News #1 - The SegWit2x Software Rollout in Bitcoin and a Look at the Market Psychology Around it

HELLOOOO STEEMIT!

As I brought up in my earlier CHART ART blog, I want to add a News series of posts which will bring forward a topic that is being spoken about online and hopefully get some discussion and debate out of it in the comments section.

So please leave a comment and give me your two cents on whatever I have posted. This is about getting discussion going and for that, I need you!

First up, cheers to @bulleth for his Market Wrap blog, where he discusses the fact that Bitcoin bears took a breather. But amongst his always excellent crypto chart analysis, he also brought attention to a Sydney Morning Herald article running the headline Bitcoin is Poised for 'Civil War'.

Now let's take a look at the article I'm talking about below:

Alternative cryptocurrencies and the price of ether continue to bleed this week, as traders position themselves for what could be the biggest event trade in cryptocurrency history: a change in the Bitcoin software.

On July 21, a new type of software called SegWit2x will be rolled out and, depending on which Bitcoin miners – those with the computing power to verify the legitimacy of the blockchain – accept it, Bitcoin could be in for some serious price adjustments.

SegWit2x is a software compromise between two warring factions within the cryptocurrency community.

It is an extension in the size of the blockchain – a digital ledger that has struggled to cope with the increasing number of transactions and seen processing fees soar – and also paves the way for some of the workload to be spread across other, emerging protocols.

But whether or not miners – mostly Chinese firms with multimillion-dollar server farms – will agree to run the software is what has traders on edge.

These miners argue a simple increase of the blockchain size is enough to solve the transaction bottleneck, but a group of core developers – imaginatively called Core Group – insist the cap on blockchain traffic is what keeps the network safe from cyber hacks.

Additionally, Core says, if some of the data is managed on other, emerging protocols, new projects could develop and further the exploration of the cryptocurrency ecosystem.

Miners have been vocally reluctant about the plan, mostly because a move to other protocols would ultimately diminish their influence and put at risk the millions of dollars they've invested to support the blockchain and verify its transactions.

SegWit2x is a compromise for both parties, an increase and a slight data re-distribution, but whether it is taken up by all parties remains to be seen. Some miners may ignore the update and continue to run the original software.

Should this happen, the Core developers will run an agenda called UASF (user activated soft fork) from August 1, which will reject transactions not compliant with SegWit.

If there are large volumes of rejected transactions, then a split in the Bitcoin currency is likely to occur.

If this happens, there will be two blockchains with two bitcoins operating in parallel and the expectation is traders will rapidly reprice the value of both, a move expected to prompt extreme volatility.

I'm not going to pretend that I'm here to better the financial world or decentralise the banking industry. As a crypto investor, all I'm interested in is the price and my bank balance as a result.

I'm also not a cryptocurrency or blockchain technology expert, but I do have a good grip on market psychology and to me, this is where the real story lies.

Market price isn't a reflection of current value, it's a reflection of where traders THINK markets SHOULD be in the future.

Now what happens, is that when markets know something is coming, they price it in. They push price further than it probably should be in anticipation. Then when the outcome is actually determined, money can be made during the eventual repricing that pulls price back into reality.

Now lets bring it back to the potential for a so called 'civil war' in Bitcoin on the back of the SegWit2x software rollout.

For one, the fact that it's in the bloody Sydney Morning Herald (about as mainstream as it can get), shows how front and centre this issue is to everyone. If your Mum has read about it in the paper, then savvy traders have certainly heard about it and have ALREADY priced its effect in.

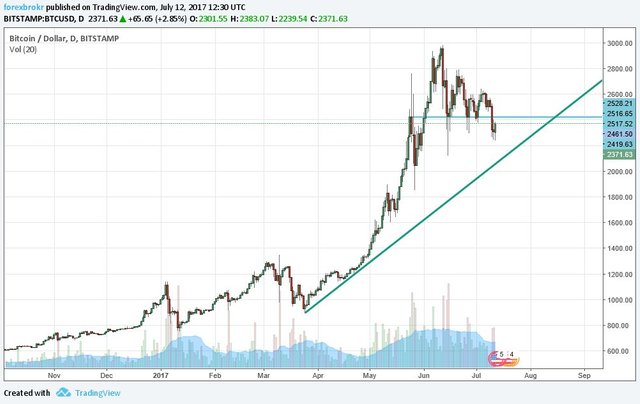

With all this talk about the crypto liquidation over the last couple of days, let's take a look at the daily chart:

Not really that bad, is it? The daily trend line is still in place and we're still above the main horizontal support/resistance zone.

If everyone does in fact know this potential issue is coming and price has fallen, then there is definite opportunity for a big repricing to the upside if nothing eventuates.

But most importantly, there is also still opportunity to the upside if things don't go smoothly as well. This is because so much of the risk is already potentially being priced in. Being over priced in.

We could literally get bad news and rally. You see it all the time in normal markets and Bitcoin is no different.

I'm most interested in hearing what some of you intelligent, tech-centric folks have to say on the SegWit2x software rollout and realistically how likely it will be that the change isn't fully adopted by the people that matter.

Is this just all media fluff?

Leave a comment and let's get this party started!

Instagram: @forexbrokr

Website: www.forexbrokr.com

There's also the branding issue: if the blockchain does split than it will probably harm the ability of crypto to become mainstream thereby hindering it's "real" growth and development. Further, the psychology surrounding the price is definitely contrived by rumour and idle speculation and not much else. I believe that the end of the month will see Bitcoin and the rest of the alt market fall because that is the historical trend. The supports you pointed to may break and it will be a good time to buy in in any case. I think fear driving the transition has many investors, who don't understand the tech, nervous and this will create panic selling to tether-based currencies or fiat. I'm holding and I hope to pick up more once the drop levels out the price from the recent surge. All in all this might be a correction rather than a crash.

Thanks for your thoughts mate.

The fact that a split will do such damage means I really can't see it happening. More one of those hollow threats to help with future negotiations on direction.

The strange thing is I want to buy in now more; but seeing the 6 and 12 month charts makes me feel that it's going to go down before the market as a whole slowly rises from the ashes.

Saw this the other day:

That's handy to have for the day traders. Good find.

(If Steemit makes the image too small, just google images 'segwit timeline' and you can see it bigger.)

Yeah Steemit is weird with images like that :/ You can also right click and view image to bring it to full resolution or ctrl + to increase the overall resolution of the web browser :)