The U.S. Dollar Index and why you should learn about it - $DXY

What is the U.S. Dollar Index - Why is it important to Crypto?

The U.S. Dollar index is a way to measure the value of the U.S. dollar by comparing it to a basket of world currencies that are large trading partners with the United States of America.

this index is calculated by factoring in the exchange rates of six major world currencies the euro, Japanese yen, Canadian dollar, British pound, Swedish krona and Swiss franc. The euro holds the most weight versus the dollar in the index, constituting about 58% of the weighting followed by the yen with about 14%.

Read more: U.S. Dollar Index (USDX)

When something is priced in U.S. $ a correlation exists

Just like gold, other precious metals and commodities such as oil, wood, soybeans, which are subject to fluctuations in the value of the US dollar, bitcoin as well is priced in US dollars.

Cryptographic assets being relatively new, the strength of this correlation or rather the impact of USD fluctuations is not fully understood as we do not have the data to make a highly accurate assessment. As well, given the low supply and high demand of bitcoin, the skew is even larger.

However, the reason I view this as important to crypto traders is that since January when bitcoin was only $1200, the DXY or US Dollar index put in a top and entered a steep downtrend that is only recently seeing some reprieve and potentially ready for a correction to the upside.

Below are some charts of DXY and its current formations. I personally am taking a bullish stance on the USD as the FEDERAL RESERVE continues with their forecasted interest rate hike schedule, adamantly so. As the Federal Reserve continues to hike interest rates we should see the USD appreciate against the basket of currencies it is weighted against.

Daily

My anticipation is a bull flag forms here depending on the behaviour of other currencies and incoming economic data.

Weekly

Coming out of severely oversold conditions, re: RSI, Stoch RSI. Recaptured the 200 day moving average.

Monthly

Looks ready for another full stochastic cycle, notice the bullish cross of the 50 day moving average above the 200 day moving average.

Conclusion

I am not going to make a unilateral prediction that BITCOIN and the USD are always going to run inverse 100%, however, the prudent investor, trader, ill recognize the importance of the inverse trends that have occurred since January. So just like gold is affected by the value of the USD, i anticipate that bitcoin will be too if we observe a sharp reversal in the DXY basket.

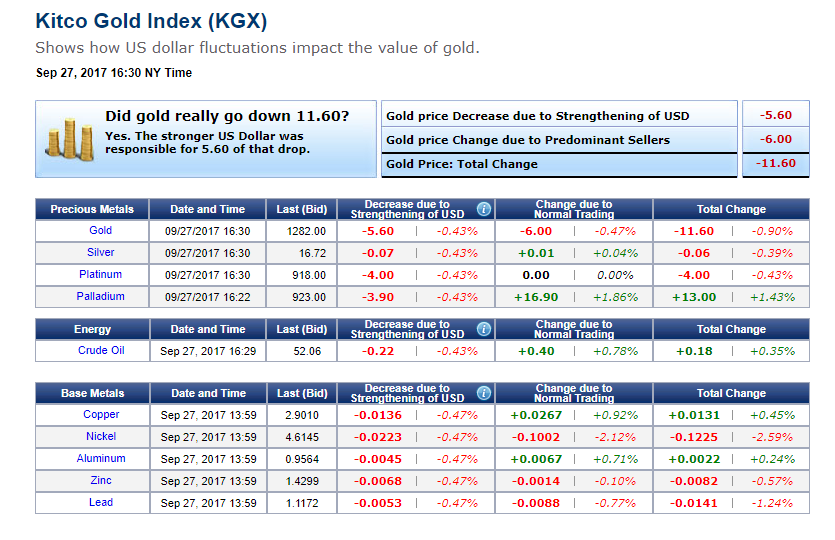

Kitco provides a service that informs how much gold is being affected by the value of the USD vs. Trading. The same can probably be assessed in bitcoin.

Check out the Kitco tool here for a deeper understanding of what affect the USD can have on a given commodity.

Previous Articles:

ETHUSD

Bitcoin

Follow at your own risk, Not a financial adviser, understand the risks associated with trading and investing. Manage your own Risk - in other words you could lose it all and I could give a fuck.

@satchmo

Bullish on the dollar. lol. ;)

On a serious note, couldn't you just buy tether? USDT, and hold that?

Crypto isn't the only thing one can trade LOL. Yes the USD is bullish, and why would i trade tether (fugazi) when i can hold USD's, buy an ETF, or trade options on it. Even better is to take advantage of the inverse correlation to gold. ;-)

So yes, reiterating my stance, very bullish on the USD & BANK Stock, BEARISH on GOLD and SILVER.

Fair enough. To each, his own, I guess. :)

Good luck to you, and good luck to me.

I love cryptocurrency articles , thanks for sharing

Thanks for the comment!

A great post with a useful information

The U.S. dollar has had its worst year in 31 years.

It is on a steep downward trajectory.

Central banks have perpetrated the largest Ponzi scheme in the history of humanity. Quantitative easing will destroy fiat currencies, paving the way for bitcoin.

can you not spam my articles. Secondly Crypto value is derived entirely from fiat. Good day.

Quantitative easing is over. Sigh. Should understand economics before you try and post about them ... to each their own I guess.

Apologies for spam though not sure why it is spam just because I disagree with you. Is there freedom of speech here on steemit or do I get flagged because I disagree?

Even though the U.S. Federal Reserved ended QE in late 2014, QE remains at all-time highs if you total QE flow from all the central banks (Bank of England, ECB, Bank of Japan, etc). This is why legendary investors such as Ed Seykota wrote Govopoly, Alan Greenspan has said "This will not end well" and veteran investor Jim Rogers in a recent interview warned another bear market is coming, and that it will be “horrendous, the worst": http://www.marketwatch.com/story/jim-rogers-says-etf-holders-will-get-mauled-by-the-worst-bear-market-ever-2017-09-21

It’s the level of debt across global economies that will be to blame.

Throw in bond legend Bill Gross's remarks about the house of cards central banks have created and you have a massive global sovereign debt bubble: https://dealbreaker.com/2017/07/bill-gross-quantitative-easing-means-we-cant-have-nice-things/

The world is interconnected so just because the U.S. Federal Reserve stopped QE in 2014, the sum total of QE is at all-time highs. This explains how central banks are now the majority holders in equities, an unprecedented situation. And the U.S. stock market being the tallest standing midget is the direct recipient of this QE flow thus U.S. markets continue to hit new highs.

Central banks have painted themselves into a corner. Yellen is attempting to normalize the balance sheet, but some of the brightest minds including those cited above argue it's too little, too late.

You can share your opinion without spamming your articls. Its hijacking. Secondly QE ended, EU is winding it down. More interesting and I dont think anyone realizes - when the Federal Reserve unwinds the assets bought during 08 -- their cash supply will go up greatly, debt can be paid down.

QE is still at record levels. European Central Bank claims they may start winding it down but so far, they continue to print at record levels. Same with Bank of Japan. Central bankers are politicians first and foremost and have an allegiance to the state, not the people. It is a lot of politico-blather that comes from the mouths of central banks.

If the Fed unwinds the assets bought since '08, we are talking many trillions of dollars. It will be a first in 5000 years of recorded human history if such burdensome debt is paid off. Never before has a government ever paid off such onerous debt. This is why the average lifetime of fiat currency is less than 40 years.

As Ed Seykota famously said, take a penny at the time of Christ and compound it at a nominal 2%/yr interest. You get 2.2 followed by 17 zeroes (2.2 x 10^17), or far more money than has ever existed. Governments and currencies fail, over and over again, because the same mistakes are made. In my discussions with Seykota, he agreed that blockchain technology may be the one great counterbalance to the coming collapse.

As for bitcoin deriving its value from fiat, there will be a dislocation at some point. When there is financial upheaval, the price of bitcoin has spiked. When Cyprus banks collapsed, bitcoin price spiked higher.

https://cointelegraph.com/news/heres-how-world-fiat-money-affects-bitcoin-price

The article concludes: So far there is no indication that fiat money influence Bitcoin price after all. Bitcoin has been developing on its own, disregarding international news and major currencies movement.

thank you