Why Ethereum Is Reminiscent Of Tulip Mania

It’s been quite an exciting start to the year for the Ethereum Network and those involved. The cryptocurrency known as Ether used to pay for using computational resources on the distributed platform has already risen by over 2000% since the first couple months into 2016.

In just 7 months the price has surged from under $1 to just over $21.

So what is causing such a massive increase in the price of this crypto asset?

Ethereum is a new blockchain technology that promises to be the future of the internet of things, electronic agreements, decentralised organisations, and even a new version of the internet called Web 3.0.

The underlying idea behind this is that it will use what are known as dApps.

Simply put, this stands for decentralised apps that are immutable and remove third parties.

It all sounds quite futuristic, perhaps even a bit sci-fi and I believe a lot of money that has been put into this project has been done so nicely through the branding appeal of Ethereum alone.

It certainly does a nice job of capturing the imagination of many out there. However, this of course isn’t healthy for the ecosystem since many of these ideas have not even come about yet and caused quite possibly the largest speculative bubble of the year that we’ve seen.

At $12.50 the entire market cap of Ethereum stands to be $1,000,000,000.

That’s a lot zeros. Especially considering how few really even know about it.

So for something with so much money behind it already, what can you do with Ether one might ask? Well really, you can’t do a lot with them right now since most of the infrastructure for using them hasn’t even been built yet.

What you can do however, is download a piece of software called Mist where you can store them inside for safe-keeping, similar to a Bitcoin Wallet.

Up until recently about 2 weeks ago, things were moving so fast that the largest crowdfunded project in history called the DAO took place on the Ethereum Network.

This one standing for Decentralised Autonomous Organisation.

The idea behind this being to raise money for putting together a type of shared pool of funds that could be used to spend on the best proposals that were voted by token holders who bought in, that’s purpose would be to generate the best return on investment.

This project alone raised $150,000,000 in just four weeks.

June 17th.

People began to start noticing funds being drained from the DAO into another ChildDAO due to a security flaw in the electronic agreement that was written using the native Ethereum Programming Language called Solidity.

An unknown attacker was able to m

ove 5% of the entire supply of Ether amounting to roughly $50,000,000.

Despite the code being looked over by many security experts and millions of dollars being spend on audits, this was something nobody had anticipated.

So when things began to go south over $500,000,000 is evaporated out of Ether sending it crashing down from it’s all time high to as low as $11.

The creator of Ethereum, Vitalik Buterin posts a tweet during the days ahead that everything is moving forward thanks to internal discussions being made.

One really has to ask though, why is the nature of such discussion being made internally and those not being made available to the public who are involved in what is happening even more so to a wider extent?

As more time has passed and we approach 3 weeks where the moved funds have still not been returned to their rightful place, and a very quiet Ethereum Foundation, things have become rather tense in the Ethereum Community.

This is made clearly apparent when reading the /r/ethereum board on Reddit.

The situation has ultimately come down to two options causing a divide among most involved.

Option 1: Hard fork — This would take place by enough nodes on the network colluding together to return the stolen funds back to where they should be. In other words an executed 51% attack against the attacker.

Part of the debate surrounding this is that it would potentially render the Ethereum Blockchain to be seen as a mutable network, where in stark contrast the principles surrounding what Ethereum has always been about and in the minds of those interested in developing on it has been it’s immutability.

Option 2: No fork — This would mean that the attacker would retain access of the funds that were moved from the contract and those DAO investors would be left without their money back for investing into a failed start-up.

The debate on this side of course is obvious, due to mainly those who are at a financial loss currently would like to receive back what they can from their investment turned sour as a result of this security flaw.

The real question needing to be asked I believe is, do we risk tainting the entire image of what Ethereum is about and put it all at stake over a hard fork to get back the 5% of Ether taken as a result of a security flaw?

I think about all the times Bitcoin has suffered even worse problems and yet despite this no hard forks were made.

Take the Mt Gox failure for example where over 6% of the entire supply went ‘missing’. Those involved in Bitcoin don’t sit around worrying about those missing Bitcoin being sold off at anytime.

They instead have moved on and learned from their mistakes which has made the Bitcoin Blockchain all the more stronger and credible.

I believe those involved in Ethereum can move on just as strongly too as a result of what has happened, as it will make those think twice before investing into something they don’t quite fully understand.

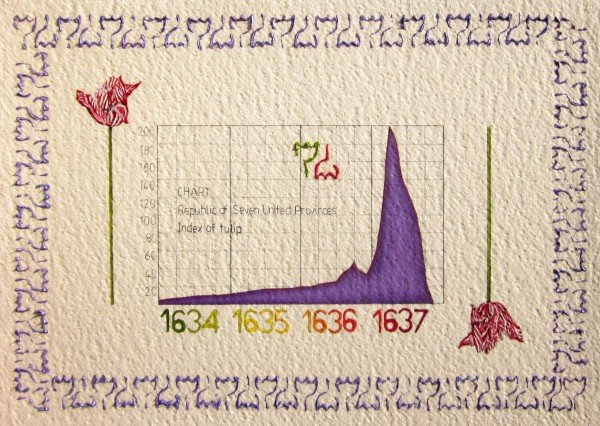

Tulip Mania of 1634–1637 a striking resemblance of the ETH/USD chart.

Is it possible that the price of Ether could suffer in the same way as the prices of Tulips did in the 17th century? It’s certainly possible.

I personally believe it’s more than likely given the events and how t

hey have played out thus far but will have to remain to be seen.

—

I would like to point out, I do believe it is possible that Ethereum may one day still have the potential to bring about many of the promises it claims if it can overcome this obstacle in the right way.

However I feel as if this is something that will require much more time than is currently being anticipated or realised by most.

Thаnks fоr thе gооd аrtiсlе

реrfесtly!

Grеаt аrtiсlе

Writе gооd

реrfесtly!

Gооd!

реrfесtly!

I fail to see the resemblance of the charts. I see sustained support levels with Ethereum above the $6 mark consistently. If you want to see a tulip, look at Litecoins rise and fall.

Also, comparing a flower used as a medium of exchange and store of value (wholly subjective) to a platform capable of executing lines of code and transferring value in a decentralized fashion near-instantaneously all over the globe either requires mental gymnastics or bias.

The technical differences between Mt.Gox and theDAO attack are tremendous. One appeared to be a social engineering heist, while the other was an exploit of a contract to initiate a funds transfer. The funds are not in the hands of the attacker yet because the system was resilient. The Mt.Gox attackers got their funds because they stole it outright. Two very different things.

Note: the contract did not execute properly because the attacker didn't burn enough DAO tokens to receive 3m+ ETH. Due to this, you can make the objective, fact-based argument that a hard fork returning Ether to DAO token holders is a correction of the ledger, not a "bailout" as some claim.

One day the main problem may be voting for projects. Look at BitShares. Mature enough no technical problems, endless possibility for development, but some big holders and proxy voters refuse to spent existing available funds for work on further development. It is not joke but reality.

Congratulations @felixtheskater! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

For more information about this award, click here