Method to the Madness - Vulture Capitalism Comes to the Blockchain

"From up here, Steem funds sure look tasty..."

Here, I propose that you consider another layer to the situation to better comprehend the current upheaval on the Steem blockchain following its abrupt sale to Tron.

Justin Sun and his representatives have likened themselves to Venture Capitalists and as investors in Steem promising to take the platform to new heights.

However, an argument can be made for a more accurate description of the VC monicker:

Vulture Capitalism

Venture vs. Vulture

There are quite a few investors in the crypto-space that view themselves as VCs looking for diamonds in the rough to get behind. Venture Capitalists play an important role in building up industry and expanding the market place.

Venture Capitalists are praised for their savvy investing and for providing much needed funding to start-ups in an effort to bring their emerging projects to market. A clear-cut example of successful Venture Capitalism would be early investors in Google such as Sequoia Capital.

A venture capitalist will typically look for companies that have growth potential and will provide capital to startup ventures. They may also support small companies that wish to expand but do not have access to equity markets. Venture capitalists will usually invest in these kinds of companies because they can earn a large return on their investments if these companies become successful and profitable

But, what exactly is the difference between a Venture Capitalist and a Vulture Capitalist anyways?

There are several particular features that distinguish Vulture Capitalism from the traditional version.

Preying on distressed companies

Highly aggressive behavior

Taking control of decision making and management

Aim to make a quick turnaround and profit

What is a Vulture Capitalist?

Here's how investopedia.com describes the phenomenon:

A vulture capitalist is an investor who buys up distressed companies in order to turn them around so he can sell them at a profit. Vulture capitalists are often criticized because of their aggressive behavior.

A vulture capitalist is a type of venture capitalist who looks for opportunities to make money by buying poor or distressed firms. They are also known for taking control over someone else's innovations and, as a result, the money that person would have acquired from those innovations. The term is slang for someone who is an aggressive venture capitalist, and as such is believed to be predatory in their nature. Just like the bird they are named after, vulture capitalists will wait until they see the right opportunity and swoop in at the last minute, taking advantage of a situation with the lowest possible price.

https://www.investopedia.com/terms/v/vulturecapitalist.asp

Sound familiar to anyone?

Aggression | Hostile Takeover

Vulture capitalists are often criticized for their aggressive behavior because they are seen as preying on the companies they buy in order to make a profit. They are called out because they will seek out the most distressed companies at really low prices. They will go to great lengths in order to keep their costs down so as to make the most profit. A venture capitalist may look first at cutting down staff, which can lead to unemployment and cause a ripple effect in the economy.

Since the announcement of Steem inc.'s sale to Justin Sun and the Tron Foundation, the Steem community reaction was a mix of surprise, confusion, anticipation and even dread.

Concern quickly turned to anger when all top-20 elected witnesses were instantly removed by Tron/Steem inc. and replaced by sock puppet witness accounts.

For a taste, check the hundreds of outraged comments by the Steem community to the announcement of HF 22.5.

An Open Letter to the Steem Community HF 22.5

While it has been argued by Tron that "malicious hackers" attempted to freeze the assets of token holders, it's clear that no token holder funds were ever at risk with a temporary reversible softfork implemented by the elected representatives of Steem's DPOS governance body and block validators - the witnesses.

These actions were taken to protect the Steem blockchain as attempts to communicate with Steem's new overlords were ignored for a considerable amount of time.

This mischaracterization of the witnesses as "malicious hackers" is, itself, a spiteful and degrading label and a complete dismissal of our community's governing process.

Additionally, these labels and false allegations were willfully spread across social media. Ultimately, this demonstrates either 1 of 2 things.

1) Deep and complete ignorance of decentralization and DPOS

2) Flagrant distain for the rules that govern the Steem blockchain.

That's it, it's either one or the other or a combination of both.

If it's entirely the latter, then this constitutes a form of extreme aggression towards the community and its membership.

Two-faced Townhalls

As communication channels were finally opened up between Tron and the consensus witnesses we saw another curious phenomena take place. While both sides met and attempted to explain their side in various Discord discussions, some headway appeared to be slowly taking root. However, any notions of progress were dashed by completely contradictory statements issued elsewhere by Tron representatives.

New, immensely damaging and hypocritical, social media posts made by Tron's CEO Justin Sun soon appeared on Twitter and in Steem posts (now deleted, but still on the blockchain). Here's just a taste of some of those highly inflammatory statements.

View Deleted Post - @Justinsunsteemit witness voting policy

Any progress that was being achieved through negotiations quickly evaporated. Tron's sincerity in understanding the community's sentiment was immediately called into question and suspicion of ulterior motives spread throughout the blockchain.

Former Steem inc. CEO, and crypto charlatan Ned Scott, even joined in with statements describing the witnesses as "thieves", "bullying" and "liars".

After being completely absent from the community for over a year while he shopped Steem to buyers in the shadows, Scott smeared those who committed countless hours to maintaining and developing the platform after suffering through 4 years of the CEO's incompetence and mismanagement.

A cowardly slap in the face by the very person who, in reality, sold the platform and the community down the river leading to the current fiasco.

Distress

vulture capitalists will usually look for distressed opportunities or companies that are failing. They will provide funding as a last-ditch effort to these companies — many that have been unsuccessful in obtaining credit or funds from banks and/or other investors. As a general rule, most vulture capitalists will buy companies at a very low price so they do not end up losing out of pocket before they attempt to turn the firm around.

In early 2018, Steem and SBD were still riding high at the crest of the crypto currency craze realizing their highest dollar valuations to date. Since this time, the crypto currency market has been in steep decline and Steem has suffered a 90% drawdown.

By November 2018, the crypto winter was settling in with Steem inc. in serious financial distress forcing the company to implement a series of painful cost cutting measures.

As a result, Steem inc. was left with no choice but to layoff 70% of its staff. Ned Scott stepped back from day-to-day operations selecting Eli Powell to fill the role as managing director of the company.

Coindesk - Steemit Lays Off 70% of Its Staff, Citing Crypto Bear Market

The struggling company also attempted to stop the bleeding by reversing their stance on maintaining an advertisement-free platform allowing the first ads to appear on Steemit.com in 2019.

With many crypto-projects folding during the extended bear market, Steem inc. struggled to stay afloat.

Eli Powell has retro-actively described the situation as being stuck in a "holding pattern". It's this type of predicament that attracts predatory outfits seeking to make a quick return on investment.

Vulture Capitalists slowly descend.

Tron

The Tron smart contract network, with a mission to "decentralized the internet", has been marketed as a competitor to Ethereum.

Beginning as an ERC-20 token on the Ethereum blockchain, Tron's transition to their mainnet and official launch occurred on May 31st 2018.

Tron has been dogged by criticism since its inception, with Ethereum founder Vitalik Buterin openly accusing Tron of plagiarizing Ether's whitepaper along with several others, including Filecoin.

BitTorrent Acquisition and Lawsuit

A major boost to Tron's portfolio occurred when it acquired the Peer-2-Peer file sharing networking company BitTorrent in June 2018. Tron hailed their purchase as a landmark achievement while highlighting the on-boarding of BitTorrent's over 100 million user base.

https://thehackernews.com/2018/06/tron-cryptocurrency-bittorrent.html

More recently, BitTorrent former developers Richard Hall and Lukasz Juraszek filed a $15 million dollar lawsuit against Tron for alleged workplace violence and harassment.

Hall says he was bullied into fast-tracking BitTorrent software releases to meet Tron roadmap targets and provided what he alleged are chat app messages from Li and Sun as evidence.

The details of the allegations surrounding the abuse are summarized in a 2019 article from cryptonews.

The No-Shop Clause

An interesting aspects of Tron's acquisition of BitTorrent is that during negotiations Tron tabled a No-Shop clause into the talks. BitTorrent representatives entered into an agreement designed to prevent the company from entertaining offers from other prospective buyers.

Typically, companies agree to no-shop as a sign of trust. In addition, companies who are in financial difficulties may also agree to the clause as not to lose a potential buyer.

No-shop clauses give a potential buyer leverage, preventing the seller from looking for another, more competitive offer. Once signed, the buyer can take the time necessary to weigh out its options about the deal before agreeing to it or walking away. They also prevent potential sellers from being targeted by unsolicited offers which may present a better opportunity. No-shop clauses are commonly found in mergers and acquisitions (M&A).

https://www.investopedia.com/terms/n/no-shop-clause.asp

Before the acquisition was finalized, Tron actually sued BitTorrent for breaching the No-shop clause. The exact details of the lawsuit remain undisclosed but Tron dropped the suit and a short time later the acquisition of BitTorrent was complete.

Non Payment?

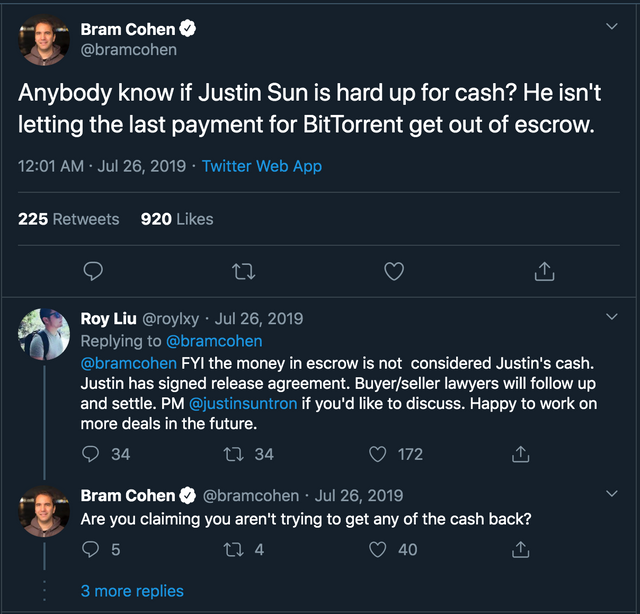

According to BitTorrent's creator, Bram Cohen, the final portion of the purchase - was not paid on time.

BitTorrent founder Bram Cohen publicly accused Justin Sun of not making the final payment on the TRON Foundation’s $140 million acquisition of BitTorrent, Inc.

https://cryptoslate.com/tron-acquisition-awry-bittorrent-justin-sun-failed-payment/

Tron/Steemit inc. No-Shop Clause?

So far, the details of Tron's agreement to purchase Steem inc. and Steemit.com remain undefined as the deal was made in secret between Ned Scott and Justin Sun's representatives.

Since the details of the agreement remain shrouded in secrecy, it is only speculation that it's possible Ned Scott entered into a No-Shop clause agreement with the Tron Foundation.

If evidence existed to support this notion, it might be found in reports by community insiders that Tron purchased the Steem inc "ninja mined" stake, an estimated 73 million tokens or 20% of the total supply in circulation, at below market value.

This would be consistent with how No-Shop clauses are used while the buyer takes time to consider the purchase. Furthermore, it buys time for Tron to allow the bear market to drive down the price of Steem even further before making a low-ball offer while also preventing Steem inc. from soliciting alternative buyers.

Quick Turnaround | Quick Profits

Vulture capitalists look for areas in which they can cut costs in order to make the most profit. Once they make their acquisitions, they may do things like cutting staff, reducing benefits or even both.

It's no secret that soon after Sun and Tron took the reigns of Steem inc. and executed the hostile takeover of Steem governance, almost all of the Steem inc. core blockchain development team resigned from the company. Although the team left the company on their own accord, it's highly likely that the work environment inside the company became toxic leading to the mass exodus. Remember former employees of BitTorrent have filed a lawsuit for harassment, bullying and workplace violence.

https://magazine.cointelegraph.com/2020/03/07/justin-suns-epic-fail-steem-community-nailed-it/

The Ninja Stake | Community Development Fund

At the heart of the current deadlock between Tron/Steem inc. and the elected witnesses of the Steem blockchain, are the tokens mined by Steem inc. in the earliest days of the platform.

The 'ninja-mined' stake has long been a contentious issue in the Steem community. There exists numerous statements from Steem inc. representatives and former CEO Ned Scott that the tokens would be used for community development and growing the Steem ecosystem.

The 'ninja mined' stake under Steem inc's control was never recognized as the sole possession of Steem inc, or communicated as such.

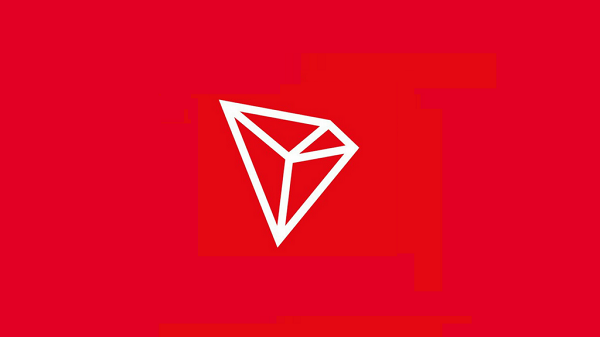

Here's a screen shot from Bitsharestalk.org on April 1st, 2016, communicating the intention of the pre-mined Steem inc. stake (at the time believed to consist of 80% of all Steem tokens in existence).

Steem inc. CTO, Dan Larimer aka Bytemaster:

We have secured ~ 80% of the initial STEEM via mining. Our plan is to keep 20%, sell 20% to raise money, and give away 40% to attract users / referrers.

https://bitsharestalk.org/index.php?topic=22125.0

https://web.archive.org/web/20170602190836/https://bitsharestalk.org/index.php?topic=22125.0

Eyeing the Community Development Fund

Since very little official information surrounding the deal has been disclosed to the community, there's much speculation as to the exact amount Justin Sun and the Tron Foundation paid in the deal to acquire Steem inc.

Although Sun himself has claimed (in at least one townhall Discord chat) that he paid market value for each token, others estimate that, instead, Justin paid somewhere in the area of $0.05 to $0.10 USD per Steem token.

In the days leading up to February 14th, when the official announcement of the Steem acquisition was made, the token was trading between approximately $0.20 and $0.22 USD. Following the announcement, Steem then temporarily climbed to $0.30 USD as news a deal had been finalized circulated through the space.

Without knowing the exact details, it's difficult to determine if Sun received a favorable deal or not. Moreover, it's possible the exact number may remain undisclosed for quite some time since there has been multiple mentions of NDAs (Non-Disclosure Agreements).

image

Simply Speculation

Though this is a matter of speculation it is possible, that Sun and his team viewed the large amount of stake held by Steem inc. as an opportunity to profit immediately from the bargain.

All Tron had to do was to plead ignorance to the community's claim on the stake, transfer the 'ninja mined' tokens to the exchanges and dump the stake.

At below market value prices, Tron would stand to make a handsome profit, instantly doubling or tripling their gains. There would be no need for marketing and promotion of Steem - simply turn around and sell the 73 million tokens.

Again, this is only speculation yet it would go a long way in explaining Justin Sun's hostile takeover of the Steem blockchain and almost myopic obsession of a quick power-down period to come to the rescue of the exchanges he convinced misallocate and powerup user tokens.

It would also suggest that acting swiftly to overthrow Steem's governance with centralized proxies and eliminating opposition would allow Tron/Steem inc. to easily reallocated funds earmarked for development. Once the tokens were transferred offchain and 'safely' on exchanges, the Steem community would be left powerless and with little to no recourse.

Furthermore, it would seem to be confirmed by Justin Sun himself when he stated that he "would like to get out" and "sell his tokens" on the market and make a quick exit.

(see: @ausbitbank Witness Meeting video at the end of this post)

Originally, Sun professed that his goal was to grow Steem, give it proper marketing and have the token listed on more exchanges to increase its value. When pressed on a time frame, Justin refused to give any details about how long he intended to be involved with Steem.

If this is truly a Venture Capitalist investment, as Sun claims, then he might commit more time to his investment and guide Steem to a brighter future.

On the other hand, as pointed out there are indications we are glimpsing the Vulture Capitalist formula.

Preying on distressed companies

Highly aggressive behavior

Taking control of decision making and management

Aim to make a quick turnaround and profit

If we subscribe to the notion we're observing the workings of Vulture Capitalists, as Tron's behavior alludes to, we can be sure they intend to dump the promised community funds to market and earn a significant profit for himself and any potential secret backers.

It is this author's opinion that viewing Tron's contradictory, hypocritical and erratic behavior through the lens of Vulture Capitalism sheds light on the Tron takeover and occupation of the Steem blockchain. It is my hope that this article may provide some insight into the methods behind the madness.

The Vultures have landed and are picking away at Steem piece by piece

Related Articles:

https://www.bloomberg.com/news/articles/2020-03-14/buffett-s-dinner-date-clashes-with-devotees-of-steemit-website

https://steempeak.com/steem/@ausbitbank/witnesses-meeting-with-tron-representative-roy-liu-full-recording

To me, @dhimmel's solution seems like the best way to fix this. It can demonstrate that any attempt to fork the chain against the will of the organic community with astroturf witnesses will result in a forked chain. Ice him out of the old iteration and fork defensively after he breaks off into a new path. This way, it is him shooting himself in the foot as opposed to us eating the rich (regardless of what his intentions were).

Then, let the exchanges decide which coin they want to represent after they judge us based on our actions. Perhaps, if he's made aware of this potential, he'd be far less likely to do it. It seems logical not to, simply so he can retain a higher value on his stake. This is why I don't oppose the gridlock because it allows both sides to stew in it more.

Setting aside what his initial intentions are, it doesn't make sense for either party to fork the chain if they care about the value of the stake. I'm not too clear on the technical implications of his plan, but I ran it by a few people, and they seem to think it's a viable solution. It might even be wise to put him on notice that he runs the risk of this happening so that he can make a logical choice.

Contrarily, were the witnesses to act in bad faith and fork him out of his investment after he backed down; if I were running an exchange, I'd drop that community's token like a bad habit, simply because they've proven they won't honor their token.

If he is put on notice, then isolating his stake after he burns the community is a defensive move. However, to preemptively do it, looks like a hostile action.

It's easy to see how he could perceive what was done to him in the soft fork as hostile, but he also appears to have had hostile intentions towards the organic community. IMO, how this ends will firmly establish the reputation of Justin Sun and the community's blockchain regardless of whether or not it remains Steem.

Vulture capitalist, or venture capitalist, we need to set a good precedent with regards to honoring their ability to take their stake to the marketplace, if we don't I don't think there will be a marketplace for our token. All the other weirdness of what he can do within the steem ecosystem with his ninja power is reasonably an internal community matter because this is a very unique situation. The sooner we allow the "neon green" stake to go to the market, the sooner it becomes a decentralized stake.

I don't think that's how this works.

We've seen how the exchanges will proceed when the Steem community is opposed by Sun, and it's not going to be based on our actions, but their financial ties, and Sun has significant influence in that regard.

Regarding forks, we'd better have a preferred option ready to roll out when Sun's is ready, because we will likely prefer nearly anything to whatever Sun implements when he gains consensus.

We'll see about exchanges in the aftermath, once Sun and Steem are a separate entity. Without a community to imbue his token with value, regardless of their prior relationships with Sun, it's likely his token will be dropped eventually by exchanges, and that will not have any bearing on a new token the community fork supports, which will have the value of the use case that provides.

There's no reason that exchanges wouldn't list that coin, as long as it will make them money.

Thanks!

Well, that's the thing—If you fork out the largest

buyer of Steem in history, it will set a precedent

that Steem might not be a safe investment, and

this is why I think it's important how the fork

goes down, if it goes down. Preferably, he could

safely remove his socks without having to worry

about losing his stake. Then Steem could carry on

without forking anyone over. And the value of the

coin will stay in one coin, instead of getting diluted

into two different coin listings. Exchanges will make

money as if the cryptosphere believes in Steem and

they may depend on how the Community behaves.

(WoS) wisdom of the stake, is supporting gridlock.

Perhaps the majority of Steem power doesn't want

anybody to break/-and-or-fork anything up.

I can't speak for any stake but mine, but I sure don't want Steem to get all forked up. I still would prefer that to a unitary executive.

I reckon most stake does too. In the event Sun forces a fork - which I am almost sure he will - if we have a suitable fork available to migrate to, I think most of the community will migrate to that fork to avoid being Sun's property on his fork.

Where goes the community the value will go too. While Sun might get his buddies to list his coin, without the community they won't make money on that coin.

The community's coin will make them money, because the community buys and sells it's coins.

It sounds like the community precipitated

one. So, I guess we shall see what it do and

how well it is received by the marketplace.

Everything in it's season. The harvest follows the planting in due time.

Unfortunately we can't put a lot of faith or trust in the exchanges helping us out with their aiding of JS in this clusterfuck. They'll support their corrupt crony friend and fucking the community in a heartbeat.

Posted using Partiko Android

Right but with dhimmel's plan we don't need

to trust Sun. We simply act accordingly if /&/

when he choose to fork everything up. Read

his latest post, see what you think about it.

Great write up.

To be honest, I think a lot of all plans were already started before the announcement. Most probably with Ned as “advisor” and his advise likely may have been - or at least hinted at - “the community and witnesses are unworkable” and “just port it to TRON and benefit the users who follow, dapps will follow since they need users”. Also “don’t wait for them or ask them, they are going to give you hell”.

That is why the initial announcement was not done to the community first, nor an introduction of the new overlords, no. It immediately went to porting and token swap, complete with announcement that exchanges would support the new TRON-based token.

Even if, of currently around 10k daily commenters, only 5K followed that would still be a massive increase to TRON who only have around 24k daily users according to dappreview.

Additionally, suddenly having both control and a massive amount of STEEM it would be possible to increase the volume of the token very easily via large scale washtrading on poloniex, and later also on polonidex.

This is not a vulture at work, this was a blatant attempt at M&A where the end goal wasn’t necessarily about making much money of Steem ASAP but a big bump in TRON activity (at least 25%), and maybe some more dapps on TRON too. At below market value acquisition, and thus probably not more than $5-8MM cost max, that alone would represent a reasonable investment already. It would also have allowed him to shitdrop STEEM all over his chain, without caring too much about the actual cost of STEEM to him.

Let’s be honest, almost every other day we are reminded on social how many dapps his origin chain has. Yet, a quick look at blocktivity shows a chain which has barely more ops daily than Steem, and that only since rather recent times (blocktivity has no ops/day history, sadly enough). All that while we have probably less than 15% of the dapps TRON has.

Don't be fooled, the end goal hasn’t changed. Definitely not after two major exchanges publicly distanced themselves from him. That only motivates JS more because since it has become a face saving exercise to win this war. Yes, now it is effectively a war for him. And Bloomberg’s post about Buffet’s “lunch date” will only have amplified that feeling for Justin.

@v4vapid, thank you for a really well thought out and thorough explanation of the scenario we're dealing with here.

I had been pondering Steem's predicament as yet another example of "predatory capitalism" and your article only bears that our further. The "no-shop" clause was another piece I had not taken into consideration; thank you for that.

A true value investor could have come in here; acquired the Steemit, Inc. stake and assets, pumped maybe $10-20M into development and marketing, and could have seen their investment in 17-cent Steem potentially turn into a result of $10 Steem in the matter of a couple of years, while also being hailed as *"the savior" of Steem. Instead we have this... shitshow.

He clearly did not expect the community to "bite back." Not only did the community bait back, it made JS lose face and credibility with his cronies at Binance and Huobi... and much of the Steem liquidity dried up, so he was prevented from executing a quick fix by trying to buy millions of Steem to get the sock puppets back in change.

It does make me laugh that TRON holds itself forth as a developer and proponent of decentralization when it is one of the most centralized blockchain operations around!

These are exactly my thoughts on what happened. I am convinced Sun's reputation as a marketer is completely BS. What he is, is connected nepotically, and his degree of competence at business is revealed by his failure to pump a couple ducats into Steem with fanfare, capitalizing on the launch of communities, and watch the price moon as the market took notice of possibly competent, well funded leadership took the helm of Steemit.

He'd have had to glad hand the witnesses and stakeholders of Steem to do that, but he could have just blown smoke up their skirts and kept them in line as @ned did for years. He just failed to bother, and revealed his lack of acumen by letting the SF happen.

Then, to make things worse, instead of holding a steady course once he realized the witnesses and other stakeholders had relevance, he chose to remove that relevance to the best of his abilities, and degrade the value of what he had just spent $M's on. He also thereby exposed the soft, white underbellies of corrupt exchanges with zero respect for their fiduciary duty to the customers, or grasp of such acts on their future market. Anybody using Binance or Huobi today is either completely incapable of due diligence, or retarded, or both. @edicted well points out that the liquidity of Steem on Binance is none, and also drives Steem price down there, which makes using Binance for Steem now, regardless of it's demonstrable cavalier treatment of it's Steem customers, a guarantee of losing value.

Honestly, @ned may have been confused by the novel business he invented, and driven to lapses of judgment by exigency because of that, but compared to Sun he was as virtuous as a Vicar. I note his potential extrication from dependence on the community has caused his lack of ethics to be far better revealed in his desperation to break free, but even he was not so stupid as to centralize the DPoS flagship of decentralization and let everyone in the market see exactly what really was behind the curtain.

Were I Sun I'd have trouble sleeping because of all the cringing I'd be doing as my mind replayed all my asinine mistakes while I tried to fall asleep. He may not be capable of that, given just how clueless he seems to have been going into this mess. I mean, you have to be able to grasp you've made mistakes to regret them.

What's important going forward to the markets is whether he reveals he is capable of learning from his mistakes. The absence of actual conciliation and moves to begin pumping Steem is painting a brilliant target on his assets by revealing his utter incompetence to conduct business affairs. Weak buzzards don't just get less of the carcass the slavering gathering of corpse eaters pick apart. They become carrion, and part of the feast.

Thanks!

Exactly, this would be the best case scenario for Tron and Steem, the win-win scenario. Only it very quickly became a complete shitshow!

Why?

That's what everyone's been scratching their heads trying to figure out.

Again, you're right over the target as Sun didn't expect the community could rally so quickly and mount an adequate defense to the takeover. Now, there's a stalemate and the longer it continues and the more they seeks to gain the upper had, their plans come into greater focus for all to see.

Yes, the irony of their mantra of "decentralizing the web" is quite comical.

I suggested to some that we help correct their typo as their slogan should read something like:

Tron: Recentralizing the web

If only it was his plan to dump those coins ASAP. There isn't near enough liquidity on the market for him to turn a profit. The price would drop too fast. Instead I fear he plans to dump millions a month over a period of years, keeping us under his thumb the whole time with no plans to invest in the network.

Yes, I would think that you're correct as it wouldn't be possible to dump the entire stake all at once, as the price would certainly tank. Perhaps, I should have put it better with "begin dumping millions of tokens". Thanks for clearing that up!

This is the best explanation of the events I have found so far, @v4vapid, thank you very much. I would like to add just two points:

The idea that one man, TAKING OVER a decentralized platform, is on a mission to “decentralize the internet” is absurd in itself. On that oxymoron he had to be recognized as — let’s say mildly — insincere player.

On the other hand, we will probably learn more on DPoS through this attack than any other theoretical argument could provide.

As soon as I finish a job that I have accepted, I’m gonna write a text about my vision how ideal decentralized platform should look… and then I’ll hope there are some skillful programmers who could read the text and make it true.

Keep up a great work, @v4vapid

LOL, yes!

I also laughed out loud when I read Tron's Mission statement - it's completely absurd when we follow their business strategies - which are anything but decentralized.

I agree, this horrible chapter in Steem's history will probably help to advance DPOS or generate some hybrids that are more resilient than the current iterations.

I'd like to hear your ideas on decentralization - maybe you should enter @theycallmedan's contest - What does decentralization mean to you?

@v4vapid DPoS needs to evolve into REDPOS for better suiting a social blockchain.

Excellent write-up V - V for vapid, not Vultures, which does seem to be what we have circling at present. I've had to distance myself a little this week, too annoyed to get involved although I understand now is probably the time to make some noise.

I think you could be right about the 'no-shop' clause - Trons dealings in the Bittorrent suggest they have gone this way before, and it's worked favorably for them.

Again, excellent work, and I hope many get to read.

Lol, V for Vultures...

It does seem to be the Modus operandi of Tron gobbling up other more innovative projects that are struggling and then plastering the Tron banner over top of it.

We haven't really seen this yet in the crypto space but I'm sure we'll see more of these type of takeovers in the future, especially from companies like Tron who don't seem to produce anything of significance on their own.

Yeah there could be more of these on the way. Perhaps they'll learn from this move - losing the faith of the community and lead developers at the company, arguably Steem's main draw must be a huge blow. I guess he'll be dumping ASAP :/

I think dumping asap may have always been part of the plan...

If they bought at below market price then he's already made a juicy profit, if he could overthrow the governance and get those funds to the exchanges quickly. He's got one foot out the door but he's taking a beating atm, especially his reputation in the space.

Great elaborating.

Vulture Capitalisam seems to fit perfectly in our situation!

Glad you enjoyed it and possibly shed some light on the situation we're in!

@v4vapid it is like you took your time to do more vulnerable researches on this Vulture Capitalist which I think is the best drama scene tittle for the current Steem situation.

I used most of my time to read alot of articles written on Justin Sun, Tron foundation and more but the bottom line is that we need to stick together as a community to battle this ruining situation.

Posted using Partiko Android

Thanks, yeah I like to do research, not sure if you meant to use'vulnerable', but i think stepping back and trying to see what's happening from another vantage point can really help to better understand the situation any situation. People are very emotional about this, myself included, so it took me a while to put these ideas down in a post. I hope that by better understanding the situation we can make more informed decisions on how to fix it. Cheers, thanks for the comment!

You are a good researcher and I think I will have to work with you as well. I love when someone view a situation from another perceptive of life and also finding solution from another angle too.

Posted using Partiko Android

Thank you for making this detailed and informative post. It does help with understanding the motivations behind hostile actions, which otherwise made no sense.

Yes, that's what has been bothering me this whole time, questions of "Why"?

Why so aggressive?

Why the erratic and contradictory behavior?

Why are they so obsessed with the powerdown and aiding exchanges?

Why did they invest in Steem, at all, in the first place?

It does help to have some sort of frame of reference in which to view the behavior. I only wish I could provide some solutions to the situation but the community is doing an admiral job fighting off these scavengers ;)

I didn't post on Steem for a long time, and I was all week collecting facts and news, and after reading this comprehensive post, I feel all and more that I had to say is here.

Steem is under a hostile takeover for sure, by a populist dictator whose actions are the opposite of what he says.

No doubt this takeover will harm all the community in the name of easy money.

I'm afraid that today like it is going on in society in general, populist leaders attract a lot of people that will follow them under the false emotional promises of the "best for the community" to fulfill just one person's wallet.

Follow the man's behaviors and actions, and don't listen to what he says.