“Can I pay with Bitcoin?”

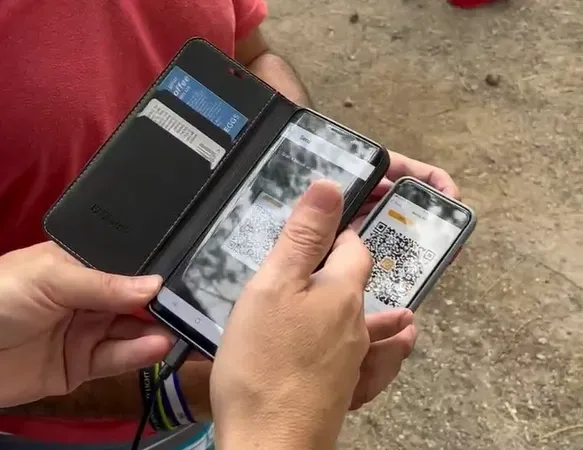

There’s something really wonderful about buying with Bitcoin—in whatever form—in a shop.

From asking the inquiry to the near-instant confirmation via the lightning network via QR code, the whole affair seems thrilling, fresh, futuristic, and, somehow, somewhat wicked. Even for folks like me, who have been using it for years all around the world, it just never gets old.

This is certainly part of the reason why Bitcoiners would really travel—ssometimes quite a long way—tto make purchases for things and services they can simply buy on their own doorstep just to re-experience the excitement of doing it, like an addict yearning for the next high.

But how far has merchant acceptance progressed, and what can we do, as regular Bitcoiners, to promote it?

The reality of merchant adoption

There’s now no question that Bitcoin itself is here to stay. It has just come too far and is worth too much to fail.

With its growing integration into the TradFi (Traditional Finance) system, we’re witnessing increased inflows of capital from big scale institutional money from all types of high value sources all around the world, including pension funds. Every day that passes further legitimizes Bitcoin’s usage, produces greater exposure, and reaches more and more people in a worldwide network effect that is often—aand very appropriately in my view—llikened to that of the internet’s in the late 1990's or early 2000's.

And we all know how it went out.

Yet, in relative terms, acceptance at the merchant level is still modest.

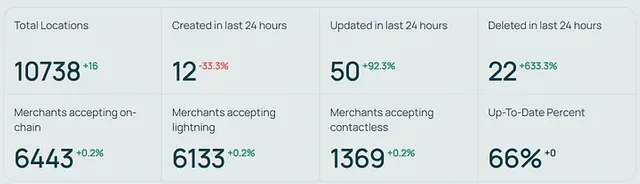

Check out these global headline figures from the greatest resource on the internet to monitor merchant adoption, found at BTCMap.

There are a lot of things we can instantly extract from this.

The top data demonstrates that an impressive sounding 10,738 shops now accept Bitcoin natively, most typically via the Lightning Network (a technique by which payments are near immediate and final and skip the lengthy confirmation waits of base layer transactions).

This is a little deceptive statistic because OpenStreetMap restrictions do not allow the inclusion of ‘online only’ businesses, and we can reasonably estimate the genuine number to be somewhere around 10–15% bigger, based on available UK data. However, for now, we’ll use the ‘clicks and mortar’ number for convenience.

Of course, it’s worth mentioning that, technically, you may use Bitcoin to settle bills anywhere where Visa or Mastercard is accepted by utilizing a proxy service such as Wirex or Nexo. This implies that the great majority of retailers on earth already accept Bitcoin—ffrequently without knowing it—ssince these services simply convert your Bitcoin to local fiat cash quickly at the point of sale. You don’t even need to inform them! (although doing so often gets some hilarious answers!)

But that’s not what we’re talking about here. We’re talking about publicly accepting Bitcoin between two people who are completely aware of what they’re doing.

That indicates that the shop has gone out of their way to enable it and either maintains it in Bitcoin format or converts it to fiat cash using one of the various ways available today to do so. Or, to put it another way, sending the value directly over the Lightning network rather than via the TradFi banking and payments systems.

So, what does that mean in global adoption terms?

Well, it’s quite difficult to locate worldwide statistics on the number of genuine retail traders as definitions vary by place and it varies regularly, but Statista gives an expected data point for 2020 of roughly 60 million merchants globally at that point. It’s as good a place as any to start.

Doing the calculations, it means that 0.018% of worldwide merchants accept Bitcoin in any native format. That’s not a lot.

The top line data also reveals that 12 new shops came on line in 24 hours (so that’s roughly two per hour), but in the same period, 22 were deleted, meaning that we really went backwards by ten (net) in that period.

This is obviously not the case on a consistent basis since it’s clear that the total number of Bitcoin accepting merchants continues to grow, but it’s also indicative of, first, how chaotic these numbers really are (especially as the map is consistently updated) and, second, may well expose some of the practical implications of accepting Bitcoin in a retail environment, something we’ll come to in a moment.

Here in the UK, it seems there are roughly 314,040 retail enterprises in total (as of January 1, 2023, again according to Statista) and around 228 stores accepting Bitcoin, or around 0.073%. Higher than the average but still very, very little, especially with allowing for the possibly massive inaccuracies in the macro picture.

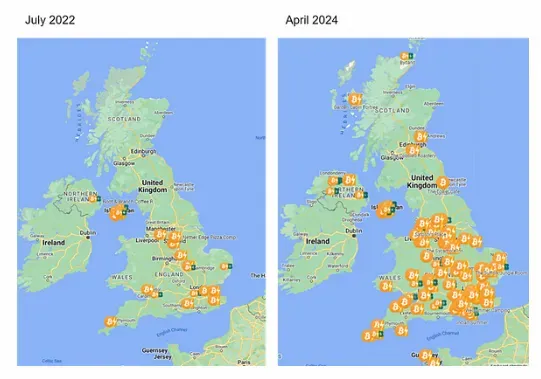

However, the development is apparent. Look at the difference in the number of merchants taking Bitcoin natively in the previous two years:

This is thanks to a mix of a rising market of clients, an increase in regular meet-up groups (already well over 50 in the UK alone!), and the simple convenience of taking Bitcoin with the current generation of equipment. It may now be done almost instantly with just an iPad or phone.

You may discover your local UK merchant here (or select your own nation here.

To be clear, however, these top line statistics can’t be relied on as anything more than suggestive. At least for now.

The practicalities of Bitcoin adoption on the ground

We’re in a classic ‘chicken and egg’ dilemma.

Which will arrive first?

Bitcoiners utilizing Bitcoin in a retail context or businesses offering payment with Bitcoin?

One, of course, is a result of the other, and while neither has much value on its own, the optimal growth plan is a balance of the two, paired with momentum.

Here’s an example that could make sense, based on my personal experience:

More than once, I’ve gone into a business that promotes taking Bitcoin, but when I’ve gone to pay, there’s been a staff member who doesn’t know how to do it, or the ‘device isn't charged’ or there is some other explanation why Bitcoin can’t be taken at that time.

Why does this happen?

More frequently than not, the shop was set up and then suffered huge intervals between Bitcoin transactions, something that probably corresponds with the use rate generally, which, although expanding, is still tiny. Eventually, the gaps became so great that they don’t bother to keep the gadget charged, or new personnel come around and it isn’t on their training plan.

This results in decreasing Bitcoin use and, eventually, the store delisting from BTCMap and no longer accepting it at all. We can be assured that some of those delistings in our example above will be for reasons similar to this.

Put simply, when there isn't enough momentum, there is a danger that shops would eventually ‘give up’ on this new payment mechanism. I have first hand knowledge withth this, having run retail enterprises (among others) in the past for about two decades in total.

In fact, one of my stores, Quantum Web Café, had thehonornction of taking the first Bitcoin payment in Reading, Berkshire, in the pre-Lightning days of 2017. It was a dreadful experience to actually execute the transaction back then, but it was PR,nderful for PR and we really did have eartravelingers coming for miles to buy coffees just because they could.

However, there were sometimes significant gaps between transactions, and had I already not schooled myself on what was truly going on here, I would have just quit doing it after a while.

These days, those gaps between retail transactions are certainly shorter and the process a thousand times easier (easier, faster, and cheaper, in fact, than contactless credit card transactions), but even so, it’s not always enough to prevent some retailers from leaving the fold, as is reflected in the numbers.

The difficulty is, given that individuals paying via the Lighting Network make up such a comparably tiny number, there’s only so many widgets people can buy from particular establishments and a limited amount of times they can drive there.

So how can we get the momentum flowing, and what can we, the day-to-day people, do about it?

The retail solution

Zooming out, the apparent response is to make using Bitcoin as ordinary as using credit cards, but this isn’t straightforward.

Apart from the bigger issue of lack of awareness about Bitcoin generally, which we can all relate to (think about your own trip and the sheer amount of questions you had!) Exactly how does a merchant go about getting involved?

Here in the UK, the answer is groups like Bridge2Bitcoin, set up and maintained by Bitcoin enthusiasts to make it easy for any store to take Bitcoin as a seamless element of their POS solution. They work as a sort of broker-stroke educator, offering a choice of super-simple all-in-one products on behalf of exchanges like CoinCorner and Swiss Bitcoin Pay, making in-store POS systems incredibly straightforward to install and use.

Even more, Bridge2Bitcoin also has access to a nationwide collection of local volunteers that work to provide expertise, support, and custom.

CoinCoiner has just integrated its services into Lolly POS till systems at a native level, meaning that anybody operating these systems (Lolly tends to specialize in the hotel and food and drink industries) may transfer over effortlessly, taking care of everything, even accounting.

Newcomers like Musqet have also overcome the problem of having separate devices for regular credit card payments and Bitcoin payments (for those that don't use Lolly systems) by providing a whole solution in one streamlined device linked to the till.

Retailers may opt to accept and store their Bitcoin or convert instantaneously to local currency inside the transaction they're completing over the Bitcoin rails, like a credit card, but more swiftly and more inexpensively. Many of these services are actually cheaper than using regular credit card terminals.

It’s a long cry from the days of extremely expensive and very sluggish on-chain transactions we used to attempt to perform at Quantum Web Café, often at a loss, just for the heck of it.

And while that has altered, there’s little denying that the part about Bitcoiners driving miles to patronize establishments that accept the payment method remains accurate. In reality, access to things like the Orange Pill App and, of course, the aforestated BTCMap make this all but an inevitability.

However, shops will find their way at their own speed, and acceptance will very definitely follow general levels of education and comprehension, notwithstanding the work of groups like Bridge2Bitcoin.

In short, it’ll take time, but it’s probable that the early adopters will almost surely hold an edge for a long time, in the same way that early website builders were able to carve out their own niche on the internet ahead of everyone else. By adopting Bitcoin, everybody gains, but notably the shop.

So, what, if anything, can we do?

The five word question

There’s actually quite a lot we can do, collectively, as Bitcoiners to move this process forward a little, especially if we’re consistent in doing it.

First, and most apparent, is to discover and support businesses and companies that take Bitcoin, even if it means going somewhat further than you would ordinarily. Posting a video of you paying and tagging the store is typically highly appreciated by the merchants, who are constantly eager to create more business.

Again, thinking back to my own retail experience, I can promise you it’s a tough game, with high overheads and a dependency on a consistent consumer stream. Extra advertising, especially to a very dedicated and passionate audience like people who use Bitcoin, may make all the difference.

Of course, it also goes without saying that if you find one of the merchants I described previously who is not exactly sure what they're doing, take the time to help them or send them to the correct place for support. And do it kindly—nnot in a condescending or dictatorial way—and remember, you were also anxious when you first started using it!

How nice is it for shops to have their consumers act as support personnel if they get stuck? We can absolutely help with that in some circumstances.

Second, you may do what I nearly always do today when paying a bill of any type in any retail location: ask a simple five word question:

Can I pay using Bitcoin?

I’ve been doing this for years, yet on my own, it makes little impact. If we all performed this on all purchases, it would surely raise some problems, especially in smaller, independent establishments where they can move fast and can potentially gain more than most anyhow.

Interestingly, because I have been doing this for so long, I have seen a difference in replies over the last year or two.

For a long time, most people glanced at me as if I’d spoken a foreign made-up phrase or just whispered something back about a scam, and while such remarks are still quite typical (be ready for this! ), there have been a few new ones recently.

For example, I went to Wokingham May Fayre with my family earlier this week and bought a very wonderful metal sculpture. As the man behind the stall grabbed his credit card machine, I asked the very same five word query.

The answer I got was a surprise:

You mean you can pay for goods, like at shops, using Bitcoin?

Not “what’s that?” not “that’s a scam!” or anything else. This was a gentleman who clearly had some grasp of what it was and recognized its worth. This time, the realization was that you could use it in everyday life to pay for items.

That’s significant. How many people are asking him what you think it would take for him to look into it more seriously? Two? Three? Probably not many more. And he’s not been the only one who’s raised a decent inquiry with at least some rudimentary knowledge of worth.

Finally, there’s one additional approach that might generate debate and intrigue: tipping the waiting staff with Bitcoin at restaurants.

I’ve personally done this a few times, and, as tipping is a fully discretionary action (at least in the UK), it means you can control the narrative. I generally propose downloading Wallet of Satoshi and transferring over a few Sats, always to the excitement of the person receiving it, who will almost always share that joy with their colleagues.

Only once have I ever had someone pick the option of having no gratuity at all over having some Bitcoin, which I feel to be unusually low. After all, I am pretty often turned down when I offer to deliver Saturdays for free to a new person I've randomly met and chatted with about it.

Even better, even if no more Bitcoiners walk in for a while and offer to tip in Bitcoin, that individual is highly unlikely to uninstall their app and lose the Bitcoin they’ve been handed. Instead, they’ll store it on their phone and forget about it until something pushes them to revisit it, possibly even spending it when they see a ‘Bitcoin accepted here’ sign.

The bottom line

Bitcoin is not a simple idea to wrap your mind around when you first encounter it, and, as the great majority of people have absolutely no understanding of how our insane and unstable financial system works in the first place, it’s frequently an uphill climb.

They just have no concept that there’s even an issue that needs solving, other than a vague recognition that something screwy is going on with earnings vs. cost of living.

As Bitcoiners who have spent the necessary time to grasp what’s happening here, we have an edge, and I consider it our obligation to gently guide people in the correct path by giving frequent contact points with Bitcoin. No one does it right away, and no one wants to be dragged there against their choice. We all find it when we’re ready, and patience and a step-by-step approach are essential.

So, ask the question, be prepared for the answers, and be well versed in downloading, setting up, and utilizing Lightning wallets, but above all, be patient, courteous, and consistent.

Welcome to SteemIt. The platform rewards posts with the STEEM token hosted on the STEEM blockchain.

Since the platform rewards posts with crypto, the work flow on the site is different than other sites.

So, the rewards come from interest on STEEM POWER. The size of the reward is determined by the STEEM POWER in one's account.

I have 750 STEEM. My 100% upvote is worth about a half a cent.

Each time I vote, the system reduces my upvote power by 2%. STEEM POWER regenerates at 20% a day. That means I get 10 upvotes a day.

I mentioned this because I noticed that you dropped three posts on your first day.

Users only get 10 upvotes a day. People rarely upvote posts by the same author.

It is best to drop a single post a day. It is likely that people will see that you wrote three posts and not upvote your content.

If you are hoping to build traffic it is good form for new users to write comments on posts from accounts with content that you appreciate.

I wish you the best on your SteemIt journey.

thank you friend