Is Cloud Mining profitable or not ? (Ethereum example)

Hi Crypto Lovers,

before I start this post, I want to mention that I am in cloud mining myself and I did not lost the feeling that it could be profitable, but to be honest I have some fears. I want to write this article to give you a different view of somebody who is in cloud mining and payed for it - I am not a Code hunter. Most (close to all) my hashing power was bought by myself.

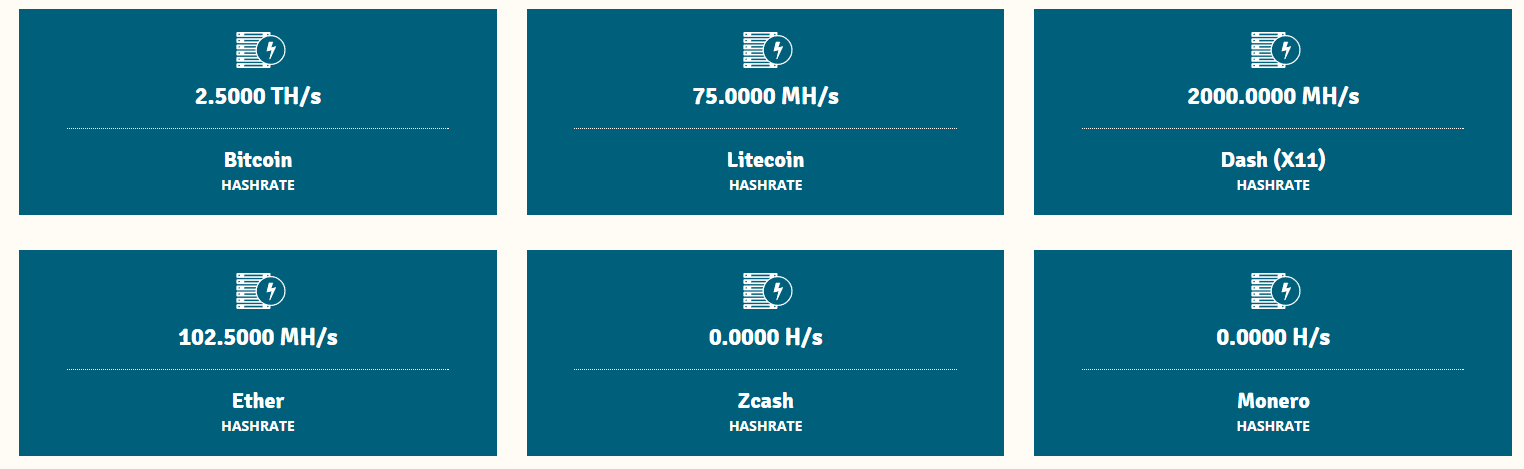

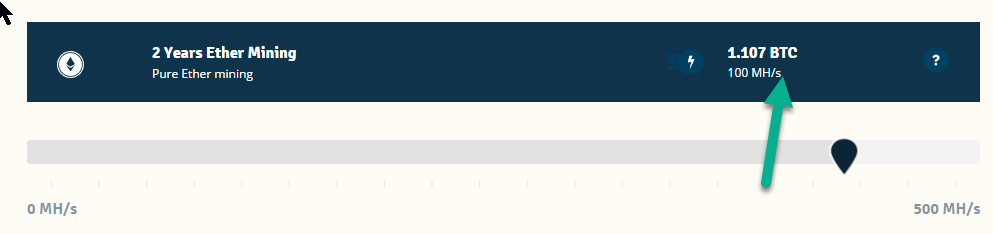

That's my Hashing power on Genesis Mining

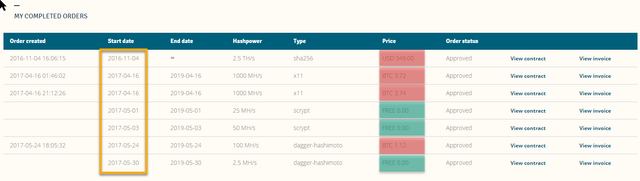

See the order details:

First lets's take a look at my really tiny SHA256 BTC Mining Operation I started in November 2016:

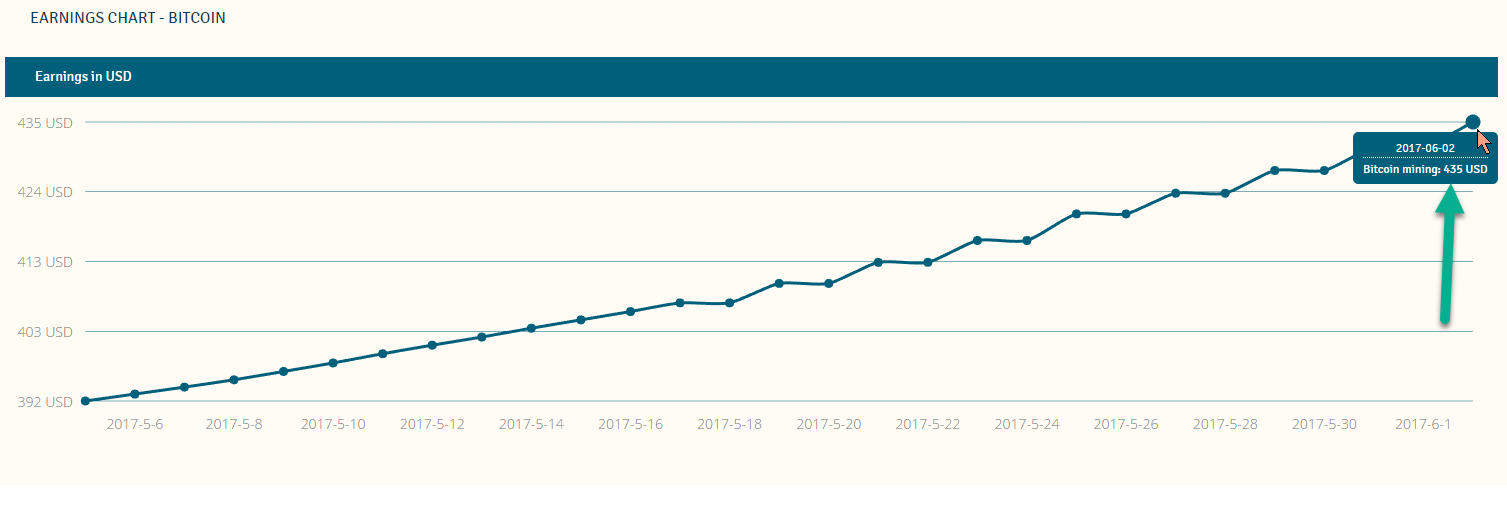

See the earning chart for this contract:

I payed 349 USD (that was the momentum I went into crypto) and till now this contract made 435 USD. So everything is good - in USD I am in profit ?!?

Am I really in profit ?

Let's take a look how much BTC we would have got on 6th of November 2016 for 349 USD:

The Price for 1 BTC was 705 USD - Wow - if I could go back to that time I would sell close to everything I own and would put everything into BTC. But back to the story. So for the 349 USD you would have got 0,495 Bitcoin. At a Price of 2500 USD/BTC you would be close to 900 USD in profit now with your holdings. In the Earnings Chart of Genesis it's in USD of the actual BTC price. So let's do the math, for 435 USD at a price of 2500 USD/BTC you get 0,174 BTC. Am I still in profit now ? OK the Contract will run way longer but what I want to focus you is keep your eyes open. You will see further down in this article that there are widespread mistakes a lot of people do while reading data.

As you already know, because you are already into cloud mining or you want to join cloud mining, it all depends on two factors. The Difficulty of the Network of the coin you mine and the price of the coin you mine (if you do the payouts in BTC).

Mistake Number 1 - Difficulty comparison

They compare the difficulty increases in Bitcoin with other Coins. They say: " Well if the Bitcoin Difficulty just increased by 120% in whole 2016 which was a bullish year, why should the difficulty do way more increase in the coin I do some mining ?

I can give you a direct answer - The BTC Network with a Hashrate of 5,668,546,478 GH/s is way further matured than other networks. It's easier and faster to double up the space of your garage than the space of your house ! You got what I am saying ?

A small local mechanical company can double up way easier and faster than for example some big global players. I think you got what I mean.

But what can I give you now to think about ?

A lot of people start the mining cause they are blinded by wrong data and even if they know they are blinded they get greedy and fire a lot of coins in to make that huge profit. Which brings us to Mistake Number two.

Mistake Number 2 - Don't be too optimistic concerning the difficulty increase

Most of the mining calculators even don't calculate the difficulty increase and give you 100 percent wrong results! But you know that and then comes guessing and gut feeling into play. How high will the difficulty go in this and this time period ?

Question should not be "How high will the difficulty go ?" The question should be " How high can I afford the difficulty to go?"

With this sight it's easier to decide whether you should jump on a contract or not. For Example let's take the Ether Mining contract, which is at this Bitcoin price really "cheap".

Let's take a whole look into Ether Cloud Mining

100 MH/s Ether Mining (Genesis Mining) costs 2799 USD for 2 years without any maintenance fees. If you pay in bitcoin that would be:

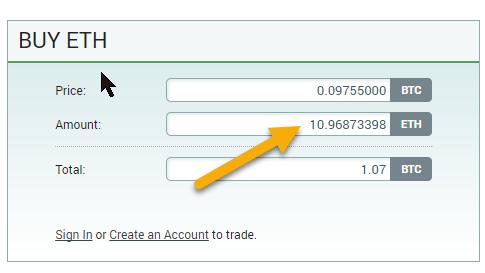

To do the math correct we must ask ourself first, how many ETH could I buy for 1.107 BTC, Oh I forgot of course you use a 3% dscount code, so the price will be 1,07 BTC and we need to ask how many ETH can I buy for 1,07 BTC.

Let's see on Poloniex:

To make the math easier. Let's say you could buy 11 ETH.

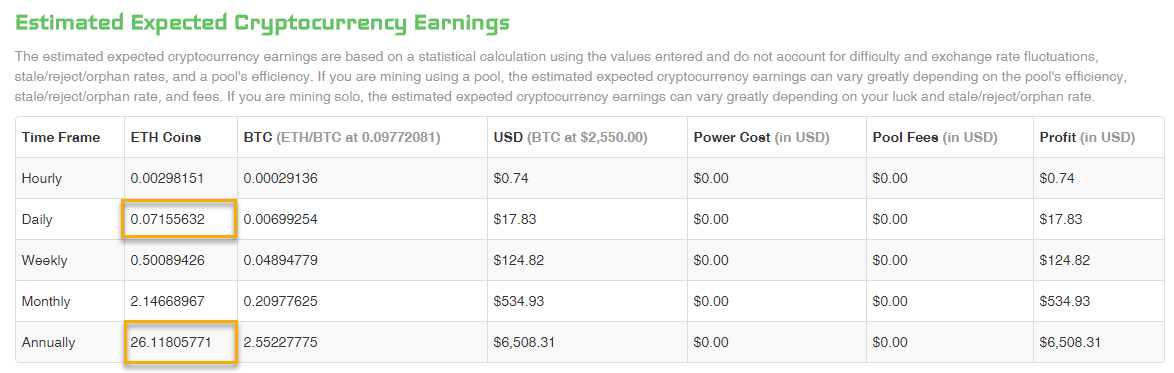

Let's check these awesome "super exactly" mining calculators:

26 ETH in the first year - Wow - All in ? Should I go all in ?

Calm down dude, relax. These calculators miss out the most important thing - the difficulty increase (and you can be sure there will be an increase)

Now for most of the people gut feelings and math in the head starts. "Even if the difficulty doubles I will make ROI in the first year....... and so on and so on". Or Even better. "If I get 0.1 ETH back every day, I need only 110 days to get ROI and then the difficult can do what ever it wants to." Whaaaat ? - Please stop thinking like that.

Let's take a look at some charts for the Ethereum Difficulty:

The time frame we are looking in this chart is from february to june, so 5 month.

Let's roll up the math to finish this article:

So we need 11 ETH back over 2 years. If we divide 11 by 720days -> We need 0,01527 ETH per day in average over the whole period. But the mining calculator above said we get 0,0715 ETH per day. So we are running now around 500% over the needed average. That's true but how long will the difficulty take to increase by 500% ?

If it does increase like the last 5 month, we will facing problems. If it takes longer we will be able to get more ETH back.

I will add detailed charts with needed Incomes over time vs. Difficulty to this post. (I am running out of time now). But I love charts and analyzing the mining operations. I am working for example on the mining analyzor template for cloud mining operations which will be releases to the steem community when it is finished and multi currency abled.

Thank you for reading, please upvote and revisit for the needed income over time charts.

THX

Please share your opinion concerning cloud mining. I want to add that I think Genesis Mining is a highly recommended partner for cloud mining and if a contract doesn't turn out in profit it's not the fault of Genesis Mining. Even if you buy your own Mining Rig you could end up without profit if the 2 unknown factors doesn't work well.

I decided not to buy more Ethereum Hash Power. I decided to buy more Steem Power. So I put 0.9 BTC in Steem Power today.

https://steemit.com/bitcoin/@hw-enthusiast/i-was-searching-a-wildcard-and-found-a-home-in-steemit

I needed to see this. It's so tempting investing big in cloud mining, the idea of daily or at least consistent payments is so attractive.

But you've laid it our perfectly. My takeaway is; buy and hold coins. Simple as that. Good luck to you and your mining operation!