What’s the big deal with blockchains?

In early 2000, members of the band Metallica heard a demo of their song "I Disappear" on the radio. The problem was that the song wasn't scheduled to be officially released until later that year to coincide with the "Mission: Impossible II" movie soundtrack. The source of the leaked track was traced back to the then popular Napster peer-to-peer (P2P) file-sharing network.

In federal district court and in a Senate Judiciary Committee hearing, Metallica argued that Napster was illegally enabling users to exchange copyrighted MP3 files. Napster was forced to search through its system and remove all copyrighted songs by Metallica.

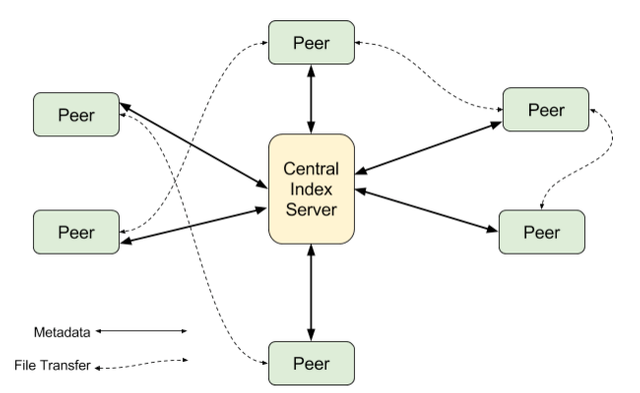

Shutting down infringing files and eventually Napster itself was possible due to Napster's underlying architecture. Although it enabled P2P file sharing over a distributed network, there was a central index server that Napster clients used to search for files and locate peers that had them.

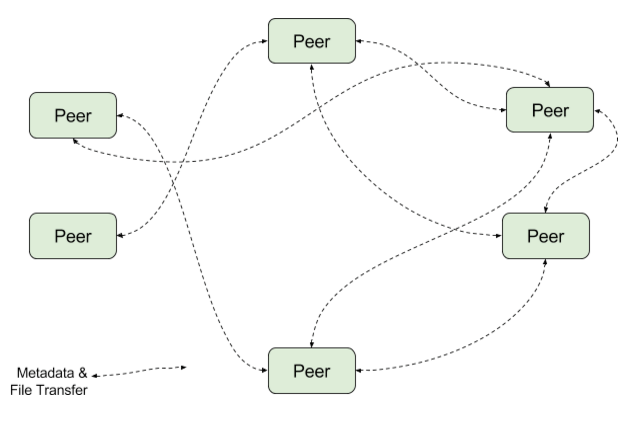

Lesson learned. It didn't take long for other P2P file sharing networks to emerge without the vulnerability of a centralized server. For example, the BitTorrent protocol distributes files and indexes among peers and trackers making it effectively impossible to shut down. Legal debates aside, BitTorrent style P2P networks were well suited for distributing large files. Whereas very popular resources tend to slow down centralized distribution services and even content delivery networks (CDNs), with BitTorrent the more popular the file is the faster it downloads – because more people are pitching in.

Large files such as Linux distributions and World of Warcraft content updates are routinely distributed to huge numbers of people with ease using P2P protocols.

Enter Bitcoin

"Governments are good at cutting off the heads of a centrally controlled network like Napster, but pure P2P networks like Gnutella and Tor seem to be holding their own." -- Satoshi Nakamoto, November 2008 (The Cryptography Mailing List)

If decentralization works so well for distributing large files, what else could we decentralize? How about money?

Before Bitcoin, conducting monetary transactions between unknown participants relied on trusted intermediaries. Intermediaries such as banks and financial service providers such as Paypal or Western Union for transacting “real” (fiat) currencies. Of course, the maintainers of World of Warcraft and Second Life issued “virtual” in-game currencies, but you couldn’t use them to buy a cup of coffee in the real world.

Since its modest beginnings in 2009, Bitcoin has demonstrated the ability to conduct transactions on a distributed network without relying on such trusted intermediaries. In my opinion, what makes decentralization a Good Thing is reduction in friction and cost, resulting in increased transactional efficiencies.

Blockchain

These days it’s hard to get through a day without hearing or talking about the promise of blockchain applications. Technologies behind blockchains (distributed databases, strong asymmetric encryption, P2P networks plus some clever game theory) have been around for quite some time. However it's just in the last several years that they've all come together in Bitcoin, the first and arguably largest blockchain application. Startups and established enterprise players across a variety of industries have enthusiastically rushed to stake a claim.In addition to the elegant technology behind distributed blockchain applications, there is a solid business proposition to be made. With Bitcoin having successfully demonstrated the decentralization of money, it becomes feasible to consider that all kinds of other transactions can also be decentralized on blockchains with similar benefits. Decentralized applications are being developed on blockchains for tracking the provenance of diamonds, simplifying interoperability of electronic health records, adding IoT smarts to the power grid and disrupting a range of industries with these other fascinating use cases.

Businesses, particularly financial institutions, treat such applications as a combination of threat and potential growth opportunity.

Technologists and business decision makers alike are responding with equal doses of sound planning and breathless optimism around this still nascent technology. Implementations appear in different forms and in different levels of maturity.

As a tech optimist, I see a future in which traditional fee-charging intermediaries and service providers may be threatened, but immense new opportunities present themselves. We’re likely to see much more prolific reduced fee (or no fee) P2P transactions without artificial intermediaries and gatekeepers.

Stay tuned..

Excellent

Congratulations @fsiddiqi! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @fsiddiqi! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!