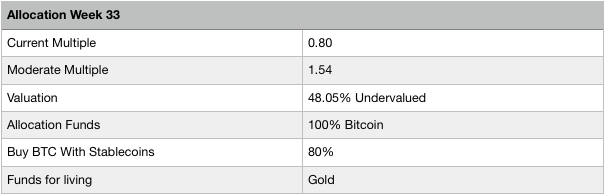

Weekly Update Diversification Protocol Week 33 - Multiple 0.80 - 48.05% Undervalued - Long Term Extremely Bullish - 100% In BTC - Living On Gold

Today is the 21th weekly update of the Diversification Protocol. This protocol is designed to allocate a weekly income or funds to be invested mostly to BTC when it is undervalued and mostly to gold and optional stable coins when BTC is overvalued. It also tells you to spend gold for living when BTC is undervalued and BTC for living when it is overvalued. This will create higher returns on your investment through a full cycle and reduce stress in a bear market. HERE you can read the protocol in dept.

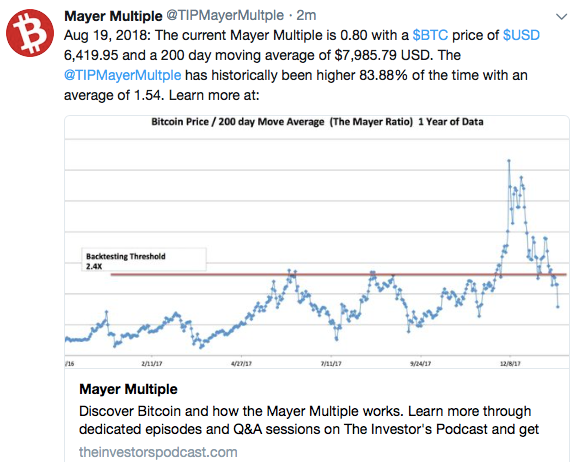

The valuation is done by using the Mayer Multiple and compare it to historical values. The Mayer Multiple is the current BTC price divided by the 200 day moving average. We use data from mayermultiple.com. When you want to be updated on the multiple several times a day you can follow THIS twitter account.

Because I just started the protocol, I didn't accumulate gold and stable coins yet. In this update I will exactly follow the protocol, but since I only start saving gold and stable coins from a multiple of 1.6, I will only be able to execute it 100% according the rules after that point is broken. Funds invested in BTC today will eventually at least partly be converted to gold, since the BTC accumulates in the same wallet and a percentage of the total BTC in this wallet will be allocated to gold at higher valuations.

The current multiple

Weekly allocations of funds

The protocol will be slightly boring until we get to a multiple of 1.6, till then we allocate 100% in BTC because it is undervalued. With the current 200 day moving average we need a BTC price of over 12,777 USD to start allocating to gold and Stable coins. This can take days or months, but it is good to be prepared already.

Important news of the week

The altcoin market crashed while Bitcoin was relatively stable

The bitcoin price and the price of alt coins was correlated through the entire bear market, but the connection seems to be broken. Altcoins experienced two days of extreme losses this week while the Bitcoin price kept hoovering around 6500 USD. It looks like the market is waking up to the fact that Bitcoin is already delivering and most of the alt coins are still based on promises.

The Bitcoin dominance topped around 55% after a low of 35% a few months ago. When Bitcoin can keep a high dominance it will benefit more from the institutional money that is coming in because many funds will allocate their investment according the dominance.

Hyper inflation in Turkey boost Bitcoin trading volume

The Turkish Lyra is crashing and pulling other weak fiat currencies down with it. Bitcoin exchanges experienced an increase in volume because many Turks want to protect their life savings and run to Bitcoin. The global currency war is making it’s first victims, it is fair to expect more currencies to go in hyperinflation mode. People now have an exit and don’t need to go under with the sinking ship.

https://bitcoinist.com/bitcoin-price-turkey-lira-value-slips/

The price of Bitcoin didn’t move much this week

The Bitcoin price rose slightly from 6352 to 6439 this week. There was not much news this week to give the market direction, it was more a trader and whales game. The 5800 mark held for the 4th time and is becoming an extremely important price level. When broken short term panic is expected, but it can also very well be the bottom. Time will tell, the only sure thing is that the valuation is very low at the moment thus long term it will probably be a good buy anyway.

Fundamentals and valuation

In the history of Bitcoin the multiple was lower than today only 16.12% of the time. Since the multiple today is 0.80 while the moderate is 1.54, there is 48.05 % discount on BTC according to this valuation method!

Long term the prospects are still extremely bullish. Lightning Network and Segwit adoption are still growing and improving faster than expected and can boost adoption for day to day payments, micro transactions and Lapps. Wall Street, governments and central banks are on the sidelines to come in and could inject huge amounts of money. Furthermore, the Mt. Gox selling fear is off the table, Bitmain can’t dump much more bitcoins and an ETF is coming closer. Short term sentiment is neutral, but for the long term almost everything is very bullish.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

thank you super interesting, also liked your post on Diversification. So by your estimation BTC price should be around 13,000 closer to the 200 MVA right? Also maybe RSI would be good to incorporate some how. good posing'

Holding gold when BTC is undervalued is a great idea for stable income. As long as the long term prospects are bullish, I remain very relaxed

Good stuff. I’ve reblogged 👍

You got a 83.33% upvote from @oceanwhale With 35+ Bonus Upvotes courtesy of @michiel! Delegate us Steem Power & get 100%daily rewards Payout! 20 SP, 50, 75, 100, 150, 200, 300, 500,1000 or Fill in any amount of SP Earn 1.25 SBD Per 1000 SP | Discord server