RE: McAfee’s Dick Math: illuminating Bitcoin’s ACCELERATING price

BTC is not calculations, even if most people think that's all it is (PoW). It's a poltical force, and war is politics by other means.

Indeed. And deterministic chaos math applies to such interrelated complex systems. All those factors may show up as patterns in price chart. Armstrong’s computer can predict “black swans” such as 9/11 because the markets move in anticipation of the event (some people knew ahead of the event and for example shorted the airlines and thus these fat tail events are really not entirely black).

Do note that living things, which people are, never actually increase in population exponentially. At least, not without plummeting in population with equal vigor.

Everything plummets eventually including even our solar system. Yet that’s vacuous while the distant future collapse of what birthed exponentially is still alive. Saplings grow exponentially to oak trees, but oaks trees neither grow to the moon nor cease to have a relevant existence.

I am reminded that String Theory is elegant, mathematically beautiful. However, that mathematical elegance can be used to describe almost any conceivable universe, and is not very useful to describe the one we're in exactly because of that.

Indeed any universal model devolves to unbounded entropy over unbounded time and thus the undifferentiated multiverse where the past, present, and future all exist simultaneously and so that nothing exists.

Our perception of our existence requires the lack of an omniscient total ordering. That total ordering may exist in some sense theoretically, but it is imperceptible because perception is not frictionless. Without friction which allows for the existence of partial orders and relativistic perception, perception would not exist. So then once we lose the perception of total order and complete information, our relativistic perception gives rise to all these phenomenon that we claim to exist and we attempt to employ mutual information to order our existence, but at scale of course nothing exists (i.e. rather is undifferentiated randomness) and everything devolves to unbounded entropy, yet the perception of that bound is never attained because discernible perception requires friction. If we could be omniscient we could not perceive our existence. Randomness or entropy (aka disorder) increases as the distribution of uncertainty becomes more uniform. So in unbounded entropy, everything is equiprobable, including the past, present, and future.

@lauch3d well points out that tulips were not simply digits, but real world items and their value crashed not because of mathematical miscalculations, but real world issues. Maths work great in hindsight, but not so well in the real world to predict value. So many different events could utterly void this calculation I am boggled that effort is undertaken to make it.

War, pandemic, the ongoing solar minimum, gamma radiation burst, solar flare, censorship, corruption, a better DLT, on and on. There is no conceivable limit to the actual events that can not be calculated but that can be counted on to affect politics, finance, and people

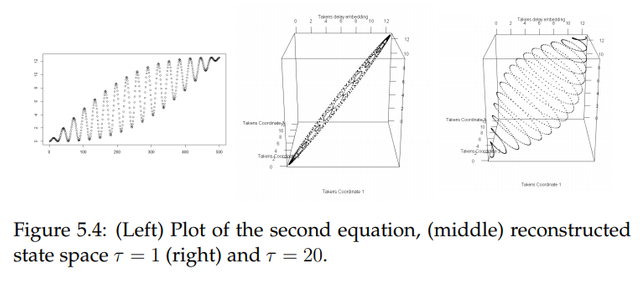

Because of friction there’s local order in chaos and friction gives rise to oscillation:

Armstrong wrote:

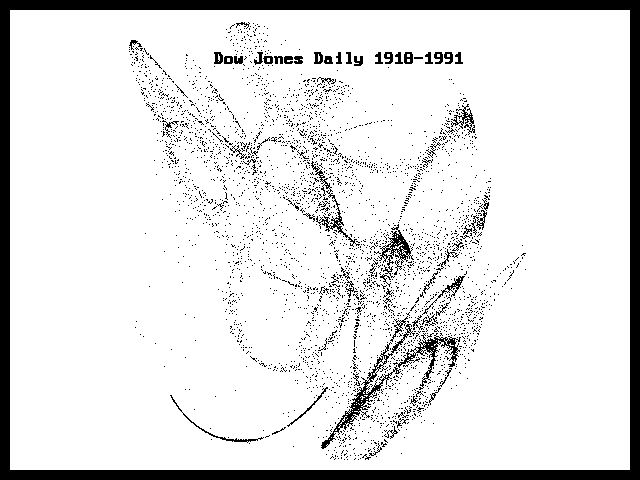

The interesting demonstration here is that (1) this is not my personal opinion, and (2) it illustrates that there is a hidden order within what appears to be chaos. Here is the output of our Chaos Modeling for the Dow Jones. This clearly illustrates that there are trading plateaus which exist where the market will trade and then breakout to a new plateau. This is taking the daily data of the Dow Jones Industrials from 1918 up until 1991.

The key here is this plot represents absolute PROOF that there is order behind the appearance of chaos. How can we even predict a turning point unless there is hidden order behind the false image of chaos.

Armstrong wrote:

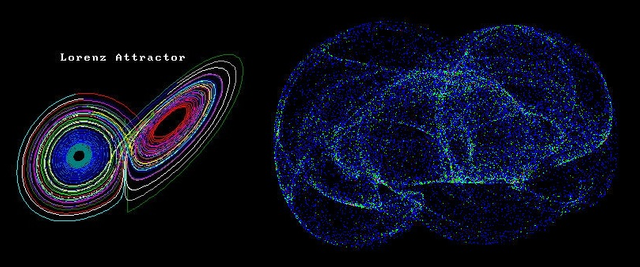

Here is a photo of starlings flying. Not only do they comply with the cyclical movement patterns, but the group is neatly formed that even complies with the science of chaos. Look at this illustration of the Chaos formation of weather data. There are boundaries that confine all movement at the extremes. Chaos was discovered by weather. What on the surface appeared to be random, actually contained hidden order.

Edward Norton Lorenz (1917–2008) was an American mathematician and meteorologist, and a pioneer of chaos theory. He discovered the strange attractor notion and coined the term butterfly effect. His strange attractor illustrated that within what appeared to be random chaos, there was actually incredible hidden order. His discovery has illustrated that predicting the future is highly complicated because (1) we are dealing with a massive amount of variables not a single cause and effect, and (2) this complexity constitutes a nonlinear system that produces the unpredictability yet within defined outer parameters.

Within any data series if we are talking about weather or markets, to the uninitiated observer who does not see patterns in charts like the the movement of starlings, they only see trajectories that appear to jump around making hair-pin turns and reversing direction only to swing back and re-reverse without warning. This is the majority who buy or sell because the group in doing so and feel comfort in collective reinforcement.

Nevertheless, their chaotic random appearance of weather or markets with respect to the behavior is like Lorenz’s strange attractor always orbiting within the shape of the system in a orderly manner confined by the outer-boundaries. The strange attractor is the actual map of all the possible states within the system yet conform to the fascinating shape defined by those outer-boundary limitations on all movement.

The entire economy is still a non-linear system that on the surface is massively unpredictable from moment to moment, yet is strangely bound within predetermined confines. This is why I state that you CANNOT predict gold or any market in isolation. Everything is connected and there is a form to this madness.

Armstrong wrote:

Behavior began to appear and this seems to be an emergence that springs from large distributed systems of data. This phenomenon we also experience in our human existence. We may taste some food, then we just have to have it as often as possible for a brief while. We eat too much of it and then suddenly our taste for it declines. The same will happen with a new song we listen to over and over again and then cannot stand to hear it one more time. This is a behavior that emerges and the same appears in computers. It does not make it “alive” but this is actually cyclical development. In any large-scale distributed system of data, there will emerge a cyclical pattern of what data is being referred to most often.

Go to a casino and just watch a roulette table. In theory, every number has an equal chance of winning. But in reality, the numbers will be cyclical. Some numbers will never come up while others repeat. It does not matter what system you look at, it will always revert to a cyclical pattern. This is the secret of nature. Observe the roulette wheel closely. The reason the house changes dealers rotating them is because this changes the cycle on that table. The cycle is not YOUR luck that will emerge from a string of times you might gamble, The house cycle differs with each dealer and that is the key to running the casino. This is why the casino rotates dealers because they fall into cycles and like counting cards, with a keen eye and an understanding of complex cyclical systems, you can see the the patterns emerge. (for your information, if I go to a casino and play roulette, within 15 minutes they come and say they recognize me as a”player” and want my name; casino understand cycles).

What emerges from any system is the unforeseen behavior arising out of sufficiently large groups of raw data. The real father of Chaos Theory was Edward Norton Lorenz (1917-2008) who was an American mathematician and meteorologist. Lorenz was certainly THE pioneer in Chaos Theory. A professor at MIT, Lorenz was the first to recognize what is now called chaotic behavior in the mathematical modeling of weather systems.

During the 1950’s, Lorenz observed that there was a cyclical non-linear nature to weather yet the field relied upon linear statistical models in meteorology to do weather forecasting. It was like trying to measure the circumference of a circle with a straight edge ruler. His work on the topic culminated in the publication of his 1963 paper Deterministic Non-periodic Flow in the Journal of the Atmospheric Sciences, and with it, the foundation of chaos theory. During the early 1960’s, Lorenz had access to early computers. He was running what he thought would be random numbers and began to observe there was a duality of a hidden repetitive nature. He graphed the numbers that were derived from his study of convection rolls in the atmosphere. What emerged has been perhaps one of the most important discoveries in modern time.

Armstrong wrote:

This extraordinary complexity of that created the surface impression of chaos, hides amazing order hidden below. This Chaotic Behavior can be observed in many natural systems, from such things as weather to economics. Our problem has been mankind’s attempt to reduce everything he sees to simple minded one-dimensional cause and effect. This type of explanation of such behavior has restrained our ability to move forward in many fields, the least of which is not social-science that includes economics.

Deterministic Chaos may be the key to everything for within both nature and our social world, we are surrounded with complexity yet we try to rationalize everything to a single dimension unable to cope with the dynamics of the world in which we live.

We can’t employ math to predict where every leaf will fall onto your lawn. But large distributed systems of chaos (including markets or the Bitcoin phenomenon) have a statistical form of topological order which is distinct from random.

The results showed that EURUSD had both lower entropy and higher persistence in topological features than QN [quantum noise] data. This suggests that EURUSD data have properties that differ from random noise. The low correlation among the entropy calculations and persistence of topological features suggests that the persistence of H1 features tells us about a different feature than mutual information. The difference in persistence of H1 features between EURUSD and QN suggest that there is some additional useful information in the topological features. An investigation of what these topological features actually implies could be useful to further understand this topic.

I cannot properly express my appreciation of your thoughtful and substantive reply, but neither can I agree that it addresses my central point: that BTC is unlikely to follow a calculable pattern in this world. Too many factors simply can't be reckoned with the relatively short history that has to date revealed impactors on BTC value, and they range from butterfly wings of little import to economic events that will result from the uncharted territory we are in with QE and negative interest rates potentially existential to BTC.

Consider population dynamics in Germany. Then consider how new impacts on German population affected it in the early 20th Century. Those impacts certainly were predictable, but the information enabling accurate predictions wasn't available to relevant parties at the time. We can look back now and say 'Well, that did this, and this did that. Perfectly within our models.' But prior to this and that those actors weren't part of the models, and those impacts weren't predicted, or even predictable. Today our models might include this and that, but I reckon it hubris to claim certainty, because no end of other impactors remain potential, and nominal to completely BTFO predictions.

It's nearly certain that various events will add influences to the system that is currently modeled, and that will dramatically change the results in unforseeable ways. Whether that's a new volcano in Iceland or Trump losing 2020 doesn't even matter. People are incapable of reckoning chaotic factors due to the very frictions of perception you well elucidated. In ancient systems, such as weather, long history enables us to reckon which factors are relevant. As you note weather is chaotic locally, but over long spans and wider regions it's relatively stable.

Predicting it, even with the massive amount of data we've collected, remains tentative still. It's noteworthy that massive political unrest over exactly predicting weather is ongoing today, with riots in Chile to secret government programs in Chinxui resulting from that disagreement. Ten years of BTC simply isn't nominal to incorporate such butterflies that might twist up it's digits like a tornado.

Like I said, you could end up right, but I'd be really surprised if events that have not affected BTC price, and thus are not influencing it's performance presently, don't before the end of 2020.

All that being said, I do wish you the best of luck. I think you need it in this endeavor.

Thanks!