An Analysis of XRP Fundamentals for the Average Joe

I use the term "Average Joe" because if your like me you work 40 - 60 hrs a week and don't always have time to do hours and hours of research to determine whether an alt coin is worth investing in or not. This is my attempt to take hours of research to consolidate it into a post with less than a 1,000 words to keep the reading time down to less than 10 minutes. My goal is to give you the most knowledge possible so you can decide whether you want to invest in a certain coin or not. I am in crypto currency for the long run and over long periods of time you will experience big up and down swings. If you invest in a coin for the wrong reasons you will prematurely sell for the wrong reasons. I want people to be knowledgeable so that when they invest they can say to themselves that I am investing in this specific coin because I believe in its vision/goal and that decision will help you weather the very volatile market.

1. What is Ripple (XRP)?

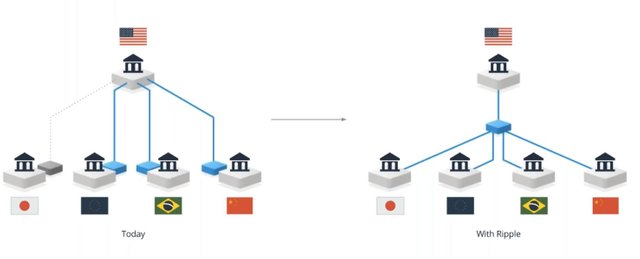

XRP is an alternative coin (alt coin) that banks use as a source of liquidity on demand in real time. This allows banks and other payment providers to extend their reach into new markets, reduce transaction fees, and increase the speed of the transactions. Their vision is to be the largest payment mediator with global reach. Today, if you had an aunt who lived in a small village in India with the nearest Western Union in a big city about one to two hours away. You have two options, either you wire the money via Western Union, or any other money transfer company, and have her travel hours to receive it while paying large transaction fees or you wire it via your bank who routes it through several other banks before getting to her specific branch in her village. The latter is also heavily infested with transaction fees going from one bank to another, which in turn also increases the length of time it takes for that transaction to process, typically three to five business days.

With XRP, your bank branch can directly send the money to your aunt’s branch bank in seconds because the XRP works as the currency not your specific currency. The XRP is already available to the bank and therefore they don’t need to send it to some major bank in India, then wait for that major bank to verify the funds are there, then send it to a smaller bank closer to your aunt’s location, and then that bank has to wait to verify the funds. Additionally, each bank is charging a fee taking their cut along the way. Also, I would like to highlight there are more mobile wallets than credit cards in India.

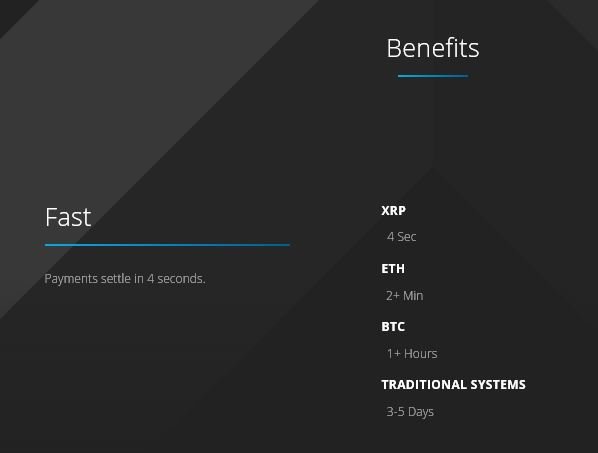

Here is an image of their transaction times compared to other forms of payment.

Here is how XRP is similar and different to BTC and ETH:

2. What Problem is XRP Trying to Solve?

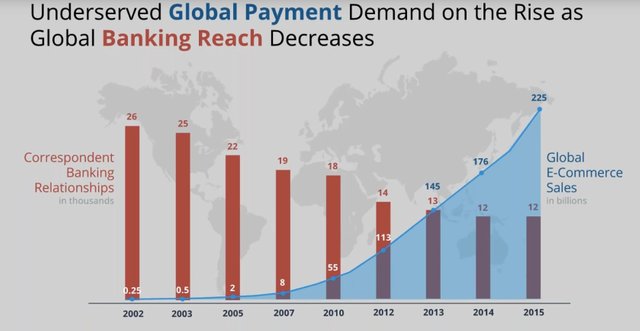

The image above depicts how the current banking system was developed to handle high-value low-volume transactions or batch transactions, however, our current economy due to e-commerce requires the banks to process low-value high-volume transactions. The banks weren’t designed for this and therefore they don’t have the infrastructure to support this. There is a 12% error on all international transactions currently. As a workaround banks and e-commerce companies have to build their own integration centers to safely and efficiently transfer payments. Just one example is Amazon, who currently has set up 126 currency integration centers all around the world to process their transactions. This is a huge cost to existing and future organizations. Currently, Visa and MasterCard charge 20% - 40% to move money across the globe. XRP states that they have saved up to 60% in costs to banks who have used XRP.

3. XRP’s Solution

Unlike any other block chain their core technology involves the Inter Ledger Protocol (ILP). The ILP helps XRP settle transactions autonomically through multiple ledgers simultaneously. The ILP technology helped XRP build a program known as Ripple Connect. Ripple Connect is the gateway between banks to the ILP, which in turn would give them access to the rest of the banks on a global scale. Please see the image below.

4. Future of XRP

Currently, XRP conducts 1,000 transactions per second per day. They have stated that they can handle the same work load of transactions as Visa can, which was 50,000 transactions per second as of April 30, 2017. The current transaction fee of XRP is $0.0004 USD. That is a 90-day historical average as of May 5, 2017. XRP also currently offers incentives to drive payment volume through XRP.

First, they offer a Fee Rebate program where qualified money marketers have their transaction fees subsidized so they can trade and process payments using XRP for free. Second, they offer a volume incentive program where they reward the companies with the largest volume through XRP. Currently, those rewards are unknown to me. Finally, they have a spread rebate where they guarantee competitive spreads to companies who process payments using XRP ensuring they are getting the best value possible when compared to any bank they may use.

5. XRP Current Users

They currently have 90 banks using XRP as a currency of conducting transactions. 10 or the 90 are part of the top 50 banks in the world. In total, there are over 20,000 banks in the world, so the opportunity for growth certainly exists. Below you will find an image of some of the banks they work with.

6. Business Model

XRP is owned by Digital Currency Group (DCG). They own Genesis Trading, a bitcoin exchange platform, and Grayscale Asset Management, which created the first publicly traded Bitcoin Investment Trust Fund (Ticker Symbol: GBTC).

https://genesistrading.com/

https://grayscale.co/

Additionally, they recently bought CoinDesk ( http://www.coindesk.com/ ), a crypto currency news network. Finally, DCG is also a venture capital firm, which has invested in over 85 Bitcoin block chain companies spread over 24 countries. Some of their investors include MasterCard, Western Union, and Foxconn, the Taiwanese multi-national electronics contract manufacturing company.

References:

https://ripple.com/

Please feel free to message me any questions and don't forget to follow, vote, comment, and resteem.

I am new on Steemit and look forward to being a productive member of the community.