You are viewing a single comment's thread from:

RE: Are people fleeing BitConnect?

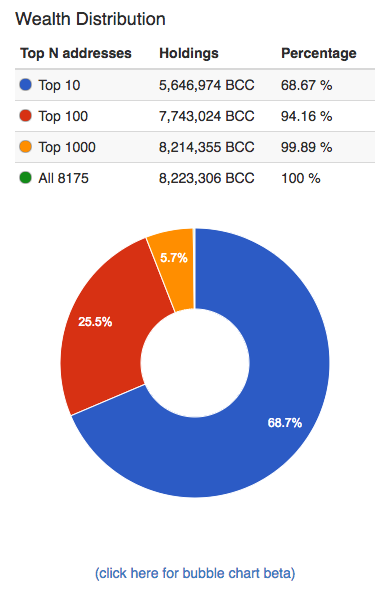

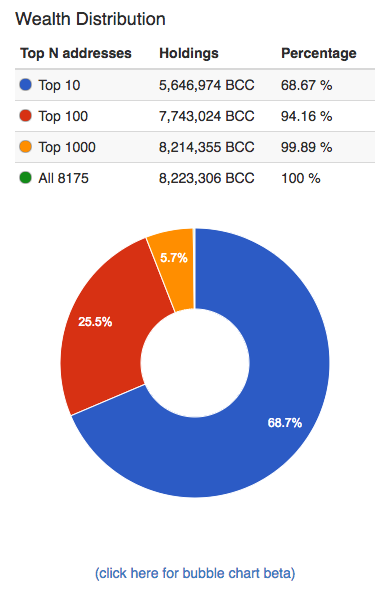

8,175 people the next morning. Updated as an easy place to keep track of the data...

8,175 people the next morning. Updated as an easy place to keep track of the data...

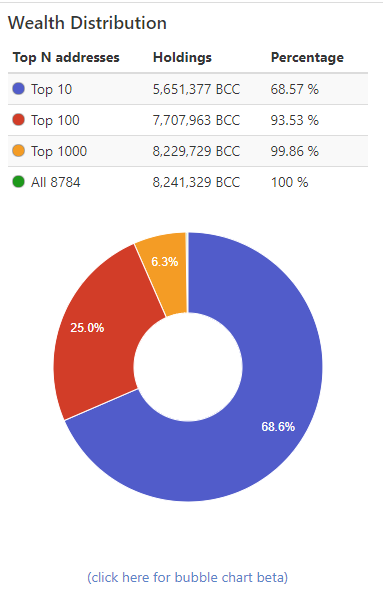

Almost all the addresses have funds again. Looks like they've bumped some funds from out of the top 100 to the little wallets. We might expect that this circulation is necessary for fictitious price pumping with matching blockchain records.

Also, is there a legitimate reason to use wallets like this? For nearly 70% of all smaller wallets to have balances blink in and out of existence over a day or two is hard to believe. The only reason for and method of liquidation would be to trade to BTC (I.E. BCC crashes while BTC soars, but they are very correlated). Why would 70% of the small cohort liquidate, and the others not move in the same direction in that case. Is this "group" supposedly just really smart/dumb?

So I spent a bunch of time on both the BCC and the bitcoin blockchain. While I wanted to write up an article explaining it all; I have not been totally able to figure it out; and quite honestly, spent time and effort on more worthy pursuits. But when I think is going on is massive moving of funds to confuse people. Imagine the following Scenario. We want to create a scam, yet hide what we are doing. (You have to try to think like an enemey...) Well They could create 5 (picking this number out of the air) fake accounts for every one real account. You could pay out small amounts of the money from a fake account to a fake account every day based on the interest rate. (This would make the fake accounts look more real.) You could also sweep all these fake interest payments back into any other sort of account. You could do this so that anyone who tried to look at all of your transactions gets really confused (it is working) and anyone who wants to "verify their transaction" can still do so. I think this is what they are in fact doing. It is a lot like a bitcoin washer or Etherium washer. i think they do this on both the BTC and BCC blockchains. While there is a cost (transaction fees) keeping everyone in the dark helps them perpetrate this fraud. I was getting so I was starting to figure out which transaction was which, but then I gave up moved on.

On the BTC chain wallets that blinked into and out of existence were either. A) just there to confuse people or b) daily interest payments. In the Bitcoin blockchain I believe they send out daily interest payments to a bitcoin address every day. (reguardless of wether people "sell" BCC.) then if they people "sell" BCC they show you the bitcoin address and allow you to take out the money. If you "reinvest" they send that money back into the pool. That said everyone does not go to the website every day, so these payments can site there for a period of time and then several can be swept up at once -as they are sold or reinvested. I was exploring the blockchain, inspecting time stamps and using You tube videos and transaction confirmation codes to verify real world withdrawls. There was a logic and I think I was following a fair amount of it. However, I still got a lot of questions I did not have good answers for. Another reason for a 70% of small cohort to liquidate could be ending of the loans. What cohort you are in is dependent on how many coins you have. How many coins you have is dependent on 1) how much you invested and 2) when you invested. People who invest early have a lot more and people who invested more money have a lot more. Small investers (~$100 USD) at the time of the starting would get thier money back at the end of 300 days. While the blockchain shows transactions from 12/26/2016 I see an uptick in transaction around 1-26. This could represent the first big influx of real small ($100) investors. With BCC at $0.25 they would have gotten 400BCC each. Now 300 days later this $100 would be about 0.5 BCC. (or the 100 compounded into 2,000 would be 10) and the number of BCC that should be ascribed to the account would be about 97% less.

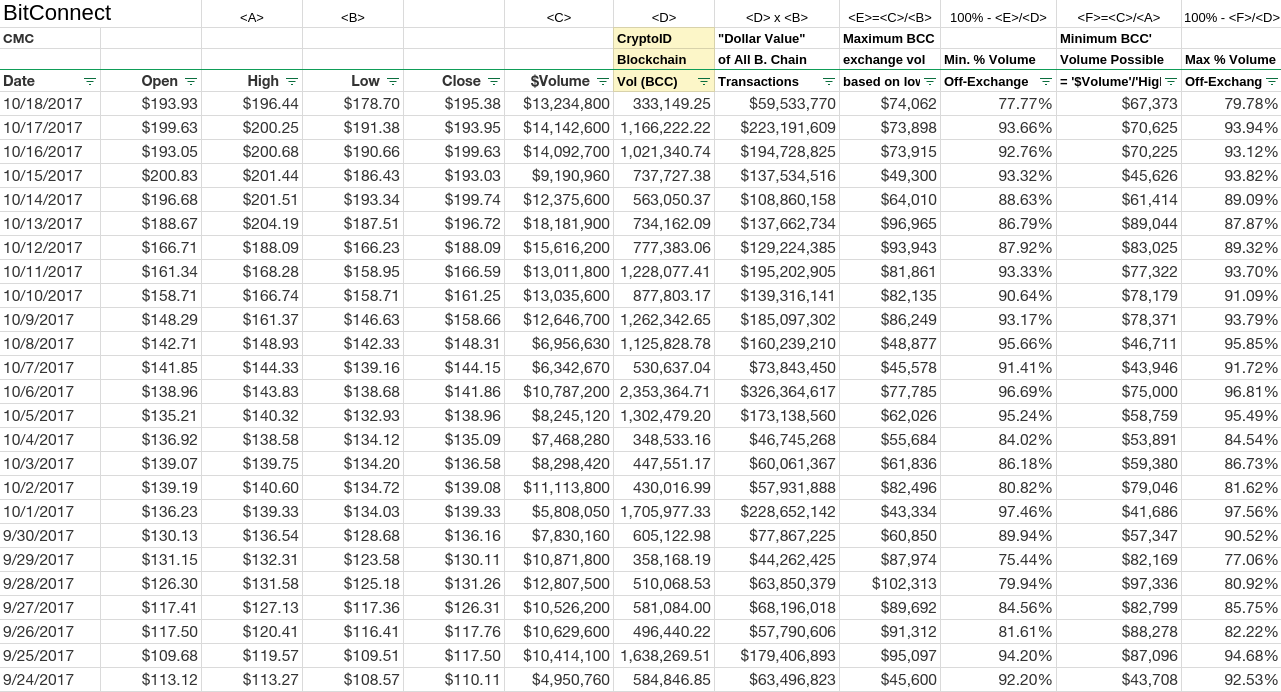

Also, I don't know if you've noticed this already, or if I'm missing something. I started comparing Coinmarketcap data (in $USD) to the block chain data on CryptoID (in BCC) by converting with an appropriate exchange rate. It looks like about 80% of daily volume is done off of any exchanges. Here is my preliminary analysis:

Also, I noted that the following days within the past year did not have enough block chain transaction volume for the minimum possible exchange transaction volume:

Google Sheet Link: http://bit.ly/2xSRblr

CMC data: https://coinmarketcap.com/currencies/bitconnect/historical-data/

CryptoID data: https://chainz.cryptoid.info/bcc/#!overview

Am I missing something here?

I read somewhere on the internet that BitConnect "pressured" Coin Market cap into listing its own exchange. If you look at volume on Coin Market Cap by exchange.

https://coinmarketcap.com/currencies/bitconnect/#markets

you will see 94% of all the volume is on BCC. Lets talk about gorillas? Where does an 800 pound gorilla sit? Wherever he wants! Since, 94% of the volume is on the BCC exchange and Bitconnect directly and indirectly controls the BCC exchange it is not exactly a "free" market. BCC is that 800 pound gorilla. Since 94% of the volume is on that market, they can control the volume and prices. So that basically means they can send whatever data they want to coinmarketcap.

I would also share I got a love hate relationship with coin market cap. I love the data they have it is very useful and all put together, I think it is one of the best sources of data around right now. If you know of a better one please share. That said, their data is not exactly clean, honest or filtered. Basically, a lot of data is crap. I detailed that here... https://steemit.com/ico/@cryptick/how-to-fake-a-top-100-alt-coin-chart

and also here...

https://steemit.com/bitconnect/@cryptick/bitconnect-scam-inside-the-bitconnect-trading-bot-post-2

In defense of coin market cap, it is not just data at one or two of the markets, it is also a massive amount of data at any (many), most? of the exchanges. You really have to look into it closely t see what it really says. I think coin market cap is probably just doing the best they can with what they get. Garbage in is garbage out. It is just many of the pump and dump coins and cons fake the data. They have bots artifically create whatever number and type of transactions they need to manufacture the volume of transactions they think would "look" good.

I mean just imagine for a minute Bitconnect is legitimate. And it only "sold" BCC tokens twice. One when a customer joined and then once when they left.

How many tokens would need to trade everyday?

See lets go with the 8,000 number of customers and assume they are all on a 6 month (180 day) investment plan and evenly spread out. 8,000 customers/180 days is 44 customers a day. If all of the customers had $1,400 each invested $61,000 of BCC would need to transact daily. If new customers joined at 8 am and old customers left at 11 am we would need two transaction. (If new customers bought directly from old customers we would only need one transaction.) That Means there would he $122,000 of BCC traded each day. Instead volume yesterday there is 15.4 million! This is flunking the smell test! All that volume is nonsense. If I told you I put 500 people in my car, you wouldn't believe me because any normal person knows a car holds about 6 and a clown car at the circus might hold 20! but there is no way it could hold 500. Well that is the kind of crazy numbers we are dealing with at the BCC volume. People who bought in to BCC aren't so good at basic math, so this is not a problem.

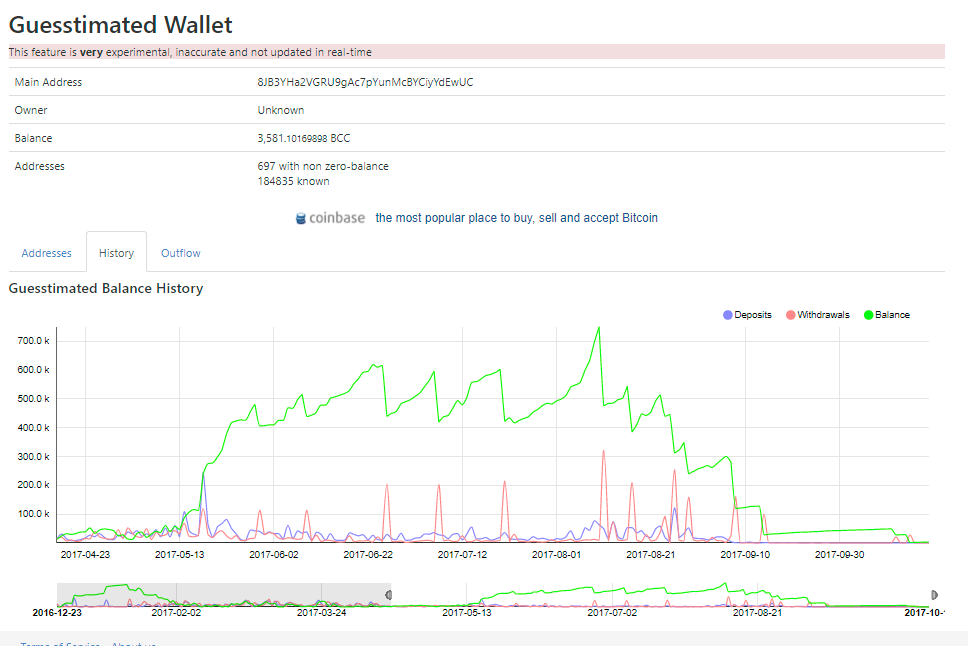

This is pretty interesting. Using the experimental wallet feature at CryptoID it appears that there are over 184,835 addresses it believes are associated to this wallet. I think the deposit pattern is consistent with it being used as a sinking fund to receive exchange transactions and drive up price. The sudden withdrawals are likely to prevent any wallets from getting too big/visible.

I think we may have been observing something similar (albeit at a different wallet) when you noted the reduction in total wallets with balances. Also, the distinction between wallets with and without balances in the image seems to confirm your reasoning in your article above: https://chainz.cryptoid.info/bcc/wallet.dws?28.htm

I don't think loan balances adequately explain the movement. Since, as you noted, there is a 300 day maturity period. I would expect that loans would mature on a rolling basis. The daily amount of loan liquidations in BCC is the the original loan BCC amount times the price ratio:

Eq 1: LoansPaidToday = VolumeLoansInBCC300DaysAgo X (Price300DaysAgo/PriceToday)

The percent change from a given days loan payouts should be close to:

Eq 2: LoansPaidToday / SUMxFrom1To300(VolumeLoansInBCCxDaysAgo)

Eq 2 should be less than 1% at around 0.34%( 1/300) , or even less given growing loan volume and increasing BCC price per the equations above.

The remainders not paid upon maturity {LoansPaidToday - VolumeLoansInBCC300DaysAgo} belong to Bitconnect, and could be collected in "sweeps" transactions to larger wallets. This could explain how the drawdown occurred, but does not explain the rapid repopulating of the wallets. Also, the change in addresses corresponds to movements in BCC/USD and BCC/BTC, which is consistent with a trading utilization(either fictional or real), but is inconsistent with fixed term debt instruments, whose operating characteristics are price agnostic.

I agree with your thinking here. When I first started to explore the BCC blockchain I was looking to do that. If the data in the BCC chain is honest. We should be able to see 1)the date every loan started. 2) approximate amount of every loan. 3) daily interest paid on every loan. From that we should also be able to check our figures with daily interest payments. (since these vary accross the loans day to day, -but should be consistent for the same day. (with the exception of you get more interest if you invest more). We would be able to know, when every loan was made. What interest is paid, if that interest is reinvested or paid out. We could conglomerate the data knowing every single customer and every single payment in and out. We could then predict the exact day it will blow up! I got frustrated and gave up before I got to that data. I think the data in the Bitcoin blockchain is a lot more "dependable." If you really want to bust this thing open I think we should look there. I think i could get to it, but it would take too much work. I don't have all the right tools, time effort. After I spent a couple of hours I started to notice things and then it started to make sense. Let me mention it here so you -and anyone else investigating knows to look for it. They purposefully complicate the data with false payments to confuse us. You have to find a few real payment, then go back and evaluate the other payments. By ID each one temporarily as real or fake and moving up and down the chain you can see the patterns. You can confirm what you are seeing Via BitConnect You tube Videos (This is the withdrawl transaction. This is this amount) and you can

then start to figure out other accounts. Generally, I saw about 5 fake transactions for every 1 real transaction. I believe every account has multiple addresses as well. (the account I was looking at had several "interest payments" but then they stopped for two weeks... appearing exactly two weeks previously. Anyway, good luck!