Where Growth Breaks the System, How ICOs Really Contribute

The market has crashed again. This would be the third time this month a scare like this occurred. At its worst, Bitcoin reached a low of $2,275 and Ether dipped as low as $213. Panic selling ensues, exchanges grind to a halt, and the price drops even faster. Hours later, even after a brief recovery, the state of the crypto world is painted red.

Despite the blood, interesting questions remain. Why did the market tank today, June 26? What does this mean for the stability of the market in the future?

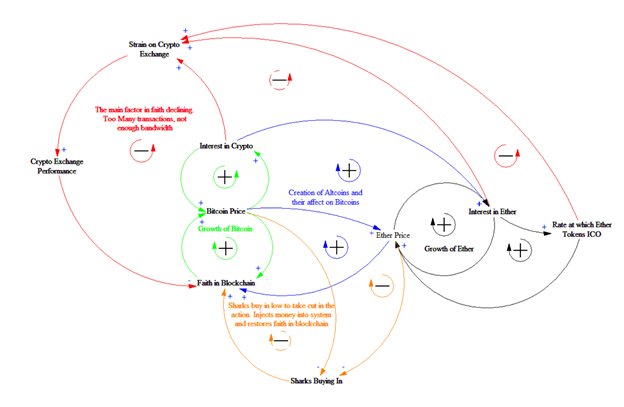

I decided to try using System Dynamics to find an answer. This is the causal loop diagram I created to help explain the phenomenon.

Wow! There’s a lot of stuff going on but what does this all mean? The idea behind a causal loop diagram is to depict visual trends to better understand the system as a whole. Let’s start with green, which is labeled Growth of Bitcoin. As interest in Crypto increases, so does the price of bitcoin. As the price of bitcoin increases, so does the interest in crypto. This is what we call a positive feedback loop. By itself, it scales infinitely with no end in sight.

Many of the loops in the middle are positive feedback loops. They continue to grow from each other and increase at an exponential rate, however, nothing grows to infinity. The section in red shows the downfall of the system. These factors can trigger downward spirals and the “bursting of the bubble”.

Exchanges exist within the cryptocurrency space to provide a way to exchange different fiat currency and different coins with each other. You may notice that Interest in Crypto and Interest in Ether both connect to Strain on Exchanges. This is the natural ecosystem for crypto. The growth of crypto generates interest, which creates strain on the exchanges. The exchanges then perform slightly slower but because the transaction takes place at a reasonable pace, faith in blockchain doesn’t decrease. We see people buying Ether and Bitcoin creating demand and increases the faith stored in the blockchain. Then we see the exchanges process these transactions and decrease that faith. This shows a balancing act which is represented by the negative signed loops, also known as Balancing Loops.

You may notice that Ether is the only other coin represented here because it has a unique feature of being able to support other “tokens”.

Here comes the tipping point. As more people become enthralled with the cryptocurrency space, more people want to carve a piece for themselves. More people dream of the possibilities with this new technology and its possible applications. A race starts to crowdfund these companies trying to fill a niche hole in the market and these companies piggy back off Ether’s token creation protocol to create a company and launch an ICO (Initial Coin Offering).

Well sometimes it’s just another token that breaks the camel’s back. With so many ICOs launching with overlapping windows, the Ether system grinds to a halt, unable to validate all the transactions running through it. This causes strain on the Crypto exchanges like Coinbase and GDX which see that their buy and sell orders aren’t being validated. Slower validation times occur and faith in the blockchain decreases. This however is only the beginning.

Faith in the blockchain holds up this entire network of connections. As soon as faith in the blockchain goes down, the price of bitcoin follows, and then comes the price in every other altcoin, Ether included. Mass panic selling occurs as people scramble to recoup their money. This adds even more strain on the Crypto Exchanges and they go down temporarily. Exchanges like Coinbase and GDAX simply cannot handle the load put upon them and collapse under its weight. This decreases the performance even more and faith starts to plummet. Prices start plummeting, there is no end in sight, and the only consolation is that the major exchanges are not pushing out orders so only the smaller lesser known exchanges can continue pushing out buy/sell orders.

Small time investors start to swarm the small exchanges looking to buy in. The price is low -- the time is now! Cryptocurrency start seeing their descent slow and right before it can stop completely, the sharks come in. Attracted by the bleeding crypto the sharks come and buy up all the devalued digital assets, injecting huge sums of money into the system. This causes Faith in Blockchain to stabilize, to increase. The money still comes in and restores faith in the system. Exchanges come back online, transactions are validated, and the gears start turning again…

Pick your spot, weather the storm. Once infrastructure can handle adoption rate, maybe it’ll all pay off.

Perfectly!

The market can be tough.

But it can be modeled and that's an important point in itself.

Congratulations @dusilb! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Good article