How To Profit From People's Tendency to OVER REACT! | Investing Psychology Series - Episode 3.

Hi guys, this is Episode 3 of my Investing Psychology Series. In this episode I want to talk about the concept of people over reacting when they get excited (market's are booming), and also when they get fearful (market's are crashing). Anyone who has been in the cryptocurrency market for even a month has seen proof that most people do not make decisions based on rationality and logic alone (if at all for some people), a lot of their decisions are emotionally-charged.

This tendency to over-react means that when you think a market bottom has occurred, it will probably go at least a bit lower! Same goes for when market's are booming, price will probably go higher than people would have expected just a short time ago because all the excitement makes people buy at all-time-highs after price has already rose a massive amount (not a great decision).

One thing to note is that over-reactions will always correct themselves. For instance, if people continually buy an asset at absurdly high prices it will eventually fall to a more suitable level. Or if people panic and sell an asset for way lower prices than it is worth, the prices will come back up a certain amount to a more reasonable price before then deciding where to go next. We have seen many corrections in the crypto market over the years and currently as I write this the correction that will occur is a bullish one. People have been mass panic selling and overreacting to pieces of news that, in my opinion, contain nothing of real substance.

So, why do people over-react to things like bearish news in the face of nothing in the real, long-term fundamentals changing? Well, I would suggest that it comes down to our most primal need for survival. When bad news comes out and everyone is reading that news confirming to each other that this could be bad, it's like a feedback loop that spirals out of control very easily and turns into the over-reaction I am talking about. The emotional, fight-or-flight part of the brain, the Amygdala, does not think about the percentage chance of a crash occurring, it either will occur 100% or it won't. As I have said it is a survival mechanism which would rather be wrong and lose you some money but save enough of your money to save your life than be right more times than not. This of course doesn't go well with investing profitably in the financial markets, because at one sign of a crash incoming you would sell everything you have, every time.

That explains to some extent why people panic sell, but why do people get so greedy and buy at all-time-highs? I believe the answer again can be explained by survival instincts. Eating as much food as you possibly could at once when you did come across food was a strategy of our ancestors to ensure their survival for longer periods of time in case they did not find any food for another long period of time. This plays into the idea of FOMO, the Fear of Missing Out, in that the inexperienced investor sees an asset rising like crazy and thinks "if I don't get in on this clear opportunity now I might not find another profitable opportunity for a while!" This of course hardly ever ends well, and even when it does is just very lucky rather than being a "correct" investing decision.

So, the lessons to take away from this episode are:

When you believe price has hit it's lowest based on looking at the charts, wait some more time for price to really show you whether it has stabilized or not. A good way of getting a feel for how much panic is still in the crypto market is to look at Social Media and places like Reddit to see how many inexperienced investors are still talking about "this is the end", "should I sell?", etc.

When you believe price has went as high as it will go, if it is a very emotionally-charged market like the crypto scene, it will probably go higher some more as it takes the inexperienced investors time to realize they have bought at the top of the trend. Selling when price has not yet hit the top is obviously not a really bad strategy, because price will most likely come down below where you sold even if you did not sell at the very top. So when it comes to selling at the top of bull moves, you can either take the safer approach and sell a bit early, or if you are a more high risk investor looking for more rewards, you can hold on a bit more before you sell in the knowledge that people love to over-react and over-pay for exciting financial assets like cryptos.

Well, that is it for the third episode of my Investing Psychology Series. If you have learned anything, have more to think about, or just agree with this post, then please up-vote and if you follow me I will follow you back! Thank you for taking the time to read such a long post as well.

Legal Disclaimer: I am not a financial advisor and so you should always do more research and think for yourself if you agree with the information I put out or not before making decisions based on anything I write in my blog posts.

As always, great article @investingtips. I am really enjoying this psychology series.

A couple of my thoughts:

Thanks man. I agree with all your points and here is my thoughts on each of them:

This is a great point, if you do your research and you KNOW the technology behind the crypto is innovative and the fundamentals are solid, rather than just relying on other people simply saying that they are, you will be in a much better position emotionally.

My thoughts are that, and they pretty much echo yours, only the people who put in amounts of money that they truly can lose without it affecting their lifestyle or ability to keep the electricity on will be able to weather longer term storms that have happened in the past in the crypto scene and i'm sure have happened in every type of market. Investing is for the long-term, not a get rich quick scheme!

Yeah man some people just don't have the nerve to withstand such fluctuations in price and volatility, for anyone who isn't sure whether they can, certainly don't invest in the crypto scene!

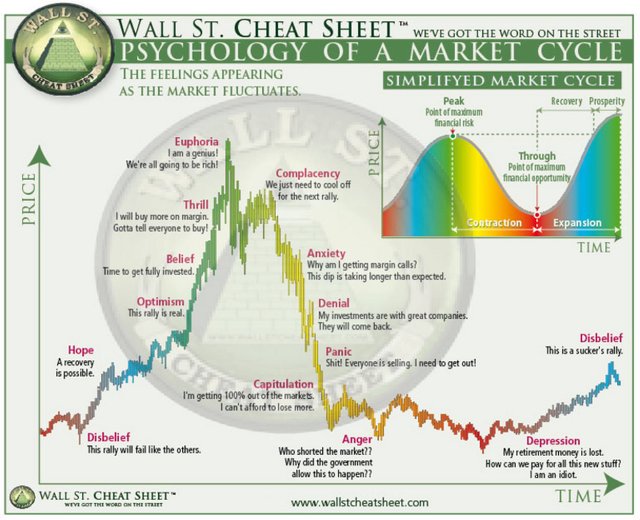

I present to you my favorite image of investing psychology.

Click here for a larger view.

Even though my post yesterday, I'm not convinced we are done with the selling since it still hasn't closed above the levels shown in the post. If it reaches the lower point of the longer term moving average again within the next few days, I suggest more buying.

Yeah man I love that image, it certainly matches up with the emotions we see in the crypto market. I just think the latter part of the image, where price never recovers beyond the high won't be accurate for solid cryptos that have a strong future, for shitcoins yes this image could be exactly what happens though!

BTC/USD has actually come strongly back into the expanding triangle I drew a few days ago (for now at least, 4hour candle hasn't closed inside yet) and so I think the recovery is in full flow now, will make a post to illustrate exactly what I mean.

I don't think that everyone now is panic selling. Instead, they sell to rebuy later on a lower price so that they have more coins in the end. However, the unexperienced investor are selling because they are afraid.

It's just crazy how news or a popular personality can affect the market.