The Corporatisation of Blockchain

How the open-source technology rooted in rebellion, is becoming a tool for big business

The origins of blockchain lie in the decades of inspiration, out-of-the-box thinking and independent development that culminated in the appearance of public platform projects like Bitcoin and Ethereum. These rose from revolutionary ideas around how technology and people-power could emulate and replace the trust we have placed in the institutions that order our society.

So as adoption of blockchain technology increases, we would expect the relevance of established organisations like governments & banks, will reduce.

Ironically enough however, this insurgent technology has been co-opted by those very established organisations as a solution to streamline organisational processes. To achieve this, closed, or private versions of the technology have been developed and it is highly likely that these implementations of blockchain will be the first to gain meaningful adoption and real use-cases.

According to research from a number of sources discussed here, 13% of senior IT leaders have current plans to implement blockchain and the enterprise spend on blockchain solutions will hit US$ 2.1b in 2018.

So is blockchain being hijacked and moving to the dark side?

No, not exactly.

The vapid truth

On the face of it, it can appear a misnomer how a tool created to decentralise the way people interact, could be useful to large-scale, heavily centralised entities like MNCs and governments. As it turns out, these organisations find themselves in the fortunate position where, by privatising the blockchain, they can use all of the beneficial features of distributed ledger technologies (DLTs) while eliminating almost all of the major challenges that are restricting its adoption in the public sphere.

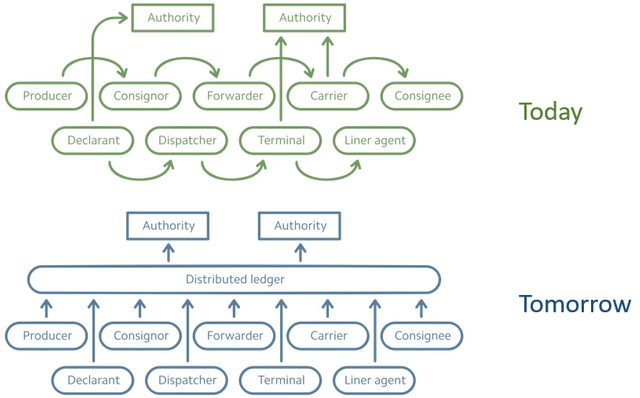

DLTs offer characteristics like database immutability, security and trust while their implementation can drastically reduce the number of disparate systems that must be administered in or between organisations. The technology has the potential to drastically improve the efficiency of organisational processes and in doing so reduce costs.

These organisations not only don't need to use an open / public blockchain, but in most cases it would be extremely undesirable. Instead they can implemet DLTs privately, where every participant must be permissioned to view the ledger or add data to it. By doing this, they bypass the biggest challenges facing public DLTs: -

- Scaling them to reasonable capacities and;

- Implementing practical and fair platform governance.

So while the potential applications of public blockchain & DLT are being stalled as the technology matures, enterprise versions are already waiting to fly off the shelf.

Will public blockchain projects survive in the interim?

Some will, some won't. Some public platform projects have understood the trends and instead of stubbornly proclaiming that they have all the solutions to public blockcian's woes, they have bitten the bullet by beginning to develop sister platforms for enterprise. These are effectively permissioned versions of their public-chain technology but heavily optimised for business needs.

The Ethereum community created the Enterprise Ethereum Alliance (EEA) which is partnering with MNCs like Microsoft, Intel and Accenture to come up with an open, standards-based architecture and specification to drive adoption of private versions of Ethereum. The EEA provides a set of extensions to public Ethereum to satisfy the performance, permissioning, and privacy demands of enterprise deployments.

Another similar example is the Waves public blockchain platform whose CEO, Alexander Ivanov, hit the nail on the head when he announced the launch of a permissioned sister platform, named Vostok. Ivanov said that it will offer private Blockchain as a Service (BaaS) to businesses and government and he made it clear that a big part of the decision to launch Vostok was that public blockchains are still many years away from being able to support mass adoption for distributed applications and it would therefore be wise to fill-in the gap with revenue generating services.

Another benefit for Waves and Ethereum is that enterprise deployments offer more controlled environments for test-driving new features that can be later rolled out into public chains at a more secure and stable stage than otherwise would be possible.

Who else is developing DLTs for enterprise?

Beyond these public ledger spin-offs there are a number of established organisations specialising in developing pure enterprise-grade private blockchain services.

The Linux foundation, in partnership with an alliance of notable companies like IBM and Oracle, have developed a competing platform for enterprise called Hyperledger that is based on open standards which any organisation may use to implement their own blockchain with a kind of freemium business model.

And R3, which describes itself as a global ecosystem comprising over 200 companies and regulators on six continents, is building a blockchain technology called Corda which they claim will transform the way finance and commerce is conducted.

There are also a raft of DLT platforms at various stages of development that can neither be described as fully public or fully permissioned, but which will largely serve commercial & industrial applications. Projects like Ripple, IOTA, Hedera Hashgraph and VeChain, to name a few. All of these platforms are designed with solutions for commerce and industry in mind, yet are not platforms that any single entity can have control over. These networks are somewhat distributed but administered by identified, trusted entities with certain levels of reputation and resources.

The solutions these platforms will provide are more collaborative or industry-wide solutions that involve many parties. These will be a mixture of permissioned solutions and hybrid solutions (where some functions are permissioned and some are public). Examples of these are supply chain solutions, trade finance solutions, inter-bank liquidity solutions and infrastructures for interoperability, like the internet of things.

Where are these solutions being applied?

So we know who's taking care of the enterprise solutions but what kinds of enterprise are starting to invest in them?

While one could argue blockchain has a potential solution for almost any process that involves transactions, agreements or record keeping, we want avoid the law of the hammer mindset. Good solution designers recognise where other tools are more optimal. The fact is that for most business processes, centralised IT systems are likely to be the most optimal solution. So where does blockchain truely add value for the enterprise?

Outlier Ventures maintains a tracker of corporate entities that are members of the major enterprise DLT alliances or are trialling, investing in, or acquiring blockchain technology. Some examples of the industry sectors where we see a concentration of activity are discussed below.

1. Smart energy

After setting up less than a year ago, the Energy Web Foundation, based out of Switzerland, has brought together nearly 50 of the worlds most prominent power generation companies, utilities and blockchain-based solutions.

Japan's biggest utility, TEPCO have invested in to the UK-based start-up Electron, who are developing a metering registration platform and an energy trading platform. Siemens and the UK utility, Centrica, are working with LO3 Energy and their 'Exergy' blockchain-based solution who are building a ubiquitous platform based on the idea of transactive energy whereby every energy asset anywhere will be able to trade with any other. These are just a few examples out of hundreds of partnerships, trials and projects that have been announced over the past few years.

This previous article goes into more detail on blockchain in the energy sector.

2. Mobility & Automotive

Technological breakthroughs have enabled vehicles to be more and more connected and increasingly autonomous, shifting the business models of car manufacturers, logistics companies mobility platforms. DLT will be part of this shift as the need for complex, immutable, automatically updating records of everything, becomes a necessity.

Volkswagen are using the IOTA platform to trial the integration their over the air update system to create an immutable audit trail, which could eventually be expanded to capture vehicle to vehicle communications, on-demand car feature configurations and extend to providing interfaces to other services such as usage-based insurance.

3. International Trade & Supply chain

The authenticity and integrity of supply chain data dictates the synchronization & efficiency of economies relative to three areas:

- The movement of physical goods

- The supporting communication and documentation

- The financial flows between disparate players

Image credits

A great example of where DLTs will be used for supply chain tracking and management is in the luxury goods industry. If commonly faked luxury brands like Cartier, Louis Vuitton, Rolex & Ray Ban can prove without any doubt the authenticity of every unit of their product, they can significantly increase their market share for their own products, while allowing customers peace of mind. VeChain is a blockchain platform integrated with an RFID system that has been developed for these exact use-cases. There are also massive opportunities in the food chain industries for example tracking the fish in fish fingers from net to plate.

Trade finance is another application that is ripe for assistance from blockchain technology. R3 is working with CryptoBLK, HSBC and multiple other banks and corporations to transform the way the process for trade finance letters of credit is done, using their Corda blockchain solution.

4. eHealth

This is an application that might be one of the first where we see governments investing heavily into blockchain solutions. Take the UK's National Health Service - one of the biggest organisations on the planet and one which relies heavily on disparate systems across jurisdictions and even paper records to keep track of the medical history and status of its millions of patients. It is likely that the situation in developing countries is even less organised.

Blockchain can provide a national-level solution for Health Information Exchanges (HIEs) allowing interoperability across jurisdictions, consistent accurate data and trusted authentication for data access. Utilising this type of system would also largely eliminate the need for a 3rd party IT service provider, hence slashing costs.

One of the first projects to come to light in this area is Medicalchain - a platform built on Hyperledger technology that enables the secure exchange of medical records between patients and doctors. They recently announced the launch of their first pilot in the UK.

5. Global Payments

RippleNet from Ripple is a global blockchain payment infrastructure for enterprise. Ripple claim that more than 75 global customers, mostly banks, are in the process of incorporating RippleNet technology commercially i.e. not as a trial. That is significant progress and would make this specialist area of the banking sector by far the most advanced commercial adopter of blockchain technology.

Summary

After 10 years of evolution since the first blockchain system went live, we are now witnessing a momentum-shift in the use-cases that are adopting the technology. While public blockchains struggle to overcome scaling and governance problems that restrict the roll out of its original vision as a way to bypass the institution, those very institutions are pouncing on the technology and applying it in imaginative ways.

While it is true that the incremental benefits to institutions that DLT offers are not quite the paradigm-shift that widespread adoption in the public sphere would signal, these are real solutions to business problems that have up until now been poorly catered for by traditional IT solutions.

As big business ironically benefits from open-source technology founded in the cypherpunk movement, it may be that in the end, the favor is returned. Enterprise implementations will no doubt become the breeding-ground for the evolution of the technology that may help to find solutions to the challenges currently restricting the adoption of public blockchain.

Hiii..rynergy

Great post with great picture.

Thanks!

Always welcome...

would this mean more public oversight and transparency into corporations due to audits on blockchain? or am i overlooking something and have no idea what im talking about?

It could do depending on what the corporation is using blockchain for. Some companies might permission public access to certain data on their blockchain such as their employment statistics, energy usage / carbon footprint and these might be used more as marketing tools. But I cannot see them volunteering to be transparent across the board until perhaps that becomes a norm that would make them look suspicious if they didn't. But I doubt that will happen soon.

Congratulations @rynergy! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @rynergy!

You raised your level and are now a Dolphin!

Do not miss the last post from @steemitboard: