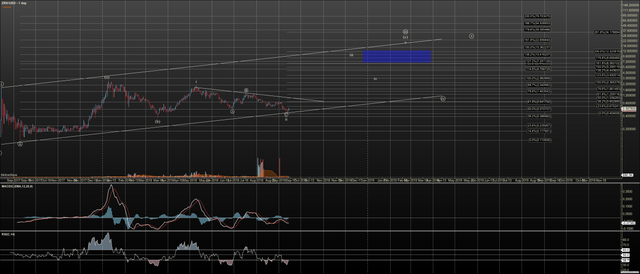

Chart of the Day: ZRX

As we approach pattern completion in Bitcoin and other large cap coins, we need to start to spot early leaders. (see: https://steemit.com/bitcoin/@wildtrader/another-bitcoin-drop-setting-up ) 0x (ZRX) is one coin which is showing a is possible here based on technicals, now price must prove. First, let me warn that the pattern of ZRX is that of a diagonal as the first leg was an ABC. These are the type of charts which show higher levels of in-predictability and so forecasts are adjusted more frequently than pure impulses according to the Elliott Wave Theory.

The technicals referred to above are the daily RSI diverging over the last couple lows, and now price turning in such a manner that technicals appear to be turning up. Currently I'm watching for the next bull leg to be a C wave of iii and it should carry us to the $10 region. However before we can put much faith in that, I need to see 5 waves up to 84 cents. This forecast will change if we drop below the February lows, or if the rally from this zone is clearly corrective in nature.

Note that free 15 day trials are available for our trading room and community on Elliott Wave Trader, where I am a full time analyst. You'll rub nose with, professional, amateur and traders in the learning process, while getting trade calls and ongoing direction for the market. No credit card is needed for a trial.

.png)

Well nicely explained.. !! Hope for the best.. But my personal opinion..It is better to wait rather buy now.. Thanks...

What is the timeframe for 10$?

Thanks Larster- Yes no timing model. You can use the 'slope' of past impulses (prior to April as a guide after 5 waves to 84 cents. But that's just a guide.

Ryan. The number of cryptos that you follow is astonishing. How do you decide which ones to actually own? Is it simply the risk reward setups or are there other considerations?

At each swing cycle turn, I put out a list to my subscribers where I calculate elliott wave projections in return, and then also knock out charts that are low probability, unless so compelling worth a small risk. I publish it out, and then invest in the best from that standpoint. Honestly, the reason I track so many is subscribers make chart requests for things I never heard of. I create the chart when requested, and jot down my findings. Feels like a giant team effort :). I can't follow everything so closely. I only cover BTC and ETH down to 15m timing, and a few others to hourly. But for most I can only do a daily chart projection. I do have bandwidth limits. But I've had subscribers call me machine, and AI LOL.

Hi @wildtrader!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 2.922 which ranks you at #10851 across all Steem accounts.

Your rank has improved 2 places in the last three days (old rank 10853).

In our last Algorithmic Curation Round, consisting of 499 contributions, your post is ranked at #401.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server