What does altcoin success look like?

What does altcoin success look like?

We have a cultural habit of measuring success in terms of economic growth, and it’s a trait the crypto world has adopted in spades. But when you only have a hammer in your toolbox, every problem looks like a nail. Can we nuance this a little better, or at least manage expectations?

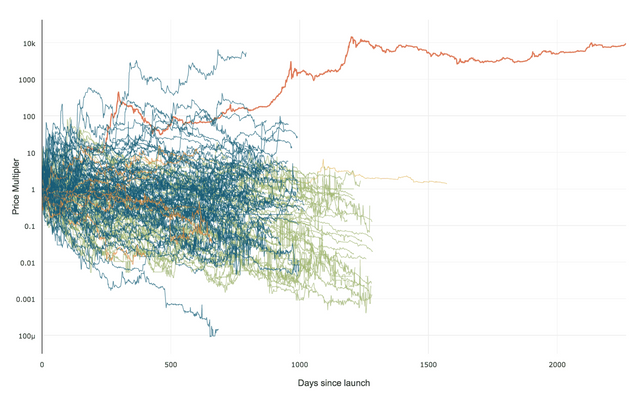

Crypto blogger Willy Woo recently published this blog post. It’s a pretty neat analysis of 118 altcoins that have managed to grow to a market cap of $250,000 or above, charted against bitcoin. The graph shows on a log scale the performance of each coin since its trading debut. Bitcoin was first openly traded in July 2010, for example, on the fondly-remembered MtGox. Around 1,300 days after it debuted it was trading at 10,000x that initial price. The bubble burst when Gox did, and it’s only now approaching that level again.

Of the 118 alts charted again bitcoin, just one tracks above it — gamecredits, if you’re interested, a three-year-old project launched to help shift money into and out of virtual economies. GAME is essentially an appcoin or CAT, just about as simple as it gets in technical terms. The author notes it as an quirk, no more than the result of random variance. ‘All my friends are asking if that wiggle above bitcoin is Ethereum. Sorry no, it’s GAME, I don’t know what that is, but it’s likely a statistical aberration — someone’s gotta get lucky. I mean when I look sideways, it’s like a rocket engine, some of the exhaust flames go to the edges, it’s just thermodynamics.’

Every other coin underperforms bitcoin, and the longer it survives, the worse it compares. What does this analysis tell us about the landscape for long-term altcoin adoption — and particularly projects like Waves, in which I have a particularly keen interest?

The secret of ‘success’

Firstly, it’s worth mentioning the oft-quoted maxim from the financial world: ‘Past performance is no indication of future performance’. Just because nothing has outperformed bitcoin doesn’t mean it can’t, only that it hasn’t. But that probably won’t be hugely convincing to altcoin holders who are looking at that chart and wondering what’s going to happen to their portfolio in the coming months and years.

Fortunately, it’s not that simple. In fact, it’s anything but that simple.

The chart uses one simple metric to compare 118 different alts that are totally disparate in nature. It’s interesting that the writer mentions Ethereum alongside gamecredits, because these two projects are perfectly illustrative of the differences. A few of the factors in play here:

Totally different landscapes. Bitcoin in 2009 entered a vacuum in which it was like nothing anyone had ever seen before. Subsequent crypto projects have all had bitcoin as a frame of reference for investors. That has enabled investors to make much faster and more informed decisions.

Different trading cultures. Bitcoin started trading in July 2010, some 18 months after Satoshi launched the protocol. For that early period, it was barely bought and sold at all. Price discovery took place through OTC trades, including for a couple of pizzas now valued at several million dollars. Its first bubble — first real speculative interest — occurred in April 2011, two months after the Silk Road launched. By comparison, the majority of alts seem to experience their first (and often only) bubble on day #1, when they are employed as pump-and-dump targets by manipulators who hold a large proportion of supply. The distribution of growth is quite different, in other words.

Bitcoin trades against fiat, mainly USD and CNY, whilst alts tend to trade against BTC. That makes for a fundamentally different pattern, because anything that happens to bitcoin also impacts the alts. A bitcoin rally tends to see a sell-off in the alts, whilst in a crash the alts often recover. But bitcoin’s movements are factored into the price of alts that trade against BTC, all things being equal. ‘Growth’ therefore takes place again two different yardsticks for BTC and alts — but the chart uses just one yardstick.

And here are the big ones:

The day #1 exchange price sets the tone for the growth capacity that follows. If a coin debuts at 1 satoshi, it has only one way to go. It can achieve 10,000x growth far more easily than a coin that, like Zcash, debuts above 1 BTC. On this chart, then, the coins are not starting from the same place — they could be starting with a difference of several orders of magnitude already factored in. A case in point — gamecredits has posted more than 5,000x growth, but is still way behind bitcoin (by a factor of 1,000) in terms of market cap.

ICO and mined coins are emphatically not the same. Related to this is how coins start out in life. Take Waves for example, which was funded with a $16 million ICO. When it started trading, it did so around that market cap. (Most crowdfunded altcoins do, or at some multiple of that amount — the point is, you have at least a rough idea what a reasonable starting price is.) That money gives Waves a great start in life, because the project doesn’t have to worry about finding cash for marketing or development. But it also means that the outlook for growth is — by bitcoin’s standards, at least — limited. Bitcoin managed to go 10,000x in value since it launched on Gox. If Waves did the same, it would have a value of $160 billion — more than ten times larger than bitcoin, or somewhat larger than IBM and approaching the GDP of New Zealand. Mined coins, on the other hand (like bitcoin, or gamecredits) have no obvious price indicators when they begin trading.

Business development is wildly different. Bitcoin had the Silk Road, and since then a bunch of applications, including other dark markets. Some alts have clear roadmaps for adoption, with real-economy customers. Others have empty promises. Needless to say, which one makes quite a difference.

In other words, lumping every alt together in the same basket and then comparing them with a single metric isn’t that useful. It does make for a nice overview, and it makes the point that — all things being equal — bitcoin is a tough proposition to beat. But it doesn’t act as a useful predictor of future growth. Imagine if you’d bought shares in Apple when it first went public in the 1970s, then compared its growth to a random bunch of stocks you’d bought just before the millennium, and you’ll appreciate the nature of the problem. Ethereum has, by all accounts, been a success in terms of trading price. It crowdfunded 31,000 BTC back in 2014, or around $15 million, and went 100-fold in a year. It’s now trading around 50x ICO price. That’s impressive, but it’s unlikely to have another 10x increase in it right now.

Growth capacity

To wind up, it’s informative to look at a few of the similarities and differences between GAME, which outperformed BTC, and Waves, with a view to applying any lessons that might arise.

Looking at the list of differences above, GAME is actually remarkably similar to bitcoin. It is a mined coin (a Litecoin clone) that started out with zero supply and grew slowly, rather than being funded and launched with an ICO. Its exchange debut was quiet; without ICO funds to back it, it traded with low volumes at a low price for some extended time, again much like bitcoin. And interestingly, whilst it does trade against BTC, there has historically been a large amount traded against fiat, once again like bitcoin. All of this has allowed it to grow rapidly but relatively steadily, whilst avoiding some of the volatility problems that come from trading against bitcoin. At a market cap of around $10 million, gamecredits has about the same value that bitcoin did at a similar point in its life post-exchange integration — on the chart, around April 2011. With a major use case in the works (integration by a big gaming company this time, rather than the currency of choice on the world’s first proper online dark market), it’s potentially poised for a bitcoin-like expansion into the mainstream.

Waves, meanwhile, hasn’t posted GAME’s 5,000x gains (by virtue of the fact it’s only a few months old and $80 billion would be a massive market cap), but it has a similar market cap in terms of orders-of-magnitude and therefore similar future growth capacity, all things being equal (which, of course, they never are). It also has significant mainstream expansion to look forward to thanks to diverse applications being built on it, including Incent, ChronoBank and many others. The two have taken very different routes, but they are currently in roughly the same position in terms of their market cap and business development. One lesson we can take from GAME for WAVES is that trading directly against fiat is not only highly desirable but necessary for long-term growth, since not only does it access a far greater pool of liquidity but also circumvents the problem of bitcoin-related volatility. This puts into context discussions about altcoin exchanges: without fiat exchanges, there’s only so far you can go.

The bottom line? We’re at a pretty interesting point in crypto history. The first large-scale applications are just around the corner. The arrow of time is selfishly asymmetric, meaning it’s not possible to invest in bitcoin in 2011. But if you want the next best thing, there are definitely options.

Woo sums up with the following thought. ‘It seems that alt-coins are best left for trading due to their volatility, but very risky as holds. This may change in the years ahead, but for now, out of 700+ coins in my database I would say less than 5 have a shot of doing something interesting. It reminds me of early stage startup investing actually.’

And he’s probably right about that. The trick is picking the five.