Global Crisis - November 2019 by Cryptocurrency Capital LLC

Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.

Warren Buffett

Everybody knows this famous statement, but how many people follow this advice that we can learn from the investment guru?

In this post, we want to point your attention to the upcoming financial crisis. No drama or exaggeration - just real facts and arguments. The goal of this article is to prepare for the worst scenario and use our knowledge and your awareness to save funds and succeed.

For the last 100 years, society observed 30 major financial crises. Based on William Gann Theory we have economic cycles divided on 30-60-90 years. 2019 - will be exactly 90 years since the "Black Tuesday" in 1929. The next crisis hard to call mortgage crisis, dotcom crisis or crisis caused by junk bonds. This one will combine everything starting from 1901.

We think it will be the transition from the old financial system to the new one. And, Cryptocurrencies, especially Bitcoin, will help to make it less stressful. But hold your breath - another recession is coming and here is why.

We've taken seventeen global economic indicators and charts: from BTC transaction volumes to the Corporate Debt outstanding as a percentage of GDP. Each government acts same as a business:

- it has assets

- it has liabilities

- it has cash flow obviously

So why can't we put it in one place and analyze the whole global economy as a business which makes the most significant returns when it comes to the assets and creates the highest risks when it comes to the liabilities.

The best indicator to analyze national economy should be (but is not) federal funds rate. Why is it so important? It is the first indicator that shows how strong the economy is. The higher the FED rate, the stronger dollar suppose to be. But why is it low here? The problem is that this indicator is a lagging indicator. You may disagree, but most increases in rates were made in advance, meaning it was and will be increased to prevent the inflation and the overall economic disaster. However, usually, it is too late to use it. Since the Economy is "overheated" already and simple rate change will not save it; extra money supply and business or personal loans have already had the impact.

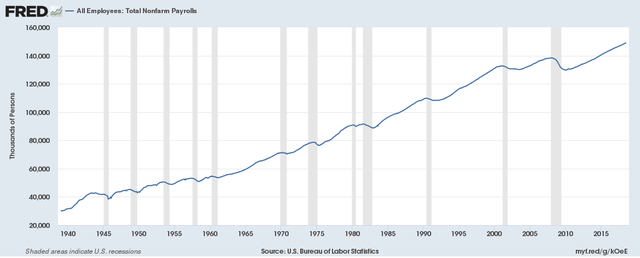

The current unemployment rate on new lows. If speaking about Nonfarm Payrolls, this indicator shows slow down in the US economy. The lower number of payrolls people receive the higher unemployment rate. The higher chance people will not pay off their credits cards. By the way, everybody was expecting more workplaces since tax tariffs were decreased - instead, buybacks for the corporate stocks appeared to be $437b (https://money.cnn.com/2018/07/10/investing/stock-buybacks-record-tax-cuts/index.html).

Financial Stress Index finds its new support levels. It's an index similar to the VIX or "Fear Index" Never shows the real current state of things, but always jumps rapidly. Same was in 2008.

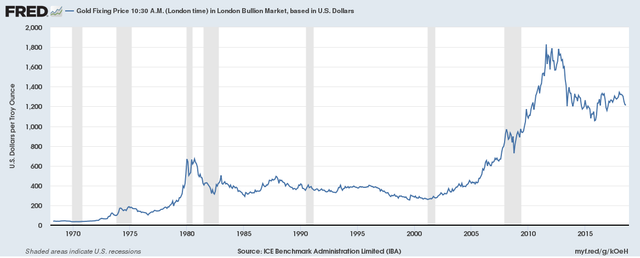

It looks like gold is ready to be used as a hedging tool, it still trying to find the strong support levels to repeat all-time highs it had between 2011-2013.

.png)

Unemployment rate finds its historical support level. Somebody will say that it is a good sign - more people involved in increasing GDP numbers. Unfortunately, it also means that new professionals - Generation Y and Z - are struggling with finding a job, as older experienced professionals competing with them. Eventually, the lower amount of payrolls paid - more student loans unpaid. This assumption applicable for the last 9 years.

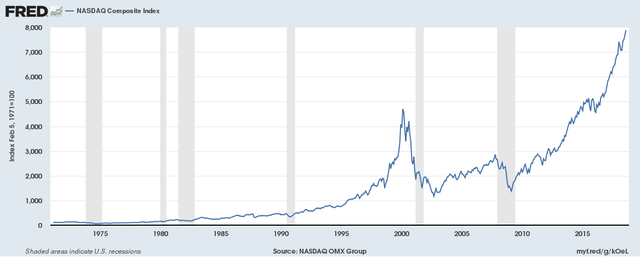

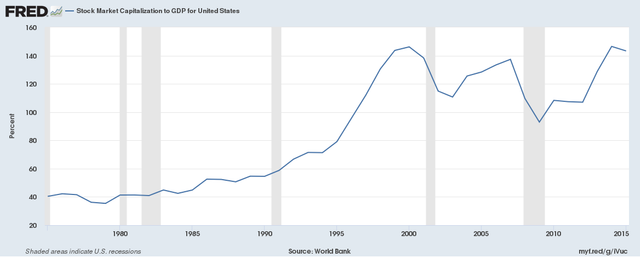

You see it in news, and this article is not an exception: Stock Market is pumped with the money that supposed to be used for creating new workplaces. However, buybacks with new funds are pushing the price up. If you would manage Goldman Sachs or Morgan Stanley would you buy more stocks of companies like Netflix, GoPro, Amazon or (even it is struggling right now) Tesla? Everyone among big players has already closed long positions and thinking of how to short it simultaneously.

.png)

Same.

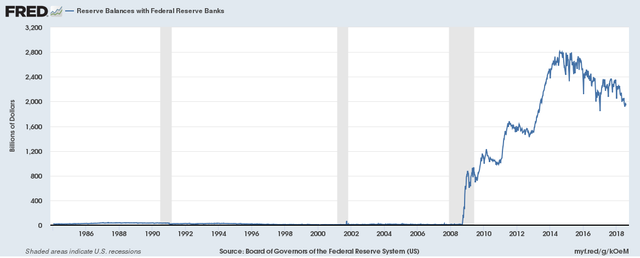

How many assets Federal Reserve Banks have? What does it mean? They will buy out government bonds; it will lead to the higher level of inflation and higher USD liquidity, but eventually will be stopped by FED rate which we have mentioned before.

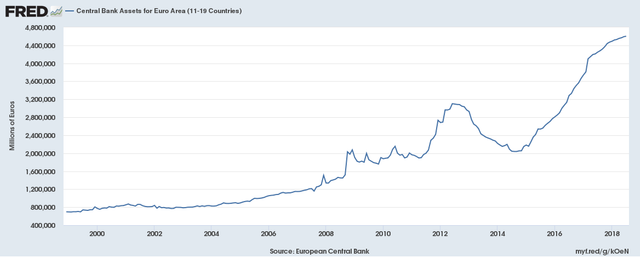

ECB and other major banks are in the middle of quantitative easing.

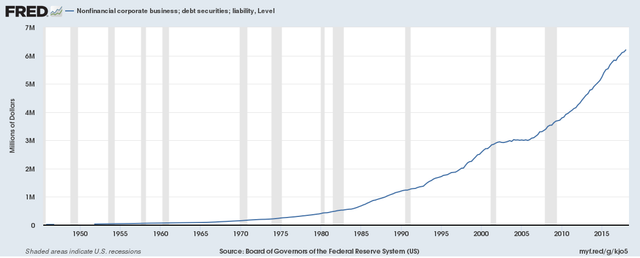

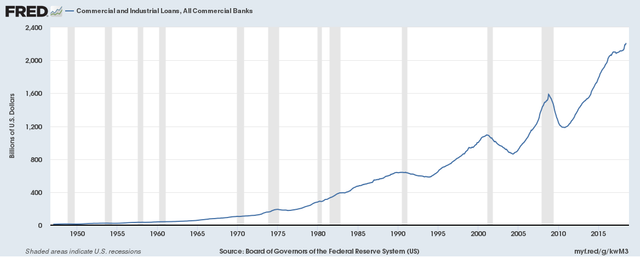

The more liabilities the "business" has the slower it grows, the higher the chance it will declare itself as a bankrupt. All-time highs on this chart.

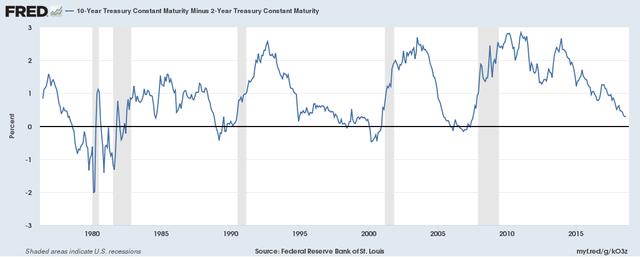

The narrower - the closer collapse.

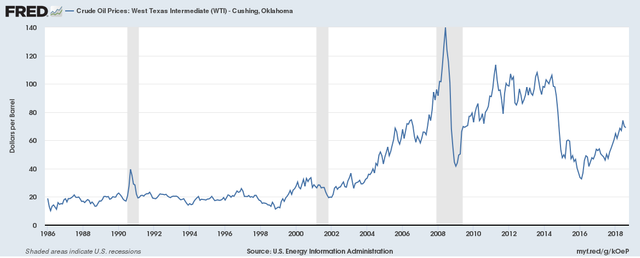

To be honest, never considered crude oil price as a reliable economic indicator - too much influence and pressure from the US government, Russian government and OPEC. Despite that this chart is included here since Iran may start to accept crypto in their financial institutions. I think it is a matter of time when the same country will use Bitcoin or other currencies when supplying crude oil to the Russia, where everyone is familiar with how to use crypto and why is it better than a dollar. Especially after/during sanctions.

Simply showing the correlation of how "the pumped stocks market" reflects "pumped GDP".

Somebody will need to give these loans back. For your house, your car, your phone AND of course for Harvard Business School degree you paid with the third party's funds.

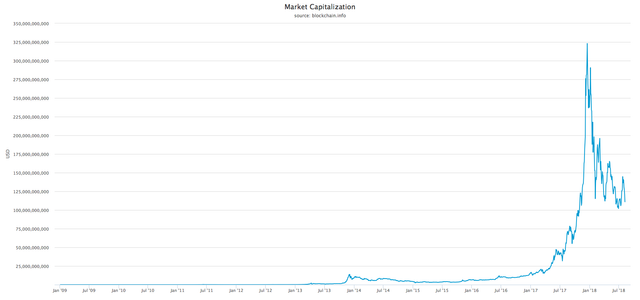

Analyzing the global economy without the Bitcoin market cap would be weird. It almost found its support level. And from my understanding, the elder generation Z becomes, the more value bitcoin has. The higher value - the higher overall usage and market cap. Ask your kids if they use digital currencies to play video games when you are not at home. Some of them are millionaires already.

.png)

Speaking about the price: We saw it before in 2011, 2013 and this year - bitcoin is volatile. Agreed. In the same time it proves that this asset acts in the same manner as the overall social behavior. When speaking about greed and fear of course. Not the rationality. Despite this fact, once the supply ended- you won't see this volatility anymore. The spread will be lower and less speculative interest will be involved. Sounds like utopia - give it 20 years.

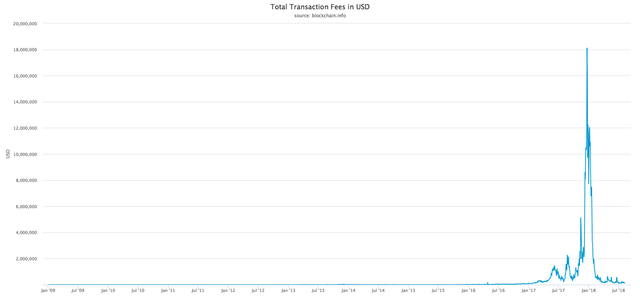

Meanwhile, transaction cost is even lower than it was before during the 2017 bull run. I guess now you understand why it is less expensive to use it for international trades: transaction speed - 20-30 minutes, transaction cost - 0.40 cents when sending $100 or $1,000,000. And of course security of payment.

What does everything from the above should mean for a retailer investor?

Make sure you apply critical thinking whenever you are making your next deposit in a bank. Accumulate alternative assets. And make sure you know about BTC. Nobody says you have to buy it. It's all under your discretion. Most people find excuses calling it "scam" or "bubble", but I bet only 2 out of 10 know what "https" means when they are typing their personal blog address or website. So why people who say "I don't believe in BTC!", "I don't know how it works!" or "Why is it better than my bank?" are putting a veto on the Digital Gold that will help society to survive in the upcoming recession?

Bonus (https://tradingeconomics.com/united-states/government-debt-to-gdp).

Please, share your feedback. We will be glad to include your observations, charts and critics in this article below. Make sure it has all appropriate links on sources. On our end we will try to update this article when it's required.

P.S. I bet you'll find a lot of typos. Numbers that's what matters. Everything else is easy to adjust.

Thank you.

Regards,

Paul Savchuk,

Chief Investment Officer at Cryptocurrency Capital LLC

Original article can be found here https://www.cryptocurrencycapital.us/outlook/global-crisis

DISCLAIMER

INVESTING IN CRYPTOCURRENCIES AND OTHER INITIAL COIN OFFERINGS (“ICOS”) IS HIGHLY RISKY AND SPECULATIVE, AND THIS ARTICLE IS NOT A RECOMMENDATION BY CRYPTOCURRENCY CAPITAL OR THE WRITER TO INVEST IN CRYPTOCURRENCIES OR OTHER ICOS. SINCE EACH INDIVIDUAL'S SITUATION IS UNIQUE, A QUALIFIED PROFESSIONAL SHOULD ALWAYS BE CONSULTED BEFORE MAKING ANY FINANCIAL DECISIONS. INVESTOPEDIA MAKES NO REPRESENTATIONS OR WARRANTIES AS TO THE ACCURACY OR TIMELINESS OF THE INFORMATION CONTAINED HEREIN. AS OF THE DATE THIS ARTICLE WAS WRITTEN, THE AUTHOR OWNS CRYPTOCURRENCY.

WITH THIS CONTENT CRYPTOCURRENCY CAPITAL LLC OR ITS AFFILIATES DO NOT PROVIDE INVESTMENT, TAX, LEGAL OR ACCOUNTING ADVICE. THIS MATERIAL HAS BEEN PREPARED FOR INFORMATIONAL PURPOSES ONLY AND IS NOT INTENDED TO PROVIDE, AND SHOULD NOT BE RELIED ON FOR, TAX, LEGAL, ACCOUNTING OR INVESTMENT ADVICE. YOU SHOULD CONSULT YOUR OWN INVESTMENT, TAX, LEGAL AND ACCOUNTING ADVISORS BEFORE ENGAGING IN ANY TRANSACTION AT YOUR OWN RISK.

CONFLICTS OF INTEREST

GIVEN THE NATURE OF THE COMPANY'S BUSINESS MODEL, IT IS NOT POSSIBLE TO FORESEE AND PREVENT ALL POSSIBLE CONFLICTS OF INTEREST THAT MIGHT ARISE OVER THE LIFESPAN OF THE COMPANY. AT THE TIME MATERIAL WAS PUBLISHED, CRYPTOCURRENCY CAPITAL LLC, ITS AFFILIATES, OR ITS PRINCIPALS, MAY HOLD LONG/SHORT POSITIONS IN THIS PARTICULAR COIN.

Congratulations @redgiromantic! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Congratulations @redgiromantic! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness and get one more award and increased upvotes!

Congratulations @redgiromantic! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!