Is This The Bottom For Bitcoin? You decide!

So the question on everybody's mind right now is whether or not Bitcoin has found a bottom in this bear market. Today we are going to examine a few of the arguments for and against this market bottom and explore what possibilities are out there for Bitcoin in 2019 and beyond.

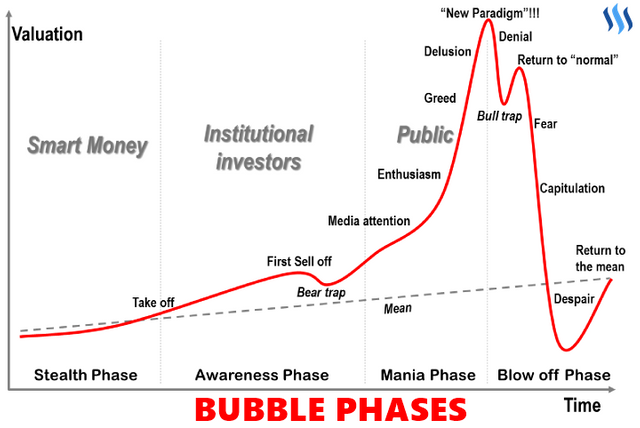

2018 was an extremely rough year for Bitcoin and every other cryptocurrency without a doubt. The never ending bear market would tease us with temporary relief rallies quickly followed by dumps in the weeks and months following. Over the summer we saw a relative period of stability but that was not enough to keep the crypto space afloat as we saw mass capitulation across the board at the end of the year. Bitcoin is still down roughly 82% from the all time highs of December 2017 which sent us soaring to unbelievable prices. What goes up must come down however and this is especially true in market hype cycles.

Some of the common beliefs among the masses going into 2019 is that "Bitcoin is a bubble" or "Crypto is a waste of money." Although we did go through the most volatile and massive run up in value that cryptocurrencies have ever seen, this is not the end by any means. Too many people are focusing on the price and not the intrinsic value proposition that blockchain and related DLTs technologies provide. Many vloggers online have been mentioning that unit bias is a huge thing in the human psyche and once the community can move past that they will see a better understanding of Bitcoin and less band wagoning on cheap altcoins that are shilled to them.

At the time of writing BTC is trading at nearly $3,583 on Coinbase Pro. Back at the height of the bull run (or very beginning of the bear market) Mike Novogratz, who is a well respected investor, trader and CEO of Galaxy Digital merchant bank, said Bitcoin would probably go back to around $8K so he held off on buying. When it continued to plummet lower and lower as the year went on the interest in cryptocurrencies began to fade and the outlook seemed grim. In the last quarter 2018 we saw crucial layoffs across the space combined with a mass extinction of alt-coin projects that just couldn't survive the crypto-winter. Even HODLers of last resort seemed depressed and beaten down- capitulating out of necessity to get by.

People who took out loans, or even worse used credit cards and cash advances, during the bull run are most certainly underwater on their debts. The only readily available options at that point will be to hold their assets until the market eventually recovers or to sell at a loss just to make payments without defaulting. Both of those actions are quite painful but one does what they have to in order to make ends meet as the community saw over the past year. Greed often gets the better of us humans so we are prone to making irrational decisions especially when the promise of vast fortunes is involved.

In an ideal world Bitcoin would become the new world reserve currency and every country would be fighting to mine for it, or at least that is what we are told by Bitcoin maximalists. There is a resounding need for a financial system that is transparent while remaining ubiquitous, reliable and trustworthy. Fiat currency is inherently flawed by design because of one main reason: INFLATION. By transitioning the entire global system to a new decentralized, self-sustaining, and most importantly deflationary model we will see a better outcome than what we are utilizing today.

So now let's get to the point of whether or not Bitcoin has bottomed in price. We should entertain both sides of the argument for the best idea of what is most likely to happen.

Say for a moment that Bitcoin has in fact bottomed at that $3,100 price zone and won't go a dollar lower from here on. At this point there are quite a few people still holding bags and waiting for the next bull run while others are slowly accumulating what they can afford. The majority of the selling pressure is of course coming from exchanges, miners and whales but there is enough daily demand at these levels to keep prices stable above $3K. Non-believers are saying "I told you so" while there are the ones who still think it will continue to drop further and are waiting on the sideline. Eventually the price begins to creep back up and gain some more momentum as the market sentiment shifts and the network effect takes ahold. Some of those investors who were waiting on the sideline to invest will FOMO into the market at much higher prices which will propel it to new highs in the coming years.

Conversely say we are going to continue to drop even further as the year goes on. The price being in the mid $3K range right now we could easily see $2,800 or $2,500 or even as low as $1,000-$1,800 according to some crypto analysts out there. The market is playing a twisted game of How Low Can We Go? The shrewdest of them all are still counting their cash profits and waiting for the market to hit absolute rock bottom before going all-in again. Who can be certain of where the true "bottom" lies and how long will we say there when it happens? Regardless of these answers the simple fact is that people DO expect the price to rebound from that point and to quite significant values long-term.

Both outcomes have the same end result and that is a much higher price for Bitcoin over time. If the price were to drop to say $1,000 or even perhaps $1,800 do you think you would be able to time the market JUST right to get a buy order in? Would you be too overcome with fear thinking about the risk of potentially losing even more or missing the true bottom at a lower price and invest less than you told yourself you would? The truth is that nobody knows the future for certain and both scenarios are possible yet we are still here to determine which is more probable. From here a drop to $1,800 would represent a further 50% decline in price. If BTC were to rebound to the all-time highs of $20,000 then you would be looking at $18,200 profit vs a $16,400 profit from current prices. Percentage-wise that is a much higher gain of over 1000% vs only 450% but those are both still serious returns either way.

Knowing that eventually Bitcoin could achieve such insane highs as a million dollars or more there are many people that are naturally interested in it for a long term investment. At that point does it really matter whether or not you paid $1,800 per coin or $3,600? Sure you could have gotten yourself more BTC for less fiat if you could have timed the bottom perfectly but how likely is it that you would have nailed it perfectly? The best strategy often times is to make sure you have a certain amount of exposure in the market while keeping some capital on hand in order to take advantage of both possibilities.

So you tell me now, has Bitcoin hit the Bottom?

Good post, lots of good information, let me give you my input:

You saw a huge layoff in STEEM, there are still way too many projects around, the only known project that got sick was NEM and maybe SUB(they are trading with their ICO money), we still have 2k cryptos in the coinmarketcap, the only true crypto that died was bitconnect. Either this bear market kills all of these shitcoins or we will go bull again and the whole market will be taking value from good projects, shit coins pumping with the money ETH, EOS, STEEM, BTC, etc... deserve! We need to kill the market now or we will be in for a bad surprise! Just like it happened in the dotcom bubble! The market went so down that many companies went bankrupt, we need that exact same thing to happen in cryptos!

You never try to buy the bottom, that is the worst idea people have about trading... You try to buy the reversal... which is clear as day when it happens, we just need to do a breakout of the bear market trendline! That's the best time to buy, that's very close to the bottom, maybe you won't be able to buy at the absolute bottom, but you will buy very near it... now , for how easy it is to spot a reversal, I made a post about it if you happen to want to read it, It's past payout so I don't feel like a leech by posting it here. But let me post 3 pics here:

As you can see, it's clear as day... when the price breaks out of those lines AKA Trendlines, it normally means a bull market starts, that's the best time to buy (in the box), it's close to the bottom, the price actually breaks out and retests the line to confirm that the bull market is about to happen!

I spent the last 6 months learning a little TA, I've talked with many traders, and they all know this... It's common knowledge in the Trading field, most Steemians don't know this, try to share it around, so people can finally stop losing money trying to buy every dip and getting dumped on!

Oh and when the price actually bottoms, the price almost never ever goes bull that exact same moment, we normally have a period of consolidation that takes months, and we normally bottom 2 times at least, so the pattern makes a M not a V, let's say the bottom is at 1800$, the price drops to 1800$ goes on a mini bull-run, consolidates an at the end of the consolidation phase it goes to 1800$ again to retest that price, go look at 2014 image that I posted and you will see this happening weeks before the bull market started. So that's also a clear sign that the consolidation phase is ending!

If we have bottomed now at 3100$, we need to pay close attention to those 2 events, if the price goes do 3100$ and gets rejected it's very likely that this is the bottom, if it breaks out of that trendline it's a 99% chance that the price has bottomed!

Cheers bud! Good luck on your investments! Just wanted to drop my 2 satoshis on this post :)

Well articulated @hotsauceislethal. It wasn't that long ago that bitcoin sank to zero price before it's meteoric rise.

Nobody is mentioning the $1M bitcoin anymore, partly I think because of the adaptive radiation of crypto landscape in general and yes many fledgling coins didn't make it through, but there are a whole lot more, carefully planning and waiting in the wings to make their own debut.

The next crop of projects surely includes a few future tech titans who are leveraging blockchain to solve massive real world problems. The trick is knowing which ones have the real potential to survive, thrive and change the world, one block at a time. ... and that takes time, research and a knack or intuition of what really needs to change now !

i wish i can decide when is the bottom, lol, but looks like mid 3k is the bottom

Wanna vote on the poll at the end?

Very good article!. I was thinking that if you treat trading BTC pairs just like FOREX, then you could make a case more towards what is the 'parity' price of BTC vs what is its 'bottom'.

If you look at the covered interest rate parity condition says the relationship between interest rates and spot and forward currency values of two countries are in equilibrium. ... Covered and uncovered interest rate parity are the same when forward and expected spot rates are the same.

With covered interest rate parity, forward exchange rates should incorporate the difference in interest rates between two countries; otherwise, an arbitrage opportunity would exist.

Now, similarly treat BTC pairs between exchanges: use buy/sell order ratios, price/ROI ratios, ETFs futures data; rather than seeking the bottom of BTC, calculate its Parity.

Using my top 3 indicators:

MACD, BOLLINGER, and ICHIMOKU, I believe Parity to be at Bid 3100, Ask 3170.

So, for less stress and hand-wringing; parity calcs will show where the bottom is, and thus, profit maximization.

--//medianation😀

Interesting results in the poll so far..

Congratulations @hotsauceislethal! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

In my opinion, the price would go down to around $1,280 and soar to the moon.

If that happened then well.. :) some would be sad but some would be happy ! lol

Thank you for using CryptoSicko!

Well done and thank you for joining and supporting my subscription based upvoting bot that provides you with daily upvotes in exchange for your spare STEEM POWER.

Delegation links for CryptoSicko

100SP 250SP500SP

Hi @hotsauceislethal!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 4.203 which ranks you at #2983 across all Steem accounts.

Your rank has dropped 7 places in the last three days (old rank 2976).

In our last Algorithmic Curation Round, consisting of 216 contributions, your post is ranked at #130.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

Hello @hotsauceislethal! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko