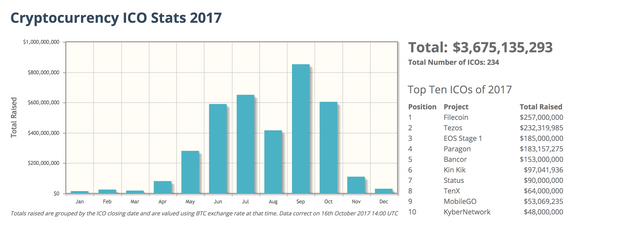

The bubble in the cryptocurrency market began to be formed at the beginning of 2017, together with the appearance of new altcoins, which are mass issued on the Ethereum blockchain. Their initial distribution occurred through the ICO. Total through the ICO was attracted ~ $3,675,135,293 according to the data of Coinschedule.

For most ICOs, according to the roadmap, the release of the finished product is scheduled for approximately spring-summer 2018. I hope that you understand that more than 90% of them will not show their investors any product. Do not be naive enough to think otherwise. We already experienced this in the dot.com era.

«It is an established fact that ninety percent of startups fail. And it should also be an established fact that 90 percent of these ERC20s on CoinMarketCap are going to go to zero.» Vitalik Buterin.

Perhaps you will say that ~ $ 3,675,135,293 of the total capitalization of the cryptocurrency market at $622,979,809,520 is a drop in the ocean. I want to note that $3 billion is ICO prices, and since that time their capitalization has significantly increased. For example, the capitalization of IOTA is $14 billion, Cardano 12 billion, EOS 6.5 blllion, Populous 1.7 billion, BitConnect 1.7 billion, etc.

After that, Tezos, who simply took $200,000,000 and did not release the token on the exchange, does not seem so dangerous to the market, does it?

What will happen when investors realize that the product they have been waiting for so long has not been developed, and most of the news has been false and only inflated the bubble? Bears will come to the market, panic sales will begin, the bubble will burst, most of the Altсoins will depreciate forever, and only the strongest will survive, which will have high fundamental indicators.

Coins with such indicators are worth buying. As a rule, their capitalization is underestimated compared to others on the market, so their fall will be milder, and they will probably survive after the market collapse.

Think why the capitalization of Civic or Storj, Monaco is ten times lower than the IOTA?

Conclusion

I have already started to gradually withdraw most of my investments, while, in my investment portfolio, I do not keep a coin without any product. I will use the profit to buy during panic sales, and I plan to use my time for analysis of projects that will survive the collapse I will buy their assets without slowing down when all others will sell.

This strategy is solely the opinion of the author. Although I have made some serious profits doing this before on the market, there is no guarantees this will work in the future.

Do you liked the article? Join our chat room in Discord, about a cryptocurrency investment & blockchain education.

I agree with you, the meteoric rise of cryptos this year will be followed by a winding down as people realize that the tech is in its early stages. Personally there are assets in my portfolio that I will not sell not matter what, simply because I can't time the market and I'd rather hold them regardless. They are a few select projects that as you mentioned have a product and potential to endure the bear market, whenever it may come.

I have already started and I plan to withdraw about 60-70% of coins by the end of the year. The fact is that I have already received over profits for this year, now it seems to me that this is the most correct decision. Maybe I'm wrong.

Too many people talk about Bitcoin, which should not talk about it. In the local absolutely stupid national show for old maidens talk about crypto-currencies, it shocked me. My friends who are not the best Internet users or financiers began ask me for advice about how to buy bitcoins. All this in addition served as a signal for me.

This is one of the reasons why I do not sell all 100% right now.